Lesson 16

advertisement

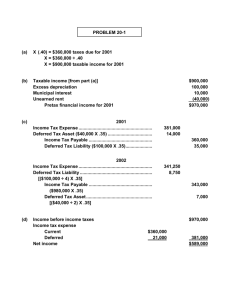

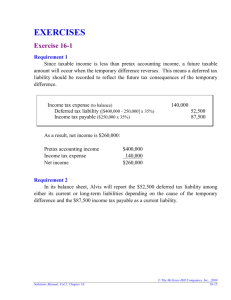

Chapter 16 Accounting for Income Taxes DEFERRED TAX ASSETS AND DEFERRED TAX LIABILITIES Conceptual Underpinning There are fundamental differences in the amount of income and expenses reported for GAAP and income tax purposes. The objective for GAAP reporting is to report the economic activities of the entity. The objective for income tax purposes is for the government to raise revenue. There are two terms that identify the types of income subject to tax under each reporting system. 1 Pretax financial income Pretax financial income is the income determined using GAAP. It is the amount of income on which income tax is computed for financial statement purposed. It is formally presented in the income statement as income before income taxes. We normally refer to it is pretax income. 2 Taxable income Taxable income is the income determined using Internal Revenue Code rules and regulations. It is the amount of income on which the entity will actually pay income tax in the current accounting period. There are almost always differences between the amount of income and therefore income tax expense reported in the financial statements and the amount of income tax liability actually paid by the entity. This difference is referred to as a deferred tax amount. If the income tax expense in the income statement is larger than the current income tax liability the difference is called a deferred tax liability. If the income tax expense in the income statement is smaller than the current income tax liability the difference is called a deferred tax asset. Temporary Differences Deferred taxes arise as a result of temporary difference between income tax expense and current income tax payable. A temporary difference is the difference between the book value of an asset or liability and the tax basis of the same asset or liability. Deferred Tax Liabilities A deferred tax liability is created as a result of the difference between the book value and the tax basis of an asset or liability. The difference creates a tax liability in future periods. EXAMPLE: Spencer Company has pretax financial statement income for the current year of $700,000. The company’s average income tax rate is 30% on taxable income. Spencer Corporation calculates deprecation expense using the straight-line method for financial reporting purposes and an ACRS (accelerated) method for tax purposes. The result will be a deferred tax liability. There will be a smaller depreciation expense D:\533581129.doc 3/8/2016 1 Chapter 16 Accounting for Income Taxes deduction in subsequent years because a larger portion was taken in the year of purchase. Let’s assume that the difference is $50,000 as calculated below. DEPRECIATION EXPENSE IRS Form 1120 Financial statements Difference AMOUNT 75,000 25,000 50,000 The above is a deferred liability as a result of expenses that will be recognized for tax purposed in subsequent periods. Now let’s look that an income item. Let’s assume that Spencer Company sold merchandise using the installment method for tax purposes but uses the accrual method for financial statement reporting purposes. This means that there will be additional income in subsequent periods on the tax return with results in an increase in the tax liability. The difference is $200,000 as calculated below. INSTALLMENT SALE AMOUNT 100,000 300,000 (200,000) IRS Form 1120 Financial statements Difference Based on this information we are now ready to calculate the deferred tax liability for the current year end. The liability is calculated as follows. Deferred Tax Temporary Difference Depreciation Installment sale Future Amounts 50,000 200,000 250,000 Tax Rate 30% 30% Asset Liability 15,000 60,000 75,000 If we know the financial statement pretax income we should now be able to calculate the taxable income. The following is a computation of taxable income. Taxable Income Pretax financial income Excess gross profit books Excess depreciation per IRS Form 1120 Taxable income Amount 700,000 (200,000) (50,000) 450,000 Income tax payable is based on taxable income using the current average tax rate. The following is a calculation of the income tax payable. D:\533581129.doc 3/8/2016 2 Chapter 16 Accounting for Income Taxes Income Tax Payable Taxable income Tax rate Income tax payable Amount 450,000 30% 135,000 The deferred tax expense is the deferred portion of the income tax that is reported on the face of the income statement. It is calculated by analyzing the deferred tax liability Taccount. In this case we are assuming that there is no beginning balance. The following is the calculation of deferred tax expense. Deferred Tax Expense Deferred tax liability at end of year Deferred tax liability at beginning of year Deferred tax expense for year Amount 75,000 0 75,000 Now that we know the income tax payable from the taxable income and the deferred tax expense from the timing differences we are ready to calculate the entire income tax expense that will be reported on the face of the income statement. The calculation of total income tax expense is as follows. Income Tax Expense Deferred tax expense Current tax expense Income tax expense Amount 75,000 135,000 210,000 So far all we have done is calculate the amounts required to prepare the year-end adjusting journal entry to record income tax expenses. This journal entry sets up the income tax expense that will be reported in the income statement, the income tax liability that will be paid to the internal revenue service and the deferred tax liability. ACCOUNT DEBIT 210,000 Income tax expense Income tax payable Deferred tax liability CREDIT 135,000 75,000 Summary of income tax accounting objectives There are two objectives in accounting for income taxes. 1 To recognize the income taxes payable for the current accounting period. 2 To record future tax liabilities as a result of items recognized in the income statement but not the tax return or recognized on the tax return but not the income statement. D:\533581129.doc 3/8/2016 3 Chapter 16 Accounting for Income Taxes Deferred Tax Assets So far all we have talked about it deferred tax liabilities. These were created as a result of income reported in the income statement but deferred into future period on the tax return, and expenses taken on the tax return in the current period which creates smaller deductions on the tax return in future periods. Now we are going to exam the impact of deferred tax assets on the financial statements. A deferred tax asset is created as a result of the difference between the book value and the tax basis of an asset or liability. The difference creates a tax asset in future periods. The net result is a decrease in taxes in future periods. If we have and expense or loss in the income statement that is not reported on the tax return this creates a deferred tax asset. The expense or loss will be used on the tax return in some future period(s). Also, if we have revenue or gain reported on the tax return that is not currently reported in the income statement this creates a deferred tax asset. The revenue or gain will be reported in some future period(s) but it will not be taxable. EXERCISE: Spencer Company has pretax financial statement income for the current year of $700,000. The company’s average income tax rate is 30% on taxable income. Spencer Corporation has an estimated warranty liability of $125,000 which is recorded on the income statement but is not deductible for income tax purposes. In addition, the company has leased a piece of equipment for $100,000 per year for three years to a customer. The lessee paid the entire three years rent in advance. At the end of the year Spencer Company has a deferred liability (unearned rent) of $200,000 recorded in the balance sheet. The rent is reported on a cash basis for income tax purposes. Each of these items creates a deferred tax asset. Using the format provided calculate the book to tax difference as a result of the estimated warranty liability. ESTIMATED WARRANTY IRS Form 1120 Financial statements Difference AMOUNT Solution: ESTIMATED WARRANTY IRS Form 1120 Financial statements Difference D:\533581129.doc 3/8/2016 AMOUNT 0 125,000 (125,000) 4 Chapter 16 Accounting for Income Taxes Using the format provided calculate the book to tax difference as a result of the unearned rent. UNEARNED RENT IRS Form 1120 Financial statements Difference AMOUNT Solution: UNEARNED RENT IRS Form 1120 Financial statements Difference AMOUNT 300,000 100,000 200,000 Based on the information provided in the above two exercise prepare the schedule of deferred tax assets. Temporary Difference Estimated warranty Unearned rent Future Amount Tax Rate 30% 30% Asset Liability Solution: Temporary Difference Estimated warranty Unearned rent D:\533581129.doc Future Amount (125,000) (200,000) (325,000) 3/8/2016 Tax Rate 30% 30% Deferred Tax Asset Liability (37,500) (60,000) (97,500) 5 Chapter 16 Accounting for Income Taxes Now that you have the future amounts involved you can calculated the taxable income. Taxable Income Pretax financial income Excess warranty expense on income statement Excess rent on IRS Form 1120 Taxable income Amount Solution: Taxable Income Pretax financial income Excess warranty expense on income statement Excess rent on IRS Form1120 Taxable income Amount 700,000 125,000 200,000 1,025,000 Now that you have taxable income you can calculate income tax payable. Income Tax Payable Taxable income Tax rate Income tax payable Amount Solution: Income Tax Payable Taxable income Tax rate Income tax payable Amount 1,025,000 30% 307,500 Instead of a deferred tax expense we will have a deferred tax benefit as a result of the deferred tax assets. Deferred Tax Benefit Deferred tax benefit at end of year Deferred tax benefit at beginning of year Deferred tax benefit for year Amount Solution: D:\533581129.doc 3/8/2016 6 Chapter 16 Accounting for Income Taxes Deferred Tax Benefit Deferred tax benefit at end of year Deferred tax benefit at beginning of year Deferred tax benefit for year Amount (97,500) 0 (97,500) The deferred tax benefit reduces current period income tax expense. Using the format calculate income tax expense. Income Tax Expense Deferred tax benefit Current tax expense Income tax expense Amount Solution: Income Tax Expense Deferred tax benefit Current tax expense Income tax expense Amount (97,500) 307,500 210,000 Base on your experience with the deferred tax liability see if you can prepare the yearend adjusting journal entry to record income tax expense, income tax payable, and the deferred tax asset. ACCOUNT DEBIT CREDIT ACCOUNT DEBIT 210,000 97,500 CREDIT Income tax expense Deferred tax asset Income tax payable Solution: Income tax expense Deferred tax asset Income tax payable 307,500 Valuation Allowance In accounting we are always careful that assets are not overstated. If the balance in the deferred asset account is greater than the expected benefit to be realized we must D:\533581129.doc 3/8/2016 7 Chapter 16 Accounting for Income Taxes establish a valuation allowance account to that will reduce the amount reported in the balance sheet to the expected realized value. This is a contra asset account off setting the deferred tax benefit. When recording the valuation allowance we charge the reduction to current period income tax expense. EXAMPLE: At December 31, 2002, Spencer Company has a deferred tax asset of $200,000. After a careful review of all available evidence, it is determined that it is more likely than not the $80,000 of this deferred tax asset will not be realized. Prepare the necessary journal entry. ACCOUNT Income tax expense Allowance to reduce deferred tax asset to expected realizable value DEBIT CREDIT DEBIT 80,000 CREDIT Solution: ACCOUNT Income tax expense Allowance to reduce deferred tax asset to expected realizable value 80,000 The above examples and exercises had you working with either a deferred tax liability or a deferred tax benefit but not both in the same problem. Now we need to integrate what you have learned into a more complete situation. EXAMPLE: The following facts relate to Spencer Company: (1) Deferred tax liability, January 1, 2003, $40,000 (2) Deferred tax asset, January 1, 2003, $0 (3) Taxable income for 2003, $95,000 (4) Pretax financial income for 2003, $200,000 (5) Cumulative temporary difference at December 31, 2003, giving rise to future taxable amounts, $240,000 (6) Cumulated temporary difference at December 31, 2002, giving rise to future deductible amounts, $35,000 (7) Tax rate for all years, 40% (8) The company is expected to operate profitability in the future. A. Compute income taxes payable for 2003. Taxable income Enacted tax rate Income tax payable D:\533581129.doc 3/8/2016 8 Chapter 16 Accounting for Income Taxes Solution: Taxable income Enacted tax rate Income tax payable 95,000 40% 38,000 B. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2003 ACCOUNT Income tax expense Deferred tax asset Income tax payable Deferred tax liability DEBIT CREDIT Analysis of income tax expense: Income before income taxes Enacted tax rate Income tax expense D:\533581129.doc 3/8/2016 9 Chapter 16 Accounting for Income Taxes Analysis of deferred tax asset and liability: Deferred Tax Future Amounts Temporary difference Future taxable amounts Future deductable amounts Totals Tax Rate Asset Liability Analysis of deferred tax liability: Deferred tax liability at end of 2002 Deferred tax liability at beginning of 2002 Deferred tax expense for 2002 Analysis of deferred tax asset: Deferred tax asset at end of 2002 Deferred tax asset at end of 2002 Deferred tax benefit for 2002 Analysis of income tax expense: Deferred tax expense for 2002 Deferred tax benefit for 2002 Net deferred tax expense for 2002 Current tax expense for 2002 Income tax expense for 2002 Solution: ACCOUNT DEBIT 80,000 14,000 Income tax expense Deferred tax asset Income tax payable Deferred tax liability 38,000 56,000 Analysis of income tax expense: Income before income taxes Enacted tax rate Income tax expense D:\533581129.doc CREDIT 200,000 40% 80,000 3/8/2016 10 Chapter 16 Accounting for Income Taxes Analysis of deferred tax asset and liability: Future Amounts 240,000 (35,000) 205,000 Temporary difference Future taxable amounts Future deductable amounts Totals Analysis of deferred tax liability: Deferred tax liability at end of 2002 Deferred tax liability at beginning of 2002 Deferred tax expense for 2002 96,000 40,000 56,000 Analysis of deferred tax asset: Deferred tax asset at end of 2002 Deferred tax asset at end of 2002 Deferred tax benefit for 2002 14,000 0 14,000 Analysis of income tax expense: Deferred tax expense for 2002 Deferred tax benefit for 2002 Net deferred tax expense for 2002 Current tax expense for 2002 Income tax expense for 2002 56,000 14,000 42,000 38,000 80,000 Tax Rate 40% 40% Deferred Tax Asset Liability 96,000 (14,000) (14,000) 96,000 C. Prepare the income tax expense section of the income statement for 2003, beginning with the line “Income before Income Taxes.” D:\533581129.doc 3/8/2016 11 Chapter 16 Accounting for Income Taxes Income before income taxes Income tax expense Current Deferred Net income $ $ $ RECONCILATION WITH TAX RETURN Financial statement income Temporary differences: Deduct: future taxable amounts Current period Prior period Beginning deferred tax liability Enacted tax rate Prior period future taxable amount $ $ $ $ $ % $ $ $ $ $ Add: future deductions Taxable income per tax return Solution: Income before income taxes Income tax expense Current Deferred Net income 200,000 38,000 42,000 RECONCILATION WITH TAX RETURN Financial statement income Temporary differences Deduct: future taxable amounts Current period Prior period Beginning deferred tax liability Enacted tax rate Prior period future taxable amount 80,000 120,000 200,000 240,000 40,000 40% 100,000 140,000 60,000 35,000 95,000 Add: future deductions Taxable income per tax return D:\533581129.doc 3/8/2016 12 Chapter 16 Accounting for Income Taxes Income Statement Presentation On the face of the income statement we break out the current income tax expense and the net change in deferred tax benefit or expense. These two amounts are then added together to give us income tax expense as reported on the income statement. The following is an example of a typical presentation. Spencer Company Income Statement For the Year Ending December 31, 2000 Revenue Expenses Income before income taxes Income tax expense Current Deferred Net income $900,000 400,000 500,000 $150,000 75,000 225,000 $275,000 Specific Differences There are actually two kinds of book to tax differences. So far we have only talked about temporary differences that will reverse in future accounting periods. There are also differences that don’t reverse and we call these permanent differences. Temporary Differences As we have discussed above there are taxable temporary differences and deductible temporary differences. 1 Taxable temporary differences a) Revenues and gains are recognized in the current income statement but taxable in some future accounting period(s) on the tax return. b) Expenses and losses are deducted on the current tax return but recognized on the income statement in some future accounting period(s). 2 Deductible temporary differences a) Revenue and gains are recognized on the current tax return but recognized in the income statement in some future accounting period(s). b) Expenses and losses are deducted on the current income statement but expensed in some future accounting period(s) on the tax return. Permanent differences Permanent differences occur as a result of differences between GAAP and income tax law. Income or expenses reported on the income statement are never reported on the tax D:\533581129.doc 3/8/2016 13 Chapter 16 Accounting for Income Taxes return; or income or expenses reported on the tax return are never reported on the income statement. There are no deferred taxes involved here. The book to tax differences are reconciled on the IRS Form 1120 which you will deal with in your corporate tax class. D:\533581129.doc 3/8/2016 14