Exploring Monetay Theory

advertisement

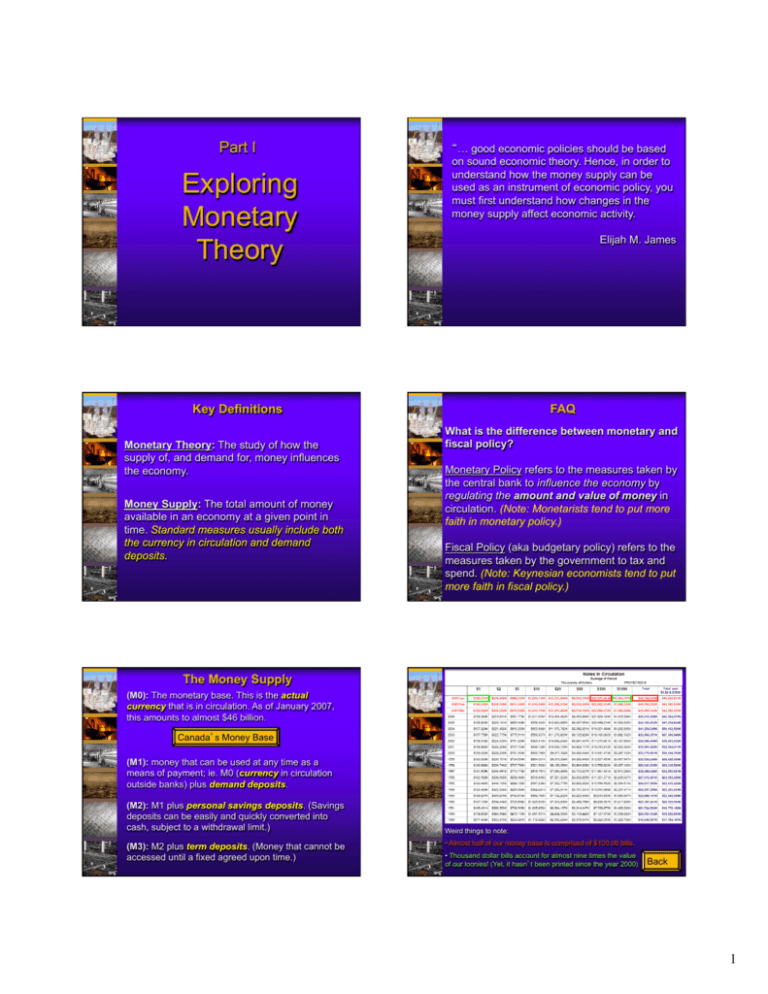

Part I Exploring Monetary Theory “… good economic policies should be based on sound economic theory. Hence, in order to understand how the money supply can be used as an instrument of economic policy, you must first understand how changes in the money supply affect economic activity. Elijah M. James Key Definitions Monetary Theory: The study of how the supply of, and demand for, money influences the economy. Money Supply: The total amount of money available in an economy at a given point in time. Standard measures usually include both the currency in circulation and demand deposits. FAQ What is the difference between monetary and fiscal policy? Monetary Policy refers to the measures taken by the central bank to influence the economy by regulating the amount and value of money in circulation. (Note: Monetarists tend to put more faith in monetary policy.) Fiscal Policy (aka budgetary policy) refers to the measures taken by the government to tax and spend. (Note: Keynesian economists tend to put more faith in fiscal policy.) The Money Supply (M0): The monetary base. This is the actual currency that is in circulation. As of January 2007, this amounts to almost $46 billion. Canada’s Money Base (M1): money that can be used at any time as a means of payment; ie. M0 (currency in circulation outside banks) plus demand deposits. (M2): M1 plus personal savings deposits. (Savings deposits can be easily and quickly converted into cash, subject to a withdrawal limit.) (M3): M2 plus term deposits. (Money that cannot be accessed until a fixed agreed upon time.) Weird things to note: • Almost half of our money base is comprised of $100.00 bills. • Thousand dollar bills account for almost nine times the value of our loonies! (Yet, it hasn’t been printed since the year 2000) Back 1 The Loanable Funds Model Real Rate of Interest S This model does not look at ALL money in an economy (which would include the money in cash registers, wallets, and stuffed under mattresses). r1 D Q Quantity of Loanable Funds Loanable Funds Theory The loanable funds model looks ONLY at the market for loanable funds. This model highlights the correlation between interest rates and the quantity of money available for loans. Market for Loanable Funds S Real Rate of Interest Market for Loanable Funds Loanable funds theory suggests that interest rates are determined by the supply and demand of loanable funds in the capital markets. • The supply of funds (S) would be provided by savings. r1 D • The demand for funds (D) would be determined by investments. The quantities of both S and D will respond to interest rates (just like in any market), and will thus determine the equilibrium level of interest (the “price” of borrowed money). Q Quantity of Loanable Funds This is a classical theory that highlights flexible prices as the primary mechanism that will correct the economy. Let’s see how! à How Loanable Funds Will Correct the Economy How Loanable Funds Will Correct the Economy If the economy starts to lag, people will buy less products Market for Loanable Funds Market for Loanable Funds S2 S S and services… 2 S r1 r2 D Q Quantity of Loanable Funds D2 This will result in lower interest rates, which will encourage more borrowing and spending! but they will save less! Real Rate of Interest Real Rate of Interest but they will save more! Thus, the supply of funds will increase and the demand for funds will decrease. r2 r1 D2 D Real Rate of Interest D Q Quantity of Loanable Funds Mnemonic: “Loanable funds are REAL-ly fun!” The Money Market Model Nominal Rate of Interest The Y-axis depicts the real interest rate (the “price” for borrowed money). It is the “REAL” rate because decisions regarding loaning of funds must take inflation into account. (We can’t very well loan money out at 2% if inflation is 3%!) r1 This will result in higher interest rates, which will discourage borrowing and spending! Thus, AD = C + I + G + (X-M) will decrease due to supressed consumption and investment (both said to be interest sensitive components of AD). A Note About the Axis in Loanable Funds S The supply of funds will decrease while demand increases, raising interest rates! Q Quantity of Loanable Funds Thus, AD = C + I + G + (X-M) will increase due to stimulated consumption and investment (both said to be interest sensitive components of AD). Market for Loanable Funds If the economy starts to overheat, people will buy more products and services… The Money Market model is based on Keynes’ “liquidity preference” theory. MS Ieq MD Qeq Quantity of Money In fact, the money demand (MD) curve is sometimes referred to as the liquidity preference curve (LP). This theory suggests that interest rates are not determined by the supply and demand of loanable funds (i.e. money in banks), but rather by the supply of and demand for liquid cash! 2 Notice that when interest rates are low, more people will “hold” (aka “hoard”) their money! r MD Quantity of Money M1 Nominal Rate of Interest A Note About the Axis in the Money Market The y-axis depicts the nominal interest rate in the money market model because the money market is focused on liquid cash for immediate use – not specifically on loaning of funds. MS Ieq It is the “nominal” rate because decisions regarding the use of cash are immediate and do not take future inflation into account. MD Qeq Quantity of Money In other words, an increase in interest rates would not increase the money supply (just as an increase in real estate prices would not increase the quantity of land). Ieq MD Qeq We’d rather hold cash than earn low interest. In this theory, the supply of money (S) would be determined simply by the money supply, and thus would remain constant with respect to interest rates. MS Quantity of Money The demand for funds (D) would be determined by the desire to hold cash in liquid form. The demand is influenced by interest rates because if interest is low, then people will be willing to forego the low interest in order to hold their cash in liquid form. However, if interest is high, then people will be willing to forego the ability to hold their cash in order to earn the high interest. Using the Money Market Model to illustrate changes to the Money Supply on Interest Rates It’s plain to see that if the money supply increases, then interest rates will fall. Nominal Rate of Interest We’d rather earn high interest than hold cash. The Money Market Model MS1 MS2 M1 M2 I1 I2 MD higher MS = lower interest Quantity of Money Looking at the aggregate model, we can see the effect that lowered interest rates will have on NDI. lower interest = higher NDI AE1 Lowered interest rates will increase investment spending, and this will add to aggregate expenditure. Examining the “monetarist’s” view of how to use monetary policy to stimulate the economy “Transmission mechanisms” in economics are just like a row of dominos! Buying bonds… 1 step increases money supply… which lowers interest rates… 2 step which increases borrowing, spending, and GDP! 3 step AE2 AE Nominal Interest Rate Keynes believed that the money circulating outside of banks was the critical issue with respect to interest rates. Nominal Rate of Interest MS Real GDP Illustrating the Keynesian perspective, which suggests that we should use fiscal policy to stimulate the economy… not monetary policy! Buying bonds… 1 step increases money supply… which increases which lowers hoarding of money! Thus decreasing interest both savings AND rates… spending! Oh no!!! 2 step 3 step 3