The Social Economic and Environmental Impacts

advertisement

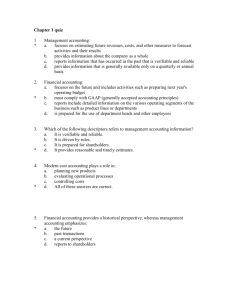

Feb. 2006, Vol.2, No.2 (Serial No.9) Journal of Modern Accounting and Auditing, ISSN1548-6583, USA An Empirical Analysis on the Dissimilation of Independent Audit Relationship Guanting Chen* Tsinghua University Lirong Ma** North China Electric Power University Abstract: Under the situation where the ownership is split up, existing shareholders might occupy potential shareholders’ interests, and similarly, controlling shareholders might occupy the interests of minority shareholders. This is called interests entrenchment effect, which leads to the dissimilation of independent audit relationship. That is to say, existing shareholders and controlling shareholders have the probabilities to utilize auditing commission to manipulate audit opinions with the purpose of interests entrenchment, which forces auditors who should be independent “third party” to become audit clients or accessories of “interests coupling between audit clients and auditees”. According to the argument above, this paper proposes the owners’ interests entrenchment hypotheses. It also proves that existing shareholders occupy potential shareholders’ interests, and controlling shareholders occupy minority shareholders’ interests on the basis of the data of A-share companies in Shenzhen and Shanghai Exchanges. Key words: independent audit relationship; dissimilation; interests entrenchment effect 1. Introduction CPAs’ essential function is that they prudently examine and attest financial statements and other economic information, and then express audit opinions objectively on the basis of their independent position and professional abilities. But in “YinGuangXia”, “MaiKeTe” and some other cases, CPAs with professional competence didn’t objectively express negative audit opinions on the false financial statements, oppositely affirmed their validity and justice without reservation. As to CPAs’ audit quality, some scholars in China (Zheng Sun and Yuetang Wang, 1999; Shuang Li and Xi Wu, 2002; Guanting Chen and Xiaoming Gao, 2004) empirically studied the relationship between audit opinions and earnings management and audit adaptation behaviors according to A-share companies’ data in Shenzhen and Shanghai Exchanges, and found that CPAs didn’t fully reveal listed companies’ earnings management and they had the tendency to make use of explanatory paragraphs to change the characters of audit opinions. The paper proposes that there are lots of factors leading to false audit opinions, but the dissimilation of independent audit relationship and the limitation of current auditing commission systems are the main causes. Under the situation where the ownership is split up, existing shareholders and controlling shareholders may occupy the interests of potential shareholders and minority shareholders, and they would manipulate audit * Guanting Chen (1963-), associate professor of Accounting Institute, Tsinghua University; Main research field: Internal Control, Tax Planning, Internal Control Based Auditing, Fraud Awareness Auditing; Address: Accounting Institute, Tsinghua University, Beijing, Postcode: 100084. ** Lirong Ma (1964-), teacher of School of Humanities and Social Sciences, North China Electric Power University; Main research field: Art and Literature Theory, Art and Literature Criticism; Address: School of Humanities and Social Sciences, North China Electric Power University, Beijing, Postcode:102206. 67 An Empirical Analysis on the Dissimilation of Independent Audit Relationship opinions to realize their entrenchment purposes. On the other hand, current auditing commission systems still require owners (in fact, the existing and controlling shareholders) to execute auditing commission, which facilitates the audit opinions’ manipulation by existing and controlling shareholders. Under the audit situations that have changed as mentioned above, independent audit relationship has been dissimilated to the independent false triangle relationship. And if auditing commission systems haven’t been adjusted accordingly, the auditors’ independence will lack ensuring of systems and it is difficult for the auditors to express audit opinions objectively. 2. Theoretical Analysis of Independent Audit Relationship’s Dissimilation 2.1 Assurance of Audit Independence---Inherent Audit Relationship Audit independence is guaranteed by the independent “third party” status of auditors in the audit relationship. Inherent audit relationship is the independent triangle relationship that is made up of audit clients, auditees and auditors. Where, auditors are independent of audit clients and auditees with the neutral status of “third party”. This relationship guarantees auditors’ independence on the level of form. The reasons why this kind of system can guarantee audit independence are mainly based on the following preconditions: (1) Property owners are accounting information users, who have potential interests conflicting with managers. The former needs reliable accounting information as information users and the latter may offer false financial reports as information providers. (2) Property owners are unary or multi-units with the same interests, and there is not any motivation for them to manipulate audit opinions. The reason why the owners commit auditing is that they want to obtain objective audit opinions on the reliability of financial statements. They have no motivation to obtain false audit reports and can’t be benefit from them either. 2.2 Managers’ Manipulation of Audit Opinions---Auditors and Auditees’ Relationship Dissimilated Generally, the former research (such as Zhiwen Li and Chaoyang Gu, 1998 1 ) suggested that audit independence was mainly destroyed by managers’ manipulation of audit opinions. That is to say, as makers and beneficiaries of false accounting information, in order not to get negative audit opinions, managers often utilize managers’ control and the advantage of the actual delivery of audit fees to coerce and entice auditors to give up objective audit opinions and issue unsuitable “clean opinions” passively or actively. In this case, “the independent relationship between auditors and auditees” is changed into “interests coupling made up of auditors and auditees”. This kind of false triangle relationship formed by managers’ manipulation of audit opinions mainly means that the relationship between auditors and auditees is changed, which is called the dissimilation of auditors and auditees’ relationship in this paper. In order to avoid collusion issues between auditors and auditees, auditing commission systems require owners to act as audit clients. On the level of system, it separates the motivation and conditions for managers to manipulate audit opinions, and it can force auditors to make rational decisions which are independent of auditees through owners’ executing commission, continuous engagement, discharge and claim rights. The prerequisite of this kind of system is still that only managers have motivation and conditions to make false financial reports and obtain unsuitable audit reports, and owners don’t have the motivation and can not be benefit from them either. 2.3 Owners’ Manipulation of Audit Opinions---Auditing Commission Party and Auditing 1 ZhiWen Li and Chaoyang Gu (1998) suggested auditors accept bribe from auditees (managers) to offer unsuitable information to the clients (owners ), namely there is collusion between supervisors (auditors ) and persons who are supervised (managers). 68 An Empirical Analysis on the Dissimilation of Independent Audit Relationship Commissioned Party’s Relationship Dissimilated Current auditing commission systems can solve the dissimilation of auditors and auditees’ relationship formed by managers’ manipulation of audit opinions, but can’t control the dissimilation of auditing commission party and auditing commissioned party’s relationship formed by owners’ manipulation of audit opinions. The latter changes the inherent meaning of the relationship between auditing commission party and commissioned party, and leads to substantive dissimilation of audit relationship---in situations where owners are multi-units and have inconsistent interests, existing shareholders and controlling shareholders may obtain interests by misleading such accounting information to users as potential shareholders and minority shareholders, and they also have motivation to obtain unsuitable audit opinions; when existing and controlling shareholders who have motivation to manipulate audit opinions execute auditing commission, in fact auditors are put on accessorial status of audit clients or “interests coupling of audit clients and auditees”, which makes independent audit relationship dissimilate to more serious “false triangle relationship” in nature , degree and range---“interests coupling of audit clients and auditors” versus auditees, or “interests coupling of audit clients, auditees , and auditors”. Concretely, in share-issuing enterprise and other enterprise which are not solely-funded, the ownership splits up in time and space, and has formed some multi-colonies such as existing shareholders and potential shareholders, controlling shareholders and minority shareholders and other stakeholders (see Fig. 1). The interests tendency and the obtaining ways of different owners are not all the same. Owners who have effective control power of a company can effectively control preparation of the company’s accounting information and disclosure policies, and can mislead other owners and reporting users to obtain interests through false accounting information. In realistic economic life this interests entrenchment effect can be mainly shown as follows: (1) existing shareholders (the second and third quadrants ) mislead potential shareholders and other investors (the first and forth quadrants ) through whitewashing financial statements for financing demand; (2) controlling shareholders (the third and forth quadrants ) encroach on minority shareholders and other investors (the first and second quadrants ) through manipulating accounting information for extra interests; Where existing controlling shareholders in the third quadrant have strongest abilities and willing to occupy interests of potential shareholders, minority shareholders and other investors. In such multidimensional environment, substantial change has taken place to existing and controlling shareholders’ roles. They have changed from users of accounting information into real providers, from victims of false financial reports into beneficiaries, and then have developed into potential beneficiaries of unsuitable audit reports and possible manipulators of audit opinions. These lead to changes of all original preconditions of independent auditing relationship: (1) Existing controlling shareholders develop into material information providers. In order to occupy the interests of potential, minority shareholders and other investors, they may get managers to offer false financial reports. (2) Existing controlling shareholders have got motivation to manipulate audit opinions. In order to prevent false financial reports from being provided negative audit opinions, existing controlling shareholders may utilize auditing commission to manipulate audit opinions directly, or incite managers to manipulate audit opinions. The changes of preconditions mentioned above make auditors directly face audit clients’ attempt of manipulating audit opinions, even audit clients and auditees’ attempt of manipulating audit opinions together, so the independent audit relationship has dissimilated to “false triangle relationship” which is not independent. On the other hand, as to this changed audit relationship, current auditing commission system doesn’t change auditing 69 An Empirical Analysis on the Dissimilation of Independent Audit Relationship commission, which offers conditions for existing and controlling shareholders to manipulate audit opinions objectively. In practice, the behavior of manipulating audit opinions can be implemented directly by owners, but it is more likely that this behavior is implemented indirectly by managers under existing controlling shareholders’ indication or acquiescence. Space Minority shareholders Interest occupation interest occupation Interests entrenchment Second First Time Existing shareholders Third Forth Potential shareholders Controlling shareholders Figure 1 Multidimensional Ownership Structure To sum up, we propose the inferences according to Fraud Triangular Theory (W. S. Albecht, 1995) as follows: If existing and controlling shareholders have behaviors of occupying potential and minority shareholders’ interests, they may have motivation to manipulate audit opinions; current auditing commission systems require auditing commission to be executed by existing and controlling shareholders, which has offered conditions of manipulating audit opinions on the level of system; under situations where motivation and conditions of manipulating audit opinions both exist, independent auditing triangle relationship can be changed into “false triangle relationship” which isn’t independent. In the inferences above, the behaviors of interests entrenchment are the precondition of audit relationship dissimilation. When we want to prove whether this precondition exists or not, so long as we find some shareholders (even minority shareholders) have behaviors of interests entrenchment, this precondition can be proved to be existing. And it is not necessary to prove that all shareholders have behaviors of interests entrenchment (existing shareholders and controlling shareholders are originally only a part of shareholders, and shareholders who manipulate audit opinions are only a part of existing shareholders and controlling shareholders). In fact, in several cases of listed companies in recent years, such as the minority stockholders of “Lotus gourmet powder” suring big shareholders for occupying fund, the big shareholders of “ST monkey’s king” defaulting listed companies’ fund, “Daqing Lianyi” false stating, “PT Zhen Baiwen” artificially increasing profit, the big shareholders of “Hongguang Industries Co.” and “ST Golden Horse” false providing funds and so on, have already proved existing shareholders and big shareholders have behaviors of occupying other shareholders' interests. In the following, we will prove in more extensive range whether the interests dissimilation effect exists or not according to the data from A-share companies of Shenzhen and Shanghai Exchanges. At first, we investigate whether existing shareholders occupy the interests of potential shareholders by examining the 70 An Empirical Analysis on the Dissimilation of Independent Audit Relationship relationship between different rights-offering requirements and earning abilities which the companies reveal, and then we analyze the impact of ownership structure on information content of accounting earnings in order to investigate whether controlling shareholders occupy the interests of minority shareholders. 3. Empirical Analysis of Independent Audit Relationship Dissimilation 3.1 Interests Entrenchment of Existing Shareholders to Potential Shareholders Potential shareholders are generally referred to fund holders who decide investment orientation according to the accounting information disclosed by companies. Potential shareholders mainly rely on accounting information disclosed by companies to make investment decisions, so if managers make false financial reports under controlling shareholders’ indication or acquiescence and receive CPAs’ unqualified audit opinions, potential shareholders may be misled and make some wrong decisions. The rights offering and seasoned equity offering are called “listed companies’ lifeline”. If existing shareholders of listed companies want to continuously control and claim huge economic resources, they must meet the requirements of rights offering and equity offering. When actual earnings indexes of listed companies can’t meet the requirements of rights-offering systems, existing shareholders may implement earnings management and manipulate audit opinions in order to occupy the interests of potential investors. 3.1.1 Literature Review Several scholars’ research proposed that listed companies in China had implemented earnings management in order to finance, which showed the phenomenon that the ROE of rights-offering companies is distributed around 0, 6% and 10%. Xiaoyue Chen, Xing Xiao and Xiaoyan Guo (2000) 2studied 1053 samples of listed companies from 1994 to 1997, and found that the distribution of ROE is obviously around 10% in the descriptive statistics and regression analysis. This evidence indicated that listed companies manipulate earnings to meet supervision departments’ rights-offering requirements. Yujian Lu (2002) 3used distribution of earnings after managing method to empirically analyze earnings management of A share companies in China implemented for avoiding losses or meeting right-offering requirements. They found the evidences that listed companies maintain ROE slightly above 6% and 10% through earnings management in order to avoid losses or to meet rights-offering line, which proved that earnings management behaviors of listed companies would change with the change of rights-offering systems. The research above shows that there are earnings management behaviors according to regulation policies in listed companies, and it shows the marginal ROE and ROE in rights-offering zones. Before accepting this conclusion, the paper will use mating analysis method to check it, and will no longer repeat its research programs. 3.1.2 Research Hypotheses A remarkable change on share-offering systems is in “notice on doing a good job of issuing new stocks of listed companies” (Security [2001]43). It can be summarized as dropping the recent three fiscal years’ average 2 Xiaoyue Chen, Xing Xiao and Xiaoyan Guo. Rights Offering and Earnings Manipulation of Listed Companies, Economic Research, 2000(1). 3 Yujian Lu. Study on Listed Companies’ Earnings Management from Distributions of ROE and ROA in China, Inquiry into of Economic Problems, 2002(3). 71 An Empirical Analysis on the Dissimilation of Independent Audit Relationship rate of return on assets (ROE for short in the following paper) from greater than 10% to greater than 6%4. There are no obvious unfavorable changes in external economic environment of listed companies in China around 2001, so listed companies’ ROE should be equal or increasing in 2001 and the following years. If listed companies didn’t take any earnings management according to rights-offering systems, the companies whose average ROE were greater than 10% in the past three years should still remain their ROE at about 10% after 2001; but if the companies managed earnings in order to meet rights-offering systems, ROE that companies would reveal might decline correspondingly when rights-offering systems lowered ROE. That is to say, under the situation where we gets rid of other factors’ influences, if one listed company take rights offering before and after 2001 respectively, and its past three years’ average ROE dropped by about 4%, especially dropped from about 10% to about 6%, then it can be inferred rationally that this company involved earnings management. Our formal hypotheses are as follows: H0: The recent three years’ average ROE of the companies that have taken rights offering respectively before and after 2001 will not be reduced. H1: The recent three years’ average ROE of the companies that have took rights offering respectively before and after 2001 will be reduced. 3.1.3 Research Design Our research method is mating analysis, that is, choosing similar companies in industries, scales and profit abilities to mate and compare their differences. In order to get rid of influence of other factors, the paper selects companies which have taken rights offering before and after 2001, and make their average past three years’ ROE before and after 2001 as one pair of samples, so the difference in every pair is the indicator whether the company had earnings management behaviors. We set x1 as the listed companies’ average ROE of the past three years when they took rights offering before 2001, and set x2 as average ROE of the past three years when they took rights offering after 2001, so the hypotheses can be expressed as formula (1): t ( x1 x 2 ) ( 1 2 ) sd / n (1) Where, s d is the variance of the difference samples, n is the sample amount and the degree of freedom is df n 1 . The decision standard is that: if t value is inside the refusing areas, then H0 will be denied (H1 will be accepted); if t value is outside the refusing areas, then H0 will be accepted (H1 will be denied). 3.1.4 Data Sources and Samples Selecting Research samples include annual reports data and rights offering information of A-share companies in Shenzhen and Shanghai Exchanges in China from 1993 to 2002. From them we select listed companies which All previous changes of systems about rights offering of listed companies in China are as follows: (1) In 1994-1995, “the company has been continuously profitable for the last three years; the average after-tax rate of return on equity is greater than 10% in the last three years” (Security [1994]31); (2) In 1996-1998, “the company’s after-tax rate of return on equity is greater than 10% in the last three years” (Security [1996]17 ) (3) In 1999-2000, “the average rate of return on equity is greater than 10% in the last three fiscal years, and every year’s return on equity is not less than 6%” (Security [1999]12 ); (4) After 2001, “the weighted average rate of return on equity is not less than 6% in the last three fiscal years” (Security [2001]43 ). 4 72 An Empirical Analysis on the Dissimilation of Independent Audit Relationship have taken rights offering before 2001 and in 2002 respectively, and we get totally 61 observation values. We don’t cover companies taking rights offering in 2001, because it is too late to reflect the effect of the regulation announced in March 2001 on that year’s earnings in financial statements. Companies’ financial data and rights offering information come from Genius Securities Information System and the Site for Chinese Listed Companies (www.cnlist.com). 3.1.5 Measurement Results The contrast results of the average ROE in the past three years are shown in Figure 2 and Table 1. % 25 20 15 10 5 0 1 5 9 13 17 21 25 29 33 37 41 45 49 53 57 61 2001年之前配股时最近三年平均净资产收益率 The past three years’ average ROE of companies that took rights offering before 2001 2002年配股时最近三年平均净资产收益率 The past three years’ average ROE of companies that took rights offering in 2002 Figure 2 The Contrast Result of the Past Three Years’ Average ROE Before and After 2001 Table 1 Rights-offering Years Before 2001 (x1) In 2002 (x2) Difference (x1-x2) T Comparison of the Average ROE in the Past Three Years Average ROE in the past three years Mean Standard deviation 14.574 3.053 10.587 2.695 3.987 3.539 8.799*** Notes: ***, **,* distributions represent being at 1%, 5%, 10% particular level. The contrast results show that average ROE of the sample companies might not drop from 10% to 6%, but for most companies that took rights offering in 2002, ROE in 2001 is obviously lower than that in 2000 and 1999. Overall, the past three years’ average ROE of companies that took rights offering before and after 2001 respectively reduced by 3.987%, which is close to 4% decreasing range of adjusted systems, so H0 is denied and H1 is accepted. 3.1.6 Interests Entrenchment of Existing Shareholders to Potential Shareholders---Summary The sample companies’ average ROE revealed in the financial reports declines obviously in the same direction and range of the systems before and after the change of rights offering systems. Under the situation where the macroeconomic environment has not fluctuated enormously, unless there are evidences suggesting the 73 An Empirical Analysis on the Dissimilation of Independent Audit Relationship decline is caused by changes of companies’ real assets and income, the drop of ROE can be rationally interpreted as a result of implementing earnings management of sample companies according to regulation policies. This above conclusion supports and proves interests entrenchment view. Combining with research conclusions of the former scholars, this paper holds that existing shareholders in China have behaviors of implementing earnings management through whitewashing the financial reports, which would mislead potential shareholders and occupies their interests. 3.2 Interests Entrenchment of Controlling Shareholders to Minority Shareholders Controlling shareholders own relatively majority shares, and can effectively control the operation and earnings distribution decisions through executing voting rights in general meetings of shareholders. Comparatively speaking, minority shareholders are in weak status, and their suggestions are difficult to be adopted unless they are in conformity with controlling shareholders. In order to maximizing their own utilities, controlling shareholders, as “rational economic people” may utilize their effective control power to develop accounting policies that are in favor of their own, incite or acquiesce managers to make false financial reports. These reports will mislead minority shareholders to make unsuitable investment, operating, distributing dividends and other decisions and then interests of minority shareholders are occupied. 3.2.1 Literature Review Morck, Shleifer and Vishny (1998)5 proposed that when controlling shareholders could control the company effectively, it was nearly unquestionable that the decisions they made would occupy minority stockholders’ rights and interests. This kind of ownership structure’s entrenchment effect might influence the quality of the company’s financial disclosure. Fan and Wong (2002)6 tested the relationship between information content of accounting earnings and ownership structure of 977 companies of seven eastern Asian countries and found that controlling shareholders revealed accounting information for their own interests, which had no credibility to outside investors. This evidence showed that concentrated ownership structure would lead to accounting earnings information’s low quality. Lemmons and Lins (2003)7 have examined the data of more than 800 companies of 8 eastern Asian countries and found that Asian financial crisis had increased controlling shareholders’ motivation to occupy minority shareholders’ interests. Corporate governance structure of China is weaker than that of the other developed countries. Low transparency and lack of disclosure are two main problems of Chinese market. In the following this paper will investigate the relationship between ownership structure and usefulness of accounting earnings, and examine whether this kind of interests entrenchment effect exists or not in China. 3.2.2 Research Hypotheses The relationship between ownership concentration and usefulness of earnings information is influenced by two kinds of encouragement effects of ownership concentration. (1) The interests entrenchment effect predicts that 5 Morck, R., A. Shleifer, and R. W. Vishny. Managers Ownership and Market Valuation: An Empirical Analysis, Journal of Financial Economics 1988, Vol. 20. 6 Joseph P. H. Fan, T.J. Wong. Working Paper, School of Business and Managers, Hong Kong University of Science and Technology, 2002. 7 Lemmon, M. L. and Lins, K. Ownership Structure, Corporate Governance, and Firm Value: Evidence from the East Asian FinancialCcrisis, Journal of Finance, 2003, Vol. 58. 74 An Empirical Analysis on the Dissimilation of Independent Audit Relationship ownership concentration leads to low quality of earning information: controlling shareholders effectively control the company, and they also control the preparation of the company’s accounting information and disclosure policies, by which they often occupy the interests of the minority shareholders. The market predicts that owners won’t disclose high quality accounting information, and this prediction reduces credibility of financial earnings, which reduces the information content of accounting; (2) Interests convergent effect predicts the interests of controlling shareholders and minority shareholders tend to be the same. After big shareholders obtain the effective control power, the increase of ownership means increase of interests claim, and it is inclined to set up good prestige for the company. Controlling shareholders’ subjective pursuit to their own interests will have the objective results that agent cost reduces, so appropriate ownership concentration can make the interests of controlling shareholders and minority shareholders tend to be the same to a certain extent. These two encouragement effects have opposite directions, and the relationship between ownership concentration and usefulness of earnings information is indeterminate, so this paper proposes following hypotheses: H3: The information content of accounting is negatively correlated with ownership concentration. It means that with the increase of the first controlling shareholders’ share ratio, the information content of accounting earnings will be reduced, and controlling shareholders occupy the interests of minority shareholders. H4: The impact of various ownership concentration on quality of the accounting earnings is different. 3.2.3 Research Design We choose the representative indexes of ownership concentration and information content of accounting separately, and use regression analysis method to test the relationship between these two factors. 3.2.3.1 The Basic Relationship between Returns on Stocks and Accounting Earnings At first, we analyze the relationship between cumulative abnormal returns of stocks and companies’ net profit, and formula (2) is shown as follows: CAR it 0 1 NI it u t (2) Where, CARit is cumulative abnormal return, NIit is companies’ net profit divided by market value of equity in the beginning of the year, and u t is the incomplete difference. The information content of accounting is measured by CAR, and the data of monthly returns are calculated from the 12th month before issuing companies’ annual reports. We adopt the Naive Model to calculate cumulative abnormal returns of stocks, namely, the monthly abnormal return of a stock is its monthly return which takes dividends and reinvestment into account minus monthly market return which is calculated by weighted average circulating market value taking dividends and reinvestment into account. Net profit is a common used index to measure accounting earnings in similar foreign research. J.P.H. Fan and T.J. Wong (2002) pointed out that the effect of using net profit value’s change NI instead of NI in the regression model is similar to the effect of using NI. So we choose to use NI as the major index to measure the accounting earnings. 3.2.3.2 Influence of Ownership Structure Then we will study the information content of earnings after controlling the ownership structure. This paper adopts the following time array-cross section regression model: CARit 0 1 NI it 2 NI it SIZEit 3 NI it LEV it 4 NI itVit u t (3) 75 An Empirical Analysis on the Dissimilation of Independent Audit Relationship Where, CARit and NIit have the same meanings as in formula II, and SIZEit stands for companies’ scales (the natural logarithm of the market value of equity in the beginning of the year), LEV it is financial leverage (total debt divided by total assets at the beginning of the year ), Vit is ownership variable (the first controlling shareholders’ share ratio), and u t is the incomplete difference. Ownership concentration is measured by the first controlling shareholders’ share ratio. Meanwhile, this paper introduces some other variables to control other factors which will influence earnings-return relationship except for ownership structure: (1) The size of enterprise (SIZE). Atiase (1985) and Freeman (1987) have proposed that public information disclosure and inner digesting of non-profit income are increasing functions of the size of enterprise. Big scale companies get more attention, which gives them more pressure of offering true and effective financial statements, and the information content of accounting is relatively rich, too. On the other hand, big scale companies’ inner structures are comparatively complicated, and it is easy to manipulate profits through related-parties trade, which leads to poor information content of accounting. (2) The financial leverage (LEV) controls debt risk and bankrupt risk. The companies with high liabilities usually have higher risk, and the relationship between earnings and return is weak. Meanwhile, the financial leverage also reflects the investment chance (Smith & Watts, 1992) of the company. Mature companies have strong abilities of raising fund, and little investment chance, so they seldom adopt stock financing because of the high cost. Their financial leverage is usually higher and their information content of accounting is relatively rich. 3.2.4 Data Sources and Samples Selecting The samples are selected from annual report data and stock markets’ trading data of A-share companies in Shenzhen and Shanghai Exchanges from 1994 to 2000. We choose samples that have intact ownership data, stock returns, earnings and some other financial data. It totally consists of 3750 observation value. We don’t cover the data in and before 1993, because there are great changes in economic situation of China after 1994, and the data can’t satisfy the assumption that every year’s data distributes in the same way. Companies’ financial data come from Genius Securities Information System and security market data come from CSMAR database of Hong Kong Technology Institute. 3.2.5 Measurement Results 3.2.5.1 Descriptive Statistics of Ownership Concentration Table 2 shows the distribution of first controlling shareholders’ share ratio of A-share companies in Shanghai and Shenzhen Exchanges in China. It can be found from the statistics results from 1994 to 2000, the share ratio of the first controlling shareholders of listed companies in China maintained at about 40%, namely, the ownership structure of the listed companies in China is highly centralized. Table 2 2000 1999 1998 1997 1996 1995 1994 Company amount 917 823 718 515 312 288 177 Total 3750.00 Year 76 Descriptive Statistics of Ownership Concentration 44.06 44.61 43.82 42.51 41.64 41.62 40.71 Standard deviation 17.80 17.90 17.79 17.49 17.95 18.74 19.30 43.35 17.98 Mean Median Minimum Maximum 43.17 43.57 43.25 41.68 41.12 41.27 42.22 7.48 7.38 6.42 6.17 6.11 5.38 4.93 88.58 88.58 88.58 88.58 88.58 85.86 88.58 42.39 4.93 88.58 An Empirical Analysis on the Dissimilation of Independent Audit Relationship 3.2.5.2 Uni-variable Regression Analysis of the Data from 1994 to 2000 Table 3 and Table 4 show the regression results of the whole and annually cumulative abnormal return and net profit of listed companies in China respectively. The estimated coefficient of NI is positive, and the estimated coefficient of NI is at 99% significant level in 1997, 1998, 2000 and as a whole. The above results indicate that there is notable positive relationship between CAR and net profit NI. Meanwhile, F value in regression result is significant at 99% level, which indicates notability of the overall equation can be ensured. The small adjusted R2 indicates it is necessary to introduce other variables to help NI to explain the equation. Table 3 The Regression Result of Market Return and Earnings (as a whole) Constant 0.041*** (5.824) Net profit (NI) 2.189*** (8.923) Adjusted R 2 0.020 Sample amount 3750 Notes: ***, **,* distributions represent being at 1%, 5%, 10% particular level, and T value is in the bracket. Table 4 The Regression Result of Market Return and Earnings (annually) Year Constant Net profit (NI) Adjusted R2 Sample amount 2000 1.146*** 0.077*** 0.007 917 (2.524) (7.333) 1999 2.155*** 0.016* 0.019 823 (4.083) (1.003) 1.235** 0.122*** 0.007 718 (2.255) (8.143) 2.465*** 0.068*** 0.020 515 (3.272) (3.393) 6.010*** -0.209*** 0.180 312 (8.267) (-7.135) 3.540*** -0.060** 0.042 288 (3.578) (-1.923) 3.424** 0.022 0.022 177 (2.257) (0.456) 1998 1997 1996 1995 1994 Notes: * ***, **,* distributions represent being at 1%, 5%, 10% particular level, and T value is in the bracket. 3.2.5.3 Multi-variable Regression Analysis of the Data from 1994 to 2000 We use the time array-cross section linear regression model in formula (3) to investigate the effect of ownership structure on the information content of accounting earnings. Table 5 shows the results of multi-variable regression analysis of listed companies of China in 1994-2000. Under the control of net profit (NI), the parameter of variable NI*V is significant at 1% level, which indicates that it has ability to explain cumulative abnormal returns CAR it . And the parameter is negative, so the main conclusion of this paper is verified: On the whole, the information content of accounting is negatively correlated with ownership concentration. Controlling shareholders may reduce quality of accounting information through manipulating accounting information in order to realize the purpose of the interests entrenchment. The overall regression effect of this model is not very satisfied, because the adjusted R2 value is relatively 77 An Empirical Analysis on the Dissimilation of Independent Audit Relationship small, which indicates that the model may have neglected some components of expected earnings and it needs to be improved further. For this reason, in the following, we investigate by groups according to ownership concentration. Table 5 The Overall Result of Multi-variable Regression Analysis of Data of Listed Companies in 1994-2000 in China Constant 0.038*** -5.055 Net profit (NI) 4.923* -1.18 NI*SIZE -0.064* (-1.207) NI*LEV -0.009 (-0.978) -0.026** NI*V (-2.173) Adjusted R2 Sample amount 0.022 3750 Notes: ***, **,*distributions represent being at 1%, 5%, 10% particular level, and T value is in the bracket. 3.2.5.4 Discussion in Different Ownership Concentration Groups According to the first controlling shareholders’ share ratio, we use 20% and 50% as boundaries to divide the market into three groups, and the regression results are shown in Table 6. From the result, we find that within different ranges of ownership concentration, the interests dissimilation effect or interests convergent effect may take the leading role, and the relationship between ownership structure and usefulness of earnings information may be different. (1) When in the zone of “first controlling shareholders’ share ratio is less than 20%”, the parameter of NI*V is notably positive, which indicates there is notably positive relationship between ownership structure and usefulness of earnings information. In the companies with this kind of ownership structure, the increase of the first controlling shareholders’ share ratio can help to improve the quality of accounting earnings information, and the interests dissimilation effect doesn’t exist. This may be because under the situation that the first controlling shareholders’ share ratio is small, they are unable to control other shareholders effectively and can’t realize their purpose of interests entrenchment. (2) When in the zone of “first shareholders’ holding share ratio is between 20% and 50%”, the parameter of NI*V is notably negative, which indicates there is notably negative relationship between ownership structure and usefulness of earnings information. In the companies with this kind of ownership structure, interests dissimilation effect exists, and the increase of the first controlling shareholders’ share ratio will reduce the quality of accounting earnings information. (3) When in the zone of “first shareholders’ share ratio is greater than 50%”, the parameter of NI*V isn’t notable, which indicates that this kind of companies has some special nature which needs further research or the interests convergent effect exists in this zone. Before concrete influence factors are confirmed, it can be explained as the moment that interests convergent effect exists and interests dissimilation effect are not notable. In the extreme case, if first controlling shareholders’ share ratio reaches 100%, the company’s single shareholder won’t occupy its own interests. 78 An Empirical Analysis on the Dissimilation of Independent Audit Relationship Table 6 Variables Constant NI NI*SIZE NI*LEV NI*V Adjusted R2 Sample amount Regression Result of Different Ownership Concentration First shareholders’ shareholding ratio <20% 0.052*** (2.332) 0.161 (0.012) -0.239 (-0.224) 0.029 (1.351) 0.122** (1.765) 0.011 343 20%< first shareholders’ shareholding ratio <50% First shareholders’ shareholding ratio >50% As a whole 0.042*** (3.786) 16.005** (2.027) -0.626 (-1.092) -0.025 (-1.247) -0.092** (-1.814) 0.034 1997 0.025** (2.021) -2.203 (-0.375) 0.378 (0.888) -0.004 (-0.281) -0.008 (-0.252) 0.021 1410 0.039*** (5.056) 4.923 (1.181) -0.065 (-0.207) -0.009 (-0.978) -0.026** (-2.174) 0.022 3750 Notes: ***, **,* distributions represent being at 1%, 5%, 10% particular level, and T value is in the bracket. 3.2.6 Interests Entrenchment of Controlling Shareholders to Minority Shareholders Summary When in the zone of “first shareholders’ share ratio is between 20% and 50%”, there is notably negative relationship between ownership structure and usefulness of earnings information, which indicates that in the 1997 sample companies that have this kind of ownership structure, the first majority shareholder may reduce quality of accounting information through manipulating accounting information to implement interests entrenchment. This evidence supports interests entrenchment view. Combining with the above cases, this paper proposes that controlling shareholders holding specific proportion of ownership in China may reveal accounting information of low quality for their own interests and occupy the interests of the minority shareholders accordingly. 4. Conclusion, Suggestion and Limitation Through analyzing changes in audit environment, this paper proposes the view that owners manipulate audit opinions for interests entrenchment purpose which leads to audit relationship dissimilation; and then we investigate A-share companies’ data of Shenzhen and Shanghai Exchanges, and verify the prerequisite of audit relationship dissimilation---interests entrenchment effect: through examining the relationship between different requirements of rights offering and the earnings abilities revealed by companies, we find that existing shareholders have occupied potential investors’ interests; through studying ownership structure’s impact on information content of accounting earning, we find that in certain range of ownership concentration controlling shareholders have occupied minority shareholders’ interests. The existence of interests entrenchment effect indicates existing and controlling shareholders may have motivation to manipulate audit opinions, and current auditing commission systems’ provision on auditing commission has offered conditions for existing and controlling shareholders to manipulate audit opinions. Existing controlling shareholders who have motivation to manipulate audit opinions can execute auditing commission, which makes independent auditing triangle relationship change to “false triangle relationship” that is not independent. In the cases of Shenzhen Yuanye, Yinguangxia, Maikete and so on, the behaviors of existing controlling shareholders, managers and certified accountants are the typical portrayals of the above views. So the dissimilation of independent audit relationship and the defects of current auditing commission systems are the basic reasons influencing auditors’ independence and the objectivity of audit opinions. Corresponding suggestion 79 An Empirical Analysis on the Dissimilation of Independent Audit Relationship is to change the current auditing commission systems, in order to get rid of both motivation and conditions for audit clients to manipulate audit opinions. For example, we can make potential shareholders, minority shareholders and other accounting statement users as audit clients, or make “the forth party” who are independent of owners and managers as audit clients, and make enterprise that owners and managers belong to as auditees, which gets back auditors’ independent status away from auditees and audit clients. The limitations of this paper which also need to be proved further include but are not limited to: The absent factors of CAR it model and the improvement of the model, the practice effect of executing audits commission by independent directors, and the actual evidence of existing and controlling shareholders’ direct or indirect manipulation of audit opinions. References: 1. Xiaoyue Chen, Xing Xiao and Xiaoyan Guo. Rights Offering and Earnings Manipulation of Listed Companies, Economic Research, 2000(1) 2. Yujian Lu. Study on Listed Companies’ Earnings Management from Distributions of ROE and ROA in China, Inquiry into of Economic Problems, 2002(3) 3. Morck, R., A. Shleifer, and R. W. Vishny. Managers Ownership and Market Valuation: An Empirical Analysis, Journal of Financial Economics 1988, Vol. 20 4. Joseph P. H. Fan, T.J. Wong. Working Paper, School of Business and Managers, Hong Kong University of Science and Technology, 2002 5. Lemmon, M. L. and Lins, K. Ownership Structure, Corporate Governance, and Firm Value: Evidence from the East Asian Financial Crisis, Journal of Finance, 2003, Vol. 58 (Edited by Yulin Shu, Ruili Shao and Jianfeng He) (continued from Page 66) References: 1. Frank M. Burke, Dan M. Guy, Audit Committee, China Zhongxin Press, 2004 2. Katherine Schipper. Commentary on Earnings Management, Accounting Horizons, Dec., 1989 3. Paul M. Healy & James M. Wahlen. A Review of the Earnings Management Literature and Its Implications for Standard Setting, Accounting Horizons, Dec., 1999 4. William. R. Scott. Financial Accounting Theory, Prentice Hall, 1997 5. Huadong Chen. Commentary on Profit Manipulation of Listed Company, Shang Hai Accounting, 2000(7) 6. Chunhua Deng. Research on Earnings Management Based on Game Analysis, Accounting Research, 2003(5) 7. Jiashu Ge, Liu Feng. Accounting Theory, Press of China Finance and Economy, 1998 8. Yueyun Lin. Several Approaches to Year Report Profit Manipulation of Listed Company, Information and Approach of China Auditing, 2000(3) 9. Feng Liu. System Arrangement and Quality of Accounting Information---Case Analysis of Hong Guang Estate, Accounting Research, 2001(7) 10. Erxing Lou. Middle-level Financial Accounting, Bookstore of Shanghai Sanlian, 1994 11. Yaping Ning. Research on Definition and Importance of Earnings Management, Accounting Research, 2004(9) 12. Rongsheng Qin. New Problem of Financial Accounting: Earnings Management, Contemporary Finance and Economy, 2001(2) 13. Zheng Sun, Yuetang Wang. Practice Research of Resource Allocation and Earnings Manipulation, Research of Finance and Economy, 1999(4) 14. Xue Wang, Wei Zhou. Reason and Measure of Short-term and Long-term Earnings Management, Science of Finance and Economy, 2004(1) 15. Minghai Wei. Commentary on Basic Theory and Research of Earnings Management, Accounting Research, 2000(9) 16. Huizhong Zhang. Commentary on Accounting Information Disclose of Listed Company, Soft Science of China, 2000(3) (Edited by Qinmei Wei, Lisa and Ruili Shao) 80