problem set 3 - Shepherd Webpages

advertisement

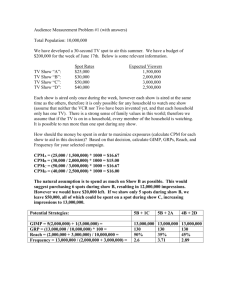

PROBLEM SET 3 TEXTBOOK, p. 439: 5* *Answers in back of textbook ADDITIONAL PROBLEMS 1. The following rates currently exist: Current spot exchange rate: $1.200 per €1 (where € = euro) Interest rate on 180-day euro-denominated bonds: 5% Interest rate on 180-day U.S. bonds: 6% International investors currently expect the spot exchange rate to be about $1.206 per €1 in 180 days. a. Given the above information, would international financial investors who do not cover the exchange rate risk shift their portfolios towards U.S. bonds, Euro bonds, or leave their portfolios as they are? Explain. b. What is the equilibrium value of the spot rate? Must the spot euro appreciate or depreciate from its current value of $1.200 to reach the equilibrium rate? 2. Assume it’s a few years ago and the Germans still use the Deutsche mark (DM) as their currency. Assume the interest rate on German assets is 5% and the interest rate on U.S. assets is 10%. The forward exchange rate is $1.05 per DM1, and the current spot exchange rate is $1 per DM1. a. You are the owner of an asset portfolio and are unwilling to bear exchange rate risk, so you always cover your international investments. Given the information above, would you shift your portfolio toward US $, DM, or leave it as it is? Explain. b. If the forward rate were to fall to $1 per DM1, what adjustments would you make to your portfolio? Explain. 3. Assume the interest rate on US $-denominated assets maturing in five years is 30% for the entire period and the interest rate on comparable Canadian dollar (Can$) denominated assets is 5%. The current spot exchange rate between the US$ and the Can$ is US $ 0.80 per Can$1. a. You are the owner of an asset portfolio, and you never use forward contracts to cover foreign exchange risk. You expect that five years from today, the spot exchange rate will be US $1 per Can$1. Would you shift your portfolio toward US $, Can$, or leave it as it is? Explain. b. If your expectation of the spot exchange rate in five years were to change from US $1 per Can$1 to US $0.90 per Can$1, what adjustments would you make in your portfolio? Explain. c. If everyone else shares your change in expectations (in part c), what will happen to the spot exchange rate? Explain. 2 4. a. Suppose that the interest rate on 30-day dollar-denominated deposits is currently 3% and the interest rate on British pound-denominated deposits is 4%. The current spot exchange rate is between the U.S. dollar and the pound (₤) is $1.50 per ₤1. Investors expect the spot rate in 30 days to be $1.485 per ₤1. Demonstrate that the spot foreign exchange market for pounds is in equilibrium at the current spot rate of $1.50 per ₤1. Draw a demand-supply diagram showing the current situation in the spot market. b. Suppose investors suddenly begin to expect the spot rate to be $1.45 per ₤1 in 30 days. Will investors shift their investment portfolios toward dollars or pounds? Explain. c. Show the impact of the event in part b on the spot foreign exchange diagram you have drawn. d. Calculate the new equilibrium spot foreign exchange rate based on the new expected spot rate ($1.45 per ₤1). Show work. 5. Consider the spot foreign exchange market for the U.S. dollar and the Swiss franc in the short-run. $ per SF1 SSF (sell SF/buy $) $.60 DSF (buy SF/sell $) # SF a. What is the relationship between the equilibrium in the spot foreign exchange market in the short run and the uncovered interest parity condition? b. What happens to the exchange rate above in the short-run if each of the following separate situations occurs? Use a diagram to illustrate. i. A decrease in interest rates on Swiss deposits. ii. A decrease in interest rates on U.S. deposits. iii. A sudden expectation that Swiss workers will go on strike to protest cuts in their wages. iv. An expectation that the Swiss Central will pursue contractionary monetary policy (which is expected to raise Swiss interest rates). v. New reports indicate that the Fed is expected to increase U.S. short-term interest rates. vi. New information indicates that Swiss elections next year are expected to result in a new government which is not friendly to business and is anti-free trade. vii. U.S. inflation is higherthan expected. 3 6. Suppose that the U.S. has been running a trade deficit of about $10 billion per month. Last month, this increased slightly to $11 billion. What is likely to be the effect on the dollar’s exchange rate value if the Commerce Department announces that this month’s trade deficit was only $6 billion? 7. A country’s government is attempting to steady the exchange rate value of its currency, while international financial investors increasingly expect that the country’s currency will depreciate. What change in the country’s interest rates should the country’s government implement? SELECTED ANSWERS TO ADDITIONAL PROBLEMS 1. a. Expected rate of return on euro bonds 5% + (($1.206-$1.2)/$1.2)x100 = 5.5% Rate of return on U.S. bonds 6% Since U.S. bonds give larger return, shift portfolio toward U.S. bonds and away from euro bonds. b. Since the uncovered interest parity condition is not satisfied, the current exchange rate ($1.200 per euro) is not the equilibrium rate. The equilibrium rate occurs when expected rate of return on euro bonds = rate of return on U.S. bonds: 5% + (($1.206 – e)/e) x 100 = 6% Solve for e: Subtract 5% from both sides: ((1.206 – e)/e) x 100 = 1% Divide both sides by 100: (1.206-e)/e = .01 Divide both terms on the right by e: 1.206/e – 1 = .01 Add 1 to both sides: 1.206/e = 1.01 Multiply both sides by e: 1.206 = 1.01e Solve for e: e = 1.206/1.01 = $1.19 per euro. For equilibrium, the spot euro must depreciate. 4 2. a. Rate of return on Ger. assets Rate of return on U.S. assets 5% + (($1.05-$1)/$1)x100 = 10% 10% Covered interest parity implies no change in the portfolio. b. Rate of return on Ger. assets Rate of return on U.S. assets 5% + (($1-$1)/$1)x100 = 5% 10% Since the rate of return on German assets is now less than that on U.S. assets, purchase U.S. assets. 3. a. Expected rate of return on Can. assets Rate of return on U.S. assets 30% 30% Uncovered interest parity implies no change in portfolio. b. Expected rate of return on Can. assets Rate of return on U.S. assets 17.5% 30% Purchase U.S. assets. c. The portfolio adjustment toward U.S. assets would decrease the demand for Can$ and increase the supply of Can$ (as people sell more Can$ to buy US $) spot rate for Can$ depreciates below $.80/US $ appreciates. 4. a. Expected rate of return on British assets Rate of return on U.S. assets 4% + (($1.485-$1.50)/$1.50)x100 = 4% -1% = 3% 3% b. Expected rate of return on British assets Rate of return on U.S. assets 4% + (($1.45-$1.50)/$1.50)x100 = 4% -3.33% = 0.67% 3% Buy more U.S. assets relative to British assets. c. Buy more U.S. assets buy more $/sell more pounds increase supply of pounds. Buy fewer British assets decrease demand for pounds spot rate for pound depreciates below $1.50. d. $1.464646 per pound. 5 5. a. When the spot foreign exchange market is in equilibrium in the short-run, the uncovered interest parity condition is satisfied (or EUD = 0). b. i. Decrease DSF and increase SSF SF depreciates. ii. Increase DSF and decrease SSF SF appreciates. iii. Decrease expected dollar-price of SF Decrease DSF and increase SSF SF depreciates. iv. Increase expected dollar-price of SF Increase DSF and decrease SSF SF appreciates. v. Decrease expected dollar-price of SF Decrease DSF and increase SSF SF depreciates. vi. Decrease expected dollar-price of SF Decrease DSF and increase SSF SF depreciates. vii. Increase expected dollar-price of SF Increase DSF and decrease SSF SF appreciates. 6. If the decrease in the trade deficit was expected, then there is no true news here, and the effect on the dollar’s exchange value now (in the very short-run) should be small. If it is unexpected, then this is news, and it can have an impact now (in the very short-run) on the dollar’s value. Most likely, traders and financial investors will be surprised that the deficit is lower than expected. They are likely to view this as positive for the dollar in the future and will buy more dollars now, causing the dollar to appreciate now. 7. If international financial investors are expecting the currency to depreciate, they will be selling more of it than they are buying. To reverse this, the government must raise interest rates to make domestic assets more attractive to investors so they will buy more domestic currency.