90226 Use computer software to process financial

advertisement

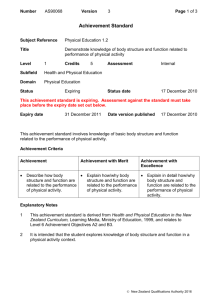

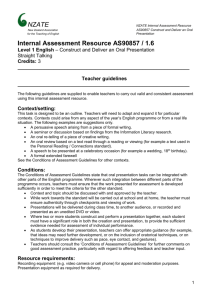

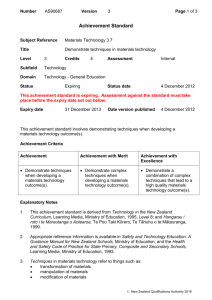

Number AS90226 Version 4 Page 1 of 3 Achievement Standard Subject Reference Accounting 2.7 Title Use computer software to process financial transactions for a sole proprietor Level 2 Subfield Accounting Domain Accounting - Generic Status Credits 3 Expiring Assessment Internal Status date 17 November 2011 This achievement standard is expiring. Assessment against the standard must take place before the expiry date set out below. Expiry date 31 December 2012 Date version published 17 November 2011 This achievement standard involves using computer software to process financial transactions for a sole proprietor registered for GST on the invoice basis. Achievement Criteria Achievement Achievement with Merit Achievement with Excellence Use computer software to process financial transactions. Use computer software to create new accounts and process a range of financial transactions. Use computer software to create new accounts and process a wide range of financial transactions. Explanatory Notes 1 This achievement standard is related to Accounting Curriculum for New Zealand Schools, Ceta Resources and Curriculum Services, New Zealand Commerce and Economics Teachers’ Association (NZCETA), 1998, (revision #2, Jan 2002); Level 2 Processing strand, pp. 26–27. 2 The context of this achievement standard is a sole proprietor trading firm using a perpetual inventory system and registered for GST on the invoice basis. 3 Financial transactions to be processed are to include selections from: Part A: cash sales cash from debtors or accounts receivable cash expenses New Zealand Qualifications Authority 2016 Number AS90226 Version 4 Page 2 of 3 cash paid to creditors or accounts payable inventory sales on credit inventory purchases on credit. Part B: Purchase of property, plant and equipment purchase on credit sundry charges to debtors sundry charges to the firm by creditors drawing of goods inventory shortage/losses inventory returns for sales inventory returns for purchases correction of errors. A range for achievement with merit should involve most of Part A and a majority of Part B. A wide range for achievement with excellence should involve nearly all of Parts A and B. 4 Assessment will require three outputs selected from: GST return bank reconciliation trial balance income statement balance sheet. 5 Achievement with merit and achievement with excellence require creating: different inventory items different accounts receivable different accounts payable (one may be non-trade) a range of new general ledger accounts (eg non-current asset, expense, liability, other income). 6 Set-up, entering opening balances, and establishing the accounting period are not assessed for this achievement standard, although they may be included as part of the assessment assignment. 7 For achievement with merit and achievement with excellence, the use of appropriate transaction references and dates is expected. 8 A computer software package with the facility to meet the requirements of explanatory notes 3, 4 and 5 must be used to process the transactions. Replacement Information This achievement standard has been replaced by AS91175. New Zealand Qualifications Authority 2016 Number AS90226 Version 4 Page 3 of 3 Quality Assurance 1 Providers and Industry Training Organisations must have been granted consent to assess by NZQA before they can register credits from assessment against achievement standards. 2 Organisations with consent to assess and Industry Training Organisations assessing against achievement standards must engage with the moderation system that applies to those achievement standards. Consent and Moderation Requirements (CMR) reference 0226 New Zealand Qualifications Authority 2016