Self Paced Training

SELF PACED TRAINING

PLEASE READ CAREFULLY BEFORE YOU BEGIN.

OBJECTIVE:

The objective of today’s training is to get you comfortable with the software and to ensure that you are certified before your shift.

Today you will do the following at your own pace. As soon as you finish these tasks you are free to go and do whatever you normally do on Sunday afternoons. Feel free to ask any questions that you have at any time.

We want to work together to achieve a common goal!

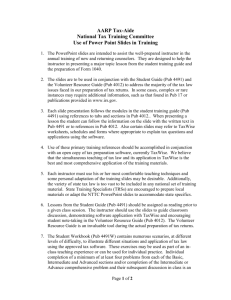

ON THE MISSOURI TAX RETURN:

County code – ADAI

School district – 241

The tasks that you will complete today are:

1.

Pick a computer which will already be logged into TaxWise.

2.

Select New Return for each client. A box will prompt you to enter their SSN twice then a new return will open.

3.

General comments on all tax returns: a.

For each return, you will be given the documents that you will need to complete the return.

b. Read the cover page for each return carefully. Many hints and answers are

given on this cover page. c. Each taxpayer has his/her social security number listed as XXX-43-3511. You

have been given an index card with 5 sets of 3 digit numbers. Use the first set for the first return, the second set for the second return, etc. This is necessary because TaxWise will not let us use duplicate numbers. d. On the main information sheet, there will be a red box for a date. Enter today’s date in the box.

4.

Complete the practice tax returns. a. Complete the first return for Lorelai Gilmore– materials to be given to you. b. Have the first return checked. When approved click “Close Return.” c. Complete the second return for Ross and Rachel Geller– materials to be given to you. d. Have the second return checked. When approved click “Close Return.” e. Complete the third return for Su Pham – materials to be given to you. f. Have the third return checked. When approved click “Close Return.” g. Complete the fourth return for Leslie Knope – materials to be given to you. h. Have the fourth return checked. When approved click “Close Return.” g. Complete the fifth return for Theodore Mosby– materials to be given to you. h. Have the fifth return checked. When approved click “Close Return.”

5.

Take the Enactus Post Test given to you by an Enactus member.

6.

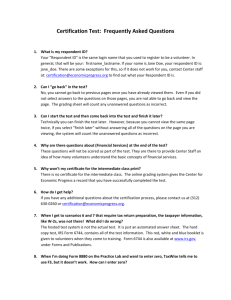

Take the certification exam: a.

Take out the certification questions and answers from the previous session. b. Open Internet Explorer and log onto https://www.linklearncertification.com/d/ b.

Click “Create an Account.” The Group should be 1- VITA Volunteer, and the

Training Source should be “Link and Learn Taxes (e-learning).” Please use the name that appears on your photo ID (ex. Driver’s license). Click

“register” and then “ok” to complete the account. Log in. d. Click the “Volunteer Standards of Conduct Exam” link and complete the exam.

Reference the training materials for help with answering these questions. Note that you have to take the “Volunteer Standards of Conduct Course” that is listed to take the exam. We will have already talked about the Standards of

Conduct, so just click next to get through the training. You may have to answer some questions on some of the pages (the system requires you to go through training before taking the test). Ask the reviewers any questions that you may have. Once you answer a question, you can go back. You need an 80% to pass and can take the test only two times.

NOTE: You are able to go back to questions if you answer the question you are currently on.

e. Click on 2014 Intake/Interview and Quality Review Training. Similar to earlier, just click next to get through the training (you have to go through the training before taking the basic exam). Click the ‘Basic Exam’ link and take the certification exam. Reference the training materials and the exam packet we covered earlier today. Ask the reviewers any questions that you may have.

Once you answer a question, you can go back. You need an 80% to pass and can take the test only two times. Remember that we went through most of the questions in the TaxWise Demonstration sessions.

7.

After completing the exam, have the reviewer check your score. They will give you a volunteer agreement to fill out and sign. Then sign the electronic volunteer agreement by checking the box on the right hand side of the screen – it will ask you to verify your signature by giving your username and password once again.

8.

Sign your name and put the time on the note card with the social security numbers you used. Turn this in to a reviewer before you leave.

9.

Bring the TaxWise Instructions and Answer Sheet home with you and turn ALL other materials into the reviewers

.

You can bring these back on the filing date along with your materials from the basic training session and Thursday night Beta Alpha Psi session.

NOTE: If you have misplaced your basic training or

Thursday training materials, you can find them at the BAP website: http://bap.truman.edu/.

10.

You are now ready to do tax returns! Pat yourself on the back for a job well done and go celebrate as you deem most appropriate.