city pride economic development strategy

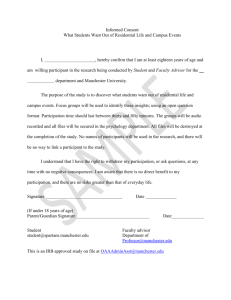

advertisement