CHAPTER 24 – Perfect Competition

advertisement

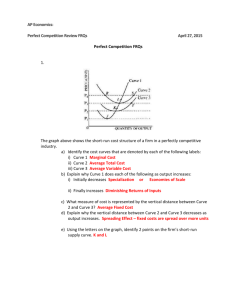

CH 24 - 1 CHAPTER 24 PERFECT COMPETITION CHAPTER OVERVIEW The main objective of this chapter is to present the model of perfect competition. Its characteristics, why the perfectly competitive firm faces a horizontal demand curve, and its profit-maximizing rate of output are discussed. The firm's break-even and shutdown points are analyzed. An important objective is the explanation of the economist's concept of zero economic profits playing a role in determining equilibrium. Another objective is to derive the firm's short-run supply curve. Next competitive price determination is presented. Then constant, increasing, and decreasing cost industries are defined and related to the long run. The firm's long-run equilibrium position is analyzed. Finally, there is a discussion of why the perfectly competitive market structure is economically efficient. CHAPTER OBJECTIVES After studying this chapter students should be able to 1. Identify the characteristics of a perfectly competitive market structure. 2. Discuss the process by which a perfectly competitive firm decides how much output to produce. 3. Understand how the short-run supply curve for a perfectly competitive firm is determined. 4. Explain how the equilibrium price is determined in a perfectly competitive market. 5. Describe what factors induce firms to enter or exit a perfectly competitive industry. 6. Distinguish among constant-, increasing-, and decreasing-cost industries based on the shape of the long-run industry supply. CH 24 - 2 CHAPTER OUTLINE I. II. CHARACTERISTICS OF A PERFECTLY COMPETITIVE MARKET STRUCTURE: Perfect competition is a market structure in which the decisions of buyers and sellers as individuals have no effect on market price. Each firm is so small that it cannot significantly affect the price of the product in question and is a price taker. A. There must be a large number of buyers and sellers. B. The product sold by the firms in the industry must be homogeneous. C. Any firm can enter or leave the industry without serious impediments. D. Buyers and sellers have equal access to information. DEMAND CURVE OF THE PERFECT COMPETITOR: Since the perfectly competitive firm produces a homogeneous commodity, the individual firm will lose all of its business if it raises it price. The demand schedule for a perfectly competitive firm is thus perfectly elastic at the market supply and market demand determined price. The firm is a price taker, i.e. it must take price as given because the firm cannot influence market price. III. HOW MUCH SHOULD THE PERFECT COMPETITOR PRODUCE?: The firm has only one decision: how much should it produce? IV. A. Total Revenues: Total revenue is the price per unit times the total quantity sold. Market price and average revenue are the same: (AR) = TR / Q = (P x Q) / Q = P. B. Comparing Total Costs with Total Revenues: The firm will maximize profits where the total revenue curve exceeds the total cost, the sum of total fixed and total variable costs, by the greatest amount. USING MARGINAL ANALYSIS TO DETERMINE THE PROFIT MAXIMIZING RATE OF PRODUCTION: The use of marginal analysis to determine the profit-maximizing rate of production is preferred to comparing total cost and revenue. The results CH 24 - 3 are the same, but business decisions are really made on the margin where marginal benefits and costs are compared. A. Marginal Revenue: The change in total revenues resulting from a change in output (and sale) of one unit of the product in question. It is computed as the change in total revenue divided by the change in output. B. When Are Profits Maximized?: Profit maximization is always at the rate of output at which marginal revenue equals marginal cost. V. SHORT-RUN PROFITS: Total profits or losses can be computed as TR-TC or as (P-ATC)XQ at the profit maximizing rate of output. VI. THE SHORT-RUN SHUTDOWN PRICE: In the short-run the firm will not shutdown as long as the loss from staying in business is less than the loss from shutting down. The firm must compare the cost of producing (while incurring losses) with the cost of closing down. The cost of continuing to produce in the short-run is given by the total variable cost. Also, as long as price is greater than average variable cost (AVC), the firm is better off continuing to produce since it covers all variable costs and some fixed costs. A. Calculating The Short-Run Break-Even Price: This is the price at which a firm's total revenues equal it total costs. At the break-even price, price equals ATC. The firm is making a normal rate of return on its capital investment, i.e., it is just covering its explicit and implicit costs. B. Calculating the Short-Run Shutdown Price: that just covers average variable costs. The price VII. THE MEANING OF ZERO ECONOMIC PROFITS: The average total cost curve includes the full opportunity cost of capital. Indeed, the average total cost curve includes the opportunity cost of all factors of production used in the production process. Economic profits are that part of accounting profits over and above what are required to stay in business in the long run. At the short-run break-even price, economic profits are, by definition, zero. CH 24 - 4 Accounting profits at that price are not, however, equal to zero. They are positive. A. The Perfect Competitor's Short-Run Supply Curve: The individual firm's supply curve is the portion of its marginal cost curve above the average cost curve. B. The Short-Run Industry Supply Curve: The short-run industry supply curve is the locus of points showing the minimum prices at which given quantities will be forthcoming, also called the market supply curve. C. Factors that Influence the Industry Supply Curve: Anything that affects the marginal cost curves of the firms will influence the industry supply curve. These are factors that cause the variable costs of production to change, such as changes in the individual firm's productivity, or factor costs (wages paid to labor, price of raw material, etc.). Because these factors affect the position of the marginal cost curve for the individual firm, they affect the position of the industry supply curve. A change in any of these non-price determinants of supply will shift the market supply curve. VIII. COMPETITIVE PRICE DETERMINATION: The industry demand curve is a representation of the demand curve for all potential consumers. The short-run industry supply curve is the horizontal summation of all the sections of the marginal cost curves of the individual firms above their respective minimum average variable cost points. The intersection of the demand and supply curves determines the equilibrium or market price. The individual firm demand curve is set at the going market price. IX. THE LONG-RUN INDUSTRY SITUATION: EXIT AND ENTRY: A. Exit and Entry of Firms: If firms in an industry are making economic profits, this will signal owners of capital elsewhere in the economy that they should enter this industry. If firms in an industry are suffering economic losses, the losses signal resource owners within the industry not to reinvest and if possible to leave the industry. Profits direct resources to their highest-valued use. In the long run, capital and labor will flow to industries where profitability is highest and will flow out of CH 24 - 5 industries where profitability is lowest. In a competitive long-run equilibrium situation firms will be making zero economic profits. B. X. 1. Constant-Cost Industries: Industries whose total output can be increased without an increase in long-run per-unit costs; an industry whose longrun supply curve is horizontal. 2. Increasing-Cost Industries: Industries in which an increase in output is accompanied by an increase in long-run per-unit costs, such that the long-run industry supply curve slopes upward. 3. Decreasing Cost Industries: Industries in which an increase in output leads to a reduction in long-run per-unit costs, such that the long-run industry supply curve slopes downward. LONG-RUN EQUILIBRIUM: Given a price of P and a marginal cost curve MC, the firm produces output at which economic profits must be zero in the long-run. The firm's short-run average cost (SAC) is equal to P at that output which is produced at minimum SAC. In addition, since the firm is in long-run equilibrium, any economies of scale must be exhausted so that it is on the minimum point of the longrun average cost curve. At that point price equals MR equals MC equals average cost where both short-run and long-run average costs are at a minimum. A. XI. Long-Run Industry Supply Curves: Market supply curves that show the relationship between price and quantities after firms have been allowed the time to enter into or exit from an industry, depending on whether there have been positive or negative economic profits. Perfect Competition and Minimum Average Total Cost: Perfect competition results in no "waste" in the production system. Goods and services are produced using the least costly combination of resources, i.e. at minimum short- and long-run average total cost. COMPETITIVE PRICING EQUALS MARGINAL COST PRICING: Competitive pricing is a system of pricing in which the price charged for the last unit produced is equal to the opportunity cost to society of producing one more unit of the good CH 24 - 6 or service in question as measured by marginal cost. The competitive solution is economically efficient because it is impossible to increase the output of any good without lowering the value of the total output produced in the economy. There are situations that arise where perfectly competitive markets cannot efficiently allocate resources. These situations are instances of market failure. Externalities and public goods, parks and the military are examples. A. Market Failure: A situation in which an unrestrained market operation leads to either too few or too many resources going to a specific economic activity. Examples are externalities and public goods. SELECTED REFERENCES Cootner, Paul H., ed., The Random Character of Stock Market Price, Cambridge, MA: M.I.T., Press, 1964. Knight, Frank H., Risk, Uncertainty, and Profit, New York: Harper & Row, 1965. Machlup, Fritz, Economics of Sellers' Competition, Baltimore: John Hopkins Press, 1952. Malkeil, Burton C., A Random Walk Down Wall Street, 4th edition, New York: W.W. Norton and Company, 1985. Miller, Roger L. and Roger E. Meiners, Intermediate Microeconomics, New York: McGraw-Hill Book Company, 1986. Robinson, E.A.G., Structure of Competitive Industry, Chicago: University of Chicago Press, 1959. Stigler, George J., "Perfect Competition, Historically Contemplated," Journal of Political Economy, Vol. LXV, 1957, pp. 1-17. Whitney, Simon N., Antitrust Policies, New York: The Twentieth Century Fund, 1958, Chapter 13, Vol. 2.