Pre-requisites - Brandeis University

advertisement

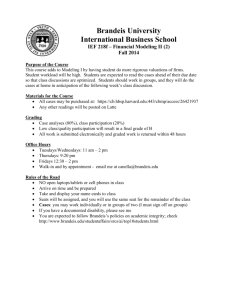

Brandeis University International Business School Financial Modeling I (1) Fall 2014 Purpose of the Course Acquaint students with modeling methodologies by having them calculate the values of various companies and projects under different market and financial conditions Understand finance for what it is - the sum total of quantitative analysis, business judgement, understanding of various industries and markets, timing, and cleverness Become comfortable in making quantitative assessments under conditions of extreme uncertainty. Pre-requisites Accounting and Corporate Finance or instructor permission Materials for the Course All cases may be purchased at: https://cb.hbsp.harvard.edu:443/cbmp/access/26422416 Any other readings will be posted on Latte Grading Case analyses (80%), class participation (20%) Low class/quality participation will result in a final grade of B All work is submitted electronically and graded work is returned within 48 hours Office Hours Tuesdays/Wednesdays: 11 am – 2 pm Thursdays: 9:20 pm Fridays 12:30 – 2 pm Walk-in and by appointment - email me at canella@brandeis.edu Rules of the Road NO open laptops/tablets or cell phones in class Arrive on time and be prepared Take and display your name cards to class Seats will be assigned, and you will use the same seat for the remainder of the class Cases: you may work individually or in groups of two (I must sign off on groups) If you have a documented disability, please see me You are expected to follow Brandeis’s policies on academic integrity; check http://www.brandeis.edu/studentaffairs/srcs/ai/top10students.html Brandeis University International Business School Financial Modeling I (1) Week Topic Reading/Case Due 1st Mandatory readings: Introduction to CF Valuation Methods What’s it Worth? A General Manager’s Guide to Valuation Using APV: A Better Tool for Valuing Operations Brazilians Build, Trade “Maid Routes” (Latte) 2nd 3rd 4th 5th 6th 7th Introduction Discounted cash flows Seasonality and forecasting Pro forma statement preparation Profitability vs. risk and liquidity Balance sheet forecasting Discount rate methodologies Sports valuations Terminal value calculations LBO valuations Risk analysis Working capital approximations Capital Cash Flows vs APV Pricing vaccines Health care pricing Insurance Strategic vs. financial acquisitions Terminal value methodologies Transactions and trading multiples WACC vs. APV Capital Cash Flows Leverage Wrap-up and reflection Toy World, Inc. Globalizing the Cost of Capital and Capital Budgeting at AES A-Rod: Signing the best player in baseball Ducati & Texas Pacific Group—A "Wild Ride" Leveraged Buyout Merck: Pricing Gardasil Radio One, Inc. Sampa Video, Inc.