South Carolina Uniform Tax Matrix

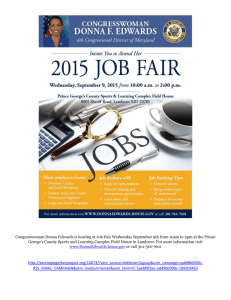

advertisement