Research Paper 6: Concessions - Education and Training Directorate

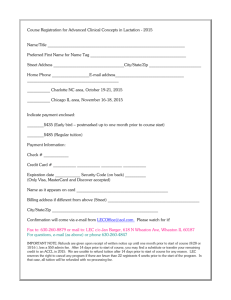

advertisement

Issues Paper – Concessions Research Paper 6 ACT Education and Training Directorate Concessions Page 1 Issues Paper – Concessions © ACT Education and Training Directorate 2014 This work is copyright. Apart from any use as permitted under the Copyright Act 1968, the work may be reproduced in whole or in part for study or training purposes, subject to the inclusion of an acknowledgment of the source. Reproduction for commercial use or sale requires prior written permission from the ACT Education and Training Directorate. Requests and inquiries concerning reproduction and rights should be addressed to the Directorate (see below). This publication is available from the Education and Training Directorate’s website at www.det.act.gov.au. If you require part or all of this publication in a different format, please contact the Directorate. Publications Inquiries: Training and Tertiary Education Education and Training Directorate Level 5, 220 Northbourne Ave, Braddon ACT 2612 GPO Box 158,Canberra ACT 2601 Tel: (02) 6205 8555 Email: actvet@act.gov.au An appropriate citation for this paper is: ACT Education and Training Directorate (2014) Skilled Capital Concessions Issues Paper, Report 6 of 8, Canberra. Publish date: December 2014 ACT Education and Training Directorate Page 2 Issues Paper – Concessions Overview Tuition fees for further education represent the cost of an individual investing in higher lifetime earnings and as such it is reasonable that individuals contribute to this investment. However, for some students, financial disadvantage means they are unable to personally cover the tuition fees required to participate in training. For a student of limited means, the upfront out-ofpocket costs associated with training could lead to a decision not to enrol or to undertake cheaper but less appropriate training. To mitigate these general financial barriers to entry, a concession approach will be implemented for Skilled Capital. Additionally, other programs will continue to complement this concession approach without replicating its support. For example, the currently scheduled VET FEE-HELP scheme will continue to support diploma and advanced diploma level qualifications. The specific design of the concession arrangements will be as follows: Concession funding will be linked to individual student tuition fees, not set at a flat rate. The ACT Government will contribute 50 per cent of a registered training organisation‘s (RTO) published tuition fee, up to a maximum of the published mandatory minimum tuition fee for each qualification. The student will fund the remainder of the published tuition fees (except in circumstances where that student is eligible for a fee waiver). Students eligible for concessions will include ACT residents who hold an Australian Government Health Care Card, Australian Government Low Income Health Care Card, Australian Government Pensioner Concession Card or Veterans Gold Cards. Eligible students who apply for concessions will be charged a reduced student fee by the RTO and the RTO will then receive a rebate from the ACT Government. The ACT Government will not make any direct payments to students for concessions. Under Skilled Capital, concessions will only be available for qualifications that are on ACT Skilled Capital Qualifications List. RTOs should also have in place formal processes for considering other statutory declarations of financial disadvantage as per current ACT requirements. This paper discusses the range of options for addressing financial barriers to entry for Skilled Capital and the rationale behind offering tuition fee concessions. Tuition fees can be a barrier for entry into training and can potentially prevent students from enrolling in training courses or otherwise limit their training options. Concessions reduce or remove tuition fees for students who meet certain eligibility criteria, usually linked to financial disadvantage. By reducing or removing the upfront costs of training for students, tuition fee concessions aim to: address barriers to entry for disadvantaged students who would like to engage in skills training but cannot afford to do so ACT Education and Training Directorate Page 3 Issues Paper – Concessions improve the choice of students with respect to the level and type of training courses that they can undertake, as generally higher level courses are more expensive. The remainder of this paper is structured as follows: Section 1 discusses financial barriers to training Section 2 discusses different approaches available to address these barriers, including examining the arrangements the ACT Government currently has in place to improve access to training for disadvantaged students Section 3 outlines the recommended design of concession funding. 1 Financial barriers to training There are strong links between education and increased personal lifetime income. In skills training, this is particularly the case for certificate III, certificate IV qualifications (for people who have not completed high school) and from diploma and advanced diploma qualifications.1 Given these personal benefits to students from completing skills training, it is reasonable to assume that students should contribute to the costs of training. For some students, however, financial disadvantage means that they are unable to personally cover the tuition fees required to undertake training. A student perspective study conducted by the Allen Consulting Group (ACG) found that financial costs may be a significant inhibitor of higher education, especially for mature age students and students from low socioeconomic backgrounds.2 For a student of limited means, tuition fees could mean he or she does not undertake training or enrols in a cheaper but less appropriate qualification for their needs. 1.1 Tuition fees Currently, students who take up a government subsidised skills training place in the ACT can face upfront fees. The Department of Prime Minister and Cabinet states that students who take up a government subsidised place in diploma and advanced diploma courses can face upfront fees that exceed $3,000 per year.3 Upfront fees can include: tuition fees – fees linked to each course to cover the RTO’s cost of training assessment fees – fees to cover initial assessments, for example recognition for prior learning assessments services or facilities fees – fees to cover the use of specialised facilities or services, for example specialist trainers or practical experience training equipment fees – fees to cover materials required by the student to undertake the training, for example the cost of a textbook for a business course, or ingredients for a culinary course. 1 Leigh A, (2008) Returns to Education in Australia. The Allen Consulting Group (2012) Greater openness in the national tertiary education provider market. p.47. 3 Australian Government, ‘Skills for all Australians – Reduced upfront costs for students – expanded access to income-contingent loans’, available at: http://www.dpmc.gov.au/publications/skills_for_all_australians/ chapter4_reduced_upfront_costs_for_students.html. 2 ACT Education and Training Directorate Page 4 Issues Paper – Concessions Tuition fees can be substantial, even without considering the other upfront costs. Information on tuition fees in the ACT indicates fees can range from $1,275 for a Certificate II in Library-Information Services to $9,829 for a Certificate III in Solid Plastering. Moreover, tuition fees charged by RTOs have increased in recent years as more importance is placed on tertiary education. For example: In 2003, the maximum tuition fees for a diploma level qualification funded by governments ranged from $500 in Victoria to $1,200 in South Australia.4 In 2008, the maximum annual student tuition fee was $1,420 in NSW compared to $877 in Victoria.5 In 2012, according to VET FEE-HELP data, 90 per cent of Victorian subsidised places in diploma and advanced diploma qualifications had a loan amount of $2,500 or less.6 1.2 Available finance The government subsidised skills training system is now one of the few areas of Australia’s tertiary education system where students are required to pay up-front fees without access to loan assistance. The economic problem associated with charging up-front fees for skills training is that, for those who cannot afford to pay, financing is, at best, available through an ineffective capital market and, at worst, unobtainable. The basic concern in lending for human capital investments is that, unlike many other investments, there is no saleable collateral in the event of default.7 Combined with rising tuition fees, the lack of access to finance creates a significant barrier for many students. 1.3 Disadvantaged students Anecdotal evidence from the Independent Pricing and Regulatory Tribunal (IPART) suggests that people from disadvantaged backgrounds are more price sensitive than other students.8 This potentially means that students unable to afford the tuition fee component may opt to complete a lower level qualification than they would have otherwise enrolled in. Reducing barriers to entry by addressing financial disadvantage aligns with Skilled Capital’s focus on increasing the training of students generally, and students in specific cohorts of need more specifically. This said, a review of the literature suggests that financial barriers are only one of a number of barriers to participation in education and training and, amongst these, is not the most significant.9 Interestingly, the ACG study found that inconsistencies in financial assistance between skills training and higher education affected the decisions of only a small number of those surveyed in the study. 4 Watson, L. (2003) ‘What do TAFE students pay? A review of charging policies in Australian vocational education and training’, available at http://www.ncver.edu.au/publications/1391.html. 5 Kronemann, M. (2008). A comparative analysis of NSW TAFE fees, NSW Teachers Federation, Surry Hills. 6 ‘Administering VET FEE-HELP Income Contingent Loan Limits for State Subsidised Places’. Unpublished paper. 7 Bruce Chapman, Mark Rodrigues and Chris Ryan (2007) HECS for TAFE: The case for extending income contingent loans to the vocational education and training sector, Treasury Working Paper 2007-2. 8 Independent Pricing and Regulatory Authority (2013), Pricing VET under Smart and Skilled, pg84. 9 ABS 6278.0 (2009), Education and Training Experience. Skinner, N (2009), Work-life issues and participation in education and training, NCVER. Maxwell et al. (2000), Social, educational and personal influences on aspiration, NCVER. ACT Education and Training Directorate Page 5 Issues Paper – Concessions However, the report noted that this might not be the case in the longer term if differences in funding levels and eligibility criteria between skills training and higher education sectors continue to widen.10 1.4 Government assistance If training produced purely private returns, it could be argued that it is up to an individual to fund their own training, with no role for government. However, as described in the Funding Model Issues Paper, education also provides public benefits, meaning there is a return to the ACT by working with disadvantaged students to mitigate or remove financial barriers to entry into training. Skilled Capital aims to encourage increased training attainment in selected qualifications through improving information and access to government subsidies. As recommended in the Funding Model Issues Paper subsidies will be provided to RTOs for selected qualifications on the ACT Skills Needs List, enabling RTOs to reduce the tuition fee required to cover course costs and increase access for students. However, unless subsidies are provided for 100 per cent of the total tuition fee, which is unlikely, a student will still be required to fund a portion of the course cost from their own pocket. 2 Options to reduce barriers to entry Three approaches have been generally favoured for reducing financial barriers to entry. Income contingent loans – enabling students to obtain a government loan to fund the costs of education. The loan is paid back contingent on achieving a certain income level. Targeted support programs – providing programs that target scholarships or financial assistance for specific groups or courses. Tuition fee concessions – government directly subsidising an eligible student’s education by paying part or all of his or her tuition fee. Each of these approaches is now discussed in turn. 2.1 Income contingent loans (ICLs) ICLs enable students to obtain a government loan to fund the costs of education. The loan is paid back contingent on the student reaching certain thresholds of income. This means students do not have any out-of-pocket upfront costs for course fees and only start making repayments on their loan when they are deemed to be in a financial position to do so. ICLs have existed in the Australian education system since 1989 when they were introduced for university undergraduate students in a system known as the Higher Education Contribution Scheme (HECS). HECS allows students to postpone the payment of tuition charges until their future income exceeds a given threshold. HECS was significantly reformed in 2005, with the introduction of ‘FEE-HELP’. Under FEE-HELP the Commonwealth covers costs at the point of enrolment for students wanting to enrol in higher education courses with charges not covered by HECS (such as for full-fee paying undergraduate or graduate courses). 10 The Allen Consulting Group, Greater openness in the national tertiary education provider market. p.61. ACT Education and Training Directorate Page 6 Issues Paper – Concessions In May 2006, FEE-HELP was extended to parts of the skills training system (VET FEE-HELP) to remove the financial barriers associated with upfront costs of higher level skills training. Other VET FEE-HELP objectives have been identified as: increasing options available to students increasing skills and qualifications increasing funding to the sector improving equity of access to HELP supporting the productivity and skills agenda providing effective student protections supporting quality, value and sustainability of the sector supporting articulation between skills training and the higher education sectors.11 However, until recently, VET FEE-HELP has operated differently across jurisdictions. The Australian Government sought to rectify this through the National Partnership Agreement on Skills Reform (National Partnership), agreed in April 2012. One of the key reforms introduced by the National Partnership was the expansion of VET FEE-HELP to students taking up government subsidised places in diploma and advanced diploma courses in all states and territories. Implementation of the National Partnership is still ongoing, but preliminary data published in the Post Implementation Review of the VET FEE-HELP Assistance Scheme shows that VET FEE-HELP students are enrolling in some areas of strong demand for training and skills development. For example, the top five courses for which students nationally received VET FEE-HELP in 2009-10 were the Diploma of Children’s Services (2,141); Diploma of Accounting (1,607); Diploma of Nursing (1,273); Diploma of Management (1,065); and the Diploma of Commercial Arts (Graphic Design) and Advanced Diploma of Naturopathy (944).12 An option to address financial barriers under Skilled Capital could be to extend ICLs to all skills training qualification levels. However, this could potentially mean offering a large quantity of small loans. The volume of small loans could make the scheme administratively costly. Further, ICL programs are currently administered as national agreements across the Australian Government and all states and territories, involving coordination and central administration through the tax system. As such, the ACT cannot extend the VET FEE-HELP scheme in absence of national agreement. 2.2 Targeted support programs Targeted support programs are those aimed at specific individuals or groups, and can play an important role in addressing financial barriers and providing opportunities for students to attend training who may not have otherwise been able to participate. The ACT Government’s primary program for targeted support for disadvantaged students has been the Priorities Support Program (PSP). PSP was designed to provide access to training opportunities for people who cannot readily 11 12 Post Implementation Review of the VET FEE-HELP Assistance Scheme: Final Report, 30 September 2011, p 25. Ibid, p 43. ACT Education and Training Directorate Page 7 Issues Paper – Concessions access other government funded training programs or who do not have a high chance of success in those programs. Targeted students included people from culturally and linguistically different backgrounds; people with a disability; people with poor literacy and numeracy skills; and people with little or no prior education or training. PSP provided grants to RTOs to deliver training, financial relief and specialty assistance to students. Table 1 provide examples of these services. Table 1: Examples of current ACT Government special support programs Program Outcome Eligibility criteria Indigenous training - CIT Provides financial support for at risk Indigenous youth Casual youth (15-24 yrs) at risk Existing worker Indigenous Australian with certificate II or below Existing worker youth (15-24yrs) at risk with certificate II or below Job Seeker Indigenous Australian Job Seeker youth (15-24 yrs) at risk Volunteer Indigenous Australian Volunteer youth (15-24 yrs) at risk Casual worker Indigenous Australian Certificate II in Aged Care – MAXNetwork Pty Ltd Provides financial support for mature aged workers to undertake a Certificate II in Aged Care Casual mature aged worker Existing worker mature aged with certificate II or below Existing worker with a disability with certificate II or below Job Seeker with a disability Job Seeker mature age worker Volunteer with a disability Volunteer mature aged worker Casual worker with a disability PSP operated within a defined funding allocation. In September each year, RTOs were invited to submit bids in a competitive tender process to offer services under PSP. Each year RTOs needed to reapply for funding under the program, even if they had delivered services in the previous year. Places and funding were allocated to RTOs informed by a priority list, and took into consideration a range of factors, such as: community need and the public benefit of the services proposed by the RTO the number of places the RTO could offer past performance of the RTO under the program. For the 2014 program, the total number of places for training provided under the PSP program was relatively small, with only 12 RTOs running projects representing 858 total enrolled places. The advantage of this targeted approach is that it is able to customise programs to the students’ individual needs. The program addressed financial barriers through student concessions to fees, and funded additional wrap-around support services such as meals, transportation and work experience placements. Providing these additional services addressed more than just pure financial barriers and provided a point of difference to a pure concession model. Anecdotal evidence provided by PSP ACT Education and Training Directorate Page 8 Issues Paper – Concessions participants is that it was an extremely valuable service that has provided them with life changing training opportunities. Despite the benefits of the program, with only 858 places in 2012-13, PSP was selective and small in scope. Unless the program was substantially expanded it would not have been sufficient to achieve the objective of general reduction in financial barriers to entry for disadvantaged students. It could have also been regarded as inequitable for this reason of benefiting only part of the target population. The PSP also suffered from a number of other drawbacks. Firstly, the funding model was supply driven, making it incompatible with the demand driven focus of Skilled Capital. Under PSP, RTOs were required to bid for funding to deliver a set number of places in particular qualifications for specific cohorts of students. The success of the program relied on the ability of RTOs to identify a sufficiently large clientele to fill those places. If an RTO could not meet its allocation, the funding was unable to be reallocated, reducing the reach and effectiveness of the program. In the reverse situation, the number of places were allocated before the market is tested for demand for those places, which may have led to competition for the same students and students missing out. These issues could be amplified if the program was extended. As the places are not advertised in a central location, lack of information has made it difficult for RTOs to fill all their allocated places, reducing the reach and effectiveness of the programs. In contrast, an ideal concession model would allow eligible students to attend any training in any RTO, better achieving the objectives of an outcomes-based Entitlement model. As RTOs were required to annually bid for program funding, the program involved high administration costs and creates uncertainty with respect to the RTO’s future income streams. On a small scale, to address niche services, this was manageable. However, an expanded scheme would compound these issues and could mean overly burdensome administration costs and inherent uncertainty both for the RTOs and the students. Finally, the tender system of funding may also have provided perverse incentives for RTOs to only bid for the lowest cost courses for the lowest cost students, which does not align to the aims of Skilled Capital. While the PSP was effective in providing a niche service, offering a point of difference to general concession funding models through wrap-around support services, the design is incompatible with an Entitlement model. It is recommended that services such as these should not be considered in place of concessions. To act as a complementary program the scope of any additional targeted support such as the PSP should be restricted to targeted support services, rather than general financial support, to avoid overlap with concessions. Eligibility for students to access additional targeted support services should be tightened to cater for only the most severely disadvantaged students. 2.3 Tuition fee concessions Currently favoured by other jurisdictions, concessions are a way for governments to address issues of financial disadvantage and additional needs and directly subsidise an eligible student’s training by funding all or part of their tuition fee. Examples of this are the Entitlement models in Victoria, Western Australia and New South Wales discussed below in Box 1. ACT Education and Training Directorate Page 9 Issues Paper – Concessions Box 1 – Concessions in other jurisdictions Victoria provides concessions for all course categories. Concessions are available to holders of the Commonwealth Health Care Card, Pensioner Concession or Veterans Gold Cards, and for persons who are dependent partners or children of these card holders. Concessions are also given to Indigenous students. Concession fees in Victoria are set at the minimum fee for each course category (ranging from foundation skills to diplomas). Concession eligible students pay this minimum fee and the rest of the relevant tuition is reimbursed to the RTO by the Victorian Government. In 2010, 24 per cent of Victorian skills training enrolments were eligible for concession fees.13 In Western Australia, concessions are available to holders of the Commonwealth Health Care Card, Pensioner Concession or Veterans Gold Cards, and for persons who are dependent partners or children of these card holders. Concessions are also available to persons in receipt of AUSTUDY, Youth Allowance, inmates of a custodial institution and persons between 15 and 18 years of age.14 The fee a concession student pays depends on the amount of hours assigned to the unit of competency, which are arranged in to bands (Band 1: 1-14 hours; Band 2: 15-24 hours etc). The concession price per unit of competency is half the non-concession tuition fee for each band of courses. Through IPART, New South Wales is proposing a scheme that sets concession fees for eligible students at flat per level of qualification, rather than varying by qualification course or units undertaken. The restriction is placed on how much the student will pay, rather than limiting the amount of the government contribution. For example, a concession student would only pay $200 for any certificate I and II qualification or $400 for any diploma or advanced diploma.15 The NSW Government reimburses the RTO for the rest of the tuition fee, regardless of the amount. IPART’s view is concession fees should vary by qualification level to reflect the longer duration of higher qualifications and balances this with price signals. In line with the other jurisdictions discussed and due to the issues identified with the other mechanisms, it is recommended that concessions be used as a means to address general financial barriers to entry into training. The following section outlines the recommendations for how these concessions should be designed. 3 Design of concession funding Two guiding principles were applied when designing the preferred concession funding model. Concession funding should be linked to individual student fees. That is, as the tuition fee increases so to should the amount of the concession funding provided. Under a system of unregulated tuition fees, a cap must be placed on concessions to limit the financial impost on the government. 13 Essential Services Commission (2009) VET Fee and Funding Review, Table 5.3 pg74. Western Australian Department of Training and Workforce Development (2013) VET Fees and Charges. 15 Independent Pricing and Regulatory Authority (2013) Pricing VET under Smart and Skilled Final Report, pg 126. 14 ACT Education and Training Directorate Page 10 Issues Paper – Concessions 3.1 Setting concessions As described above, in other jurisdictions, the general approach to concessions has been to regulate the flat fee concession fees that students pay (with a set fee for either each level or type of qualification). This approach was examined in the context of the ACT and found to be inappropriate for two reasons. Both reasons occur because of the unregulated nature of tuition fees in Skilled Capital. Firstly, setting a dollar amount that concession students would pay leaves the ACT Government open to pay the remainder of the tuition fee. In a system where RTOs can flexibly set their fees, this puts no limit on government spending. It also makes government spending unpredictable, as it would depend on which RTO a concession student chooses and at what level that RTO has chosen to set their tuition fee. This would be in opposition to the second guiding principle outlined above. Secondly, there is no easily identifable benchmark at which to set a fixed concession student fee. Setting the concession fee too high could lead to the illogical situation where an RTO could choose to set the general student tuition fee below the concession student fee. The only way to guard against this situation would be to set the flat fee at the minimum fee. However, the minimum fee is designed as the very least buy-in a student should make. Setting the concession fee at that minimum level would mean that government contributions would be a very large proportion of the tuition fee in most circumstances. For these reasons, a more flexible approach to concession funding is needed and so it is recommended that concessions should be paid as a percentage of general tuition fees (to recognise the ability of RTOs to flexibly set fees), but that government contributions should have a cap for each qualification level (to align with budget constraints). Under this recommended model, the tuition fee paid by students would be variable, allowing for differences in training hours, tuition cost per cost hour and other factors that RTOs will take in to account when setting their tuition fee. This would also allow RTOs to compete for concession students on price and quality of training, as well as full tuition paying students, as aligned with the objectives of Skilled Capital. It is recommended that eligible students who apply for a concession would be charged a reduced student fee by the RTO, for which a rebate would be provided by the ACT Government to the RTO. Where it can be avoided, the ACT Government should not make any direct concession payments to students. 3.2 Indicative concession range Given a lack of evidence around the effectiveness of specific concession formulas, it is preferred that when setting the percentage of tuition fees that will be funded for concession students, the ACT Government is guided by a Budget Impact Cost Model.16 This model estimates the cost to the ACT Government of different concession levels, taking into consideration the efficient costs of identified qualifications, as well as subsidy rates. 16 The Budget Impact Cost Model is an internal model developed by Training and Tertiary Education to determine the overall cost of the Skilled Capital program and assess the cost impact of various specific policies within the program, such as concession payments. ACT Education and Training Directorate Page 11 Issues Paper – Concessions In line with the budget modelling undertaken, it is initially proposed that additional funding for concession students provides 50 per cent of the published tuition fee capped at a maximum of the published mandatory minimum tuition fee for each qualification. The remainder of the tuition fee is paid by the student, and has no maximum set on it (as per the Tuition Fees Issue Paper). An example of how this concession rate will operate is shown in Box 2 below. Box 2 – Example calculations of the concession rate Two hypothetical RTOs offer the same qualification. The efficient price for this qualification is $1000 and the government subsidy is $600. Therefore, the gap is $400 and the cap on concession funding is set at a quarter of this, $100. RTO A has a published tuition fee of $500. Fifty percent of this published tuition fee is $250, which is above the concession funding cap. Therefore the RTO would only receive the capped amount for a concession student from the government, $100, and the remaining $400 of the tuition would be paid by the concession student (or waived by the RTO under exceptional circumstances). RTO B has a published tuition fee of $100. Fifty percent of this published tuition fee is $50, which is below the concession funding cap. Therefore the RTO would receive the full 50 per cent of the tuition amount for a concession student from the government, $50, and the remaining $50 of the tuition would be paid by the concession student (or waived by the RTO under exceptional circumstances). A flexible concession tied to tuition fees means the concession will vary for each student up to the maximum concession amount. As the tuition fee for Student A is sufficiently higher than Student B, the proportion of Student A’s tuition fee funded by the government (the concession) will be capped at the maximum concession amount. Once a concession schedule is determined, it is recommended that it be published to provide clarity for RTOs and so that it may be used to inform the setting of their tuition fees. The maximum concession values by qualification should be reviewed as tuition fee and cost information is collected. The values should be reviewed periodically and adjusted as required. The proposed tuition fee with concession should be compared with those in New South Wales where relevant so that there are not substantial cross border differences for the same qualification. 3.3 Eligibility As per arrangements used in the ACT (e.g. under the PSP) and other jurisdictions (as discussed above), the following is recommended. Eligibility to Skilled Capital concessions should be granted for ACT residents who are holders of the Australian Government Health Care Card, Australian Government Low Income Health Care Card, Australian Government Pensioner Concession Card or Veterans Gold Card, and for persons who are dependent partners or children of these card holders. RTOs should also have in place formal processes for considering other statutory declarations of financial disadvantage. ACT Education and Training Directorate Page 12 Issues Paper – Concessions 3.4 During the initial phase, concessions should only available for qualifications that are on the ACT Skilled Capital Qualifications List. Fee waivers Although it is usually not ideal for a student to have no personal buy-in to their training (as discussed in the Tuition Fees Issues Paper), in extreme circumstances, it may be considered appropriate that a student does not have to pay any tuition fees to their training and is granted a fee waiver. In an open demand driven market, the government cannot control if an RTO chooses to give a student a complete waiver from all tuition fees or not. However, it is recommended that RTOs should be required to have a mechanism in place to consider exceptional circumstances under which a fee waiver may be warranted. The use of these mechanisms could be periodically monitored, to ensure they are not being used inappropriately to avoid minimum fee provisions. ACT Education and Training Directorate Page 13