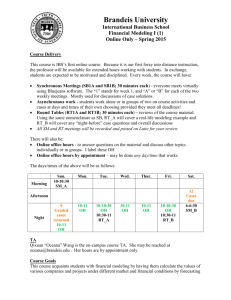

Course FAQs - Brandeis University

advertisement

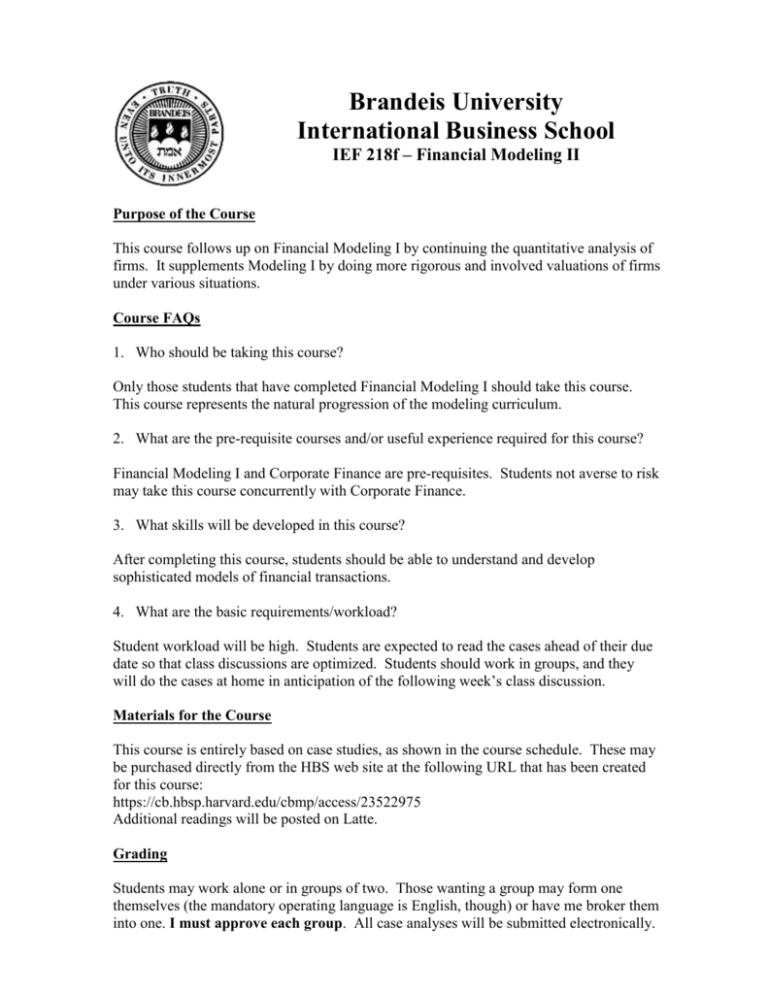

Brandeis University International Business School IEF 218f – Financial Modeling II Purpose of the Course This course follows up on Financial Modeling I by continuing the quantitative analysis of firms. It supplements Modeling I by doing more rigorous and involved valuations of firms under various situations. Course FAQs 1. Who should be taking this course? Only those students that have completed Financial Modeling I should take this course. This course represents the natural progression of the modeling curriculum. 2. What are the pre-requisite courses and/or useful experience required for this course? Financial Modeling I and Corporate Finance are pre-requisites. Students not averse to risk may take this course concurrently with Corporate Finance. 3. What skills will be developed in this course? After completing this course, students should be able to understand and develop sophisticated models of financial transactions. 4. What are the basic requirements/workload? Student workload will be high. Students are expected to read the cases ahead of their due date so that class discussions are optimized. Students should work in groups, and they will do the cases at home in anticipation of the following week’s class discussion. Materials for the Course This course is entirely based on case studies, as shown in the course schedule. These may be purchased directly from the HBS web site at the following URL that has been created for this course: https://cb.hbsp.harvard.edu/cbmp/access/23522975 Additional readings will be posted on Latte. Grading Students may work alone or in groups of two. Those wanting a group may form one themselves (the mandatory operating language is English, though) or have me broker them into one. I must approve each group. All case analyses will be submitted electronically. The final grade will be based on the following: Case analyses (80%) Class participation (20% - Note: Lack of class participation and, for that matter, quality class participation will result in a final grade no higher than a B.) All case analyses will be returned within a week and final grades will be available the last day of class. Office Hours Tuesdays/Thursdays/Fridays: 11 am – 2 pm Wednesday nights @9:20 pm Walk-In: if my door is open, then I’m in, so look for me By appointment - email me at canella@brandeis.edu Disabilities If you are a student with a documented disability on record at Brandeis University and wish to have a reasonable accommodation made for you in this class, please see me immediately. Academic integrity You are expected to be familiar with and to follow the University’s policies on academic integrity (see http://www.brandeis.edu/studentlife/sdje/ai/). Instances of alleged dishonesty will be forwarded to the Office of Campus Life for possible referral to the Student Judicial System. Potential sanctions include failure in the course and suspension from the University. Brandeis University International Business School IEF 218f – Financial Modeling II Week Topic 1 st 3rd 4th 5th 6th 2nd Introduction Valuation of a company in bankruptcy Industry-specific metrics Treatment of capital expenses Valuation of a telecom firm Options valuation Valuation of a new firm using subscription based business models Comparables and sum of the parts valuations Valuation of a telecom firm Controlling interest valuation Strategic vs. Financial acquisitions Review and reflection Case Due Continental Airlines - 1992 Vodafone AirTouch’s Bid for Mannesmann Netflix.com, Inc. Amtelecom Group Inc. Spyder Active Sports - 2004