15_bank regulation

advertisement

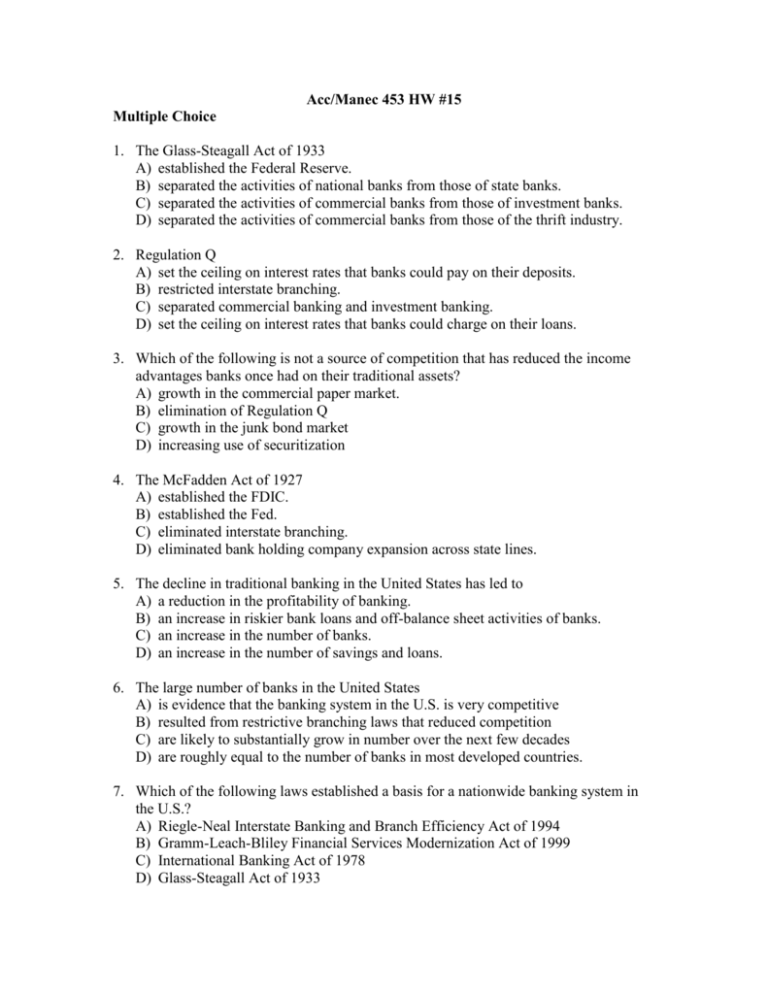

Acc/Manec 453 HW #15 Multiple Choice 1. The Glass-Steagall Act of 1933 A) established the Federal Reserve. B) separated the activities of national banks from those of state banks. C) separated the activities of commercial banks from those of investment banks. D) separated the activities of commercial banks from those of the thrift industry. 2. Regulation Q A) set the ceiling on interest rates that banks could pay on their deposits. B) restricted interstate branching. C) separated commercial banking and investment banking. D) set the ceiling on interest rates that banks could charge on their loans. 3. Which of the following is not a source of competition that has reduced the income advantages banks once had on their traditional assets? A) growth in the commercial paper market. B) elimination of Regulation Q C) growth in the junk bond market D) increasing use of securitization 4. The McFadden Act of 1927 A) established the FDIC. B) established the Fed. C) eliminated interstate branching. D) eliminated bank holding company expansion across state lines. 5. The decline in traditional banking in the United States has led to A) a reduction in the profitability of banking. B) an increase in riskier bank loans and off-balance sheet activities of banks. C) an increase in the number of banks. D) an increase in the number of savings and loans. 6. The large number of banks in the United States A) is evidence that the banking system in the U.S. is very competitive B) resulted from restrictive branching laws that reduced competition C) are likely to substantially grow in number over the next few decades D) are roughly equal to the number of banks in most developed countries. 7. Which of the following laws established a basis for a nationwide banking system in the U.S.? A) Riegle-Neal Interstate Banking and Branch Efficiency Act of 1994 B) Gramm-Leach-Bliley Financial Services Modernization Act of 1999 C) International Banking Act of 1978 D) Glass-Steagall Act of 1933 E) McFadden Act of 1927 8. The bundling of a portfolio of mortgage or student loans into a marketable capital market instrument is known as A) Computerization B) Consolidation C) Economies of scope D) Securitization 9. Which of the following innovations helped banks circumvent restrictive branching laws? A) Financial derivatives B) Securitization C) Bank holding companies and ATMs D) Sweep accounts 10. Which of the following is not true of a banking system with deposit insurance? A) Depositors are more likely to deposit their money in a bank B) Depositors are less likely to withdraw their money in the event of a crisis. C) Depositors are less likely to collect information about the quality of the bank’s loans. D) The moral hazard problem in banking is reduced. 11. The presence of deposit insurance increases the adverse selection problem in banking by A) attracting risk-loving people into bank ownership B) increasing risky loans in banking C) reducing bank capital D) reducing the amount of deposits in the bank 12. If the FDIC considers an insolvent bank “too big to fail”, it will resolve the insolvency through the A) payoff method, which guarantees all deposits B) payoff method, which guarantees only deposits that do not exceed $100,000 C) purchase and assumption method, which guarantees all deposits D) purchase and assumption method, which guarantees all deposits that do not exceed $100,000 13. The “too big to fail policy of the FDIC A) Decreases the moral hazard incentives for large banks. B) Increases the moral hazard incentives for large banks. C) Decreases the moral hazard incentives for small banks. D) Increases the moral hazard incentives for small banks. 14. Which of the following banking regulations is most focused on reducing adverse selection in banking? A) Consumer protection laws B) Disclosure requirements requiring banks to use standard accounting principles C) Periodic on-site examinations D) Bank charter requirements 15. The McFadden Act of 1927 and the Glass-Steagal Act of 1933 A) Increased bank competition and increased efficiency in banking B) Reduced bank competition and reduced efficiency in banking C) Increased bank competition and reduced efficiency in banking D) Reduced bank competition and increased efficiency in banking 16. The primary objective of the Basel Accord was to standardize A) deposit insurance across international boundaries B) bank examinations across international boundaries C) bank capital requirements across international boundaries D) branching restrictions across international boundaries 17. Which of the following was not a cause for the savings and loan and banking failures in the 1980’s? A) regulation Q was removed allowing risky institutions to pay more to attract funds B) there was a sharp increase in interest rates in the early 1980’s C) regulators responded by drastically increasing capital requirements, pushing banks into insolvency D) banks and savings and loans had greater competition from junk bonds and commercial paper, and they responded by making riskier loans to maintain profits 18. Which of the following caused a significant but possibly manageable problem of savings and loan and banking failures to explode into a true crisis during the 1980’s? A) an increase in the frequency of examinations by the FDIC and FSLIC B) regulatory forbearance on the part of regulators C) pressure from Congress and the industry to close insolvent thrifts D) a reduction in the growth rate of troubled savings and loans and banks 19. The final cost to the taxpayer for the savings and loan bailout was approximately A) $20 million B) $150 million C) $20 billion D) $150 billion Free Response 1. Provide examples of two market situations where (1) adverse selection and (2) moral hazard might be a problem.