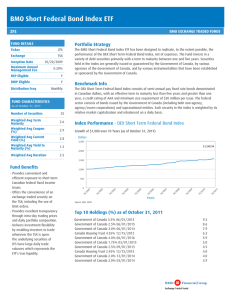

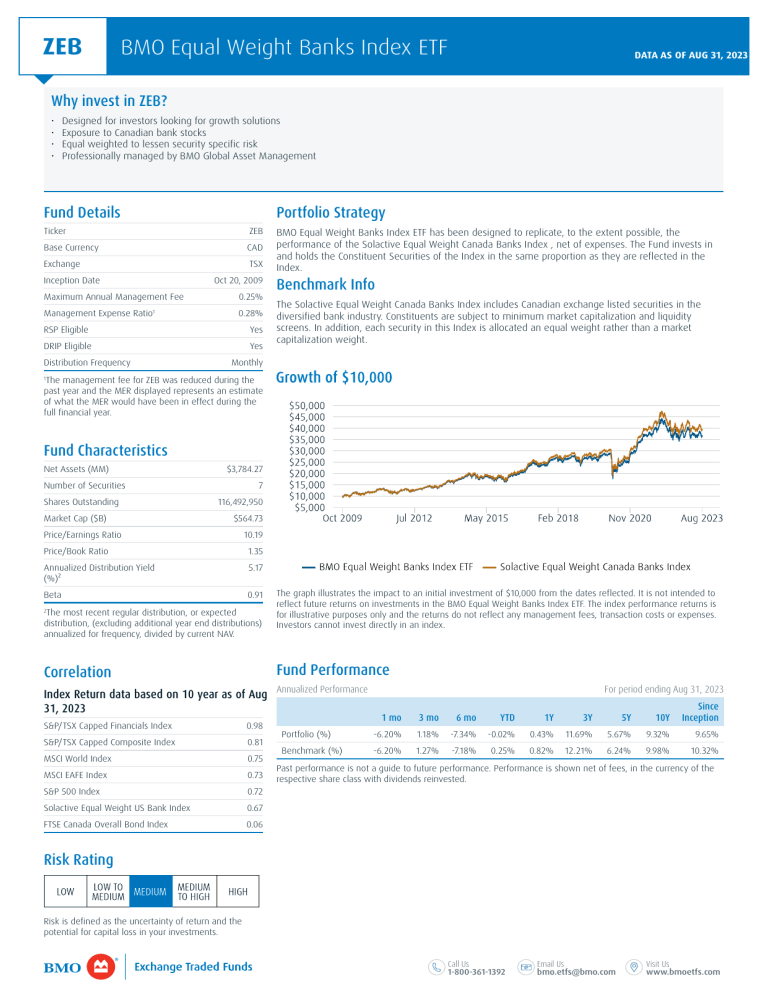

ZEB BMO Equal Weight Banks Index ETF DATA AS OF AUG 31, 2023 Why invest in ZEB? • • • • Designed for investors looking for growth solutions Exposure to Canadian bank stocks Equal weighted to lessen security specific risk Professionally managed by BMO Global Asset Management Fund Details Portfolio Strategy Ticker ZEB Base Currency CAD Exchange TSX Inception Date Oct 20, 2009 Maximum Annual Management Fee 0.25% Management Expense Ratio1 0.28% RSP Eligible Yes DRIP Eligible Yes Distribution Frequency The management fee for ZEB was reduced during the past year and the MER displayed represents an estimate of what the MER would have been in effect during the full financial year. Fund Characteristics $3,784.27 Number of Securities Shares Outstanding Market Cap ($B) Benchmark Info The Solactive Equal Weight Canada Banks Index includes Canadian exchange listed securities in the diversified bank industry. Constituents are subject to minimum market capitalization and liquidity screens. In addition, each security in this Index is allocated an equal weight rather than a market capitalization weight. Monthly 1 Net Assets (MM) BMO Equal Weight Banks Index ETF has been designed to replicate, to the extent possible, the performance of the Solactive Equal Weight Canada Banks Index , net of expenses. The Fund invests in and holds the Constituent Securities of the Index in the same proportion as they are reflected in the Index. 7 116,492,950 $564.73 Price/Earnings Ratio Growth of $10,000 $50,000 $45,000 $40,000 $35,000 $30,000 $25,000 $20,000 $15,000 $10,000 $5,000 Oct 2009 Jul 2012 May 2015 Feb 2018 Nov 2020 Aug 2023 10.19 Price/Book Ratio 1.35 Annualized Distribution Yield (%)² 5.17 Beta 0.91 BMO Equal Weight Banks Index ETF Solactive Equal Weight Canada Banks Index 2 The graph illustrates the impact to an initial investment of $10,000 from the dates reflected. It is not intended to reflect future returns on investments in the BMO Equal Weight Banks Index ETF. The index performance returns is for illustrative purposes only and the returns do not reflect any management fees, transaction costs or expenses. Investors cannot invest directly in an index. Correlation Fund Performance The most recent regular distribution, or expected distribution, (excluding additional year end distributions) annualized for frequency, divided by current NAV. Index Return data based on 10 year as of Aug Annualized Performance 31, 2023 S&P/TSX Capped Financials Index 0.98 S&P/TSX Capped Composite Index 0.81 MSCI World Index 0.75 MSCI EAFE Index 0.73 S&P 500 Index 0.72 Solactive Equal Weight US Bank Index 0.67 FTSE Canada Overall Bond Index 0.06 For period ending Aug 31, 2023 1 mo 3 mo 6 mo YTD 1Y 3Y 5Y 10Y Since Inception Portfolio (%) -6.20% 1.18% -7.34% -0.02% 0.43% 11.69% 5.67% 9.32% 9.65% Benchmark (%) -6.20% 1.27% -7.18% 0.25% 0.82% 12.21% 6.24% 9.98% 10.32% Past performance is not a guide to future performance. Performance is shown net of fees, in the currency of the respective share class with dividends reinvested. Risk Rating Risk is defined as the uncertainty of return and the potential for capital loss in your investments. Call Us 1-800-361-1392 Email Us bmo.etfs@bmo.com Visit Us www.bmoetfs.com ZEB BMO Equal Weight Banks Index ETF Sector Allocation DATA AS OF AUG 31, 2023 Top Holdings Geographic Allocation Toronto-Dominion Bank Financials 99.94% Canada 100.00% 17.26% Bank Of Nova Scotia 17.00% National Bank Of Canada 16.66% Can Imperial Bk Of Commerce 16.61% Bank Of Montreal 16.41% Royal Bank Of Canada 16.01% The portfolio holdings are subject to change without notice and may only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security. Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the prospectus before investing.The indicated rates of return are the historical annual compound total returns including changes in prices and reinvestment of all distributions and do not take into account commission charges or income taxes payable by any unitholder that would have reduced returns. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.This communication is intended for informational purposes only and is not, and should not be construed as, investment and/or tax advice to any individual. Particular investments and/or trading strategies should be evaluated relative to each individuals circumstances. Individuals should seek the advice of professionals, as appropriate, regarding any particular investment. BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and portfolio manager and separate legal entity from the Bank of Montreal. ® "BMO (M-bar roundel symbol) "is a registered trade-mark of Bank of Montreal, used under licence. S&P®, S&P 500® and S&P/TSX Capped Composite are trade-marks of S & P Opco, LLC and TSX is a trade-mark of TSX Inc. These and other associatedtrademarks and/or service marks have been licensed for use by BMO Asset Management Inc. None of the BMO ETFS are sponsored, endorsed, sold orpromoted by any of its aforementioned trade-mark owners and the related index providers or their respective affiliates or their third party licensors and theseentities make no representation, warranty or condition regarding the advisability of buying, selling or holding units in the BMO ETFs. Call Us 1-800-361-1392 Email Us bmo.etfs@bmo.com Visit Us www.bmoetfs.com ZEB BMO Equal Weight Banks Index ETF DATA AS OF AUG 31, 2023 MSCI Ratings are currently unavailable for this fund. To be included in MSCI ESG Fund Ratings, 65% of the fund’s gross weight must come from covered securities. Cash positions and other asset types not relevant for ESG analysis are removed prior to calculating a fund’s gross weight. The absolute values of short positions are included in a fund’s gross weight calculation, but are treated as uncovered for ESG data Security asset type must have recourse to the rated issuer. The fund holdings date must be less than one year old and must have at least ten securities. For newly launched funds, ESG information is typically available 6 months after launch. Call Us 1-800-361-1392 Email Us bmo.etfs@bmo.com Visit Us www.bmoetfs.com