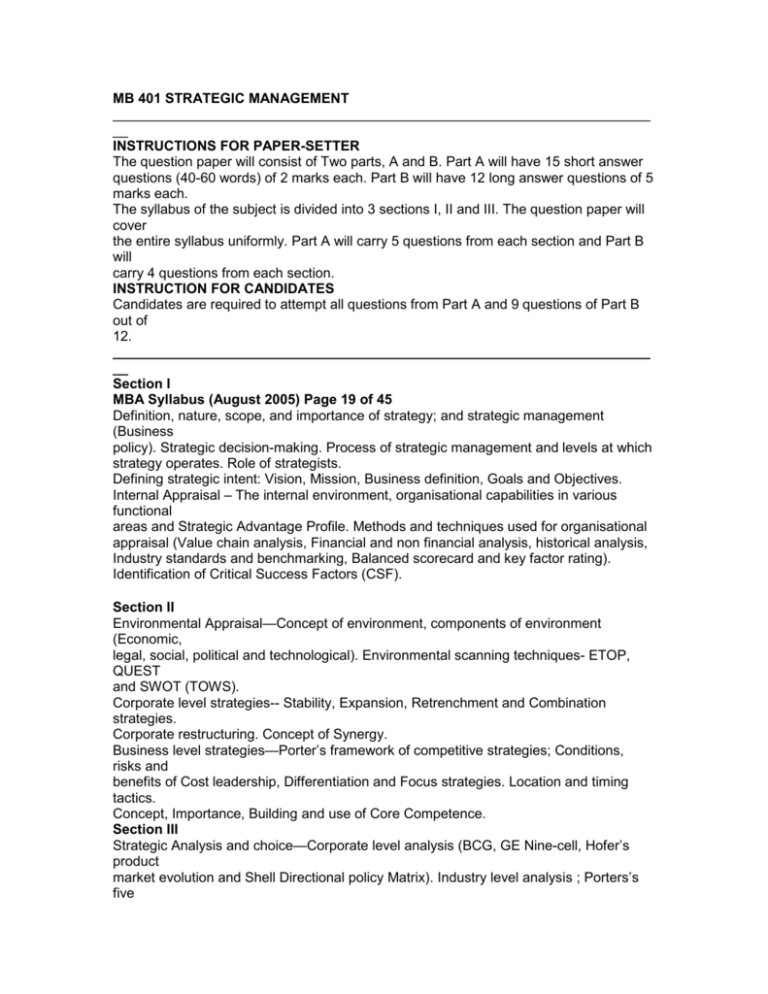

MB 401 Strategic Management Syllabus 26-01-2006

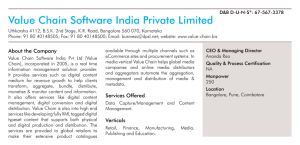

advertisement