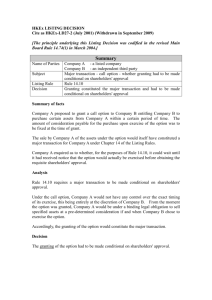

us privatizations - Morrison & Foerster LLP

advertisement