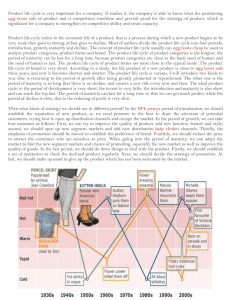

paper-of-risk-management

advertisement

1 Managing Enterprise Risk By: Mr.Khurram Sultan Cihan University – Business Administration Department E-mail: k.sultan@msn.com Dr. Nasrat Abdalraheem Madah Cihan University – Business Administration Department E-Mail: nasrat_a_rawi@yahoo.com Abstract: The aim of this research is the applications of Enterprise Risk Management (ERM) process at United Grain Grower Enterprise in Canada as a case studied. Its problem is determined by the following question: how can we describe the risk faced by UGG, and what are the applied enterprise risk management processes used to deal with those risks? Within this research we used a specific model represented by case study analysis to answer the above question, which require many steps to cover the different meanings of risk and state the basic theoretical sections related to Enterprise Risk Management process. As well as analysis of the case studied and determining the ERM processes used, and comparing the related results. The main Conclusion of this research is: There are different alternatives that can be used by any enterprise to manage its risks such as integrating enterprise risk management policies into company's core values, performing risk analysis, and implementing various strategies to minimize risk. Introduction: This research is divided into four chapters. In the first one, we discuss the research methodology by showing the research problem and importance, its objectives and hypotheses. In the second chapter, we study the theoretical section which explains the concept of risk and different ERM processes and methods. In chapter three, we introduced the empirical section of this research by stating data required and its analysis in order to determine ERM tools used by UGG, and explain why it selected such tools, as well as the data analysis and the results. In addition, we will summarize the conclusion that can be drawn from the information presented in the previous chapters; this will present the final chapter, the research conclusion. Finally, we listed a group of references used to achieve the objectives of this research. 2 Chapter 1: Research Methodology: This chapter will summarize the general background of the research by stating the research problem, importance, objectives, hypotheses, and model. 1.1 Research Problem and Importance: 1.1.1 Research Problem: Today’s enterprises face many types of risks represented by uncertain events and situations in business environment. Such events may effect positively or negatively the ability of these organizations to achieve overall goals and objectives. These, effects may also become the major reasons behind the survival of these organizations. That explains the necessity for any enterprise risk management to deal with different methods to reduce the uncertainty levels by reducing the frequency and severity of any possible risky event. Thus, enterprise risk management methods will enable organizations to avoid or eliminate their risks, and achieve superior position in marketplace by achieving satisfaction of all other parties (employees, customers, suppliers, sister divisions, and so forth). That means we can understand that risk can’t be totally eliminated but only minimized to some extent through the utilization and implementation of the right tools, methods, and processes of enterprise risk management. According to the previous discussion we can demonstrate the problem of this research by the following question: How can enterprises manage their risk? In other words, what are available alternatives that can be used by any enterprise to achieve best transactions with risky circumstances to obtain better possible outcomes? 1.1.2 Research Importance: We can easily introduce our answer to the question surrounding the importance of this research according to the following points: 1. The importance of the subject studied, managing enterprise risks, since it discusses many important issues which cover the basic techniques used in managing enterprise risks. 2. The importance of ideas included within the theoretical section of this research to others. 3. The outcomes and results that can be obtained from the subject studied. 1.1.3 Research Hypotheses: We can present the following hypotheses as an answer to the previous question which was shown in the research problem: There are different alternatives that can be used by any enterprise to manage its risks such as: 1. Integrating enterprise risk management policies into the company’s core value. 2. Performing risk analysis. 3. Implementing various strategies that achieve marginal benefits more than marginal cost to minimize risk. The testing of the research hypotheses will be represented according to a certain model used within the research that will be discussed in later paragraphs. 3 1.1.4 Research Objectives: The objectives of this research are demonstrated by the following points: 1. Presenting a thorough theoretical coverage to the subject studied (enterprise risk management) by discussing the meaning , types of risk, methods and processes used to deal with enterprise risk, as well as other related subjects. 2. Used case study about real enterprise (United Grain Grower) as a tool to answer research problem question. 3. Determining the types and levels of risks faced by the enterprise represented in the case studied, and the steps used to minimize the effects of these risks. 4. Obtaining satisfying results to the research in an appropriate manner that consists with the problem studied and hypotheses of this research. 1.1.5 Research Model: In order to achieve objectives of this research and test the validity of its hypotheses, we depended on a certain model that includes the following steps: 1. Introducing theoretical sections required to cover the subject studied. 2. Selecting a case study about a real life enterprise, and introducing an overview of its history and work. 3. Analysing the case studied and defining the implemented enterprise risk management methods. 4. Analysing the outcomes of the methods and processes used. 5. Accepting or rejecting our research hypotheses according to special comparison between actual practises of ERM and theories. 6. Summarizing the basic conclusion of this research. Chapter 2: Theoretical Section: This chapter summarizes the theoretical section in this research, which demonstrates the various definitions of risk, the different processes and methods used in risk management, and take an in-depth review of Enterprise Risk Management (ERM). 2.1 Overview of Risk and its Management: 2.1.1 Different Meanings of Risk: The term risk has many meanings in our everyday life and business; generally it can be described as any situation surrounded by uncertainty about what outcome will occur. Financial and investment management describe risk as an indication to the possible variability in outcomes around some expected value (Harrington and Niehaus; 2004; 1). While in other cases risk can refers to the expected losses associated with specific events. It can be defined as the combination of the probability of an event and its consequences (http://www.theirm.org). According to the above discussion, Figure (1) explains that the term risk can be used in specific sense to describe the variability around the expected value and other times to describe the expected losses. 4 Risk Uncertainty The order or nature of things is unknown And / Or Expected loss The amount of loss an average firm reports annually Figure (1): Two different meanings of risk. Source: Created by the researcher according to references used in this research. Regardless of the different meanings of risk, it is closely tied with cost and higher expected losses that can be found in two different forms; direct and indirect expected losses. For example, if a factory’s warehouse is burned by a fire, the direct loss should be equal to the value of destroyed facilities and goods. While, indirect losses arise as a consequences of the direct loss, such as delays in production because of the lack of storage facilities, or the cost of renting another warehouse instead of the destroyed one (Booth, 2000, 44). In general, we can determine the different types of indirect losses according to figure (2). Loss of normal profit (net cash flow) Extra operating expenses Higher cost of funds and forgone investment Bankruptcy costs (legal fees) Figure (2): Types of indirect and direct losses. Source: Harrington and Niehaus; 2004; 3. 5 Finally, we can look about risk management cycle and process according to the following steps and we reveal these steps and relationship between them in figure (3): 1. Establish a risk management group and set goals. 2. Identify risk areas. 3. Understand and asses the scale of risk. 4. Develop risk response strategy. 5. Implement strategy and allocate responsibility. 6. Implementation and monitoring of controls. 7. Review and refine processes if needed. Establish risk management group and set goals Identify risk areas Review and refine processes Understand and asses scale of risk Information for decision making Implementation and monitoring controls Develop risk response strategy Implement strategy and allocate responsibilities Figure (3): The risk management steps and relations between them. Source: Collier; 2009; 58. 2.1.2 Risk Management Methods and Costs: 2.1.2.1 Risk Management Methods: According to the risk management literatures, we can define three major methods used when managing risks as below: 1. Loss Control: Concerned with reducing the level of risky activity, and increased precautions, is also known as risk control, and defined as actions that aim to reduce the frequency and severity of losses. Risk management activities which reduce the frequency of losses is labelled as loss prevention. For example the inspection of the train rails form time to time that could significantly reduce the frequency of train accidents. On the other hand, risk management activities that affect the severity of 6 losses are called loss reduction. Such as installation of a sprinkler system in an office can reduce the damage caused by a fire breakout. Generally, many types of loss control methods influence both the severity and frequency of losses. 2. Loss Financing: A way of getting funds to finance and pay for losses that could occur, including retention, insurance, hedging, and other contractual risk transfer. Retention means that a company holds the responsibility to pay for all or part of the losses; retention is also known as self insurance. Insurance is a contract between two parties where the insurer promises to pay for a specified loss, in exchange for receiving a premium from the insured. Insurance contracts can reduce risk for the insured, by transferring the cost of risk to the insurance company. While, we use hedging to manage price risk by using financial derivatives such as forward, swaps and options. It is mainly used to deal with losses that occur as a result of changes in interest rates, and commodity prices. Finally, other contractual risk transfers allow businesses to transfer risk to another party. Like insurance contracts and derivatives, the use of these contracts also is pervasive in risk management. for example, businesses that engage independent contractors to perform some task routinely enter into contracts, commonly known as hold harmless and indemnity agreements, that require the contractor to protect the business from losing money from lawsuits that night arise if persons are injured by the contractor (Venette, 2003, 56). 3. Internal Risk Reduction: refers to diversification, and investment in information. Diversification refers to reducing risks by diversifying activities, for example a person should invest his money in more than one place, to avoid the risk of losing it all. The second method of reducing risk internally is through investment in information, more information leads to more accurate forecasts. (http://www.crra.org). 2.1.2.2 Risk Management Cost: Regardless of the type of risk being considered, the cost of risk has five main components, expected cost of losses, cost of loss control, cost of loss financing, cost of internal risk reduction, and the cost of residual uncertainty. Table (1) illustrates these five types of cost in more details. There are three major types of tradeoffs exist among components of risk cost, which are those between the expected cost direct/indirect losses and loss control losses, the cost of loss financing/internal risk reduction and the expected cost of indirect losses, and finally the cost of loss financing/internal risk reduction and the cost of residual uncertainty. 7 Table (1): The five types of cost of risk management. Types of Cost Expected cost of losses Cost of loss control Cost of loss financing Cost of internal risk reduction Cost of residual uncertainty Description Includes both the expected cost of both direct (cost of repairing) and indirect losses (loss of profits from forgone investment), that occur as consequence of direct losses. Refers to the extra limitations on risky activities and precautions taken to minimize the frequency and severity (which will be later discussed) of accidents. For example the cost of testing a consumable product for safety prior to its release into the market, in addition to any loss in profit from decreasing the distribution of the product to reduce the probability of liability law suits. Includes the cost of self insurance, the loading in insurance premiums, and the transaction costs in arranging, negotiation and enforcing hedging arrangements and other contractual risk transfers. The cost of self insurance includes reserving funds to pay for losses; this cost includes return on income from investing these funds. Also the cost of lost opportunity that can occur if maintaining reserve funds reduces the ability of investing in profitable ventures. Includes transaction cost associated with achieving diversification and the cost of managing a diverse set of activities that aim to reduce the risk exposure. It also includes the cost of obtaining and analyzing data and other types of information to obtain more accurate cost forecasts. This cost arises because ambiguous and uncertain situations are generally costly to risk adverse individuals and inventors, also known as risk avoiders. For example residual uncertainty might reduce the price cautious customers are willing to pay for the firm’s products. Source: Created by the researcher according to the references used in this research. 2.2 Enterprise Risk Management: Most corporate risk managers believe that pure risk, such as liability suits, property damages, and worker injuries which are usually managed by loss control, and loss financing methods, is the essence of risk management. but financial managers refers to risk as price risk such as interest rate risk, and exchanging rate risk, which are usually managed by derivative contracts (bonds, options, futures, and swaps). In all cases, to manage corporations risk we have two basic alternatives; aggregate and disaggregate approaches. Thus, by using disaggregate approach we manage risks or exposures separately. While we bundle sum of exposures when we manage our corporations risk according to aggregate approach. Traditionally, risk management has taken a disaggregated approach. Pure risk managers focused their attention on individual sources of risk. Financial risk managers focused their attention on other sources of risk. The respective managers would attempt to reduce risk from individual exposures without considering the interactions among the various sources of risk. But many of the arguments for why firms should reduce risk suggest a more aggregate focus. For example, the progressive tax rate argument implies that firms should focus on taxable income, which depends on many sources of risk, including property losses, exchange rates, and so on. This means that with aggregate approach firms need to consider interactions between the various sources of risk. Then, the aggregate approach was developed into what is known as Enterprise Risk Management 8 (ERM), which we will cover in the following paragraphs by discussing, the essentials and structure of ERM, components and levels of Enterprise Risk and modern ERM to achieve a clear understanding which will be used in the analysis of the case studied within the next chapter. 2.2.1 Essentials of Enterprise Risk Management: The Casual Actuarial Society (CAS) committee on Enterprise Risk Management has adopted the following definition of ERM: it’s a discipline by which an organization in any industry, assesses, controls, exploits, finances, and monitors risk from all sources for the purpose of increasing the organization’s short and long term value to its stakeholders (http://www.casact.org). ERM is a risk-based approach for managing an enterprise, integrating concepts of Strategic planning, operations and performance management as well as internal control. it is continually evolving to address the needs of various stakeholders, who want to understand the broad spectrum of risks facing complex organizations, to ensure they managed and monitored there risk appropriately. is an approach that is equally important to the board of directors and to operational managers linking together risk management with business strategy and embeds a risk management culture into business operations, and encompasses the whole organization and seeks to foster a change in the culture of the organization towards one where risks are considered as a normal part of the management process (Chong; 2004; 49, and Morley, 2002, 78). World-class ERM includes a framework of the following components: 1. Risk management structure: to facilitate the identification and measurement of risk. 2. Resources: to support effective risk management. 3. Risk culture: to strengthen decision-making processes by management. 4. Tools and techniques: to enable the efficient and consistent management of risks throughout the organization. The structure of Enterprise Risk Management processes comprises five steps, they are: 1. Establish the goals and context for ERM. 2. Identify risks. 3. Analyse risks in terms of likelihood and estimate the level of risk faced. 4. Evaluate risks. 5. Treat risks with the most suitable options (Saunders and Cornet; 2006; 179). Figure (4) demonstrates that risk management process is ongoing process depending on continuous communication, monitoring and the review which are inter-related operations with all five steps included within risk management process. 9 Figure (4): The risk management process. Source: www.ncsi.com.au. 2.2.2 Components of Enterprise Risk: Enterprise risk varies according to the type, nature, and entity of the business in addition to other factors it consists of three main components: 1. Business risk: refers to failures faced by an organization to compete and operate successfully in its environment, such risk can suddenly occur or arise over time. There are many factors that can cause business risk. For example, failure to update a product or service, inability to keep up with technological advances, and customer preferences may change over time. For more detailed example1, we will introduce the case of Daimler and Chrysler which is a company that suffered a business risk loss: In 1998 Daimler exchanged stock worth $38 billion to merge with Chrysler Corporation. After investing billions of dollars in Chrysler over a 10-year period, it sold the bulk of the firm to Cerberus for less than $8 billion. It is likely that it used a thorough acquisition analysis that considered the possibility of such debacle. Thus, the synergies and shared technologies between Daimler and Chrysler did not materialize, and the clash of culture proved to be disastrous. Daimler failed to merge the distinct German corporate culture with the proud but troubled executives and workers in Detroit. 2. Financial risk: it refers to the lacks of required and adequate funds that organizations need to perform their operations. The problem can be caused by inadequate initial 1 For more details about this and following examples see: Hampton; 2009; 6-8. 10 capitalization or from cash flow operations, in addition customers may fall short in paying their bills or creditors can tighten lending requirements. An organization may have excessive debt obligations relative to its assets values and cash flows and high interest costs. We can state the following case which compares between Webvan and Amazon Company for more details on financial risk. In the 1990s, the two company entered the online area for consumer products. Amazon.com started operations in 1995, selling books via the internet, and then diversified to sell other products. Webvan was an online food business that accepted internet orders and delivered grocery products to customers. Amazon succeeded in its venture and became the largest online retailer in the world. Webvan ran out of money and filed for bankruptcy in 2001. ERM analysis shows key differences: both companies needed considerable capital, but the financial risk was much greater for Webvan. one part of the exposure was of its own making, Webvan signed a one billion dollar contract with Bachtel to build warehouses, purchased a fleet of vehicles, and spent a large sum of money on computer equipment. While, the second part was the difference in markets between Amazon and Webvan. The expensive delivery of Webvan squeezed the profits from the grocery business. Webvan was doomed by a combination of tight cash flow accompanied by capital inadequacy. That is the fact that financial risk can cause many complications and lead to financial distresses and may be bankruptcy. 3. Hazard risk: is exposure to risk resulting in loss without the possibility of gain. This type of risk is insurable. For example, damaged assets such as destroyed buildings or warehouses caused by a fire, physical injury to employees, or even customers and unrelated third parties resulting in law suits and liability claims. Note that hazard risk is related to both business and financial risk, because its occurrence can cause both business and financial damage. Again we selected special example to explain the concept of hazard risk, it is the case of Philips, Nokia, and Ericsson . Lightning struck a Philips Electronics N.V. Semiconductor fabrication plant in New Mexico in March 2000, starting a small fire that was quickly extinguished. Nobody was hurt, and damage was minor. The plant was the only source of microscopic circuits for cell phones. Forty percent of production went to Nokia and I.M. Ericsson. In addition to the trays of wafers that were destroyed in the fire, production was interrupted. After the fire, Philips alerted 30 customers that a fire had taken place and that production had been stopped. Philips also estimated the time delay prior to restarting production, telling customers that a one-week delay was expected. The actual delay turned out to be much greater. In response to the news, Nokia behaved in accordance with the individualistic and aggressive culture of Finland. It demanded to know all details of Philips’ operations so that other factories could be used to supply microchips. It put the search for microchips into a critical-risk category. The result was almost no disruption of deliveries to customers. Ericsson was a different story. It behaved more in accordance with the consensual and laid-back culture of Sweden. Lower-level employees did not tell the head of production about the delay for several weeks. When Ericsson finally requested help from Philips and other suppliers of microchips, it learned that Nokia had locked up all spare capacity. For Philips, the losses were in the range of $1 million to $3 million after $40 million in lost sales were offset by business interruption insurance. For Nokia, some additional costs were offset by a 3 percent rise in market share as it replaced Ericsson in some markets. Ericsson was the big loser, suffering a $2.3billion loss in its mobile phone division in 2000, accompanied by a withdrawal from the market, in April 2001. Finally, this case indicates that no loss is small when an organization does not understand the relationships among risks. 11 Thus, we can easily agree that ERM recognizes that some risks are serious and some are not. A large loss involves the destruction of a majority of assets, an unbearable financial loss, and an inability to continue operation. It produces a near-term, if not immediate, bankruptcy and dissolution of the enterprise. A critical or major loss seriously hampers a company’s ability to do business. An example is the collapse of a major operating unit or product line, followed by a substantial financial distress that could lead to bankruptcy. Lesser losses might be significant reducing current year earnings or minor hurting an operating unit but not impacting financial statements In order to complete the above discussion we need to mention that we can achieve risk reduction by reducing the severity and/or frequency of losses. Severity resembles the magnitude and size of the loss or damage, a medium-high or high severity loss can cause many damages and business disruption, to people, assets and reputation. While, a mediumlow or low severity will usually cause less damage, which can be dealt with in most cases easily. Frequency refers to likelihood of the occurrence of a loss and how many times it occurs. Some losses, like vehicle accidents, are fairly frequent and predictable. Some potential losses are so remote that we cannot imagine how they would happen. (http://www.businessdictionary.com). Figure (5) shows a graph of frequency and severity. As we move up and to the right on the graph, we increase the danger to the enterprise. Low-frequency and low-severity exposures are not of much concern. High-frequency and high-severity exposures can produce disastrous consequences. High Increasing risk Severity Low Low Frequency High Figure (5): The effect of Severity and Frequency on risk levels. Source: Hampton; 2009; 10. 2.3 Modern Enterprise Risk Management: Comparing to traditional risk management, enterprise risk management has transformed into a broader more complicated concept by covering four main areas. According to (Moeller; 2009; 31-32). we can state the four main areas of modern enterprise risk management as following; 1. Hazard risk management: to assess hazard risk managers follow a five step process including: Identify the exposures, assess the frequency and severity of the exposure, identifying alternatives, choosing the best option and implementing it, and monitor the implemented options to perform adjustments when needed. Note that this process sets up both preventive and crisis risk management (Coombs, 2004, 98). 12 2. Internal Control: all companies have processes called internal control that make sure policies are being followed effectively. It helps in improving efficiency and effectiveness, make financial reporting more reliable, and ensure the compliance with laws and regulations. Internal control systems are common among most organizations, particularly, in industries regulated and controlled by government agencies. 3. Internal Audit: it adds further cover that internal controls are working. This approach is not risk management; it focuses on the effectiveness and efficiency of all internal processes including risk management. From a risk manager’s perspective, internal audit is a process that focuses on whether risk is being actually avoided, reduced or transferred. The internal audit team monitor and examine operating activities, insure consistency of procedures and compliance with regulations. Finally, the audit team present a report to management determining any weaknesses and failures to meet and comply with policies. 4. Regularity Compliance: This refers to efforts to ensure conformity with official requirements imposed by statutes, public agencies, or the courts. Such as rules governing plant safety, environment, reliable financial reporting, and compliance with social and economic conditions. Many organizations have a single compliance unit or officer who interprets directives, laws and regulations, offers education and training, and recommends processes to conform to regulations. Finally, modern risk management is extended from traditional risk management, and built upon its solid foundation, which provides organizations by a number of tools and procedures to use when dealing with enterprise risk. 2.4 Risk Retention and Reduction Decisions: Risk retention is a risk management strategy under which a decision maker assumes all or part of a risk, instead of buying partial or full insurance or transferring risk by hedging. It’s a method of self-insurance whereby the organization retains a reserve fund for the purpose of offsetting unexpected financial claims (http://www.businessdictionary.com). Table (2): summarize the potential savings from increasing retention to a firm and how to achieve each one of these benefits. Table (2): Potential savings from increasing retention. Possible benefits How to achieve Additional retention enables is the ability to 1. Savings on premium loadings. save on some of the administrative expenses and profit loadings in insurance premiums, thus reducing the expected cash outflows for these loadings. Specific sources of savings include lower commissions to insurance brokers, possible savings in underwriting expenses and administrative costs of claim settlements, and savings in state premium taxes. 2. Reducing exposure to insurance Further motivation to increase risk retention has been the desire to reduce their vulnerability to market volatility. annual swings in insurance prices due to the effects of shocks to insurer capital on the supply of insurance or the insurance underwriting cycle. Loss financing is part of a long term business strategy. Once a firm decides to insure a particular exposure, it may be costly to change its strategy in response to an insurance price 13 3. Reducing moral hazard. increase. As a consequence, the purchase of insurance can lead to the perverse result, even though the purpose of purchasing insurance generally is to reduce uncertainty in cash flows, the volatility in insurance prices can cause uncertainty to the firm. Deductibles reduce moral hazard, without these contractual provisions, expected claim costs would be higher and therefore so would insurance premiums. Consequently, when moral hazard is more of a potential problem, firms tend to retain more risk. 4. Avoiding high premiums caused The insurers find difficulties in precisely estimating claim costs for all potential buyers, by asymmetric information. which causes some buyers to face prices relatively high compared to their true expected claim costs. These buyers have further incentive to retain more risk. It is often argued that another advantage of 5. Maintaining the use of funds. retention is that the firm gets to maintain use of the funds that otherwise would be paid in premiums until claims costs are paid, given that competitive insurance premiums will reflect the present value of expected claims costs. Source: Harrington and Niehaus; 2004; 456. While, increasing risk retention obviously exposes the firm to greater risk; the greater risk from increased retention increases the probability of financial cost distress with associated adverse effects on lenders, employees, suppliers, and customers, which causes them to contract with the firm at less favourable terms. Increased retention may require the firm to raise costly external capital and miss some profitable opportunities (Regester, 2002, 65). In all cases, the level of retention/reduction depends on the following firm characteristics: 1. Closely held firms versus publicly held firms: the owners of closely held firms typically have a significant proportion of their own wealth invested in the firm and thus are undiversified compared to shareholder of publicly traded firms with widely traded stock. Because owners of closely held firms are less diversified, they have incentive to retain less risk. Similarly, firms that have managers who own large amount of stock and therefore are undiversified are more likely to reduce risk. 2. Firm size and correlation among losses: if a firm has a large number of independent exposures, then the law of large numbers operates at the firm level, allowing the firm to predict its average loss per exposure more accurately. Consequently, one more major benefit of insurance, larger firms with their generally large cash flows also are better able to readily finance losses of any given size out of cash flow than are smaller firms, and they often are able to raise external funds at lower cost. Each of these influences reduces the demand for insurance by large firms (Jaques, 2007, 244). 3. Investment opportunities: firms that are likely to have investment opportunities will need funds to finance them. These firms will be more likely to reduce risk because an unexpected loss will force the firm to abandon the investment project or raise costly 14 external capital. Firms that operate in the growth industries and firms that require continual investment in research and development are likely to benefit from risk reduction (Dowling, 2001, 36, and Venette, 2003, 114). On the other hand, risk reduction refers to the decision to reduce uncertainty (variability) by using two approaches; disaggregate or micro approach and aggregate or macro approach. Disaggregate approach means hedging or insuring each individual risk separately. While, aggregate or macro approach refers to hedging their risk exposures under one unified frame work. Traditionally, risk management has taken a disaggregated approach. Pure risk managers focus their attention on individual sources of risk. The basic guidelines for optimal retention/reduction decisions, in view of the trade-off between the benefits of increased retention, through saving on explicit and implicit loadings in insurance premiums and the costs of increased uncertainty is: retain reasonable predictable losses and insure potentially large, disruptive losses (Regester, 2002, 245). Thus, for individual firms, application of the guideline that firms should retain predictable losses but insure large and unpredictable losses depends on specific magnitude of the benefits and costs of increased retention, but the point at which losses can be classified as predictable or disruptive, also depends on firm size, the cost of raising external funds, and the expected value of cash flows. Due to special circumstances, retention strategies adopted by a particular firm may vary and differ from the basic guideline (www.mccombs.utexas.edu). Chapter 3: Overview of the Case Studied: The objectives of this chapter are represented in introducing an overview of the United Grain Grower (UGG) enterprise and explain how it implemented an enterprise risk management process, which will lead to obtaining clear ideas for analysis of the case studied and testing the hypothesis of this research. 3.1 Overview of United Grain Grower (UGG)2: United Grain grower formed in Winnipeg, Manitoba. This provides commercial services to farmers and markets agricultural products worldwide. It was founded in 1906 as a farmer owner cooperative and became a public owned company on the Toronto and Winnipeg stock exchange in 1993 its comprised from four main segments: Grain handling service, crop production service, livestock service, and business communication. The farming industry in Canada is regulated by several government agencies like the Canadian Wheat Board (CWB) which markets grains for human consumption on behalf of farmers. About 85% of wheat and 45% of the barley produced in Canada is sold through the CWB and about 60% of UGG’s grain handling is on the behalf of the CWB, which determines the prices paid to farmer’s storage and transportation of grains. UGG must obtain an operating licence from the commission, because the Canadian grain commission regulates and maintains quality standards. Table (3) provides data on grain shipments and deliveries for the industry and for UGG from 1981 up to 1993. Then, UGG has a market share of 15% as the third largest provider of grain handling service in western Canada. Table (4) provides information on the volume of UGG grain shipments, as well as its gross margin and earnings, which illustrates that UGG achieved the highest level of grain shipped 2 For more details about the case studied see : Harrington and Niehaus, 2004, 591-603. Also for more information about UGG enterprise visit : www.Unitedgraingrower.ca. 15 in 1997 with 5.591 tonnes and the highest gross margin and earnings in 1998 (21.8C$ per tonne and 5.8C$ per tonne accordingly). Table (3): Grain shipments and deliveries for UGG and its industry. Year 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 Tonnes Industry shipment 26,871 30,392 33,142 33,905 27,183 27,443 33,322 33,435 23,364 29,682 33,376 34,374 30,989 UGG shipment Crop yields Weighted Average 4,298 4,842 5,367 5,320 4,020 4,394 5,368 5,072 3,928 4,954 5,498 5,720 5,125 30.9 34.7 37.4 33.3 28.6 32.5 40.0 36.3 26.3 31.3 38.4 37.3 37.0 Table (4): Earnings for grain handling segment. For years ended July 31 1997 Grain shipment (tonnes) 5.591 Gross margin (thousands of C$) 113.013 Expenses excluding depreciation 73,108 Depreciation 11.502 Earnings before interest and taxes 28.403 Per tonne of grain shipped: Gross margin 20.2 Earnings before interest and taxes 5.1 1998 5.170 112.459 72.886 9.763 29.810 1999 4.328 93.542 69.140 10.082 14.320 21.8 5.8 21.6 3.3 The crop production services unit (second UGG segment) provides inputs such as seed, fertilizer, and crop production products to farmers. In addition, through its farm sales and services division, it provides a range of consulting, agronomic, and financial services to farmers. UGG’s livestock services (third UGG segment) provide inputs to producers of cattle, hogs, and poultry. This particular unit faces tough competition from a number of other grain and feed companies. UGG’s smallest business unit (fourth UGG segment) farm business communications provides information needed to run a profitable agribusiness. In addition to publishing periodicals, it has developed a web-based information on weather market prices and agribusiness news. UGG differentiate itself from competition through distinctive products and superior services to farmers . Figure (6) illustrates earnings before interest and taxes (EBIT) for each of UGG’s business units overtime, grain handling service and crop production service, account for more than 80% of UGG’s earnings in most years. 16 Figure (6): Earnings before and taxes over time for UGG’s business segmants. 3.2 UGG Enterprise Risk Management Process: 3.2.1 Types of UGG Risk Exposures: UGG began its enterprise risk management process by forming a risk management committee consisting of Chief executive officer (CEO), Chief financial officer (CFO), risk manager, treasure manager, compliance manager, and manager of corporate audit services. The committee along with a number of UGG employees identified and ranked the risks of 47 exposure areas, from which six major risks were chosen for further investigation, they are: 1. Environmental liability (obligation based on the principle that a polluting party should pay for any and all damage caused to the environment by its activities). 2. The effect of weather on grain volume. 3. Counterparty risk (The risk to each party of a contract that the counterparty will not live up to its contractual obligations). 4. Credit risk (probability of loss from a debtor’s default). 5. Commodity price and basis risk (the possibility that a commodity contract's basis will move against the investor). 6. Inventory risk (The possibility that something such as a price change will cause any reduction in the value of inventory). Therefore, Willis group Ltd., took the task of gathering data and estimating the probability distribution of losses from each of the above major six risk exposures. it used probability distributions to quantify the impact of each source of risk on several measures of UGG’s performance, including return on equity and earnings before interest and taxes (EBIT). Figure (7-9) demonstrates analysis conducted by Willis risk solutions based on counterparty risk of UGG. 17 Figure (7): Frequency of losses from counterparty risk. Figure (8): Severity of losses from counterparty risk. Figure (9): Total losses from counterparty risk. Based on data provided by UGG and discussions with UGG employees, Willis estimated that the number of counterparty losses per year could be described by a Poisson distribution as explained in Figure (7), and that the loss severity on any given loss - Figure (8) - could be described by a lognormal distribution. Then, by using the probability distribution for the number of losses and for the loss per event, they can estimate the annual loss distribution from counterparty risk according to Figure (9) above. Finally, the impact of counterparty risk on the probability distribution of various performance measures such as (EBIT) could be estimated based on the assumptions that all other risk factors took on a specific value. The analysis conducted by Willis risk solutions led to the conclusion that, out of the six risk exposures, UGG’s main source of unmanaged risk was from the weather. Therefore, the parties focused their energies on understanding how the weather affected UGG’s performance. Willis risk solutions conducted an in depth regression analysis of how crop yields in three provinces in western Canada were influenced by the weather. Table (5) reflects the results of regression analysis of crop yields (bushel per acre) and weather conditions in the three Canadian provinces using data from 1960 to 1992. Temperature is measured in fahrenheit and preception in inches. The time trend variable equals (year - 1960); thus, for year 2000 the time trend equals 40. 18 Table (5): Results of regression analysis of crop yields and weather conditions in three Canadian provinces. Dependent Variable Province Crop Intercept Alberta Manitoba Saskatchewan Alberta Manitoba Saskatchewan Wheat Ceof: Stat: Wheat Ceof: Stat: Wheat Ceof: Stat: Oats Ceof: Stat: Oats Ceof: Stat: Oats Ceof: Stat: 59,88 4,49 79,34 5,70 55,60 4,02 43,53 1,89 121,02 4,89 74,07 2,93 Explanatory Variable Time trend Average June Average July temperature Temperature 0,33 -0,76 2,70 6,19 -3,19 2,63 0,42 -0,98 1,00 5,94 -4,38 0,98 0,19 -0,93 4,80 2,65 -3.01 4,44 0,69 -0,17 4,70 7,59 -0,41 2,71 0,65 -1,50 5,30 5,16 -3,77 2,96 0,24 -0,76 9,30 1,91 -1,82 4,70 RSquared 0,68 0,65 0,61 0,72 0,64 0,56 From the first row of the above table, the positive cofficient (0.33) on the time trend variable indicates that alberta’s wheat yeilds have increased over time. On average, wheat yields have increased about 0.33 bushel/acre each year since 1960. The negative cofficient (-0.76) on the average June temprature variables indicates that wheat yields in Alberta are negativly related to the average June temperature. Finally, the positive cofficient (2.7) on the average July precipitation variable indicates that crop yields increase on average with rainfall in July. The R-sqaured indicates that about 68 percent of the annual variation in alberta wheat yeilds is explained by these three variables. The remainder of table (5) indicates that, in general, crop yields for wheat and oats have increased over time, are negatively related to average June Temperature, and are positively related to average July precipitation. Table (6) discribe the statistics for variables used in regression analysis. The regression results can be used to assess how expected crop yields would be affected by deviations from normal weather conditions. For example, if temperature and precipitation were expected to take on their historical average values as presented in table 6. Then, the predicted wheat crop yield for 2000 would be: Yield = 59.88 + 0.33(40) – 0.76(56.6) + 2.7(2.06) = 35.6 bushels per acre. If instead the average June temperature was higher than the mean value by one standard deviation (2.2) degrees from table (5), the Alberta wheat crop yields would be: Yield = 59.88 + 0.33(40) – 0.76(58.8) + 2.7(2.06) = 34.0 bushels per acre Thus, an increase of 2.2 degrees from normal reduces crop yields on average by about 1.6 bushels per acre. 19 Table (6): Statistics for variables used in regression analysis. 1960-1992 Average June Temperature Mean Value Standard Deviation Alberta Manitoba Saskatchewan Average July Temperature Mean Standard Value Deviation (inches) (inches) 2.06 0.51 1.83 0.67 1.55 0.61 56.6 61.7 60.4 2.2 3.0 2.8 Correlation coefficient: For June average temperature For July average temperature Alberta Manitoba Saskatchewan Alberta Manitoba Saskatchewan Alberta 1.00 0.41 0.69 1.00 0.51 0.74 Manitoba 1.00 0.87 1.00 0.55 Saskatchewan 1.00 1.00 Having established a relationship between crop yields and weather, Willis then estimated the realtionship between crop yields and UGG’s grain volume. They first calculated a weighted average crop yield for Western Canda using crop yeilds by grain/seed and by province and the proprotions of total production of each grain/seed in each province. The values for this wieghted average crop yield are reported in Table (3) stated in paragraph 3.1. They found that UGG’s grain volume in year t was highly correlated with overall crop yields in year t-1. The next step in Willis analysis was to relate UGG's grain volume to UGG’s financial results using the information in table (4). To summerize, Wellis established a relationship between weather and UGG’s gross profit using the following steps: Weather Crop yields Table (4) UGG’s grain volume Table (2) UGG’s profit Table (3) The results of this analysis are summarized in Figure (10), which illustrates how weather influences UGG’s gross profit. The relatively volatile curve indicates UGG’s actual gross profit during 1980-1992 period and the less volatile curve indicates what UGG’s gross profit would have been if weather was constant over the period. Figure (10): Influences of Weather on UGG’s profit. 20 3.2.2 Alternatives for Managing UGG's Exposures: Having quantified their exposure to weather risk, UGG managers explored several options, Retention, weather derivatives, and an insurance contract. The retention approach meant continuing operations as they had been and not trying to reduce the weather exposures, its exposed the enterprise profitability to large changes due to weather variations. There were three disadvantages of such volatility. First, UGG had been planning to continue to make large investments in storage facilities (grain elevators). The ability to finance these capital expenditures from internally generated funds would allow the firm to avoid the costs associated with raising external capital. And, to the extent external capital would be needed, the rate that the firm would have to pay on borrowed funds would likely be higher if they retained the weather risk. Second, the variability in its cash flow caused UGG to hold extra equity capital as a cushion against unexpected low cash flows in any given year. If the firm could reduce its weather risk, it could increase the proportion of the firm financed with dept without paying higher yields, which in turn would allow it to gain additional interest tax shields. Third, although much of UGG’s current business could be characterized as a commodity business, UGG tried to distinguish itself from competitors by creating products with brand names and by providing ongoing services to customers. Stability in the firm’s cash flows would help the firm characterize itself as a company that suppliers and customers could rely on for many years. The main advantage of retaining the weather risk was the cost associated with shifting it to someone else. Weather derivatives are contracts that are sold in the over-the-counter (OTC) market by firms such as Enron and Duke Energy. Such a contract could be tailored on a number of dimensions to meet the specific needs of the buyer. For example, the underlying variable determining the payoffs could be one or a combination of weather variables such as rainfall and snowfall. The payoff structure could resemble put options, call options, swaps or combination of these structures. Figure (11 A-C) provides an example how UGG could potentially use a weather derivative. Suppose that based on Willis analysis of the sensitivity of crop yields to weather and the sensitivity of gross profit to crop yields, UGG’s expected gross profit exhibited the pattern depicted in Figure (11A). The vertical axis measures expected gross profit, and the horizontal axis measures a weather index that equals a weighted average of various temperatures in Western Canada. As the index increases, expected gross profit increases. Assuming that the relationship between gross profit and the weather index is linear. Since low weather values of weather index correspond with to low expected profits for UGG a derivative contract that would pay UGG money when the index is low would provide a hedge. For example, the put option structure illustrated in Figure (11B) would help to hedge UGG’s risk. When the put option payoff from Figure (11B) is added to expected gross profit from Figure (11A), UGG’s expected profit would vary with the weather index as depicted in Figure (11C). Figure (11A): Un-hedged profits. 21 Figure (11B): Payoff on a weather derivative. Figure (11C): Hedged profits. Hedging their weather risk with derivatives was feasible but entailed several difficulties. Although Willis preformed sophisticated analysis of the effect of weather on UGG’s gross profit, the results of this analysis had to be converted into a desired contract structure that was extremely difficult. Finally, UGG managers wondered whether they could construct an insurance contract that would payoff UGG when its grain shipments were abnormally low. The problem with such a contract is the moral hazard, because UGG’s pricing and service also influences its grain shipments. One solution to this problem was to use industry wide grain shipments as a variable that would trigger payments to UGG. Industry shipments would be highly tied with UGG’s shipments. In addition, UGG’s own a relatively low market share, thus, it would have minimal effect on the value of industry wide shipments, which would significantly reduce the moral hazard problem. 3.3 Assessment of UGG’s Risk Management: According to the previous discussion of the major factors included within the case studied, we can ask some questions and answer them in order to accomplish better assessment for UGG's risk management: First, what were the types of exposures faced by UGG enterprise? And what was the most important exposure and why? Second, how can we describe the risk management process within UGG enterprise? 22 Third, what are the available alternatives that UGG risk managers can use in managing their possible exposures? Fourth, what was the selected alternative chosen by UGG risk mangers and why? Finally, how can we evaluate the UGG risk management activities according to the depended hypothesis of this research and its theoretical section? Now, we will start our answers of each question to obtain a target results which we can rely on to introduce the basic conclusions of this research as we will mention in chapter 4: Conducted studies by UGG’s risk management committee pointed that UGG faced 47 risk exposures, as mentioned in the case, six major risk exposure were identified including: 1. The environmental liability. 2. The effect of weather on grain volume. 3. Credit risk. 4. Counterparty risk. 5. Commodity price and basis risk. 6. Inventory risk. Analysis showed that the effect of weather was the most important exposure faced by UGG, because it was the main source of unmanaged risk. This was further emphasized by the results of the regression analysis conducted by Willis group which concluded that even the slightest change in the average temperature would severely affect UGG’s crop yields, thus effecting UGG’s gross profit. To manage its risk, UGG’s started with determining the context of risk. After that it dealt with analysis of determined risk by depending on internal and external sources to identify and evaluate the possible outcomes of each possible exposures. Internally they formed a risk management committee, consisting of chief executive, chief financial officer, risk manager, treasure manager, compliance manager, and manager of corporate audit service. Externally they hired the services of Willis Risk Solutions, a unit of the Willis Group Ltd, a major insurance broker that took on the task of gathering data and estimating the probability of losses from the risk exposure faced by UGG. Finally they used available results to treat their risks with continuous consulting and monitoring. After completing the above risk management process and determining the weather risk as main exposure, UGG’s managers were faced by three options to treat this risk: 1. Retention option: meant ignoring the exposure to weather an continue operations as normal, this approach would cause large swings in UGG’s profits due to the unpredictability of the weather. Also retention would force UGG to abandon their plans to continue investment in storage facilities and any further development, because it will lose the ability to generate internal funds to finance such developments. As well as carrying the cost of obtaining external capital. In addition to reduce necessary stability of UGG’s operations to maintain the trust and healthy relations with both customers, suppliers and other parties. 2. Weather derivatives option: Since low weather values of weather index correspond with to low expected profits for UGG. A derivative contracts would pay UGG money when the index is low and provide a hedge against weather exposure. But making a contract based on the effects of weather would be very difficult, because converting the results of the analysis conducted by Willis into a desired contract structure would be extremely difficult. 3. Insurance contract option: UGG’s managers wondered whether they could construct an insurance contract that would pay UGG when grain shipments drop due to the weather exposure. As mentioned before earlier, such an insurance contract faces moral hazard. 23 From the researcher viewpoint, UGG managers needed to answer the following questions in order to make such decisions depending on the above three alternatives: 1. Given that any method of reducing the weather exposure will be costly, what are the benefits of UGG’s diversified owners from reducing the weather risk? 2. How could they structure a weather derivative to cover the exposure? 3. How could they structure an insurance contract to cover the grain volume exposure? 4. Are there any advantages of the insurance contract approach versus the use of the weather derivatives? The reason behind our viewpoint related to make a good an effective decision which will lead to reducing possible exposures of losses with lower effect on UGG cash flows or internal funds. This really supported by the selected option, UGG resorted to the third choice, an insurance contract. Thus, we can easily agree with UGG risk mangers decision because it consistent with the guideline of risk retention and reduction. They selected insurance contract since weather risk is large or not reasonable, not predictable and disruptive. Thus, UGG Currently purchased a number of different insurance policies for various traditional risk exposures. For example, it purchased a variety of policies to cover its property exposures and liability exposures to cover its tort liability. Then, UGG asked Willis to investigate the possibility of structuring an insurance contract on industry grain shipments. Willis then contacted several major commercial insurers, including a division of large reinsurer Swiss Re, called Swiss Re New Markets, which tailored an insurance contract that hedged UGG against their weather exposure. Finally, the above analysis of enterprise risk management processes within the enterprise studied indicate that we accept the hypothesis of this research according to what were stated within this analysis: there are different alternatives can be used by any enterprise to manage its risks such as integrating enterprise risk management policies into company's core values, performing risk analysis, and implementing various strategies to minimize risk. Chapter 4: Research Conclusions: Having done this research and written the paper “Managing Enterprise Risk” the researcher came to the following conclusions: 1. Risk can be described as any situation surrounded by uncertainty. It’s an indication to the possible variability in outcomes around some expected value. 2. There are different risk management methods, each one used for specific purpose, such as Loss Control, Loss Financing, and Internal Risk Reduction. 3. Risk is costly and its management costs include the expected cost of both direct and indirect losses, cost of loss control, cost of loss financing, cost of internal risk reduction, and cost of residual uncertainty. 4. Enterprise Risk Management is a discipline by which an organization in any industry, assesses, controls, exploits, finances, and monitors risk from all sources for the purpose of increasing the organization’s short and long term value to its stakeholders. 5. Enterprise risk management process includes: establish the goals and context for ERM, identify risks, analyse risks in terms of likelihood, evaluate risks, and treat risks with the most suitable options. Thus, to manage its risk, the enterprise studied started with determining the context of risk, dealt with analysis of the determined risk to identify and evaluate the possible outcomes of each possible exposure. Internally, they formed a risk management committee consisting of many managers. Externally, they hired the services of Willis 24 Risk Solutions to gather data and estimate the probability of losses from the risk exposure. Finally, they used available results to treat their risks with continuous consulting and monitoring. 6. There are three major components of enterprise risk; business risk, financial risk, and hazard risk. 7. ERM recognizes that some risks are serious and some are not, which can be determined by measuring the severity and frequency of losses. 8. The basic guideline for optimal retention/reduction decisions is: retain reasonable predictable losses and insure potentially large or disruptive losses. 9. We accept the hypothesis of this research according to the analysis' considerations of enterprise risk management processes within the enterprise studied and what we stated within this analysis. Then, we can say that: There are different alternatives can be used by any enterprise to manage its risks such as integrating enterprise risk management policies into company's core values, performing risk analysis, and implementing various strategies to minimize risk. 10. According to the previous point we found that although UGG purchased a number of different insurance policies for various traditional risk exposures, it asked Willis to investigate the possibility of structuring an insurance contract on industry grain shipments. The aim behind this process is to minimize risk and maximize shareholders value and achieve good and effective relation with all other parties. 11. Finally, this research covers the basic ideas related to managing enterprise risk according to selected case study. All other subjects which were not covered within this research, such as the possible trade off between different types of risk, the component of cost of risk, and the details of risk reduction and retention decisions, represent open questions for future studies. 25 References: 1. Books: 1. 2. 3. 4. 5. 6. 7. 8. Chong, Yen, Y., “Investment risk management”, John Wiley & LTD, Sussex, 2004. Collier, Paul, M., “Fundamentals of Risk Management for accountants and managers: Tools and Techniques”, Jordan Hill, Oxford, 1ST edition, 2009. Hampton, John, J., “Fundamentals of Enterprise Risk Management”, Amacom, New York, 2009. Harrington, Scott, E. and, Niehaus, Gregory, R. “Risk Management and Insurance”, McGraw-Hill, Inc., New York, 2nd Edition, 2003. Morley, Michael, "How to Manage Your Global Reputation: A Guide to the Dynamics of International Public Relations", Palgrave MacMilan, Basingstoke, Second Edition, 2002. Regester, Michael & Larkin, Judy ,“Risk Issues and Crisis Management: A Casebook of Best Practice”, Kogan Page Ltd, Third Edition, London, 2002. Saunders, Anthony and, Cornett, Marcia, “Financial Institutions Management: A Risk Management Approach”, McGraw-Hill, Inc., New York, 5thEdition, 2006. Venette, Steven (2003) “Risk communication in a High Reliability Organization’’, North Dakota State University, Second Edition, North Dakota. 2. Journals and Theses: 1. 2. 3. 4. Booth, Simon (2000) “How can Organizations Prepare for Reputational Crisis”? Journal of Contingencies and Crisis Management, Volume 8, Number 4, pp. Coombs, Timothy (2004) "Impact of Past Crisis on Current Crisis Communications: Insight from Situational Crisis Communication Theory", Journal of Business Communication, , Volume 41, Number 3, pp. Dowling, Grahame, "Creating Corporate Reputation: Identity, Image, and Performance", Oxford, Oxford University Press, 2001. Jaques, Tony, ‘’Issue Management and Crisis Management: An Integrated, Non-linear, Relational Construct’’, RIMT University, Melbourne, 2007. 3. Websites: 1. 2. 3. 4. 5. 6. 7. 8. 9. http://www.theirm.org/publications/documents/ARMS_2002_IRM.pdf-20-11-2010. http://www.casact.org/research/erm/overview.pdf-24-11-2010. http://www.ncsi.com.au/Publications.html-16-12-2010. http://www.businessdictionary.com/definition/riskretention.html?q=risk%20retention-9-1-2011. www.mccombs.utexas.edu/dept/irom/bba/risk/rmi/arnold/presentations/ch022_NH_377rev-17-12011. http://www.k-state.edu/internalaudit/intcontr.html-17-1-2011. http://www.investorwords.com/4292/risk.html-23-1-2011. http://www.palgrave-journals.com/rm/index.html-28-12-2010. http://www.hbs.edu/centennial/businesssummit/global-business/enterprise-risk-management.pdf11-12-2010. 26 الخالصة باللغة العربية يهدف هذا البحث الى التعرف على تطبيقات عملية إدارة مخاطر المؤسسة ،إذ جرى اختيار United Grain ) Grower Enterprise in Canada (UGGكحالة تمت دراستها في هذا البحث. يمكن تحديد مشكلة البحث من خالل طرح السؤال االتي :كيف يمكننا وصف المخاطر الذي تواجهه ،UGGوما هي عمليات إدارة المخاطر المستخدمة للتعامل معها؟ اعتمد ضمن هذا البحث نموذج محدد يتمثل في تحليل حالة دراسية لإلجابة على السؤال أعاله .االمر الذي تطلب العديد من الخطوات لتغطية معاني مختلفة للخطر وعرض الجوانب النظرية األساسية المتعلقة بعملية إدارة المخاطر في المؤسسة .ومن ثم تحليل الحالة المدروسة وتحديد العملية المتبعة في ادارة المخاطر التي واجهت المؤسسة المدروسة ،ومقارنة النتائج ذات الصلة بما يتماشى مع اختبار قبول او رفض فرضيات البحث. يتلخص االستنتاج الرئيسي لهذا البحث :بان هناك بدائل مختلفة يمكن استخدامها من قبل أي مؤسسة إلدارة المخاطر مثل تكامل سياسات إدارة مخاطر المؤسسة مع قيمها األساسية ،وإجراء تحليل للمخاطر ،وتنفيذ استراتيجيات متنوعة لتقليل المخاطر. جرى تقسيم هذا البحث إلى أربعة فصول .في الفصل األول ،مناقشة منهجية البحث التي تظهر مشكلة البحث وأهميته، وأهدافه والفرضيات التي يعتمدها .بينما جرى في الفصل الثاني ،دراسة القسم النظري الذي يشرح مفهوم الخطر والطرائق والعمليات المختلفة إلدارة مخاطر المؤسسة. بينما تناول الفصل الثالث ،الجانب العملي للبحث من خالل عرض وتحليل بيانات الحالة المدروسة بغية تحديد األدوات التي استخدمت من قبل UGGفي إدارة المخاطر التي واجهتها ،وأسباب اختيار تلك األدوات ،وتحليل بيانات النتائج المترتبة على ذلك .والوصول الى تصورات مستوفية بخصوص فرضيات البحث. ختم هذا البحث بالفصل الربع والذي تمثل باهم االستنتاجات المقدمة في ضوء نتائج تحليل الحالة المدروسة .وأخيرا، جرى عرض قائمة المصادر المستخدمة لتحقيق أهداف هذا البحث.