Financial Institutions and Markets

advertisement

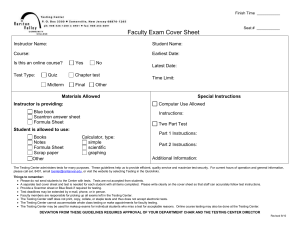

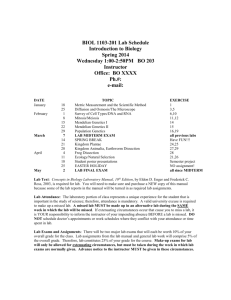

Bang College of Business Department of Finance FN 2201 - FINANCIAL INSTITUTIONS AND MARKETS COURSE SYLLABUS Fall 2013 Instructor’s Name Maya Katenova Office 339 Office Phone E-mail mayak@kimep.kz Office Hours To be confirmed Course Description/Overview Learning objectives The purpose of the course is to introduce the basic concepts and vocabulary relating to the operation of the financial system, to explore the fundamentals of interest rates and to examine the regulatory environment affecting financial institutions. The course introduces an overview to financial systems in general as well as in Kazakhstan. At the end of the course, students should be able to do the following: KNOWLEDGE & Skills 1. Have general understanding of financial institutions and markets 2. Understand the concepts of risk and return, and the trade-off between risk and return 3. Understand how change in interest rates affects investment return 4. Understand impact of monetary policy on interest rate changes, currency exchange rate etc. 5. Understand the basic principles of forward rates, forward exchange rates etc. 6. Get the principles of money markets, bond market, stock market and mortgage markets 7. Understand how sustainability/ESG (economic, environmental, social & governance) issues and ethical standards affect investment decisions made by participants of the financial markets (institutional investors, corporate lenders, insurance companies, hedge funds and corporations). COURSE OUTLINE The following topics will be covered. Week Topics 1 2 3 4 5 6 7 8 9 Why Study Financial Markets and Institutions Overview of the Financial System Understanding Interest Rates The Behavior of Interest Rates The Risk and Term Structure of Interest Rates Exam 1 The Money Markets The Bond Market The Stock Market. Ethics and Sustainability in Financial Markets. Main reading Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 9 Chapter 10 Chapter 11, Slides Chapter 12 The Mortgage Markets 10 Chapter 13 The Foreign Exchange Market 11 Exam 2 12 Chapter 7 Structure of Central Banking 13 Chapter 8 and 14 13-14 Conduct of Monetary Policy: Tools, Goals and Targets Chapter 17 Bank management 15 *This outline is tentative and subject to further changes. Amendments might be made depending on class progress, time, etc. READINGS AND COURSE MATERIALS Financial Markets and Institutions, Frederic S. Mishkin and Stanley G. Eakins, Fifth International Edition (Edition 4 is also applicable for the course) Students must read each material before the class in which the material is covered. Assigned exercises, solution to assigned exercises will be available from the L:/. Additional reading materials will be provided. CLASS STRUCTURE You will have one 1 hour 15 minutes lecture and 1 hour 15 minutes tutorial per week. In general, each week we will cover a new topic. During the lectures the instructor will introduce the topic to you and discuss the most important issues, then you will practice theory during tutorials by solving problems, having discussions etc. The tutorial instructor is the most important person for you because he/she will evaluate your performance and give you a final grade. CLASS ATTENDANCE Class attendance and participation is required. The attendance record will be kept during the tutorials. You may not be allowed to enter the classroom if you are late for more than 10 minutes for lectures, tutorials and exams. OFFICE HOURS Course instructors are available to assist students and answer students’ questions individually during their office hours. Students should approach the instructor based on the tutorial’s session. It means that students should consult the instructor first. Your instructor will keep attendance record, grade and keep your exams and accept appeals. Of course you can arrange the individual meeting with other instructors. ASSESSMENT The course evaluation is based on continuous assessment. The third exam is final. Assessment components and the exact split of points is as follows: Exam I Exam II Attendance Exam III (Cumulative) Total 25 % 25 % 10% 40 % 100 % Exams will be administrated during the semester (students will be notified in advance). Examination rules apply. Exams and quizzes are closed book and closed-notes and may include problem solving, multiple-choice and essay questions. It is a responsibility of each student to write the tests in the scheduled time. There will be NO MAKE-UP EXAMS. If you missed the scheduled test, and if you could provide fully documented and compelling reasons for the absence, the assessment marks will be transferred to the final exam. GRADING You can receive the grade Incomplete to Retake (IR) only if you miss final exam. You can receive the grade Incomplete (I) only if you passed any 2 out of 3 exams with very high grades (not less than 70%) and you have an official proof of your inability to finish the course. EXAMINATION RULES The following exam rules will appear on the exam cover. By reading and understanding them before the exam you can better plan and prepare for the exam. 1. Be sure that you have your ID with you. You will not be allowed to continue the exam without ID. The missing ID also may be penalized. 2. If you are late for the exam by more than 10 minutes you will not allowed to enter the examination room. 3. Write neatly and legibly. It is your responsibility that we can clearly read and follow your notes. Verbal explanations regarding to your notes will not be accepted. 4. Show all your work. Answers without supporting calculations or explanations receive zero credit! 5. Use full calculator display for all your calculations in order to minimize rounding errors. All financial sums must be rounded to the nearest cent, all interest rates, standard deviations, financial ratios etc. must be rounded to three decimal places when expressed as percentages or to five decimal places when expressed as decimal numbers (i.e. $12.78 instead of $12.80; 10.344% or 0.10344 instead of 10.3%). Rounding errors are penalized. 6. Use answer sheet to record your answers. Answers not recorded in the answer sheet receive zero credit. 7. Allowed is: pen(s) or pencil(s), eraser (or white correction fluid), ruler, calculator, English dictionary, financial tables. Mobile phones, notebooks, personal organizers, palmtops or any other electronic devices are not allowed and may not be kept by students during the examination. 8. You must use your own tools (calculator, financial tables etc.). No tools can be shared by students. 9. KIMEP exam rules apply. Talking, looking at other students' papers, sharing of anything (information or physical items), using unauthorized notes or tools is considered cheating. The opening of the exam papers before the instructor’s permission is considered cheating. Any cheating results in zero points on an exam and in disciplinary action. 10. Students may not leave the classroom during the examination for any reason (unless they want to finish their examination earlier). 11. All personal belongings must be put aside to designated areas. Students can keep items according to point 7 of these rules. 12. Exam papers without student signature, name, and student ID number on the exam cover will not be graded. You are allowed to fill in he front page of the exam work when the exam papers are distributed to you. 13. No make-up for missed exams. Missed exams receive zero points.