Determinants of Profitability

advertisement

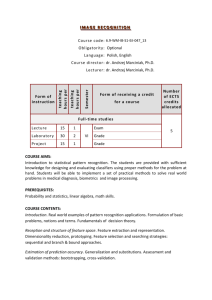

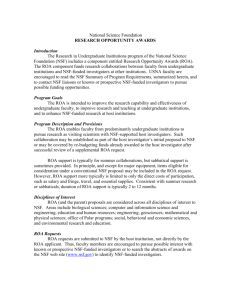

Determinants of Profitability: What factors play a role when assessing a firm’s return on assets? Neil Nagy Senior Project Dr. Newman Dr. Nelson The University of Akron 3/12/09 Abstract This paper looks at financial statement variables that likely have an impact on firm profitability. I collect firm financial data from recent years and test for factors affecting a company’s return on assets (ROA). I find evidence that a firm’s sector, sales, level of acquisition activity, reinvestment rate, prior year’s net profit margin & 3year return are all significant in determining ROA. Also debt-to-equity level, beta, and dollar value of capital expenditures were also relatively significant. Furthermore, I find evidence that a firm’s level of free cash flow, taxes, advertising expense, and inventory turnover do not seem to have an impact on firm ROA. Note: This paper has been expanded since my Econometrics class. Major changes are as follows: 1) updated time period of data, 2) ran single regressions on all years rather than regressions on each individual year, 3) ran a one and two-way fixed effects model, 4) added new variables, 5) extended the literature review, and 6) gathered data on solely S&P 500 companies. Introduction, Hypothesis, and Motivation There has been a growing number of papers recently that test for measures and determinants of firm profitability in the market place. This paper focuses on one of these measures: return on assets (ROA) and the factors that influence it. This is an important topic of interest, as stocks trade in part on news of profitability. A firm that displays solid operating fundamentals and generates high returns on its assets is sure to see that success translate into its stock price. Fundamental profitability analysis is objective and a true indication of how a company is performing. Stock prices, on the other hand, are subject to speculative swings that can make it difficult to identify the actual value of a firm. With the current emphasis on personal retirement plans and the grim outlook for social security, it is becoming more and more necessary for individuals to understand what drives firm profitability so that they may recognize these factors and make good investment decisions. In this study, I will investigate the effects of a number of factors including research and development (R&D) expenditures, sales, debt-to-equity ratios, capital expenditures, and the sector the firm is classified in on ROA. This study tests if financial statement data can be used to determine a firm’s ROA. This will be accomplished by using multivariate regressions in order to gauge the importance of these factors. The following portion of this paper is a literary overview of research applicable to this discussion. I will then proceed into the other sections of the paper: my model setup, data sources and descriptions, my model estimation, and my findings. To close out I will briefly summarize and conclude with an economic interpretation of the results. 1 Literature Review This section provides a review of some of the relevant literature that has been done on firm profitability and performance in the market place. Hansen and Wernerfelt (1989) integrated two sample models of firm performance, one which used economic factors and one which used organizational factors. The economic factor model is based primarily on economic tradition, emphasizing the importance of external market factors in determining firm success. The other model, organizational, is built on the behavioral and sociological paradigm and sees organizational factors and their fit with the environment as the major determinants of success. Their results confirm the importance and independence of both sets of factors in explaining performance, but they also find that organizational factors explain roughly twice as much variance in firm profit rates as economic factors. Hirschey and Wichern (1984) analyze the consistency, determinants, and uses of accounting and market-value measures of profitability. They find that differences between accounting and market measures of profitability suggest the validity of cautioning remarks concerning the use of accounting data as it has a primarily historical interpretation unlike market-value measures of profitability which are expectational or forward looking. In addition, they find that there exists a significant explanatory role for R&D intensity, TV advertising, leverage, and industry growth as determinants of profitability. Kessides (1990) estimated a specified model of oligopoly. Kessides finds that the existence of firm effects implies inter-firm differences in internal efficiency, and also that such firm-specific efficiency characteristics persist across industries (i.e. if a firm is 2 relatively efficient in market A, it is also likely to be relatively efficient in a randomly selected market B). The author also finds that the presence of industry effects signifies cross-industry differences in the height of effective entry barriers, the net advantage of size, and various elasticities. Overall, the study clarifies the relationship between market share and profitability. Brush, Bromiley, and Hendrickx (1999) find that both corporation and industry influence business unit profitability but corporation has the larger influence. The authors use a continuous variable model, as an alternative to the more conventional ANOVA or VCA. This approach estimates the coefficients of corporation and industry effects on business segment returns while explicitly removing the simultaneous effects that might cause inconsistent estimates. In the end, they find a sizable corporate effect on business segment performance, one which appears to be greater than the industry effect. Brush and Bromiley’s findings contradict Rumelt's (1991) widely cited paper, in which Rumelt finds that corporations explain almost none of the variability in business unit profitability. Lenz (1981) provided an interdisciplinary review and evaluation of empirical studies on the performance of whole enterprises. Lenz summarizes and comments on identifying factors that influence organizational performance and also reviews environmental factors affecting firm profitability. Importantly, organizational factors are influenced entirely by human decision making which varies substantially. Also most substantial environmental changes (ex: consumer demand, inflation) will not likely have a uniform impact across companies. Levy (1997) conducts an investment experiment, in which a real monetary profit or loss can occur, to test the Capital Asset Pricing Model (CAPM). He finds that risk and 3 return are strongly associated. While in most cases the Generalized CAPM (alternative risk return model developed by Levy (1978), Merton (1987) and Markowitz (1990)) beta provides the best results, the CAPM beta reveals a strong positive association with mean returns. Levy’s results along with the risk-return equilibrium model provide grounds enough to incorporate beta as a variable associated with company profitability. Powell (1996) looks to answer the question: how much does industry matter in explaining firm performance? His findings support those reported in earlier studies (that industry membership explains roughly 20% of financial performance), but he addresses shortcomings in previous methodologies including the incorporation of personal interviews with CEOs, a sample composed of undiversified firms competing in a wide variety of industry sectors, and analyses of specific industry factors. Powell concludes that not all of the 80% of unexplained performance variance is attributable to firmspecific resources since some will also be attributable to shared generic strategies, strategic group membership, other shared resources, or chance. Roquebert et al (1996) addresses the issue of the relative degree of variance in ROA accounted for by industry, corporate, and strategic business unit (SBU) effects while controlling for the business cycle and the interaction between the business cycle and industry. Their findings provide evidence that strategic management theory has an important role to play in SBU profitability. In Campbell’s (1996) paper he uses an equilibrium multifactor model to interpret the cross-sectional pattern of postwar U.S. stock and bond returns. He uses revisions in forecasts of future labor income growth as proxies for the return on human capital. Campbell finds that aggregate stock market risk is the main factor determining excess 4 returns; but in the presence of human capital, the coefficient of firm risk aversion relative to non-human capital intensive firms is much higher. Thomadikis (1977) finds that current market structure appears to imply an ability of firms to maintain and extend their current advantages into the future. Furthermore, the author finds support that industry concentration plays a role in the determination of both excess profits expected from currently held assets and those expected from the firm’s investment options. Past literature in relation to firm profitability is extensive and over the course of time has addressed several missing components as well as crucial flaws and holes in previous models and methodology. Still today economists acknowledge that there is plenty of room for further research in this area. For instance, a more in depth look at the organizational factors referred to Lenz’s (1981) study is still needed as there is no precise way to account for a company’s management, core business practices, or strategic outlook within the world of modeling. Unfortunately I too ran into the same problem as past researchers when trying to account for the organizational impacts on firm profitability, which is that data for such factors is both subjective and not easily attainable. Below I will discuss my contributions to past studies with the motivation of drawing conclusions and discussing the implications of my findings toward the end of the paper. First, I test for new variables indicating a firm’s reinvestment rate, prior year’s net profit margin & 3-year return as well as financial statement data such as free cash flow, taxes, & inventory turnover. My motivation for testing these new variables is simply the fact that they’ve not been tested previously as regressors to ROA. I believe drawing conclusions on the implications and 5 effects of these variables will provide further insight into the relationship between financial statement data and profitability. Secondly, I look at a more updated time horizon (2003-2007) than in past studies. These years mark the first period following the Sarbanes Oxley Act which was put into effect in 2002 and establishes new or enhanced standards for all U.S. public company boards, management, and public accounting firms. With this Act accounting standards reached a new level of financial statement clarity and it has effectively put an end to frauds similar to those created by Enron, Tyco International, Adelphia, Peregrine Systems and WorldCom.1 Third, in reference to Brush, Bromiley, and Hendrickx (1999) I decide to test if a firm’s GICS market sector has an impact on firm performance. I do this with market sector binaries and a two-way fixed effects model controlling for the company. I also use a variable indicating the number of industries in which a firm conducts business. Such information will allow me to investigate whether or not the broader market in which a firm competes has an effect on profitability. Fourth, I test to see if acquisition activity within a firm has an impact on the bottom line as management teams conduct acquisitions in expectation that it will be accretive to the company’s earnings. Finally, I also include a human capital measure to see if human capital can be shown to influence profitability; I found forecasts of future labor income growth difficult to attain so instead I use R&D as a proxy for return on human capital because it is an easily quantifiable indicator of human capital intensity across companies as it is measured in dollars invested. Model Setup 1 Information on Sarbanes Oxley disclosures can be found at www.sarbanes-oxley.com. The intention of this paper is not to draw conclusions about the effects of Sarbanes Oxley on firm financial statement data but only to note that the period tested represents the first years following its passage. 6 The importance of measuring firm profitability is the result of a number of underlying economic principles. First, from a labor economics standpoint, in the model I will be testing the effects of R&D on ROA. Traditionally, R&D has been recognized as a form of human capital investment (Campbel (1996), Eberhart, Maxwell, & Siddique (2004)), so results of this model will provide evidence as to how beneficial R&D is to a firm. Secondly, over the past 15 years the U.S. economy has been driven by debt, due to the surge of low-rate loans, rapid growth in credit cards, and easy-to-attain mortgages; Such bad lending which has led to the current credit crunch. (The Economist March 22, 2008 pg79-89) Now with the current deleveraging taking place within the credit markets the economy has recently been under strain causing lending to slow which has caused some panic amongst consumers. This could indicate a secular shift from spending to saving which, according to economic principle, would lower an individuals’ marginal propensity to consume. Soaring worries concerning the build up of debt and the future of social security could spark a transition from consumption to savings. With a broader demand for financial security, the ability to make wise investment choices is an underlying reason why judging firm profitability is crucial. Third, by testing the correlation between risk and return I can test the economic and financial concept of the efficient frontier. The efficient frontier is a line created from the risk-reward graph, comprised of optimal portfolios. The line includes the optimal portfolios plotted along the curve with the highest expected return possible for the given amount of risk. This concept is illustrated below. 7 Thus a positive correlation between Beta and lnROA will support the economic theory of the efficient frontier where as a negative correlation would yield contradictory evidence to the theory. Finally, further evidence about what components drive company returns will help generate competition in the market place, as firms strive for efficiency and competitive advantage. This is important as competitive markets promote low prices, productivity, new products, and innovation. The end models used in this analysis is stated below in Equation (1), (2), and (3): (1) lnROA = β0 + β1RDInt + β2Sales + β3DE + β4Acq + β5CurrR + β6Capx + β7ThreeYrRt + β8 BusSeg+ β9QualRank + β10NPM + β11ReinR + β12Year + β13ConsStap + β14Finan + β15HlthCare + β16Tech + β17Industr + β18Telecom + β19ConsDiscr + β20Energy + β21Mater + ε (2) lnROA = β0 + β1RDInt + β2Sales + β3DE + β4Acq + β5CurrR + β6Capx + β7ThreeYrRt + β8 BusSeg+ β9QualRank + β10NPM + β11ReinR + ε (3) lnROA = β0 + β1RDInt + β2Sales + β3DE + β4Acq + β5CurrR + β6Capx + β7ThreeYrRt + β8 BusSeg+ β9QualRank + β10NPM + β11ReinR + ε In my original model I had tested Beta as an independent variable as well, however, when setting up Beta against lnROA I found that an endogeneity problem existed as Beta and lnROA had a strong positive correlation. This is consistent with Levy (1997) findings. In order to maintain the accuracy of the model I removed Beta as it 8 certainly skews my model results with an artificially high R-Squared. The high correlation between Beta and lnROA lends support to the financial and economic principle of the efficient frontier described earlier in this section. In addition, I also removed variables indicating a firm’s level of free cash flow, taxes, advertising expense, and inventory turnover as they were not significant in impacting firm ROA; thus these variables are not accounted for in the final model. Despite the fact that none of the past literature tests these variables I decided I would try running them out of curiosity. I expected these to have only small impacts on the dependent, however, when tested none were significant at any commonly accepted confidence levels. My final models combine both elements of past models and the addition of new regressors which are described in the Literature Review section (Pgs 2-6) and in further detail below. In addition I use a firm’s GICS sector code and variables for past returns and acquisition activity which have not been used previously. The following is a description of some of the financial variables which will be used in the model, and the signs that they are expected to hold when regressing ROA. To begin, the dependent variable, ROA, is a ratio of a firm’s net income divided by its total assets. ROA gives an idea as to how efficient management is using its assets to generate earnings. The assets of a company are comprised of debt and equity which are both used to fund the operations of the company. So ROA gives investors an idea of how effectively the company is converting the money it has to invest into net income. RDInt represents a firm’s R&D intensity which is defined in two ways: a firm’s R&D expense divided by its total sales and a firm’s R&D expense divided by its total 9 assets. This method is consistent with the method used by Chan et al (2001) for defining R&D intensity. Basically, R&D intensity gives an idea of how much a given firm is investing in R&D relative to the firm’s size (which is controlled for with total sales and total assets). I use R&D intensity as a proxy for human capital because the nature of research and development is idea driven and it is a variable that can be tracked across time and companies. R&D represents intangible information, meaning investors have no way of valuing its benefit and thus must speculate as to the return R&D expense will create and how long it will take to create that return. In my model, I test if R&D intensity will be at all beneficial to ROA with in the current year. This is a different test than the one conducted by Eberhart et al (2004), who used lags and concluded that returns from R&D tend to be fully recognized 5 years later. I estimate that a firm with high R&D concentration (proxy for high utilization of human capital) will be more profitable than a firm with lower R&D. I used 3 years for two reasons: first, a 3-year lag has never been tested, and second, I did not have adequate data for a 5-year lag. Sales represent a company’s net sales, which are the amount of sales generated by a company after the deduction of returns, allowances for damaged or missing goods and any discounts allowed. The sales number reported on a company's financial statements is a net sales number. Deductions from the gross sales are represented in the net sales figure. Net sales give a more accurate picture of the actual sales generated by the company. A company will book its revenue once the good or service is delivered or performed for the customer. This is an obvious candidate for a variable that would determine a firm’s profitability. Since it is in a company’s best interest to sell their goods 10 in the market, one must expect that higher Sales should yield a positive boost in return relative to the company’s assets as compared to a lower level of sales. Capx represents capital expenditures (CAPEX). These are funds used by a company to acquire or upgrade physical assets such as property, industrial buildings or equipment. This type of outlay is made by companies to maintain or increase the scope of their operations. These expenditures can include everything from repairing a roof to building a brand new factory. In terms of accounting, an expense is considered to be a capital expenditure when the asset is a newly purchased capital asset or an investment that improves the useful life of an existing capital asset. If an expense is a capital expenditure, it needs to be capitalized; this requires the company to spread the cost of the expenditure over the useful life of the asset. Though CAPEX should drive returns in the long-run, it goes as an expense to the firm in the short run. In my model I use the current year’s CAPEX so I expect that it will have a negative impact on profitability. BusSeg is the number of market segments in which a company conducts business. A well-diversified firm will often achieve its diversification by conducting business in different geographical areas or in different industries. I unfortunately was not able to attain sufficient data for the geographical regions in which S&P companies do business but I was able to find statistics as to how many industries a firm operates within. Since diversification spreads environmental and business risk it is expected that the number of business segments in which a company operates would have a positive influence on return on assets. ReinR is a firm’s reinvestment rate. The reinvestment rate is defined as the rate of return for the firm's investments on average. A firm will reinvest income into new or 11 current investments in order to capture interest rate opportunity. This is similar to CAPEX but different in the sense that the company is not purchasing or upgrading physical property but rather buying securities such as stock and bonds. Security purchases can be conservative or aggressive when taking on risk and seeking return. If the economy is in a growth cycle (as it was in the time period analyzed), and the firm is not taking on excessive amounts of debt while being able to attain good short-term financing, then it is beneficial for it to invest rather than hold cash. Management that reinvests its earnings should recognize increased efficiency and a greater source of funds for the future by utilizing a rate of return therefore boosting ROA. DE is the firm’s debt-to-equity ratio, calculated as total liabilities divided by shareholders’ equity. This is a measure of a company’s financial leverage. A high debtto-equity ratio tends to mean that a company has been aggressive in financing its growth with debt. This can create volatile earnings, and puts a company’s stock more at risk, as it is not a conservative investment. It is a basic principle in finance that greater risk equals greater potential return so one might expect a high debt-to-equity ratio to generate a higher ROA, however, like R&D, the effects debt-to-equity are not tangible and risky so is not likely to create short term returns. Theoretically the debt-to-equity ratio should be negatively correlated with ROA in the current year. NPM stands for net profit margin, which is calculated by taking a firm’s net income divided by revenues. It measures how much out of every dollar of sales a company keeps in earnings. So for instance, if a company has a net profit margin of 20% then this means that the company has a net income of $0.20 for each dollar of sales. Net profit margin is useful when comparing similar companies because a higher profit margin 12 indicates a more profitable company that has better control over its costs compared to its competitors. Thus a company which maintains a higher spread over its costs is likely to recognize higher returns on its assets. CurrR stands for current ratio, also known as the “liquidity ratio,” which is calculated by taking a firm’s current assets and dividing them by a firm’s current liabilities. The current ratio is mainly used to give an idea of the company's ability to pay back its short-term liabilities (debt and payables) with its short-term assets (cash, inventory, receivables). The higher the current ratio, the more capable the company is of paying its obligations. A ratio under 1 suggests that the company would be unable to pay off its obligations if they came due at that point. This shows the company is not in good financial health. The current ratio can give a sense of the efficiency of a company's operating cycle or its ability to turn its product into cash. Companies that have trouble getting paid on their receivables or have long inventory turnover can run into liquidity problems because they are unable to alleviate their obligations. A firm with a higher current ratio will often be able to attain financing at a better rate thus reducing interest expense and generating higher ROA. Acq is a variable accounting for a firm’s acquisition activity in a given year. An acquisition is a corporate action in which a company buys most, if not all, of the target company's ownership stakes in order to assume control of the target firm. Acquisitions are often made as part of a company's growth strategy whereby it is more beneficial to take over an existing firm's operations and niche compared to expanding on its own. The acquiring company often offers a premium on the market price of the target company's shares in order to entice shareholders to sell. For example, News Corp.'s bid to acquire 13 Dow Jones was equal to a 65% premium over the stock's market price. Firms invest in acquisitions because they believe that they will drive revenue growth down the road, however, in the short-term it is only likely to hurt a firm’s ROA, as money is used. This principle would dictate that an increase in Acq will contribute positively to future ROA but negatively to current ROA therefore Acq should have a negative coefficient. ThreeYrRt is the 3-year stock return of a company. In other words, this tells how much a stock appreciates or depreciates in a three year period. This is related to ROA because a firm with strong historical performance is more-often-than-not likely to outperform a firm with poor historical performance. A 3-year return measure is an indication of management and investor confidence. This is why most investment textbooks (such as 24 Essential Lessons to Investment Success by William J. O’Neil) and online professional advisement tools (such as Morningstar) will urge investors to check a stock or mutual fund’s past performance before committing money. I lag this variable one year in my model as an indicator of how the stock performed in the recent past. If the company has a high 3-year stock return then one would expect the current year’s ROA to be higher. Thus a higher ThreeYrRt should yield a stronger ROA. QualRank is the Standard and Poors quality ranking. Standard and Poors assigns a ranking to individual company stocks. Over the long term stocks of companies with a high S&P Quality Ranking, which measures consistency of earnings and dividends growth over the last 10 years, outperform both low-quality ranking stocks and the S&P 500 Index. I use data for the S&P Quality Ranking to measure company consistency and stability across years. S&P’s High Quality Ranked stocks have been cited as outperforming the broader market in articles such as BusinessWeek’s: “Stocks: Stability 14 is Sexy Again by Karyn McCormack.” To test such statements I incorporate these rankings and see if they have an impact on ROA. If articles are correct then I’d expect a negative coefficient on QualRank as lower numbers are equivalent to higher rankings; thus a company stock ranked: ‘1’ is the highest. Finally, the remaining variables used are binaries created to reflect the sector a company is classified in, using the General Industry Classification System (GICS). Powell (1996) finds strong evidence that industry accounts for approximately 20% of firm financial performance. Thus it is considered crucial to have an industry variable within the model. In this analysis, all sectors are tested against ROA, leaving Utilities as the control group, as it is expected to be the least volatile from year to year. Given the time periods of the regressions, every sector except Financials should have a positive correlation with ROA. Financials is not expected to be positively correlated with ROA, as firms struggled to generate capital initially after 9/11, and then became overvalued in the following years as speculators drove up prices. Data Sources and Description In this analysis, a variety of variables will be investigated that from a theoretical perspective might logically affect ROA. Table 1 below provides descriptions for each independent variable within the final regression models. 15 Variable lnROA ROA RDInt CurrR DE NPM ReinR Capx ThreeYrRt BusSeg Sales QualRank ReinR Acq Tech Industr Telecom ConsDiscr Energy Mater ConsStap Finan HlthCare N 2393 2393 2393 2393 2393 2393 2357 2375 2390 2110 2393 2393 2357 2393 2393 2393 2393 2393 2393 2393 2393 2393 2393 TABLE 1: SUMMARY STATISTICS OF RELEVANT VARIABLES Mean Std Dev Minimum 1.7907968 0.8353164 -4.0745419 7.8366578 5.4087489 0.0170000 0.0245045 0.0410065 0 1.7327108 1.3589434 0.2320000 0.9807965 4.6611003 -31.9740000 9.6429072 7.8515051 -11.8270000 15.3887913 90.0474201 -3534.98 934.2238808 1854.65 0 12.9604021 20.4581025 -57.3130000 3.6056872 2.0756133 1.00 14731.04 28207.64 154.682000 14.0501463 4.2927947 7.00 15.3887913 90.0474201 -3534.98 -8.1331266 77.9136221 -1684.00 0.1358128 0.3426613 0 0.1604680 0.3671163 0 0.0150439 0.1217528 0 0.1964062 0.3973623 0 0.0982031 0.2976513 0 0.0647723 0.2461750 0 0.1061429 0.3080848 0 0.0125366 0.1112860 0 0.1161722 0.3204982 0 Maximum 3.9187404 50.3370000 0.2819189 27.3920000 119.1850000 117.5730000 2027.43 17717.00 221.1430000 10.00 375376.00 21.00 2027.43 622.00 1 1 1 1 1 1 1 1 1 The independent variables: Sales, Capx, and Acq are recorded in thousands of dollars and all other variables are reported as a percentage except for QualRank and BusSeg which are reported at their actual value and the sector binaries which coordinate to a given GICS sector identification number. The data used in this paper came solely from Research Insight (previously called COMPUSTAT). Research Insight is a subscription-needed statistical database, housing U.S. company financial statement and market data for every year since 1952. I decided to collect data on the Standard and Poors (S&P) 500 Index as it represents the premiere 500 companies in the United States in which data are most easily attainable for and in which individual and institutional investors are most likely to be attracted to invest in. Because some entries were missing variables, I was only able to 16 use data from the years 2003-2007. From here, new variables were created using SAS that were not provided through Research Insight. These variables are described in the above ‘Model Setup’ section and were used to represent R&D intensity (R&D expense/Total Assets, R&D expense/Sales) as well as changes in level which are accounted for by the binary variables for sector and market value. All preferred stock entries which arose in the Research Insight query results were excluded from the downloaded dataset because preferred stock does not represent the issuing company but is rather just a type of stock issued by a company and includes a different ticker symbol then the company itself. In addition, all exchange-traded funds (ETFs) which were downloaded into the dataset have been excluded because ETFs are merely an index of companies in a given industry and therefore, like the preferred stock, do not actually have data for the variables. My final models used 2076 out of 2393 read observations because 317 of the observations were missing for several companies in the Research Insight data for reasons unknown. In order to create the variable RDInt, R&D expense was divided by total assets. In addition, R&D expense was divided by total sales. Therefore, all companies were excluded that had a value of zero for either total assets or total sales, in order to accomplish this division. Also excluded is any observation where ROA was less than or equal to 0 because the final model uses semi-log regressions, in which case ROA must have a positive value. The final model is a semi-log regression because it tested out better than the linear and double-log regressions. Table 2 below provides summary statistics for the mean of each of the final variables. One table is appropriate, as the variables do not change substantially in the 17 different observation years. The numbers of observations displayed in the table are those that remained after exclusions. Model Estimation There were no relevant models in the reviewed literature that regressed ROA as the dependent variable, so measurement principles and evidence of variable relationships from Roquebert et al(1996) and Hirschey and Wichern (1984), specifically measures of industry (sector binaries, BusSeg) and leverage (DE), are used in order to formulate a logical equation that theoretically should work to a reasonable extent in modeling ROA. This approach took a number of tests in which several regressions were run, employing an assortment of different variables. Linear, semi-log, and double-log models were tested to determine which approach most closely resembled the data as well as a one-way (Equation (2)), and two-way fixed (Equation (3)) effects regression controlling for year and company. All variables were then removed that were insignificant in every model type tested. These omitted variables included variables for tax level, advertising expense, inventory turnover, and free cash flow. I also attempted using 1-year lagged variables for RDInt, ReinR, and Capx to see if these would drive returns in future periods. The lag flipped the sign of the parameter estimate for Capx while RDInt and ReinR maintained the same sign. This was expected, however, every variable I tried to lag became less significant. This would imply that past performance measurements are less relevant to current profitability measures and that higher significance is found amongst the independent variables when taken in the same time period as the dependant. This makes sense for two reasons. 1) every observation I lagged was a company specific variable 18 meaning that it varies in its scope and its effectiveness across companies and 2) my dataset spans only across a relatively short time horizon so I was unable to lag my variables to test for recurring long-term effects. Take, for instance, R&D intensity. This variable will always be more significant when observing its effects on profitability in the same time period as opposed to a future time period. This is because no matter which company is investing in R&D, the company will always book it as an expense in the current time period and thus the investment will deduct from total return. However, when looking at a future time period this will not always be the case as a given company ‘A’ might recognize return on its investment after a year but a second company ‘B’ won’t recognize any returns for 7 years. This might not be the case when looking over a longer time horizon or when considering a universal variable such as inflation in which the same rate would apply to all companies thus creating a more predictable effect in the future. In the end, the models I decided to use were the Ordinary Least Squares Semi-log form, the One-way Fixed Effects, and the Two-way Fixed Effects. I went with the Semilog form as it explained more of the variance than that of the ordinary least squares and double-log models and was also able to account and draw conclusions for my industry sector binaries. I chose to stick with the one and two-way fixed effects models for three reasons: 1) to draw conclusions when controlling for the company and the year, 2) to account for the sector binaries since they won’t run in the fixed effects models, and 3) though independent variable significance was similar across models there were some discrepancies. Equation (1) represents the Semi-log model while Equation (2) and Equation (3) were used for the One-way and Two-way Fixed Effects models respectively. 19 The major limitations of the models include the inability to account for variables that have been found to be significant in prior studies. Hanson (1989) finds that both organizational and economic factors drive firm financial performance. This model is very organizationally driven, but does not focus much on economic factors except accounting for firm sector. I chose to ignore inflation rates in the model due to the fact that I could not regress across years and therefore could not see the affects of changing inflation within the period. Also past studies such as Lenz (1981) concluded that inflation did not have a significant impact on firm profitability, as inflationary pressures tend to be weighted evenly across sectors. In addition, another limitation that arises is that certain determinants have been left out of the models due to lack of data and/or hard to quantify values. For instance, it would have been preferred to have statistics on the efficiency of firm management which Roquebert et al (1996) suggested may be important in determining company performance. But this information is subject to highly subjective interpretation and represents data that is not quantifiable. Similarly, it would have also been nice to have recorded historical data on the number of geographical areas in which an S&P 500 company operates as a means of measuring geographic diversification which has been shown to spread and/or minimize a firm’s beta while maintaining better returns. Results The results of the various models are listed in Table 2 and Table 3 below. Table 2 reports the relevant variables and how they perform in each model, in addition to the parameter estimates for the final variables along with their standard errors, and level of significance. In general, most variables were found to be significant but with low 20 parameter estimates, meaning that there is strong evidence that the variables are correctly effecting ROA but to a minimal extent. TABLE 2: REGRESSION RESULTS FOR ALL VARIABLES, DIFFERENT MODELS DEPENDENT VARIABLE: lnROA Ordinary Least Squares One-Way Fixed Effects Two-Way Fixed Effects Variab Param Stnd Param Stnd Param Stnd Estim error Estim error Estim error Intercept -59.332 13.22703 *** 2.031603 0.0728 *** 1.896134 0.2627 *** RDInt 2.10047 0.43356 *** 2.345286 0.415 *** 3.78386 1.0834 *** Year 0.02871 0.00660 *** Sales 0.00001 7.651E-7 *** 7.833E-6 7.89E-7 *** 2.967E-7 1.872E-6 CurrR -0.031 0.01157 *** 0.0148 0.74 -0.02826 0.0223 DE -0.0096 0.00277 *** -0.00792 0.00284 *** -0.00235 0.00239 NPM 0.05462 0.00201 *** 0.04839 0.00211 *** 0.064131 0.00238 *** Acq -0.2197 0.0475 *** -0.27755 0.0562 *** -0.20635 0.0438 *** ReinR 0.00058 0.00013 *** 0.000562 0.000135 *** 0.000228 0.0001 ** Capx -0.0001 0.000013 *** -0.00011 0.000013 *** -0.0002 0.00019 ThreeYrRt 0.00812 0.000688 *** 0.008215 0.000847 *** 0.007161 0.00073 *** BusSeg -0.006 0.00651 -0.0215 0.00720 *** -0.0212 0.0127 * QualRank -0.0419 0.00324 *** -0.04917 0.00367 *** -0.00021 0.00642 Tech 0.53167 0.06669 *** Telecom 0.35872 0.11796 *** ConsDiscr 0.7658 0.05157 *** Energy 0.4739 0.05938 *** HlthCare 0.64939 0.06487 *** Mater 0.57134 0.06464 *** Finan 0.18875 0.1257 ConsStap 0.84078 0.06002 *** Industr 0.557 0.05312 *** 2004 0.19042 0.0484 *** 0.19587 0.0318 *** 2005 0.11049 0.0469 ** 0.10821 0.0300 *** 2006 0.13045 0.0468 *** 0.11927 0.0294 *** 2007 0.04099 0.0461 0.03639 0.0279 Note: Asterisks indicate significance:*** 1% Level, **5% Level, *10% Level In addition to the final variables, and after running multiple tests, variables that were not significant were removed from the model equations. These included variables representing a firm’s free cash flow, tax level, inventory turnover, and advertising expense. 21 RDInt is significant at the 1% confidence interval in determining ROA in years 2003 through 2007 in every model. This would imply that the investment in human capital was very significant and is beneficial to profitability within the same year. This result varies from what I expected. I predicted that RDInt would have a positive impact on ROA but I was expecting that contributions to profitability would be seen down the road and not within the same year as the investment took place. So in summary according to the Semi-log model, a one unit increase in RDInt caused ROA to rise 2.10047%. In the One-way Fixed Effects model, a one unit increase in RDInt caused ROA to rise 2.345286%. In the Two-way Fixed Effects model, one unit increase in RDInt caused ROA to rise 3.78386%. Year was only used in the Semi-log model as seen in the equations above. Year accounts for the change in time and is significant at the 1% confidence interval. According to the Semi-log model, ROA increases 0.02871% for each year that passes. This makes sense because on average firm profitability has been shown to appreciate over time which can be seen by looking at any long-term stock index chart as these are measures of average market performance. Below is a chart from MSN Money showing the price appreciation of the S&P 500 over the time period in the model. 22 http://moneycentral.msn.com/investor/charts/chartdl.aspx?Symbol=%24INX Sales was significant in both the Semi-log and One-way Fixed Effects models at the 1% confidence interval. Given the time period in the Semi-log model, for every $1000 increase in Sales, ROA rose 0.00001%. In the One-way Fixed Effects model, a $1000 rise in Sales caused ROA to increase 7.833E-6%. This shows that the impact of sales on profitability is minuscule but positive. The parameter estimates for CurrR proved significant only in the Semi-log model. It was significant at the 1% confidence interval but held a negative sign which was not anticipated. The effect on ROA though negative was small and since it was insignificant in the other two models I don’t put much weight on the result of the Semi-log model. The parameter estimate of CurrR in the Semi-log model implies that liquidity has a negative impact on firm profitability. For every one unit increase in a firm’s current ratio, ROA dropped 0.031%. DE in this time period had a slight negative effect on ROA and is significant at the 1% confidence interval in the Semi-log and One-way Fixed Effects models. This means that in general less leveraged firms benefited more than those maintaining higher debt 23 levels. This is not surprising as debt financing leads to elevated risk in the near-term before yielding potentially higher returns down the road. Also higher debt can lead to bankruptcy if a firm is not careful about managing interest rate risk and cashflow. Given the time period in the Semi-log model, for every one unit increase in the debt-to-equity ratio ROA drops 0.0096%. In the One-way Fixed Effects model, a one unit increase in DE caused ROA to fall 2.345286%. NPM was significant at the 1% confidence interval across models and had a positive outcome to ROA. This was expected and signifies that from 2003-2007 companies with a greater profitability margin or spread over their costs tended to see higher returns on their assets. In the Semi-log model, a one unit increase in a firm’s NPM yielded a positive impact on ROA of 0.05462%. In the One-way Fixed Effects model, a one unit increase in NPM caused ROA to increase 0.04839%. In the Two-way Fixed Effects model, a one unit increase in NPM caused ROA to rise 0.064131%. Continuing, Acq was also significant at the 1% confidence interval in every model and the theoretical sign expectations held as Acq had a negative impact on ROA. Acquisitions are large investments and require large outlays of cash that hurt profitability in the near-term. In the Semi-log model, a $1000 increase in a firm’s acquisition activity yielded a negative impact on ROA of 0.2197%. In the One-way Fixed Effects model, a $1000 increase in Acq caused ROA to decrease 0.27755%. In the Two-way Fixed Effects model, a $1000 increase in Acq caused ROA to fall 0.20635%. ReinR was significant in determining ROA at the 1% confidence interval in the Semi-log and One-way Fixed Effects models and significant at the 5% confidence interval in the Two-way Fixed Effects model. These results match my initial 24 expectations as ReinR had a positive influence on ROA. This indicates that companies that reinvest more of their earnings into securities tend to recognize higher returns in the near-term. In the Semi-log model, a one unit increase in a firm’s ReinR produced a positive impact on ROA of 0.00058%. In the One-way Fixed Effects model, a one unit increase in ReinR caused ROA to rise 0.000562%. In the Two-way Fixed Effects model, a one unit increase in ReinR caused ROA to rise 0.000228%. Capx had a slightly negative influence on ROA in every model and was significant at the 1% confidence level in the Semi-log and One-way Fixed Effects models. This was anticipated and means that, like acquisition activity, the initial investment in physical capital at a firm tends to detract from profitability in the first year. In the Semi-log model, a $1000 increase in a firm’s Capx created a negative impact on ROA of 0.0001%. In the One-way Fixed Effects model, a $1000 increase in Capx caused ROA to decrease 0.00011%. ThreeYrRt was significant at the 1% confidence interval in each of the final models and always led to higher ROA. This was as predicted and lends support to the idea that historical performance is useful when generating future return forecasts. In the Semi-log model, a one unit increase in a firm’s ThreeYrRt produced a positive impact on ROA of 0.00812%. In the One-way Fixed Effects model, a one unit increase in ThreeYrRt caused ROA to rise 0.008215%. In the Two-way Fixed Effects model, a one unit increase in ThreeYrRt caused ROA to increase 0.007161%. BusSeg was significant at the 1% confidence interval in the One-way Fixed Effects model and the Two-way Fixed Effects model was significant at the 10% confidence level. The number of business segments actually had a slight negative effect 25 on ROA in all three models. This means that diversification across industry segments was not helpful to attaining stronger profitability. This comes as a surprise as diversification is a way of diversifying risk and creating safer returns. In the One-way Fixed Effects model, operating in one additional business segment decreases ROA by 0.0215%. In the Two-way Fixed Effects model, an additional business segment led to a 0.0212% decrease in ROA. QualRank was beneficial to ROA in all three models and significant at the 1% confidence level in both the Semi-log and One-way Fixed Effects models. Though the parameter estimates are negative the S&P quality ranks were actually helpful to profitability because a rank of 1 is better than a rank of 10. In the Semi-log model, a one rank increase in the firm’s QualRank detracts from ROA by 0.0419%. In the One-way Fixed Effects model, a one rank increase in the firm’s QualRank detracts from ROA by 0.04917%. The remaining final variables are binary and represent a firm’s GICS sector classification. The parameter estimates for every sector variable had a positive impact on ROA and demonstrated significance at the 1% confidence level in the time period except for Finan. Finan was not significant in determining profitability in the model. ConsStap clearly displayed the most relevance, improving ROA by 0.84078%. Companies in the Telecom and Financial sector benefited the least as Telecom only improved ROA by 0.35872% and Finan benefited ROA by only 0.18875%. In other words, firms in sectors such as Consumer Staples and Consumer Discretionary tended to see higher returns and companies in the Financial and Telecom sector benefited the least. 26 For the fixed effects models independent variables were generated for each year with 2003 acting as the base year. 2004, 2005, and 2006 were all significant at the 1% confidence level and contributed to ROA growth by a range of 0.11049% to 0.19042%. 2007 was not significant in determining ROA. Table 3 provides a summary of the statistical strength of each model. Every model had a significant F value, meaning that all were valid. The Adj. R2 of the Semi-log model was 0.5242. For the One-way Fixed Effects it was 0.4642 and for the Two-way Fixed Effects it was 0.8566. The RMSE was similar in the Semi-log and One-way Fixed Effects models while varying significantly in the Two-way Fixed Effects model. TABLE 3: DESCRIPTIVE STATISTICS FOR ALL YEARS DEPENDENT VARIABLE: lnROA OLS Semi-log One-way Fixed Two-way Fixed 0.5242 0.4642 0.8566 0.56349 0.5732 0.3366 107.76 4.95 9.53 2076 2076 2076 Variab Adj R2 RMSE F Value N Conclusions This paper sought to answer the question: What factors determine firm profitability? Or more specifically, what factors affect a firm’s ROA? To conclude, it was found that a number of financial statement variables and ratios can be used to gauge ROA. For instance this paper lends support that financial statement data such as: sales, current ratio, debt-to-equity ratio, and net profit margin are significant when determining profitability. Also significant were proxies for human capital investment, historical performance, and industry diversification. Also of importance, this paper finds evidence that tax levels, advertising costs, inventory turnover, and free cash flow did not appear to have statistically significant impacts on a firm’s ROA in any of the models tested. 27 It was found that the broader market sector in which a firm competes is highly significant in determining profitability. Of the industry sectors tested, it was found that companies in Consumer Staples and Consumer Discretionary were the most helpful to returns. Furthermore, the Financial sector, though beneficial to ROA, was the least helpful. This is likely due to the raising of interest rates by the Federal Reserve in the early 2000s, the impact 9/11 had on lending institutions, and possibly the accordance with the accounting rules dictated by the Sarbanes Oxley Act. The results leave several implications for investors and businesses. Viewing evidence about what drives company profitability will help businesses understand which economic and financial factors are critical to track and analyze in order to attain operational success. Importantly, if businesses know which factors are likely to boost performance, then this should create increased competition in the marketplace. Economically, this would aid in keeping prices low, providing new substitute and complementary goods and creating jobs. For individuals, the fear of not having money after retirement provides incentive for people to setup personal investment plans. Http://seniorliving.about.com says this about social security “It is true that Social Security benefits are experiencing financing problems, and while this will not affect today's retirees and near-retirees, the problems are very serious. People live longer, the first baby boomers are five years from retirement, and the birth rate is low. This results in a large drop in the worker-tobeneficiary ratio… At this rate of decline there will not be enough workers to pay scheduled benefits at current tax rates. Without a large infusion of additional revenue, 28 Social Security benefits are not sustainable over the long term. There will be a massive and growing shortfall over the next 75 years.” Despite the bleak and uncertain outlook on Social Security people can use this knowledge and personally start taking care of their retirement through equity investing. Recognizing the drivers of ROA will help new investors analyze financial statements and make informed equity investment decisions. It is important that individuals recognize the urgency of investing for their future and that stocks historically have appreciated over time leading to substantial long-term gains in the market. Implications for public policy include further education about personal finance in regards to investment analysis. With a debt driven economy, the need to save and guarantee future financial security is becoming evermore apparent. A society that understands financial measurements and their implications on company operating performance is more capable of making good decisions that can help drive economic prosperity and growth. 29 References Brush, Thomas H, Philip Bromiley, Margaretha Hendrickx (1999). “The Relative Influence of Industry and Corporation on Business Segment Performance: An Alternative Estimate,” Strategic Management Journal 20(6), pp. 519-547 Campbell, John Y. (1996). “Understanding Risk and Return,” Journal of Political Economy 104(2), pp. 298-345 Chan, Louis K.C., Josef Lakonishok, and Theodore Sougiannis (2001). “The stock market valuation of research and development expenditures,” Journal of Finance 56, pp. 2431-2456 Eberhart, Allan C., William F. Maxwell, and Akhtar R. Siddique (2004). “An examination of long-term abnormal stock returns and operating performance following R&D increases,” Journal of Finance 59, pp. 623-650 Hansen, G. and B. Wernerfelt (1989). “Determinants of Firm Performance: The Relative Importance of Economic and Organizational Factors,” Strategic Management Journal 10(5), pp. 399-511. Hirschey, Mark and W. Wichern (1984). “Accounting and Market-Value Measures of Profitability: Consistency, Determinants, and Uses,” Journal of Business and Economic Statistics 2(4), pp. 375-383. Kessides, I.N. (1990). “Internal Versus External Market Conditions and Firm Profitability: An Exploratory Model,” Economic Journal 100(402), pp. 773Lenz, R. T. (1981). “Determinants of Organizational Performance: An Interdisciplinary Review,” Strategic Management Journal 2(2), pp. 131-154. Levy, Haim (1997). “Risk and Return: An Experimental Analysis,” International Economic Review 38(1), pp. 119-149. McCormack, Karen. “Stocks: Stability is Sexy Again,” BusinessWeek. Apr 2006. Available at: http://www.businessweek.com/investor/content/apr2006/pi20060420_620314.htm?campaign _id=rss_daily Pettengill, Glenn N, Sridhar Sundaram, Ike Mathur (1995). “The Conditional Relation between Beta and Returns,” Journal of Financial and Quantitative Analysis 30(1), pp. 101-116. Powell, Thomas C. (1996). “How Much Does Industry Matter? An Alternative Empirical Test,” Strategic Management Journal 17(4), pp. 323-334. Roquebert, Jaime A., Robert L. Phillips, Peter A. Westfall (1996). “Markets vs. Management: What ‘Drives’ Profitability?”, Strategic Management Journal 17(8), pp. 653-664. Thomadikis, S.B. (1977), “A Value-Based Test of Profitability and Market Structure,” Review of Economics and Statistics 59, pp. 179-185. 30