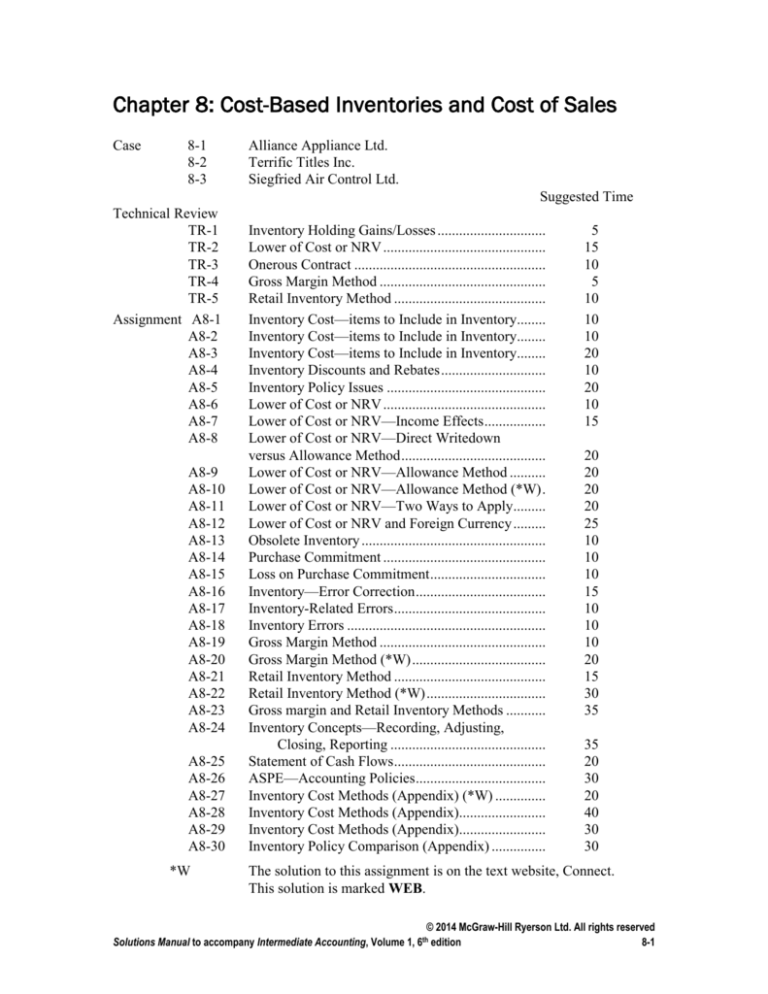

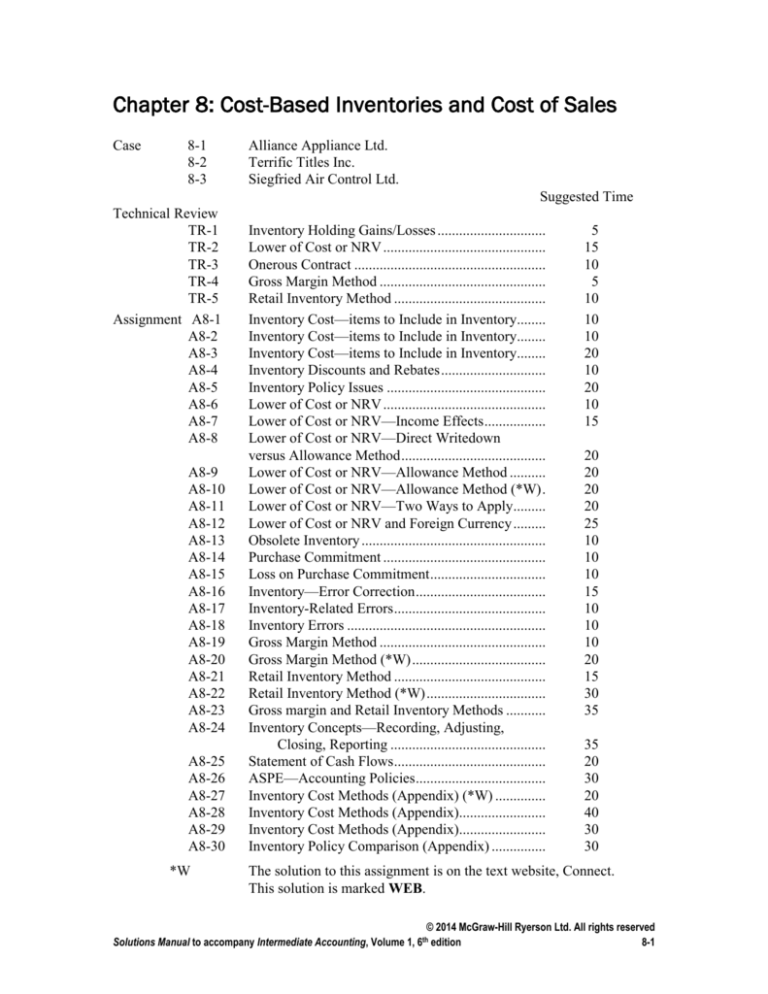

Chapter 8: Cost-Based Inventories and Cost of Sales

Case

8-1

8-2

8-3

Alliance Appliance Ltd.

Terrific Titles Inc.

Siegfried Air Control Ltd.

Suggested Time

Technical Review

TR-1

TR-2

TR-3

TR-4

TR-5

Assignment A8-1

A8-2

A8-3

A8-4

A8-5

A8-6

A8-7

A8-8

A8-9

A8-10

A8-11

A8-12

A8-13

A8-14

A8-15

A8-16

A8-17

A8-18

A8-19

A8-20

A8-21

A8-22

A8-23

A8-24

A8-25

A8-26

A8-27

A8-28

A8-29

A8-30

*W

Inventory Holding Gains/Losses ..............................

Lower of Cost or NRV .............................................

Onerous Contract .....................................................

Gross Margin Method ..............................................

Retail Inventory Method ..........................................

Inventory Cost—items to Include in Inventory........

Inventory Cost—items to Include in Inventory........

Inventory Cost—items to Include in Inventory........

Inventory Discounts and Rebates .............................

Inventory Policy Issues ............................................

Lower of Cost or NRV .............................................

Lower of Cost or NRV—Income Effects .................

Lower of Cost or NRV—Direct Writedown

versus Allowance Method ........................................

Lower of Cost or NRV—Allowance Method ..........

Lower of Cost or NRV—Allowance Method (*W) .

Lower of Cost or NRV—Two Ways to Apply.........

Lower of Cost or NRV and Foreign Currency .........

Obsolete Inventory ...................................................

Purchase Commitment .............................................

Loss on Purchase Commitment ................................

Inventory—Error Correction ....................................

Inventory-Related Errors ..........................................

Inventory Errors .......................................................

Gross Margin Method ..............................................

Gross Margin Method (*W) .....................................

Retail Inventory Method ..........................................

Retail Inventory Method (*W) .................................

Gross margin and Retail Inventory Methods ...........

Inventory Concepts—Recording, Adjusting,

Closing, Reporting ...........................................

Statement of Cash Flows ..........................................

ASPE—Accounting Policies ....................................

Inventory Cost Methods (Appendix) (*W) ..............

Inventory Cost Methods (Appendix)........................

Inventory Cost Methods (Appendix)........................

Inventory Policy Comparison (Appendix) ...............

5

15

10

5

10

10

10

20

10

20

10

15

20

20

20

20

25

10

10

10

15

10

10

10

20

15

30

35

35

20

30

20

40

30

30

The solution to this assignment is on the text website, Connect.

This solution is marked WEB.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-1

Questions

1.

Inventory is important because it is a material high-risk current asset, and, if properly

managed, inventory systems can be used to enhance profits. If inventory is poorly

managed and controlled, there are many opportunities for both error and fraud.

2.

Trading Entity

Merchandise Inventory—Goods on hand purchased for resale.

Manufacturing Entity

Raw Materials Inventory—Goods held for manufacturing products

Work-in-Process—Goods in the process of being manufactured

Finished Goods—Goods completed by the manufacturing process

Production Supplies Inventory—Items needed to perform plant maintenance.

Both entities can have miscellaneous inventories (e.g., office supplies)

3.

a.

b.

c.

d.

e.

f.

g.

h.

Include in inventory

Include

Exclude*

Include**

Exclude

Include***

Include

Include

*

Do not include in regular inventory. If the goods can be returned make no entry.

If the goods cannot be returned, the purchaser should include the damaged goods

in a special inventory—damaged goods.

** Inclusion or exclusion depends on the provisions of the sale agreement. This

answer assumed returns are allowed.

*** Not yet irrevocably sold; answer may depend on past history of sales (and

revenue recognition policy).

4.

a.

b.

c.

d.

e.

f.

Include

Exclude (recoverable)

Exclude

Exclude

Exclude

Include

5.

The purpose of the LC/NRV rule is to avoid overstating the future economic benefit

of inventory.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-2

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

6.

Raw material is used in production of a final product. If the NRV of the final product

is greater than the total cost of production, the full cost of the raw materials will be

recovered in the final sale. Therefore, the raw material should not be written down.

7.

Computation:

1.

2.

3.

4.

5.

Cost of goods available......................................................

Net sales revenue ............................................................... $160,000

Gross margin ($160,000 × 0.30) ........................................

48,000

Cost of goods sold ($160,000 – $48,000) ..........................

Ending inventory ($180,000 – $112,000) ..........................

$180,000

112,000

$ 68,000

8.

The degree of aggregation (items vs. categories) is important because it establishes

the extent of netting that will be permitted in calculating the need for writedowns. If

the test is done item-by-item, decreases in the NRV of some items cannot be offset

against increased NRV of other items; if the test is done by categories, offsetting is

allowed within that individual inventory category. The result can affect net income.

9.

An onerous contract is a purchase contract that locks the buyer into a price that is

higher than the going market price. The necessary are conditions are that:

a. the purchase contract is not open to revision or cancellation, and

b. a loss is likely to be material, and

c. the loss can reasonably be estimated.

10. When a purchase is made under an onerous contract, the portion of the cost that is

recorded as inventory is only the current market value of the items purchased. The

excess amount is a loss, charged against earnings as a loss in the net income section

of the CSI, thereby reducing the current period’s net income.

11. Required inventory disclosures are:

– basis of valuation for each inventory category

– carrying values of major categories of inventory

– amount of inventories carried at fair value less costs to sell (that is, not valued at

historical cost or LC/NRV)

– amount of inventories recognized as expense during the period

– the amount of any writedown recognized as expense in the period (IFRS only)

– the amount of any writedown reversal, and the reasons therefore (IFRS only)

– carrying value of any inventories pledged as collateral (IFRS only)

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-3

12. The reasons for which an enterprise would use a valuation method are:

a. The inventory is valued at NRV by groups rather than individually, thereby

eliminating the possibility of directly reducing individual items’ cost basis.

b. The company wishes to maintain the integrity of the original costs in the

records so as to more easily reconcile them to the SFP control account.

c. Possible subsequent reversals are much easier under the valuation method

because it’s not necessary to go back and restate the original inventory

amounts.

13. The gross margin method is used to estimate the value of the ending inventory

independent of a physical count of the goods on hand. The method uses the average

gross margin (gross margin divided by sales). The rate, which must be estimated on

the basis of past experience, is applied to current data provided by the records, that

is, sales, beginning inventory, and purchases. The critical assumption is that the past

gross margin rates provide a reliable basis for projecting the current rate.

14. The approach of the retail method of estimating inventories is to account for

merchandise activities at retail and cost. From such data, a cost/retail ratio is used to

convert retail amounts to cost. It is necessary to maintain a record of the beginning

inventory, purchases, and adjustments thereto at both cost and retail. With this data,

the average relationship between cost and retail (i.e., the cost ratio) can be computed

on the basis of actual data for the period. The total goods available for sale at retail

is reduced by the sales amount, giving the ending inventory valued at retail prices.

The cost ratio is then applied to the retail value to provide the estimated ending

inventory at cost.

15. The year-end inventory cut-off is important because it affects inventories,

receivables, revenues and cost of sales. The goods shipped must correspond to the

goods invoiced during the periods. If goods are invoiced to the customer (and

included in the sales revenue) but not shipped until after the cut-off date (and

therefore not included in cost of sales), matching will not be achieved and net

income will be misstated.

16. Cost of goods sold can be measured using the following cost flow assumptions:

a) Specific identification

b) FIFO

c) Average cost

– Cost of specific items sold is expensed

– Oldest costs are expensed, recent purchases retained

– Average cost of purchases is used to value inventory

and cost of goods sold.

When prices are rising, FIFO will always result in the highest net income, as old

cheaper units are expensed. Specific identification may have the same result, but not

“always”, depending on the exact units sold. Average cost blends the various levels

of cost, which yields a higher inventory level and lower net income than FIFO.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-4

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

17. The weighted-average method is used with a periodic inventory system. A weightedaverage is computed at the end of the period by using total purchase costs, beginning

inventory costs, and the number of units in the beginning inventory and purchases. It

is used because it is theoretically sound and systematic, and it is relatively easy to

apply when the periodic inventory system is used.

The moving-average method is used with a perpetual inventory system. A new

average is computed after each purchase to allow recognition of cost of goods sold at

the most recent average cost after each sale.

18. Under a periodic inventory system, the ending inventory each period is determined

by a physical count; the unit costs are then applied by using one of the inventory cost

flow policies. Cost of goods sold is calculated only after a physical count.

Under a perpetual inventory system, all receipts and issues of inventory items are

directly recorded in detailed inventory records so that a continuous inventory balance

is maintained in the records. Cost of goods sold is recorded after each sale. Any one

of the inventory cost flow policies may be used.

Perpetual systems are more expensive to maintain, and are common when an entity

needs to know detailed information on a daily basis regarding specific inventory

units and costs. It is also more common when accurate interim (monthly) results are

needed. Otherwise, periodic systems are used.

19. The HST is an “input tax credit” on purchases and will reduce the amount of HST on

sales that Zena will pay to the government. The materials cost is recorded net of HST

and the HST is debited to the “HST payable” account:

Inventory (or purchases)

HST payable

Accounts payable

200,000

24,000

224,000

Note: HST paid on purchases is an “input tax credit”, deducted when computing the

amount of HST payable to the government. Thus, the debit is to “HST payable”

rather to a receivable.

20. A perpetual inventory system does not eliminate the need for a physical count of

inventories. To verify the accuracy of the perpetual inventory records, it is necessary

that physical inventory counts be taken from time to time. This should be done

annually or on a rotation basis throughout the year. Any errors found in the perpetual

inventory records are corrected so that such records agree with the physical count.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-5

Cases

Case 8-1 Alliance Appliance Ltd.

Overview

This case is designed to highlight the differences in financial reporting under IFRS as

compared to ASPE. The student must adopt an advisory role and prepare a report to the

CFO concerning ten specific issues. The issues mostly are general presentation issues, but

a few also include more specific treatments, such as held-for-sale properties, inventory

valuation, and an onerous contract.

Sample response

To: Chief Financial Officer, Alliance Appliance Ltd.

From: Maxwell Davies, Henry & Higgins

Date: 04 April 20X4

I have reviewed the reporting issues that you raised concerning a potential switch from

ASPE to IFRS. I am happy to provide my advice, enumerated in the points that follow:

a. IFRS does not require specific financial statement titles; the titles you presently use

are quite acceptable, with one exception. The exception is that instead of “Statement

of Retained Earnings”, AAL would need to provide a “statement of changes in

shareholders’ equity”. “Retained earnings” would be just one column within this

statement.

b. On the income statement, expenses would need to be organized either by function

within AAL or by nature (that is, by type of expense). For example, a functional

classification could be by ‘assembly’ and by ‘distribution’. A classification by type of

expense would, in contrast, be items such as employee expense (that is, wages,

salaries, and benefits) and by depreciation expense. Therefore, consistent

classification is necessary.

c. There will be no change in reporting preferred dividends under IFRS. Retained

earnings will be one column in the statement of changes in shareholders’ equity, and

dividends paid will continue to be a component displayed in that column.

d. The estimated cost of fulfilling the guarantees is treated as a liability under IFRS.

However, under IFRS, a portion of the sales revenue you deferred as a separate source

of revenue and recognized only as the guarantees run and lapse.1

e. Gains and losses from foreign currency transactions would continue to be shown on

the income statement under IFRS, unless they are hedged, in which case they may

pass through Other Comprehensive Income, which is a category of shareholders’

equity and be shown in the statement of changes in shareholders’ equity rather than on

the income statement.

1

Whether students get this point will depend on what they’ve learned about revenue recognition in their

previous courses. They shouldn’t be penalized if they don’t know what to do with it.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-6

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

f. The Japanese contract would qualify as an “onerous contract” under IFRS; the amount

by which the contract price is greater than the fair value would be recognized as a loss

at the balance sheet date. ASPE doesn’t use that particular terminology, but the

potential loss should be recorded under ASPE also.

g. Under both ASPE and IFRS, inventory written down can be written back up if fair

value recovers, but no higher than their originally recorded cost. No adjustment or

change in practice would be required.

h. Under ASPE, the asset exchange can be valued at either the value of the consideration

or the value of the asset acquired, whichever is the more reliable measure. In contrast,

IFRS requires that the value of the consideration be used, regardless of which measure

is more reliable. The carrying value of the acquired lot will need to restated if and

when AAL switches to IFRS.

i. The cumulative currency translation difference (CCTD) is treated essentially the same

under ASPE and IFRS—a separate component of shareholder’s equity. The only

difference is that under IFRS, the cumulative amount is shown on the statement of

changes in shareholders’ equity as one component of other comprehensive income.

j. The building has been written down prematurely. It should be continue to be reported

at its depreciated cost (and depreciation should continue) until it has been abandoned.

Once it is abandoned in 20X7, depreciation can cease and the asset should be written

down to its recoverable value. Under IFRS, however, it cannot be reclassified as a

held-for-sale asset unless it is likely to be sold within the next year. If no process for

sale has begun, then the asset cannot be reclassified but must remain in the buildings

account as an idle asset.

I hope my responses will help you in AAL’s potential shift to IFRS. Please do not hesitate

to contact me if you’d like more information.

Best wishes,

Maxwell Davies, staff auditor

Henry & Higgins

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-7

Case 8-2 Terrific Titles Inc.

Overview

This case raises several issues, some of which are obvious and some are less obvious. The

issues are:

Inventory valuation

Revenue recognition

Expense recognition

Intangible assets and deferred charges

If TTI acquires ABC, ABC will need to change its policies to conform with IFRS since

ABC will be consolidated into TTI’s results, and therefore must follow IFRS.

There is some conflict between the accounting policies that ABC will have to adopt in the

future and TTI’s immediate objective to establish a bid price based on earnings projects.

A bid price would be based on TTI’s evaluation of (1) earnings potential and (2) volatility

of earnings and/or cash flows. High earnings is good, but volatility is bad—the risk vs.

return trade-off

Sample response

Dear Ms. O’Malley:

I am pleased to report my findings concerning Ashwin Book Corporation’s accounting

policies and practices. I believe that it will be necessary to make some adjustments to

ABC’s reported numbers for 20X3 as well as take some additional factors into account

when we project the company’s earnings into the future in order to establish a bid price.

One overriding consideration is that ABC, as a private company, seems to use an

amalgam of Canadian accounting standards for private enterprises and some eclectic

accounting policies that appear to be rather unorthodox. In effect, ABC uses a disclosed

basis of accounting. If we acquire ABC, the company will need to change its accounting

policies to conform with IFRS, since we use IFRS and we will need to consolidate ABC.

My discussion of the major issues is as follows:

a. Inventory valuation. ABC develops and produces its own books. All of each title’s

development, production, and printing costs are included in inventory and allocated

over the number of copies in each edition’s initial press run. The result is that the first

print run has a huge unit cost while succeeding press runs (if any) bear only the cost

of that particular print run. As a result, cost of goods sold will be very high for the

initial run, quite likely yielding a negative gross margin for that initial run, even for a

very successful book. For performance evaluation and for earnings prediction, these

numbers are apt to be very misleading. As well, loading all of these costs into the

inventoriable cost will usually result in an inventory value that is significantly higher

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-1

than net realizable value. Therefore, the development costs should be removed from

inventory and accounted for separately.

b. Development and production costs. We have a dichotomy in this regard. For financial

reporting purposes, ABC will have to change their accounting policy for development

costs to accord with IFRS, once we acquire them. One option is to expense

development costs when they are incurred—even for historically successful books.

An edition’s success may not be predictable with assurance, because new competitors

enter the market regularly.

On the other hand, spreading the development and production costs over the 3-year

life span of the book will assist with our prediction of future earnings (on which we

base the bid price) as well as ongoing evaluation of ABC’s management. However, it

is questionable as to whether these costs can properly be considered as an intangible

asset, and thereby capitalized and amortized. IFRS discourages treating expenditures

for new products as intangible assets (IAS 38, paragraph 69). Every new edition is, in

effect, a new product, and therefore I recommend that ABC’s policy for these costs

should be to expense them when incurred.

For our analytical purposes in developing a bid price, however, I suggest that we

remove development and pre-production costs from inventories in recent prior years

and amortize them over 3-year periods just so we can discern the underlying earnings.

Then we can look at the cash flow volatility over the years to measure the risk

potential of the erratic production levels.

c. Revenue recognition. ABC recognizes revenue when books are shipped. However,

there is a 6-month official return policy that is unofficially stretched for college and

university bookstores, which account for 90% of total sales. The return rate seems to

be difficult to predict. If it is not feasible to make a reliable estimate of the return rate,

either overall or book-by-book, revenue recognition probably should be deferred until

the 6-month “official” return period has ended.

d. Supporting material for instructors. The cost of providing free supporting materials

for instructors can be considerable. They have no inventory value in the usual sense

because their net realizable value is zero (even though students would love to get their

hands on solutions manuals). The significant cost of these items suggests that instead

of inventorying the costs, ABC should instead defer some of the revenue and treat

each book’s sale as really being a multi-deliverable contact: (1) a book delivered to

the students when they buy them, and (2) supporting material prepared and made

available for instructors. While there is no measurable value for the second

deliverable, an allocation of revenue could be based on the relative costs of the two

deliverables. ABC shouldn’t be pouring more money into production and support that

can be received in revenue. Such a revenue allocation would give ABC managers a

better idea of the “real” price that they should be charging for the book.

e. Inventory valuation of returned books. ABC restores returned books to inventory at

the unit cost they originally bore. This has two problems: (1) the original assigned

cost is too high, as discussed above, and (2) if large quantities of a book are returned,

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-2

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

it probably indicates that the book is unsuccessful and therefore that its net realizable

value is much lower than the original unit cost. We will need to determine how much

of the current inventory is comprised of returned books, and probably write off those

books for our estimation process.

f. Inventory of old editions. An inventory of old editions should not be assigned any

value as assets. By definition, they are obsolete, even if there may be some residual

sales. By retaining some inventory at normal cost, ABC management may be tempted

to retain more than necessary in order to avoid depressing earnings by a write-down.

g. Website development costs. It is doubtful that these costs would qualify as an

intangible asset under IFRS. The success of the website is not predictable with

reasonable assurance. The costs should be expensed when incurred. However, we

should take into account in our projects that delivering support material electronically

will significantly reduce the cost of printing and distributing instructors’ supporting

materials. That cost reduction may be offset, however, by the necessity to put more

resources into development of electronic learning aids in order to keep up with the

competition.

h. Sales discounts. The company currently is charging “discounts taken” on accounts

receivable to interest expense. Instead, the discounts should be deducted from

revenue.

I hope that I have identified the major issues that I see with ABC accounting. If you wish

me to pursue any of these matters further, I will be happy to visit the company again and

take a closer look at their accounting records.

Sincerely,

Ian Fanwick

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-3

Case 8-3 Siegfried Air Control Ltd.

Overview

This case focusses on inventory valuation and related aspects such as (1) lower of cost or

NRV, (2) unrealized foreign currency gains/losses and hedges thereof, and (3) revisions

of cost estimates on uncompleted projects. It provides an overview of material covered in

Chapter 3 (other comprehensive income) and Chapter 6 (revenue recognition for

contracts). The issues presented in the case can be treated individually.

Sample response

To: Vice President, Finance

From: Theresa Tie, accounting advisor

Subject: Recommendations on accounting policies

I am pleased to provide my recommendations on the five inventory-related issues that you

raised. First, however, SAC must establish the reporting standards on which your

financial statements should be prepared.

As a Canadian private company, you can use either international standards (IFRS) or the

CICA’s accounting standards for private enterprises (ASPE). The bank is your only

external user. The bank been happy (so far) with unaudited statements, and thus are not

likely to expect statements prepared on international standards; they will be very familiar

with ASPE since undoubtedly a lot of their other corporate clients also use it. Therefore I

would strongly recommend adopting Canadian accounting standards for private enterprise

(ASPE).

After establishing the basis for SAC’s financial statements, I will move to the specific

issues that you raised. My recommendations follow below.

1. The company seems not to be including any overhead in the cost of manufacturing and

inventory. Overhead should be charged as a manufacturing (and inventory) cost, not

only direct materials and direct labour. Overhead should be charged to inventory on a

normal-capacity basis, with no increase in charges due to idle capacity.

2. SAC has an unrealized foreign currency gain of $156,000. On the balance sheet date,

the account payable must be restated. However, since the Euro payable has been

hedged, the SAC should not recognize the gain in income. Instead, the unrealized gain

should be credited to accumulate other comprehensive income and reported as a

component of other comprehensive income for 20X5.

3. The practice of charging warranty costs to expense when incurred may be justified

when the costs are immaterial or are difficult to predict. Historically, that seems to

have been the case. With the new units, however, it seems that a significant portion of

the sales revenue is actually going to providing servicing under provisions of the

warranty. This suggests that the company should take an alternative approach and start

deferring a portion of the sales revenue and allocating it over the warranty period.

Incurred warranty costs would then be recognized directly as expenses on the income

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-4

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

statement, deducted from the deferred revenue recognized in the period. This change

would be a change in accounting policy, however, and should be implemented in the

next fiscal year, not in the current year.

Based on experience to date, SAC should estimate the costs of servicing under

warranty for the remaining warranty period of Sigmunds (the new model) that have

been installed as of the end of 20X5.

4. The older model (Erda) is about to become obsolete under legislation in Ontario. Some

may still be sold in Ontario prior to the effective date of the new legislation, and it still

can be sold in the U.S. at a reduced price (wholesale). The Erdas must be written down

to lower of cost or recoverable value. The writedown should be 10% of the current

book value plus the estimated average cost of shipping the units to the U.S. Although

some units may still be sold domestically, they probably will need to be discounted as

well. Therefore, all remaining Erda inventory should be written down to their net

recoverable value—that is, to their fair value minus costs to sell (including

transportation).

5. There are two issues concerning the building conversion project: (a) should SAC

recognize any revenue and profit from this contract, and (b) how much should be

reported as the value of inventory relating to this project at the end of the year.

The original estimate was that the project would earn SAC a profit of $200,000 (that

is, $1,200,000 contract price minus $1,000,000 estimated cost)The project supervisor

estimates that the project is 40% complete, which implies the possibility of

recognizing 40% of the profit. However, estimated total costs have risen to

$1,150,000, leaving a potential profit of $50,000. Of the estimated total costs, SAC has

incurred $600,000, or 52% of estimated total costs. The 40% estimate is based on

physical work (i.e., labour cost). Under ASPE, either percentage could be used to

estimate the proportion of profit to the recognized in 20X5.

The company has incurred costs of $600,000 so far, including the major materials cost

of the compression and air-handling equipment. There is no indication as to whether

overhead is included in the $350,000 of non-equipment costs—that is, the $600,000 in

total costs minus the $250,000 in equipment costs. If not, then overhead should be

added to that amount.

The question then becomes whether the full estimated cost of the project can be

recovered. If more than $50,000 in overhead is added to the inventory amount, the

company would suffer a loss on the project and the inventory should be written down

to an amount equal to $1,200,000 minus the estimated cost to complete.

I hope that you find my recommendations helpful. Please do not hesitate to contact me if

you have any questions about my recommendations or have additional issues that need to

be addressed.

Sincerely,

Theresa Tie

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-5

Technical Review

Technical Review 8-1

The holding loss (gain) can be computed as follows:

Year-end

20x4

20x5

20x6

20x7

20x8

(a)

Allowance to reduce

inventory to LC/NRV—

Opening balance

$

0

0

2,000

1,000

4,000

(b)

Allowance to reduce

inventory to LC/NRV—

Amount required*

$

0**

2,000

1,000

4,000

0**

(b) – (a)

Holding loss

(gain)

$

0

2,000

(1,000)

3,000

(4,000)

* Cost less NRV, if NRV is less than cost.

** NRV is in excess of cost; no allowance is required.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-6

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Technical Review 8-2

Computations:

Type

#

Cost

Per unit

Total

NRV

Per unit

Total

LCNRV

By type

By class

Class 1

Basic

50

$ 100

$ 5,000

$ 120

$ 6,000

$ 5,000

Super

30

150

4,500

140

4,200

4,200

Total, Class 1

$ 9,500

$10,200

90 $ 10,800

100 $ 12,000

$ 9,500

Class 2

Regular

120

Deluxe

60

130

7,800

140

8,400

7,800

Super deluxe

40

200

8,000

150

6,000

6,000

Total, Class 2

$ 26,600

Totals

$ 36,100

10,800

$ 26,400

$ 26,400

$ 33,800

$ 35,900

Requirement 1

By item, the writedown is the total cost for all items minus the sum of the individual

LCNRV:

Writedown = $36,100 – $33,800 = $2,300

Requirement 2

By class, the writedown is the sum of the cost of all items minus the sum of the LCNRV

for each class:

Writedown = $36,100 – ($9,500 + $26,400) = $200

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-7

Technical Review 8-3

18 November:

Loss on onerous purchase commitment (850 kg × $3 loss) ...............

Estimated liability on onerous purchase contract (850 × $3) .....

2,550

2,550

[The remaining commitment in the purchase contract is for 850 kg: 1,500 – 650. Issuing

an order for 110 kg triggers recognition of the potential total loss. No entry is necessary to

record the purchase order at this point.]

27 November:

Inventory (110 kg × $17) ...................................................................

Estimated liability on onerous purchase commitment

(110 kg @ $3 loss) ...............................................................

Accounts payable (110 kg × $20) ...............................................

1,870

330

2,200

Note: Any inventory remaining in storage at year-end should be written down to market

price if fair value is lower than cost.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-8

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Technical Review 8-4

(in thousands of dollars)

Sales revenue [1]

Cost of goods sold:

Beginning inventory

Purchases [2]

Goods available for sale

Ending inventory [5]

Cost of sales [4]

Gross margin [3]

Cost data (known)

$1,460,000

$ 400,000

966,000

1,366,000

Partially estimated amounts

$1,460,000

$ 400,000

966,000

1,366,000

344,000

1,022,000

$ 438,000

[1] $1,500 gross sales – $40 returns = $1,460

[2] $900 purchases + $26 shipping + $40 import duties = $966

[3] $1,460 net sales × 30% gross margin = $438

[4] $1,460 net sales – $438 gross margin = $1,022

[5] $1,366 goods available for sale – $1,022 cost of sales = $344

Notes:

Students may be tempted to include HST on both sales and purchases in their

calculations. However, those amounts are credited/charged directly to the HST

Payable account and are not included in either sales amounts or in inventory.

Import duties are included in purchases, however, as they must be absorbed by the

vendor (i.e., Tate Tasers Inc.)

Storage costs are not included in inventory but are expensed as a period cost.

Shipping to customers is a selling cost, not part of goods available for sale.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-9

Technical Review 8-5

At cost

Inventory, 1 July

+ Purchases

– Purchase returns and allowances

+ Markups (net) ($195,000 – $38,000)

Retail value goods available for sale

– Markdowns (net) ($60,000 – $23,000)

Goods available for sale

– Sales (net of returns: $1,680,000 – $80,000)

Inventory, 30 September, at retail

Inventory, 30 September, at cost:

($532,000 × 54 % cost ratio*)

At retail

$ 362,000

830,000

(16,000)

$ 537,000

1,500,000

(25,000)

$ 1,176,000

157,000

2, 169,000

(37,000)

$2,132 ,000

(1,600,000)

$ 532,000

$

287,280

* Cost ratio = $1,176,000 ÷ $2,169,000 = 54%

Since the retail method is an estimate, there is no point in carrying the cost ratio out to

more than two significant digits.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-10

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignments

Assignment 8-1

Cost of inventory:

a.

Bookkeeper’s inventory count

Less HST included above (refundable by the government)

$30,000

(4.100)

b.

2% cash discount on $6,000 worth of goods

(120)

c.

This is an overhead cost, not to be included in inventory

0

d.

The title for these goods now resides with the buyer, despite return

privilege

0

e.

Items must be reduced to cost by deducting $1,000 gross margin*

(1,000)

f.

Add goods on consignment, not included in the original count, at

cost**

8,000

g.

Correction to reduce inventory value to cost actually incurred:

$14,000 × (1.00 – 0.40)

Corrected inventory count

(8,400)

$24,380

* Cost = $3,000 ÷ 150% = $2,000

Markup = $1,000

** Assumes that the goods will be sold at retail for $10,000; therefore 20% commission =

$2,500 and cost = ($10,000 $2,000) = $8,000.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-11

Assignment 8-2 (WEB)

Items to be included in inventory:

Physical count

$ 120,000

California sales tax

3,000

Import excise tax

4,000

Bonded inventory in U.S. dollars:

US$22,000 × C$1.05

Total

23,100

$150,100

Notes:

Payments in advance (item b) are a receivable (or prepaid asset) until the goods are

received.

HST (item c) is not included as it decreases the amount of HST on sales that is due to

the government.

California sales tax (item d) is not recoverable and should be included as part of the

cost of inventory.

The items being tested (item e) are already included in the physical count and should

not be added in again.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-12

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-3

Requirement 1

Inventory

Preliminary value

(a) Sale not recorded

(b) Goods in transit

(c) Invoice unrecorded

(d) Freight for goods in inventory*

(e) Goods on consignment

(f) Purchase discount accrued

Revised total

(g) Net realizable value

Required allowance

Existing allowance

Holding loss

$689,600

(54,300)

37,500

—

5,000

(21,900)

(4,000)

$651,900

605,000

46,900

32,200

$ 14,700

Accounts

Payable

$456,300

—

37,500

51,100

5,000

—

(4,000)

$545,900

Inventory would be reported net on the balance sheet at $605,000. Accounts payable has a

corrected balance of $545,900.

* An alternative would be to charge this amount to a separate expense account as “freight

in”, a practice often used when it is impracticable to allocate shipping costs to various

inventory items.

Requirement 2

The holding loss on inventory is $14,700. See calculations in requirement 1.

Requirement 3

Corrected cost of goods sold:

Preliminary value

Increase in purchases [(b) $37,500 + (c) $51,100

+ (d) 5,000 – (f) $4,000]

$2,211,400

89,600

Holding loss for 20X6

14,700

Decrease in closing inventory ($689,600 – $651,900)

37,700

$2,353,400

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-13

Assignment 8-4 (WEB)

Requirement 1

Cost per unit of inventory ...................................................................................

Less: 2% discount (note 2) ..................................................................................

Less: Quantity rebate...........................................................................................

Total cost — 30 units × $465 ..............................................................................

$500.00

(10.00)

(25.00)

$465.00

$13,950

Notes:

1.

The freight charges are not included because the shipping is FOB destination,

wherein “destination” is at Majestic Store, and thus the shipper pays the freight cost.

2.

IFRS requires that the discount be deducted regardless of whether or not Majestic

takes the discount.

Requirement 2

Accounts receivable ...........................................................................

Cost of sales (170 × $25) ............................................................

Inventory (30 × $25) ...................................................................

5,000

4,250

750

Because receipt of the rebate is certain by the end of the year, inventory and cost of goods

sold should reflect the net cost.

Requirement 3

Cash.......................................................................................................... 5,000

Accounts receivable (consistent with requirement 2) ........................

5,000

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-14

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-5

Case A Inventory cost should be recorded net of early-payment discount regardless of

whether it was taken or not. Inventory should be reduced by $56,000 × 2% =

$1.120. The restated inventory will be $54,880.

Case B The policy of defining market value as replacement cost is not acceptable.

Market value should be defined as net realizable value. If sales price has not

declined, NRV is likely unimpaired and no LC/NRV write-down would be

needed. As a result of the write-down, inventory is potentially understated and

income understated.

Case C Company policy is unacceptable. Goods on consignment belong to the company,

and cannot be regarded as sold until re-sold to a final customer. Inventory is

understated, accounts receivable overstated, and income is overstated by the

$32,000 gross profit on the sale.

Case D Company policy is unacceptable. The company is recording goods at cost, but

has not recognized the adverse purchase commitment agreement as an onerous

contract liability relating to the 35 remaining units (of the 150 contracted) yet to

be acquired.

In 20x5, the company should have recognized a loss on the purchase agreement

of $160,000 (i.e., $2,000 per unit × 80 units remaining in the commitment).

In 20X6, the company should have recognized a recovery of $1,500 per unit, or

$120,000 total, which is calculated on the remaining units from year-end 20X5,

not 20X6. The 45 units acquired at $16,000 in 20X6 should be written down by

$500 per unit × 45 units = $22,500, to their current value at year-end. Income

and retained earnings are overstated in 20x5 and liabilities are understated.

Currently, inventory is overstated in 20x6; the impairment must be recorded.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-15

Assignment 8-6

Requirement 1

Average discount — 40% of sales at 10% discount; 60% of sales at 3% discount =

(0.40 × 0.10) + (0.60 × 0.03) = 0.04 + 0.018 = 5.8% average discount

NRV = [($70,000 – $5,000) × (1.0 – 0.058)] × (1 – .06)

= $65,000 × 0.942 × 94%

= $61,230 × 94%

= $57,556

Writedown = ($60,000 – $57,556) × 20 = $2,444 × 20 = $48,880

Requirement 2

Revenue = $63,000 × 94% × 5 = $296,100

Cost of goods sold = $57,556 × 5 = $287,780

Gross profit = $8,320

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-16

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-7

Requirement 1

Holding loss on inventory (CGS) .....................................

Inventory ..................................................................

4,000

4,000

Requirement 2

Accounts receivable ($20,000 × 150% × 60% sold) .........

Sales .........................................................................

18,000

Cost of goods sold ($16,000 × 60% sold) .........................

Inventory ..................................................................

9,600

Inventory (40% × $4,000 original writedown)..................

Cost of goods sold ....................................................

1,600

18,000

9,600

1,600

Requirement 3

The writedown had the effect of reducing net income by $4,000 in 20X6. In 20X7,

income was increased by $2,400 through the sale of 60% of the written-down inventory.

Income increased again 20X7 by the write-up of the $1,600 for year-end inventory. The

effect was to transfer all of amount of the writedown from 20X6 to 20X7, based on the

best estimates at the time. Therefore, 20X7 net income increased by $4,000, the full

amount of the 20X6 writedown.

Without the writedown, 20X6 earnings would have been $54,000 while 20X7 earnings

would have been $56,000.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-17

Assignment 8-8 (WEB)

Calculations:

Individual

LC/NRV

Individual

writedown

$ 8,000

$ 8,000

$ 500

10,400

11,700

10,400

—

$18,900

$ 19,700

Item

#

Cost

NRV

A

100

$ 8,500

B

260

A+B

C

150

10,500

7,500

7,500

3,000

D

200

10,000

12,000

10,000

—

C+D

$20,500

$19,500

Total

$39,400

$35,900

$ 3,500

Group

LC/NRV

Group

writedown

$18,900

nil

$19,500

$ 1,000

$38,400

$ 1,000

Requirement 1

Item-by-item, the writedown would be $3,500:

Cost of goods sold (LC/NRV loss on inventory*) ............

Inventory ..................................................................

3,500

3,500

Requirement 2

Treating the four items as two classes, the write down would be:

$39,400 – $38,400 = $1,000

Cost of goods sold (LC/NRV loss on inventory*) ............

Allowance to reduce inventory to LC/NRV.............

1,000

1,000

Requirement 3

a. With an individual writedown, the recovery for Item A can be reversed, but only to

the extent of the original writedown:

Inventory ...........................................................................

Cost of goods sold ....................................................

500

500

b. When inventory is grouped by class, no recovery is recorded because none of the

writedown (of $1,000) pertains to class A+B.

* The loss must be disclosed in the notes. Alternatively, these amounts can be debited to a

separate account for “Loss on inventory”.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-18

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Requirement 4

The advantage of using an allowance is that the individual subsidiary inventory records

do not need to be adjusted for the writedown (nor for any subsequent recovery in value).

The allowance method is essential when LC/NRV is performed by inventory class rather

than item-by-item, because there would be no way to make the detailed inventory records

conform to the general ledger control account.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-19

Assignment 8-9

20X6

NRV: $300,000 × (1.00 – 0.10 – 0.05) = $300,000 × 85% = $255,000

Cost – NRV: $340,000 – $255,000 = $85,000 writedown at the end of 20X6

Holding loss on inventory (CGS)......................................

Allowance to reduce inventory to LC/NRV.............

45,000

45,000

20X7

Cost (without writedown): $340,000 + $50,000 = $390,000

NRV: $370,000 × 90% = $333,000

Allowance required at the end of 20X7: $390,000 – $333,000 = $57,000

Adjustment from 20X6 allowance balance to 20X7 balance: $45,000 – $17,000 =

$28,000 reversal of writedown

Allowance to reduce inventory to LC/NRV......................

Holding gain on inventory (CGS) ............................

28,000

28,000

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-20

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-10 (WEB)

Requirement 1—Loss for 20X1

a)

Individual items

Allowance

A ........................................ $1,000

B.........................................

5,000

C.........................................

0

D ........................................

1,500

E ......................................... 16,000

F .........................................

0

Total ................................... $23,500

b) Category

A - C Cost, $75,000, NRV, $77,000 ..................

0

D - F Cost, $80,000, NRV, $62,500 .................. $17,500

Total ......................................................... $17,500

Requirement 2

a) By individual items:

Holding loss on inventory .................................................

Allowance to reduce inventory to LC/NRV.............

23,500

23,500

b) By category:

Holding loss on inventory .................................................

Allowance to reduce inventory to LC/NRV.............

17,500

17,500

Requirement 3—Loss for 20X2

a)

Individual items

Allowance

A ........................................ $2,000

B.........................................

1,000

C.........................................

0

D ........................................

1,500

E .........................................

3,000

F .........................................

2,000

Total ................................... $9,500

b) Category

A - C Cost, $60,000, NRV, $64,000 ..................

D - F Cost, $72,000, NRV, $65,500 ..................

Total .........................................................

0

$6,500

$6,500

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-21

Journal entries

a) By individual items:

Allowance to reduce inventory to LC/NRV1 ...................

Inventory ..................................................................

14,000

14,000

b) By category:

Allowance to reduce inventory to LC/NRV2 ....................

Inventory ..................................................................

11,000

1

Adjusting entry: reduces the valuation account from $23,500 to $9,500.

2

Adjusting entry: reduces the valuation account from $17,500 to $6,500.

11,000

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-22

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-11 (WEB)

Requirement 1

Keyboards:

A

B

C

Hard drives:

X

Y

CD Burners:

D

E

Lower of cost or NRV applied by

Items

Classification

Req. (a)

Req. (b)

Cost

NRV

$ 564

760

900

2,224

$ 480

700

990

2,170

$ 480

700

900

2,700

4,800

7,500

2,550

5,400

7,950

2,550

4,800

2,280

10,000

12,280

1,980

11,600

13,580

1,980

10,000

Total cost

$22,004

Lower of cost or NRV

$ 2,170

7,500

12,280

$21,410

$21,950

Requirement 2

(a)

Items

Periodic inventory;

allowance method:

Holding loss on inventory

Allowance to reduce

inventory to LC/NRV

(b)

Classification

594*

54**

594

54

* $22,004 – $21,410 = $594

** $22,004 – $21,950 = $54

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-23

Requirement 3

The application of lower of cost or NRV to individual items may be theoretically

preferable because this represents a pure application of the LCNRV method and is

entirely consistent with the concepts underlying the method.

In some cases, however, the difference in inventory valuations produced by the two

alternatives may be so small as to make the item-by-item applications not practicable.

This is particularly true when items within a category are homogeneous, which means

that the computations of “cost” and “NRV” may be conducted at a broader level of

aggregation. In this particular situation, this appears to be the case; therefore, both

applications derive very similar results. Of course, this difference also should be

compared to cost of goods sold and net income, etc., in assessing its materiality.

Another factor to consider is the reliability of estimates; use of categories rather than

individual items may compensate for imprecision of estimated values.

One further note is that classifying can net profitable items with unprofitable ones and

thereby, sometimes, generate misleading information. There may be ethical dimensions

in how management defines a “classification” which may allow them to reduce their

write-downs by grouping high-margin and negative-margin items together.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-24

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-12

Requirement 1— Direct writedown

December 20X7:

Holding losses on inventory..............................................

Inventory, Class A....................................................

Inventory, Class B ....................................................

600,000

400,000

200,000

June 20X8:

Inventory Class B ..............................................................

Recovery of inventory value ....................................

80,000

80,000

November 20X8:

Accounts receivable ..........................................................

Cost of goods sold .............................................................

Sales revenue ...........................................................

Inventory Class B .....................................................

380,000

365,000

380,000

365,000

March 20X9:

Accounts receivable (€200,000 × C$1.70)........................

Cost of goods sold ............................................................

Sales revenue ...........................................................

Inventory, Class A....................................................

340,000

300,000

340,000

300,000

April 20X9:

Cash (€200,000 × C$1.62) ................................................

Foreign currency loss [€200,000 × (1.70 – 1.62)].............

Accounts receivable .................................................

324,000

16,000

340,000

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-25

Requirement 2 — Allowance method

December 20X7:

Holding loss on inventory .................................................

Allowance to reduce inventory to LC/NRV.............

600,000

600,000

June 20X8:

Allowance to reduce inventory to LC/NRV Inventory .....

Recovery of inventory value ....................................

80,000

80,000

November 20X8:

Accounts receivable ..........................................................

Cost of goods sold .............................................................

Allowance to reduce inventory to LC/NRV Inventory .....

Sales revenue ...........................................................

Inventory, Class B ....................................................

380,000

365,000

60,000

380,000

425,000

March 20X9:

Accounts receivable (€200,000 × C$1.70)........................

Cost of goods sold ............................................................

Allowance to reduce inventory to LC/NRV......................

Sales revenue ...........................................................

Inventory, Class A ....................................................

340,000

300,000

400,000

340,000

700,000

April 20X9:

Cash (€200,000 × C$1.62) ................................................

Foreign currency loss [€200,000 × (1.70 – 1.62)].............

Accounts receivable .................................................

324,000

16,000

340,000

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-26

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-13

The inventory that is being sold through the distributor must be written down to lower of

cost or NRV. Net realizable value is $220 minus $44 commission per unit, which yields a

NRV of $176. Original cost was $250. Therefore, the writedown is as follows:

Writedown = ($250 – $176) × 600 units = $44,400.

Holding loss on inventory* ..............................................

Inventory, Model T ..................................................

44,400

44,400

*Students may choose to use an allowance rather than a direct writedown, which is

completely satisfactory. The credit then would be to “Allowance to reduce inventory to

LC/NRV.”

No adjustment is necessary for the remaining 400 units because the new sales price is still

higher than production cost. However, this assumes there is evidence that the Model Ts

actually can be sold at the reduced price of $280.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-27

Assignment 8-14

Requirement 1

To record the purchase of 50,000 crates @ $12:

Crate Inventory (including 7% PST).................................

GST payable ($600,000 × 5%) .........................................

Accounts payable .....................................................

642,000

30,000

672,000

Requirement 2

The potential loss on the onerous contract is $3 × 150,000 = $450,000:

Estimated loss on onerous purchase contract ....................

Estimated liability on onerous contract ...................

450,000

450,000

This loss should be recorded only if (1) the low price of the crates is expected to continue

throughout the fiscal period and (2) Lumber Products Ltd. refuses to renegotiate the

contract.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-28

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-15

Requirement 1

The necessary contractual and economic conditions that would require only disclosure of

the contract terms by means of a note in the financial statements would be either: (a) the

contract is subject to revision or cancellation, or (b) a future loss cannot be reasonably

estimated.

Note: At the end of 20x5, a purchase contract for a maximum of $900,000 for

subassemblies during 20x6 was in effect. At the end of 20x5, the subassemblies

had a current replacement cost of $850,000.

Requirement 2

The necessary contractual and economic conditions that would require accrual of a loss

would be (a) the contract is not subject to revision or cancellation, (b) a future loss is

likely and material, and (c) the loss can be reasonably estimated.

Loss on purchase commitment* ............................................................ 50,000

Estimated liability—noncancellable purchase commitment ...........

50,000

*The amount of the loss is based on the estimated current replacement cost ($900,000 –

$850,000).

Requirement 3

Purchases............................................................................................... 830,000

Estimated liability—noncancellable purchase commitment ................. 50,000

Loss on purchase commitment .............................................................. 20,000

Cash.................................................................................................

900,000

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-29

Assignment 8-16

Requirement 1

Cost of Inventory:

a. Merchandise in store ($490,000 retail ÷ 1.4) ................................................ $350,000*

b. Goods held for later shipment ($16,800 ÷ 1.4) .............................................

12,000

c. Merchandise on consignment [$24,000 × (1 – .50)].....................................

12,000

d. Office equipment (should be reclassified as capital assets) ..........................

0

e. Goods out on approval (not yet accepted by customer), at cost ...................

4,000

Corrected inventory, 31 December 20x5 ............................................................. $378,000

* Goods in transit are not included because they were shipped FOB destination, which

means that title has not yet transferred to the buyer.

Requirement 2

Statement of Comprehensive Income:

a.

b.

c.

d.

e.

f.

g.

Ending inventory overstatement ($490,000 – $378,000) ........................... $112,000

Cost of goods sold understated ................................................................... 112,000

Gross margin overstated ............................................................................. 112,000

Pretax income overstated ............................................................................ 112,000

Income taxes overstated ($112,000 × .30) ..................................................

33,600

Net income overstated ($112,000 – $33,600).............................................

78,400

Amortization expense understated on office equipment; amount not

determinable. Also affects tax expense and net income.

h. Sales may be overstated, depending on how consignment and “on approval”

items have been accounted for. Also affects gross margin, tax expense and net

income.

Statement of Financial Position:

Current assets: inventory overstated ............................................................. $112,000

Capital assets, understated ............................................................................

20,000

[Also understated is accumulated amortization, amount undeterminable.

This also affects deferred income taxes and retained earnings.]

Current liabilities: income taxes payable overstated ....................................

33,600

Retained earnings overstated ........................................................................

78,400

Note: there is also a potential overstatement of accounts receivable, and, as a result,

incorrect deferred income taxes and retained earnings, if sales were improperly

recorded.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-30

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-17

1. Corrected net income:

Draft net income, 20X4

$ 550,000

a. Understatement of purchases (and cost of sales)

– 25,000

b. Cut-off error: sale not recognized until 20X5, mismatch of revenue

and expense

+ 120,000

c. Understatement of 20X4 ending inventory (overstatement of cost of

+ 50,000

sales)

d. Consignment recorded as a sale (125,000 revenue – 80,000 CGS)

Corrected net income

– 45,000

$ 650,000

2. Correcting entry, if errors are discovered after release of the 20X4 financial statements:

Inventory (opening) [50,000(c) + 80,000(d)]

130,000

Sales (for 20X5)

120,000(b)

Purchases (for 20X5)

25,000(a)

Accounts receivable

125,000(d)

Retained earnings

100,000*

* 50,000(c) + 120,000(b) – 45,000(d) – 25,000(a) = $100,000

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-31

Assignment 8-18

Case A

1. The inventory in transit was recorded as a 20X4 purchase but was not included in the

ending inventory. Therefore, the 20X4 ending inventory was understated and 20X4

cost of sale was overstated.

2. Correcting entry in 20X5:

Inventory (opening)

Retained earnings

265,000

265,000

The 20X4 financial statements must be restated.

Case B

1. The year-end inventory was properly stated in the 20X3 financial statements, which

means that the $400,000 of inventory was not included in ending inventory on the

20X3 SFP. When the physical count was compared to the perpetual inventory

records, there would have been a $400,000 discrepancy that would have been viewed

as either missing inventory or a recording error. As a result, the cost of sales will

have been properly calculated for that year because it is based on the physical count.

Although COS was correct (using the physical count of the ending inventory),

20X3 revenue and accounts receivable were both understated by $640,000, the

unrecorded sale. Net income for 20X3 was similarly understated by $640,000.

2. Correcting entry in 20X4:

Accounts receivable

Retained earnings (to restate 20X3 earnings)

640,000

640,000

The 20X3 financial statements must be restated by increasing (1) sales revenue and (2)

accounts receivable by $640,000.

Since the inventory was properly stated at year-end 20X3, the shipment must have been

recorded in cost of sales on 31 December 20X3 when the goods left the warehouse.

We’ve assumed that the 4 January 20X4 entry was only for issuance of the sales invoice

and not for cost of sales, and therefore no correction is needed for cost of sales in 20X4.

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-32

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-19 (WEB)

Cost of goods available for sale:

Beginning inventory .....................................................................

$320,000

Purchases...................................................................................... $500,000

Freight-in......................................................................................

16,000

516,000

Less: Purchase returns and allowances .......................................

14,000 502,000

Cost of goods available for sale ..................................................

822,000

Deduct estimated cost of goods sold:

Sales revenue ............................................................................... 800,000

Less: Returns ...............................................................................

35,000

Net sales ................................................................................. 765,000

Less: Estimated gross margin ($765,000 × 30%) ....................... 229,500 535,500

Estimated cost of ending inventory....................................................

$286,500

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-33

Assignment 8-20 (WEB)

Requirement 1

Gross margin: $750,000 × 33.3% = $250,000

Cost of goods sold: $750,000 – $250,000 = $500,000

Cost of goods available for sale: $140,000 + $800,000 + $7,000 = $947,000

Ending inventory: $947,000 – $500,000 = $447,000

Requirement 2

Fiction:

Gross margin: $590,000 × 28.6% = $168,740

Cost of goods sold: $590,000 – $168,740 = $421,260

Cost of good available for sale: $100,000 + $600,000 + $5,000 = $705,000

Ending inventory: $705,000 – $421,260 = $283,740

Non-fiction:

Gross margin: $160,000 × 37.5% = $60,000

Cost of goods sold: $160,000 – $60,000 = $100,000

Cost of goods available for sale: $40,000 + $200,000 + $2,000 = $242,000

Ending inventory: $242,000 – $100,000 = $142,000

Total ending inventory (fiction and non-fiction) $283,740 + $142,000 = $425,740

Requirement 3

In this situation, applying the gross margin method separately to fiction and non-fiction

and aggregating the results is preferable because (1) the markup percentages are different

for the two categories and (2) the categories represent different proportions of total sales,

purchases, and inventory on hand. A physical count should be much closer to the

separate application of the gross margin method ($425,740) than the aggregate

application ($447,000).

©2014 McGraw-Hill Ryerson Ltd. All rights reserved

8-34

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

Assignment 8-21 (WEB)

Requirement 1

At cost

Inventory, 1 June

+ Purchases

– Purchase returns and allowances

$ 226,000

519,600

(9,000)

+ Markups (net) ($122,000 – $38,000)

Retail value goods available for sale

– Markdowns (net) ($88,000 – $43,000)

Goods available for sale

– Sales (net of returns: $1,050,000 – $50,000)

Inventory, 30 June, at retail

Inventory, 30 June, at cost:

($299,000 × 55 % cost ratio*)

At retail

$

336,000

940,000

(16,000)

84,000

1,344,000

(45,000)

$ 736,600

$ 1,299,000

(1,000,000)

$ 299,000

$ 164,450

* Cost ratio = $736,600 ÷ $1,344,000 = 55%

Since the retail method is an estimate, there is no point in carrying the cost ratio out to

more than two significant digits.

Requirement 2

If the estimate of ending inventory were based on the ratio between cost and retail value,

the estimated inventory would reflect approximate purchase cost. However, the retail

method increases the ratio by deducting markdowns from the denominator of the cost

ratio. The resulting cost ratio takes into account that some goods have been marked down,

and thus approximates lower of cost or NRV valuation.

© 2014 McGraw-Hill Ryerson Ltd. All rights reserved

Solutions Manual to accompany Intermediate Accounting, Volume 1, 6th edition

8-35

Assignment 8-22 (WEB)

Requirement 1

At cost

Goods available for sale:

Beginning inventory .......................................................... $ 180,500

Purchases (net) ..................................................................

955,000

Freight-in...........................................................................

15,000

Additional markups ...........................................................

Additional markup cancellations ......................................

Retail value, before markdowns..............................................

Markdowns .......................................................................

Employee discounts (a markdown) ...................................

Total goods available for sale ....................................... $1,150,500

Cost ratio $1,150,500 ÷ ($1,770,000 + $10,000) = 65%

Deduct:

Sales ..................................................................................

Ending inventory

At retail .............................................................................

At cost, ($460,000 × 65%) ................................................

299,000

Ending inventory per physical count:

At retail .............................................................................

At cost, ($475,000 × 65%) ................................................

308,750

Indicated excess:

At retail .............................................................................

At cost ............................................................................... $ 9,750

At retail

$ 300,000

1,453,000

31,000

(14,000)

1,770,000

(8,000)

(2,000)

1,760,000

(1,300,000)

460,000

475,000

$ 15,000

Requirement 2

The above computations indicate a general correspondence between the two

independently derived totals. The difference, at cost, of $9,750 is only 3.16% of the cost

of the inventory from the physical count; thus, this difference would probably not be

investigated at great length because it is not material. Nevertheless, the auditor would

consider whether:

a.

The physical count was correct. Presumably, the auditors observed the physical

count and made their own test counts. In this follow-up phase of the audit, attention