Syllabus - Brandeis University

advertisement

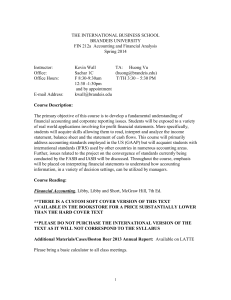

BRANDEIS UNIVERSITY BUS 113a INTERMEDIATE ACCOUNTING Spring 2016 Professor: Robert A. Angell Email: rangell@brandeis.edu Phone: 866.700.0894 TAs: Sara Pipe-Mazo (sarapm@brandeis.edu Office hours: T/Th 6:30 – 7:30 pm and by appt. Office location: Sachar 1D COURSE DESCRIPTION This course will build on Bus 6a (Financial Accounting)by examining in detail the accounting theory and concepts which form the background for the external financial reporting. Students will expand their understanding of accounting and evaluate the impact of alternative accounting procedures on financial statements. Topics covered will include revenue recognition, accounting changes/errors, inventory measurement and valuation, long lived asset acquisition, disposition and impairment. Instruction will be a combination of lectures, case studies , problem solving, and group presentations. This cours requires a significant amount of out-of-class work as well as working in groups to prepare for presentations. Problem solving and case studies are very important in this class since it develops students’ critical thinking and communications skills. LEARNING GOALS Upon completion of this course, the students will have a deeper understanding of: The environment of financial accounting and reporting, the conceptual framework and how accounting principles and rules are created. The income statement and the balance sheet, earnings management and revenue recognition Time value of money concept and tools to conduct financial analysis of financial statements The individual accountg constituting Assets, or those accounts populating the left-hand side of the balance sheet COURSE MATERIALS Intermediate Accounting, Kieso, Waygandt and Warfield with Wiley Plus Code; Wiley 15th ed. 2014 (Hardcover, Loose Leaf or Digital) (Link: www.wileyplus.com/class/472224) Cases may be purchased directly form Harvard Business School Publishing (Link: https://cb.hbsp.harvard.edu/cbmp/access/43531345) Please bring a basic function calculator to all class meetings. Additional Course Materials/Cases are available on LATTE COURSE REQUIREMENTS AND GRADING POLICY Course Grading and Exams Your course grade will be determined based on the following formula: Homework/Attendance/Participation Exam 1 Exam 2 Final Exam Group Project 10% 20% 20% 35% 15% (Case Study Presentation) 100% Attendance Students are expected to attend all classes and be prepared. Please arrive for class on time and remain until the end of class. It is extremely disruptive when students enter late or leave early. I do understand that there are valid reasons for needing to be late or leave early, as such, please notify me prior to class. It is expected that you will come to each class ready to discuss the readings, exercises and problems. Homework In an accounting class, keeping up with the assigned homework problems is critical to your success. If you do not take the time to challenge yourself and struggle with the issues in each problem, you will, in all likelihood, perform very poorly on exams. IMPORTANT: ALL HOMEWORK SHOULD BE YOUR WORK AND NOT THE WORK OF OTHERS. Participation Students are expected to adequately prepare for each class session and to actively participate in class discussion. Class participation involves being regularly engaged in the discussion/lecture and making a positive contribution by asking thoughtful questions, sharing relevant experiences, requesting clarification and making comments. All forms of participation should be conducted in a manner that is respectful of fellow students and the professor. Exams THERE WILL BE NO MAKE-UP EXAMS, UNLESS THE STUDENT HAS A VALID EXCUSE AND NOTIFIES THE PROFESSOR PRIOR TO MISSING THE EXAM. There will be absolutely no opportunity to assign the weight of a missed exam to another exam. If you miss an exam without a valid excuse, you will receive a grade of zero. Therefore, please make every effort in advance to ensure that you will be in attendance on the exam dates shown on the syllabus. Make-up exams will only be scheduled if you miss an exam for a legitimate reason; you will need to provide evidence for your absence and you must notify me prior to the scheduled exam time. All exams are closed book with no index cards/review sheets of any kind permitted while taking the test. The use of text capable calculators is strictly prohibited. Academic Integrity Academic integrity is central to the mission of educational excellence at Brandeis University. Each student is expected to turn in work completed independently, except when assignments specifically authorize collaborative effort. It is not acceptable to use the words or ideas of another person- be it a world-class philosopher or your lab partner- without proper acknowledgement of that source. This means that you must use footnotes and quotation marks to indicate the sources of any phrases, sentences, paragraphs or ideas found in published volumes, on the internet, or created by another student. Violations of university policies on academic integrity, described in Section 3 of Rights and Responsibilities, may result in failure in the course or on an assignment, and could end in suspension from the University. If you are in doubt about the instructions for any assignment in this course, you must ask for clarification. Student Accommodations If you have a documented disability on record at Brandeis University and require accommodations, please contact Beth Rodgers Kay (brodgers@brandeis.edu) and bring it to my attention prior to the second meeting of the class. CLASS SCHEDULE – Subject to Change at Professor’s Discretion Date Day Topics/Chapters 1/14 Th Introduction Chapter 1 CA1-3, 6, 15,17 1/19 T Conceptual Framework E2-3, 4, 6, CA2-6 1/21 Th Accounting Information System Disclosures Chapter 2 Chapter 3 (including App 3a and 3b) 1/26 T Chapter 4 E4-8, P4-1, 7, CA4-2,6 1/28 Th 2/2 T Chapter 5 (including App 5a) E5-4, 6, 17. P5-5 2/4 Th Time Value of Money Concepts Chapter 6 P6-2, 4, 6, 9, 11 Chapter 18a E18-1, 3, 6, 7, 9, 14, 24, 25, 26, P18-2 Income Statement and Comprehensive Income Income Statement and Comprehensive Income Balance Sheet And Earnings Management Reading Assignments (due the next class) E3-6, 18, P3-2, 8, 11 Balance Sheet And Earnings Management Case 1 Microsoft’s Financial Reporting Strategy First Examination (Chpts 1-5) 2/9 T 2/11 2/15 to 2/19 2/23 Th 2/25 Th 3/1 T Case 2 Accounting for iPhone at Apple Inc. Revenue Recognition 3/3 Th Revenue Recogniton 3/8 T Case 3 Salesforce.com 3/10 Th Chapter 7 E7-2, 12, 18,27, P7-5, 8, 11 3/15 T Cash and Receivables Valuation of Inventories Cost-Basis Chapter 8 P8-2, 4, 11 3/17 Th Inventories: Additional Valuation Issues Chapter 9 E9-3, 7, 12, P9-7, 10, 11 3/22 T Chapter 10 E10-13, 16, 22,P10-1, 4, 6, 8 3/24 Th 3/29 T Case 4 Compass Box (Inventory) Acquisition and Disposition of Property, Plant & Equipment (PP&E) Review Chapters 6-10, 18 3/31 Th Second Exam (Chpts 6-10, 18) 4/5 T Depreciation – A Method of Cost Allocation Chapter 11 E11-1, 11, 16, 19, P11-1, 7 WINTER BREAK T 4/7 Th 4/12 T 4/14 Th 4/19 4/22 to 4/29 T Case 5 Merrimack Tractors & Mowers, Inc.: LIFO or FIFO Intangible Assets Chapter 12 E12-1, 11, 16, P12-3, 4, 5 Case 6 Delta Cargo (PP&E) Review SPRING BREAK Final Exam – Cumulative (Date and Location TBD )