BMO Short Federal Bond Index ETF

advertisement

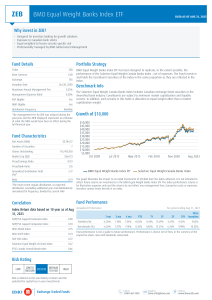

BMO Short Federal Bond Index ETF ZFS BMO EXCHANGE TRADED FUNDS FUND DETAILS Portfolio Strategy Ticker ZFS Exchange TSX Inception Date Maximum Annual Management Fee 10/20/2009 0.20% RSP Eligible Y DRIP Eligible Y Distribution Freq Monthly FUND CHARACTERISTICS As of October 31, 2011 Number of Securities 25 Weighted Avg Term Maturity 2.6 Weighted Avg Coupon (%) 2.9 Weighted Avg Current Yield (%) 2.8 Weighted Avg Yield to Maturity (%) 1.2 Weighted Avg Duration 2.5 The BMO Short Federal Bond Index ETF has been designed to replicate, to the extent possible, the performance of the DEX Short Term Federal Bond Index, net of expenses. The Fund invests in a variety of debt securities primarily with a term to maturity between one and five years. Securities held in the Index are generally issued or guaranteed by the Government of Canada, by various agencies of the Government of Canada, and by various instrumentalities that have been established or sponsored by the Government of Canada. Benchmark Info The DEX Short Term Federal Bond Index consists of semi-annual pay fixed rate bonds denominated in Canadian dollars, with an effective term to maturity less than five years and greater than one year, a credit rating of AAA and minimum size requirement of $50 million per issue. The federal sector consists of bonds issued by the Government of Canada (including both non-agency, agency/crown corporations) and supranational entities. Each security in the index is weighted by its relative market capitalization and rebalanced on a daily basis. Index Performance - DEX Short Term Federal Bond Index Fund Benefits - Provides convenient and efficient exposure to short-term Canadian federal fixed income issues. - Offers the convenience of an exchange traded security on the TSX; including the use of limit orders. - Provides excellent transparency through intra-day trading prices and daily portfolio composition. - Delivers investment flexibility by enabling investors to trade whenever the TSX is open. The underlying securities of ZFS have large daily trade volumes which represents the ETF's true liquidity. Source: DEX, 2009 Top 10 Holdings (%) as of October 31, 2011 Government of Canada 3.5% 06/01/2013 Government of Canada 2.5% 06/01/2015 Government of Canada 3.0% 06/01/2014 Canada Housing Trust 4.55% 12/15/2012 Government of Canada 4.0% 06/01/2016 Government of Canada 1.75% 03/01/2013 Government of Canada 2.5% 09/01/2013 Canada Housing Trust 2.45% 12/15/2015 Government of Canada 2.0% 12/01/2014 Government of Canada 2.0% 03/01/2014 9.2 8.6 7.9 6.2 5.9 5.0 4.5 4.0 4.0 3.9 BMO Short Federal Bond Index ETF ZFS BMO EXCHANGE TRADED FUNDS CORRELATION (Based on 10 years return data as of September 30, 2011) DEX Short Term Federal Bond Index DEX Short Term Overall Bond Index 0.98 DEX Overall Bond Index 0.83 US HY Corporate Bonds CAD Hedged -0.23 Canadian Large Cap Equity -0.32 US Large Cap Equity CAD Hedged -0.27 International Equity CAD Hedged -0.32 Emerging Markets Equity -0.13 Source: DEX, S&P, Bloomberg Fund Performance for Period Ending: October 31, 2011 1 mo 3 mo YTD 1 yr Since Inception -0.22 1.44 3.80 3.23 3.46 For more information, including how to purchase BMO ETFs, please contact Client Services at 1-800-361-1392 or visit bmo.com/etfs Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing. The funds are not guaranteed, their values change frequently and past performance may not be repeated. This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individuals circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. BMO ETFs are managed by BMO Asset Management Inc., an investment counsel firm and separate legal entity from the Bank of Montreal. ® Registered trade-marks of Bank of Montreal, used under licence.