2014-2016 strategic marketing plan

advertisement

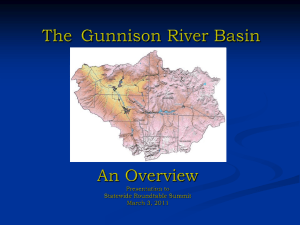

2014‐2016 STRATEGIC MARKETING PLAN GCBTA BACKGROUND: In Gunnison County, the Board of County Commissioners also serves as the Board of the Gunnison County’s Local Marketing District (LMD). The LMD provides public funding for tourism promotion efforts that are contracted to the Gunnison‐Crested Butte Tourism Association (GCBTA). Marketing funds are generated through a 4% occupancy tax on the sale of hotel rooms and vacation rental housing throughout the County. GCBTA VISION: Provide economic development through tourism, contribute to a desirable quality of life and serve as a model of community leadership in action. GCBTA MISSION: Enhance economic vitality by marketing our county as a year‐round destination and foster relationships with community partners. GCBTA VALUE PROPOSITION: Through life‐enriching adventures and inspirational, authentic experiences, Gunnison County delivers lasting memories unlike any other vacation destination. ELEVATOR SPEECH ‐ The Tourism Association’s primary function is to market Gunnison County on a year‐round basis to increase overnight visitors in support of our local economy. More than 5.5M dollars was generated in local taxes in 2012. Direct employment in the county represented 1,900 tourism‐related jobs. Total direct spending by tourists visiting Gunnison County was 150.6M dollars, representing a 5.76% increase over the prior year. Source: The estimates of the direct impacts associated with traveler spending in Colorado were produced using the Regional Travel Impact Model (RTIM) developed by Dean Runyan Associates, Colorado Tourism Office research report, June 2013 ***** PURPOSE OF THE STRATEGIC MARKETING PLAN: The Strategic Marketing Plan is a comprehensive plan developed to guide the Gunnison‐Crested Butte Tourism Association’s (GCBTA) marketing programs over the next three years, aimed at boosting brand awareness for Gunnison‐Crested Butte area, with the purpose of achieving economic development through tourism. 1 Gunnison‐Crested Butte Tourism Association EXECUTIVE SUMMARY As one of Gunnison County’s leading economic sectors, tourism benefits all citizens in our community. Its economic benefits extend to every municipality in the County with direct and indirect impact to a variety of hospitality‐related industries including: restaurants, hotels/lodging, ski resorts, convenience stores, gas stations, area attractions, and ongoing events. GCBTA presents the tourism ‘face’ of the County and it’s “Colorado. Pure & Simple.” brand. ECONOMIC DEVELOPMENT THROUGH TOURISM Our vision is of a tourism sector that will create prosperity for Gunnison County. To achieve this vision, GCBTA will look to maintain current market share, achieve growth in key emerging markets and further concentrate our marketing efforts and resources where we can create a competitive advantage. THE STATE OF U.S. TOURISM Spending by domestic and international visitors was $858 billion in 2012 in current dollars. This represents a 5.4 percent increase over 2011. When adjusted for changes in prices (constant dollars), spending increased by 2.7 percent – compared to a 3.2 percent increase from 2010 to 2011. In real terms, tourism output has still not recovered from the steep decline in 2008 and 2009. Source: Dean Runyan Associates, June 2013 On a nationwide basis, travel and tourism experienced growth in 2012, continuing the upward momentum and recovery that began in 2009. Domestic trip‐taking rose 2% overall in 2012, mainly reflecting a sharp increase in discretionary or “marketable” leisure travel. Following 4 years of virtually no growth, marketable leisure trips finally saw a release of pent‐up demand, increasing by 9% year over year However, this was almost counterbalanced by a 2% decline in visits to friends and relatives and a 5% drop in business travel. There were slight declines in touring and special event trips nationally. The past decade has seen a 25% increase in outdoor vacations on a national basis. Colorado has followed a similar trend, although with wider ups and downs from year to year than the slow, steady rise nationally. Source: CTO, Longwoods International, May 2013 2 Gunnison‐Crested Butte Tourism Association STATE OF COLORADO TOURISM Colorado continued to break records in terms of both visitor volume and visitor expenditures in 2012. Overnight trip numbers reached a record 29.5 million trips, rising 2% versus 2011. The number of visitors coming to Colorado on marketable leisure trips totaled an all‐time high of 14.6 million, 2% higher than in 2011. Visits to friends and relatives rose by 1%, and business trips increased 2%, continuing the upswing that began in 2009. In 2012, Colorado attracted more visitors on city, casino and outdoor and resort trips. Volumes of touring, special event and combined business‐leisure travel declined slightly. Day travel to and within Colorado continued to improve, rising by 6% to 30.8 million trips in 2012. As marketable leisure travel to Colorado rose at a substantially lower rate than this type of travel nationwide, Colorado’s overall share of marketable trips dropped from 2.7% to 2.4%. Colorado maintained its lead among states in the competitive overnight ski travel market, garnering 19.4% of all overnight ski trips in 2012. In summary, Colorado continued to see growth in the travel and tourism sector in 2012. Leisure travel continued to lead the way, particularly the marketable trip segment which is the focus of the Colorado Tourism Office marketing efforts. THE ECONOMIC IMPACT OF TOURISM TO GUNNISON COUNTY The Colorado Tourism Office (CTO) monitors Colorado’s performance in the global travel arena. This allows CTO to develop effective marketing strategies and programs, and to react quickly to changing markets and economies. CTO hired Dean Runyan Associates to describe the economic impacts of travel to and through Colorado and each of its 64 counties, four tourism regions, and eleven districts. The estimates of the direct impacts associated with traveler spending were produced using the Regional Travel Impact Model (RTIM) developed by Dean Runyan. Travel‐generated earnings are distributed roughly 47 percent to the Denver Metro region, one‐quarter to the Mountain Resort region, and the remainder to the Pikes Peak region and all other counties. However, the size of travel‐generated earnings in relation to total earnings is actually much lower in the Denver Metro region as compared to the Mountain Resort region. GUNNISON COUNTY: In 2012, the economic impact of overnight travel to Gunnison County was a follows: Total Direct Travel Spending in Gunnison County was $150.6 million, representing a 5.76% increase over the prior year. Total Direct Earnings in Gunnison County was $40.2 million, which is a 7.5% increase over the prior year but still lags slightly behind earnings from 2006‐2009. Direct Employment in the County represented 1,900 tourism‐related jobs, a 2.8% increase over the prior year. While direct employment continues to lag behind the peak of 2,200 tourism related jobs noted in 2006, the upward trend is noticeable and promising. Local Tax Revenue exceeded $5.5 million, representing a 7.2% growth over the prior year. Notably, 2012 is the highest revenue year on record since 1996. State Tax Revenue was reported at $3.4 million, demonstrating a 7.1% increase YOY. Source: Dean Runyan Associates, June 2013 3 Gunnison‐Crested Butte Tourism Association TRENDS IN TOURISM Longer‐term travel trends are forecast as follows: With the drop in Colorado touring trips in 2012, the state’s trend for this travel segment now is looking similar to the national trend which has been fairly flat for the past 3 years. City trips to Colorado have remained quite flat over the past 5 years, while the national trend saw a dip in 2009/2010 followed by some recovery. The past decade has seen a 25% increase in outdoor vacations on a national basis. Colorado has followed a similar trend, although with wider ups and downs from year to year than the slow, steady rise nationally. The past 5 years look fairly flat for resort trips across the country. In contrast, the longer term pattern for Colorado appears to be fairly steady growth, including in 2012. After several years of plateau, special event travel on a national basis has fallen slightly since 2010. Colorado has maintained a fairly steady number of visitors in this segment over the past 6 years. The trends in combined business‐leisure trips for both the nation and Colorado continue to be quite flat over the long term. Source: CTO, Longwoods International, Colorado Travel Year 2012 MARKET SHARE Colorado’s overnight marketable trips rose 2% year over year, while this type of travel increased 9% on a national basis. As a consequence Colorado’ overall share of the national market for this discretionary type of travel declined to 2.4%. Despite this shift, Colorado retained a ranking of 16th among the 50 states as a destination for marketable leisure trips, the same as in 2011. Colorado’s share of overnight touring trips dropped to 2.8%, the same as a prior low ebb in 2006. Colorado ranked 13th among the states as a touring destination in 2012, down from 11th the year before. Colorado’s share of outdoor trips in 2012 declined to 3.4% which ranked it 11th among the states for this type of travel. In 2012, Colorado retained its number one ranking for ski trips across the country with an 19.4% share, which was up slightly versus 2011(18.6%). These pleasure and business travel volume estimates are based on trips taken by individuals 18 years of age or older, and include 11.3 million trips by residents of Colorado. 4 Gunnison‐Crested Butte Tourism Association Colorado had a 2.0% share of day trips nationwide in 2012, the same as in 2011. Source: CTO, Longwoods International, Colorado Travel Year 2012 COLORADO TOURISM EXPENDITURES Total spending by domestic visitors to Colorado amounted to $11.2 billion in 2012, an increase of 5% over 2011. Gunnison County captured $150.6 million of those dollars, representing a 5.76% increase YOY. Overnight visitors’ expenditures rose by 3% to $9.6 billion in 2012. Spending improved among both leisure and business visitors: o The expenditures of people visiting Colorado on marketable trips grew to $5.35 billion, 1% more than in 2011. o A 5% increase in the spending of people visiting friends and relatives brought total expenditures for that segment to $3.1 billion for the year. o Day visitors’ spending rose to $1.64 billion in 2012, a 19% increase over 2011. o Colorado residents, the majority (83%) of day visitors, accounted for 73% of day visitors’ expenditures in the state. The increase in spending by overnight visitors benefited all of the five main business sectors affected by travel and tourism fairly equally, rising 2 to 4% across the board. Expenditures on transportation gained 2% to reach $2.2 billion in 2012, a reflection of higher car rental rates and gas prices. And spending on lodging rose 2% to $2.7 billion, a function of higher occupancy levels and increased room rates. Expenditures on food and beverage improved by 2% to $1.9 billion. Overnight visitors spent $1.5 billion on recreation, sightseeing and attractions, an increase of 3% over 2011. And travelers’ retail purchases increased by 4% to $1.3 billion in 2012. Consistent with the national trend, Colorado visitors who stayed in commercial accommodations when traveling in 2012 tended to spend more on things apart from lodging than those staying with friends/relatives or in other types of accommodations. The average expenditures of Colorado day visitors remained slightly below the national average ($53 vs. $56). Source: CTO, Longwoods International, Colorado Travel Year 2012 TRAVEL TRENDS The digital age has changed the way we work, play, shop, find information and interact with others. It should come as no surprise that it has also fundamentally changed the way we think about and experience travel – from the way we go about researching content to how we receive our information. As demand for travel grows, high‐quality and authentic experiences will be sought by travelers. As reported by The Denver Post, on 10/13/13: Summer business in resort towns is growing at a faster rate than winter, revealing both a recovering economy and a shift in resort tourism. While summer is growing, it's still a fraction of winter business in the big resort communities While Colorado's high country will always rely heavily on skiers, mountain towns are seeing more summer vacationers in a trend that promises swifter growth than downhill skiing — especially if weak snowfall continues in the high country. 5 Gunnison‐Crested Butte Tourism Association SKI TRAVELERS: WHO ARE THEY? According to the 2013 PhoCusWright U.S. Skier and Ski Traveler Report; and PhoeCusWright Consumer Travel Report/5th Edition, adults who take ski trips are a distinct and special bunch: Compared to the general U.S. traveler population, a higher proportion of ski travelers are male, younger and more affluent. Whereas U.S. travelers are evenly split between male and female – with women frequently taking a lead in travel planning and therefore attracting considerable attention from travel marketers – this is not the case with skiers. About two thirds of skiers are male, under 45, and perhaps of most importance to travel marketers, high earners. Nearly half report an annual household income of at least $100,000, compared to a quarter of general U.S. travelers 58% report downhill skiing as the most common form of the sport. Snowboarding has become a truly distinct phenomenon, representing 25% of the total ski/board market. Most skiers refer to themselves as either skiers or snowboarders, though 16% of those surveyed do participate in both. Of those who participate in both, 6 out of 10 are under the age of 35. The Information Age: Skiers – both day skiers and ski travelers – are much more digitally engaged than U.S. travelers. Three fourths of day skiers own a smartphone, and nearly half own a tablet. Eight in 10 ski travelers own a smartphone, while more than half (55%) own a tablet. Both groups of skiers are much more likely to own these devices than are general U.S. travelers. High mobile device ownership affects the entire ski travel life cycle: Ski travelers are more likely to research, shop for and share their ski travel experiences through their smartphones and tablets. Social Media: Skiing, like travel, is a social experience. Just 15% of skiers typically use social networks when planning and shopping for their ski travel, the incidence. Ski travelers are more inclined than other segments to share their travel experiences. 6 Gunnison‐Crested Butte Tourism Association Ski Factors Driving Destination Selection: Ski Travel Shopping: Online information sources – including websites and apps – dominate the ski travel shopping process. Seven in 10 ski trips are planned using websites via computer. Online Purchase Incidence of travel components and lift tickets: HIGHLIGHTS & CONCLUSIONS A rebounding economy demonstrates an upward trend in travel. A slow economy led to more conservative choices for travel in recent years, resulting in shorter, less expensive trips. 2013 GCBTA advertising results, and tax receipts, demonstrate a positive turn around for the Gunnison‐Crested Butte area. Retiring ‘Baby Boomers,’ the largest population, will take advantage of their wealth and free time to travel more. Consumer use of available technology allows them to make better‐informed decisions about purchases and serve as “go‐to” authorities for each other about the value and reliability of different options. This reality underscores the importance of connecting with consumers at every touch point – before, during and after their trip. THE VACATION PLANNING PROCESS Travel is not typically an impulse purchase. For many visitors, a trip to Crested Butte or Gunnison is the culmination of a dream – maybe the trip of a lifetime. Inspired to visit many destinations, consumers go through a complex planning and purchase process to narrow a long list of potential destinations, gather information, make a decision, and eventually purchase a vacation. Throughout their vacation, consumers continue to make decisions about daily activities such as where to eat, activities, attractions and more dining and attractions, as well as evaluating their overall vacation experience. TRENDS, OPPORTUNITIES AND MARKETING STRATEGIES The development of this three‐year marketing strategy has been guided by careful attention to tourism trends – on the local, regional and national level – in an attempt to identify the best drive/fly markets from which to draw visitors, celebrate the diverse tourism products available in the County by season, and adapt to changes in how visitors search for information and have changed their travel behavior. 7 Gunnison‐Crested Butte Tourism Association Gunnison‐Crested Butte’s social media efforts and new website will continue to capitalize on the consumer’s need for timely and relevant information – delivered in a variety of mediums compatible with mobile, tablet and desktop devices. In terms of marketing focus and segmentation, the research clearly shows that the top segments of interest, value and opportunity for destinations within Colorado continues to be skiers in winter and touring vacationers in summer. Unlike many other consumer purchases, visitors buy a destination “experience” comprised of places to visit, places to stay and things to do. As a leading vacation destination, Gunnison‐Crested Butte’s assets are numerous, with consumers citing outdoor recreation, The marketing and media plans embrace and capitalize on shifts in consumer travel habits from weeklong vacations to shorter, less expensive, more value‐ oriented(not discounted) trips. The plan also embraces the use of constantly changing technology (online/social/eMarketing) to allow Gunnison‐ Crested Butte to capitalize on immediate opportunities such as seasonal changes weather (snow conditions, fishing or fall foliage), and to promote available inventory in peak and off‐seasons. The marketing strategy also focuses on the number of airline seats, acknowledging year‐round, nonstop jet service to the Gunnison‐Crested Butte Regional Airport (GUC) from Denver on United Airlines, winter seasonal flights from Chicago on United and from Dallas/Ft. Worth on American. And nonstop winter and summer flights from Houston on United. MARKETING STRATEGY The multi‐year marketing strategy is designed to create a roadmap that results in increase visitor volume, revenue, and economic growth through tourism over a period of three years. We will achieve our goals through action in four key areas: 1. Maintaining current market share by helping the community to deliver on the brand promise and reducing competitor encroachment; 2. Growing new and emerging markets to increase overall visitation to the County; 3. Removing barriers to growth by encouraging collaborative partnership opportunities and coordination between destinations within the county; 4. Delivering focused and integrated marketing efforts in priority drive/fly markets with emphasis on reaching high potential markets that we’re currently not reaching while continuing to message to our tried‐and‐true customers; and 5. Helping the community to create and deliver its version of an excellent visitor experience. YEAR‐ROUND OVERNIGHT LEISURE VISITORS ORIGINATE FROM: FOR COLORADO (skewed FOR GUNNISON‐CRESTED by Denver)* BUTTE** Colorado Colorado California Texas Texas California Arizona Illinois New Mexico New York Illinois Florida Kansas Arizona New York Oklahoma Florida Missouri Nebraska Washington Utah Top urban areas Top urban areas generating generating Colorado’s GCB’s overnight visitors:** overnight visitors: Denver, CO Denver Dallas‐Ft. Worth, TX Colorado Springs Grand Junction‐ – Pueblo Montrose, CO Albuquerque – Colorado Spring‐ Santa Fe Pueblo, CO Grand Junction – New York, NY Montrose Houston, TX Phoenix San Francisco‐ Los Angeles Oakland‐San Jose, CA Dallas – Ft. Worth Chicago, IL 8 Gunnison‐Crested Butte Tourism Association Chicago Salt Lake City New York City Los Angeles, CA Phoenix, AZ *Source: CTO, Longwoods International, Colorado Travel Year 2012 **Source: GCBTA data from 2013 website traffic and advertising inquiries Social Media Audience Engagement: Top 10 Fans by State 1. Colorado 2. Texas 3. Oklahoma 4. Illinois 5. New Mexico 6. Arizona 7. Kansas 8. California 9. Missouri 10. Washington Top 10 Fans by City 1. Denver 2. Gunnison 3. Colorado Springs 4. Crested Butte 5. Grand Junction 6. Boulder 7. Pueblo 8. Fort Collins 9. Dallas, TX 10. Austin, TX Top 10 “People Reached” by state 1. Colorado 2. New Mexico 3. Texas 4. Illinois 5. Oklahoma 6. Arizona 7. Kansas 8. New York 9. Nevada 10. Utah Top 10 “People Reached” by City 1. Denver 2. Colorado Springs 3. Gunnison 4. Crested Butte 5. Grand Junction 6. Pueblo 7. Albuquerque, NM 8. Fort Collins 9. Dallas, TX 10. Houston, TX Top 10 “People Engaged” by state 1. Colorado 2. Texas 3. Oklahoma 4. Arizona 5. Illinois 6. Kansas 7. New Mexico 8. Virginia 9. Missouri 10. Minnesota Top 10 “People Engaged” by City 1. Gunnison 2. Denver 3. Colorado Springs 4. Crested Butte 5. Grand Junction 6. Pueblo 7. Houston, TX 8. Dallas, TX 9. Austin, TX 10. Montrose **Source: GCBTA 2013 social media analytics 2014 MEDIA & PUBLIC RELATIONS TACTICS Deploy year‐round media efforts to promote best offerings and continue to garner top of mind awareness for Gunnison‐Crested Butte as a preferred destination. Print 2014 Colorado Official State Visitors Guide AARP The Magazine AAA Encompass – Colorado AAA – regional targeting Boulder Weekly – seasonal Scene magazine issues Crested Butte News – seasonal vacation planner issue; promote Visitor Centers Denver International Airport – Vacation Planner Distribution Denver Life ‐ regional Elevation Outdoors – regional Gunnison Country Magazine – annual issue; ad to promote Visitor Centers High Country Angler – national Newspaper Insert – geo‐targeted to top 10 DMA’s Texas Monthly ‐ regional Traveler Fun ‐ national True West – national 9 Gunnison‐Crested Butte Tourism Association United Hemispheres – national US Pro Challenge – regional advertising to promote the 2014 event Online/eMarketing AARP.com – travel site & targeted eNewsletters AmericanCowboy.com Bootprints.com Colorado.com CTO eNewsletter features CTO/Madden Media geo‐targeted eMarketing to Chicago, Houston, Dallas, Colorado and Oklahoma Chicago Travel & Adventure Show CrossCountrySkier.com Digital Post Media/Denver Post Go‐colorado.com LAmagazine.com eMarketing – Colorado eMarketing – geo‐targeted eMarketing – Gunnison Getaways Expedia.com MyWedding.com Official GCBTA Visitor website On the snow.com Paddling.net SEO program – elevate web rankings Sojourn Traveler Taking the Kids/Fun in the Snow Texas Monthly eNewsletters & web USAToday.com travel section US Pro Challenge – targeted eMarketing to promote the event US Pro Challenge – online advertising to promote the event Virtual vacation planners – online niche publications premiering 2014 (weddings, Kid‐ friendly, etc.) Radio Houston – summer flight promotion (partnership with the RTA) Houston – ski season campaign Dallas/Ft. Worth – ski season promotion Out of Home; Marketing partnership with RTA to promote Houston non‐ stop service RTA airport banners RTA bus panels RTA luggage tags Social Media GCBTA is following every hospitality‐related Chamber of Commerce member in our news feed Ongoing postings to promote events, attractions, dining, etc. by season Feature events Airline and travel deals Deal of the Day (lodging, photo workshops, etc.) Seasonal campaigns Website Brand new visitor website Updated features include: o Dynamic website designed to be responsive to various platforms including mobile, laptop and desktop devices o Calendar of events by event type and date o Chamber Members may access their listings and update content 24/7 o Links to new areas, including the CBMR Snow Report, Western and more Fulfillment The official and comprehensive Gunnison‐Crested Butte Vacation Planner is created and mailed to travelers in response to advertising inquiries The official guide is also distributed at Colorado Welcome Centers, Denver International Airport, and regional Visitor Centers Introduce in 2014 a series of online (downloadable) niche vacation planners for ease of activity planning: o Destination Wedding Guide o Sportsmen’s Guide o Kid‐friendly Activities Guide o Other niche guides to be identified Public Relations Calendar of Events – GCBTA outreach to the local hospitality community is an ongoing effort throughout the year, resulting in the most robust and comprehensive visitor event calendar in the Valley. News releases – local News releases – Colorado News releases – national + geo‐targeted to top DMA’s Journalist visits – host individual travel writers throughout the year Journalist Familiarization (FAM) Programs – group of journalists hosted in partnership with Colorado Tourism Office and Crested Butte Mountain Resort: Mexico, Germany & United Kingdom and more 10 Gunnison‐Crested Butte Tourism Association Colorado Media Blitz – to be conducted in Spring and Fall, targeting travel writers and editors with in‐ person visits to remind them of Gunnison‐Crested Butte travel offerings Blog – monthly story postings to promote seasonal offerings/experiences to be introduced summer 2014 THE GUNNISON‐CRESTED BUTTE VISITOR Lifestyle Analytics of Colorado DMA’s: Denver residents are: 203% more likely than the national average to participate in snow skiing/winter sports 62% more likely to participate in camping/hiking 40% more likely to enjoy horseback riding 39% more likely to take part in mountain biking activities 24% more likely to attend arts/cultural events 11 Gunnison‐Crested Butte Tourism Association Colorado Springs residents are: 131% more likely than the national average to participate in snow skiing/winter sports 68% more likely to enjoy horseback riding 63% more likely to enjoy camping and hiking 23% more likely to enjoy hunting/shooting 20% more likely to fishing frequently 11% more likely to take part in mountain biking activities 4% more likely to attend cultural/arts events WHEN DO THEY VISIT SPRING Demographics: Weekend warriors Sports enthusiasts Empty‐nesters Couples without children SUMMER FALL Demographics: Outdoor Families Weekend warriors Sports enthusiasts Empty‐nesters Couples Demographics: Weekend warriors Sports enthusiasts Empty‐nesters Couples WINTER Demographics: Outdoor family travel (lighter focus than summer) Empty nesters Couples Weekend warriors Sports enthusiasts WHERE DO THEY COME FROM? SPRING SUMMER FALL Geographic: CO and TX (some national reach) Drive/fly markets Geographic: primarily CO and TX; secondary CA, FL, IL, NY, MO, KS, OK Drive/fly markets Geographic: CO and TX; select mid‐west states (some national reach) Drive/fly markets WINTER Geographic: Denver, Houston, Colorado Springs, Dallas – Ft. Worth, Austin, San Antonio, Grand Junction, S. California Chicago and Arizona Fly/drive markets WHAT DO THEY DO WHEN THEY’RE HERE SPRING SUMMER Fishing Fishing Mountain biking Mountain biking, Western heritage Western heritage Rafting National Parks Events Boating Arts/culture Hiking Packages Rafting Dining & Spirits Farmer’s Market Horseback riding Wildflowers Weddings Western heritage Night skies Driving tours Events Arts/culture Dining & Spirits 12 Gunnison‐Crested Butte Tourism Association FALL Hunting Fishing Mountain biking, Western heritage Soft adventure (fall colors/scenic drives) Rafting Farmer’s Markets National Parks Horseback riding Night skies Driving tours Arts/culture Events Weddings Dining & Spirits WINTER Downhill skiing Nordic skiing Dog Sledding Tubing Snowshoeing Snowmobiling Ice skating Ice fishing Arts/culture Events Weddings Dining & Spirits STRATEGIC MARKETING GOALS 2013 TO 2015 DESIRED OUTCOME: INCREASE VISITATION TO GUNNISON COUNTY 13 GOAL #1: MAINTAIN VISITOR MARKET SHARE AMONG KEY GEOGRAPHIC MARKETS o OBJECTIVE #1: Each year, identify/confirm our top 5 geographic markets STRATEGY: Conduct primary and secondary research to confirm top 5 geographic markets and adjust accordingly. TACTIC: Utilize primary research employed by GCBTA and its community partners: may include Visitor intercept studies, Destimetrics (formerly MTrip), online surveys. TACTIC: Utilize secondary research available in the market: DMAI national research, Dean Runyan, Longwoods International, and other Colorado Tourism Office studies. TACTIC: Make necessary adjustments to the strategic plan based on research outcomes. o OBJECTIVE #2: In 2014/15/16, maintain our visitor market share in the top 5 geographic markets STRATEGY: Create opportunities to (re)connect with our current customer base and provide timely and relevant points of persuasion. TACTIC: Grow our consumer database by specific interest (i.e. Skiing, arts/culture, etc.) and customize messages to engage the visitor about the topics that interest them most. Include a strong call‐to‐action and incentivize visitation. TACTIC: Monitor and harness the power of social media to enhance and leverage the positive experiences of travelers to attract new visitors, as well as encourage return visits. TACTIC: Use nimble marketing channels to connect “just‐in‐time” and be part of the conversation: eMarketing, Facebook, blogs, etc. STRATEGY: Ensure that travelers become more familiar with the broad range of recreational opportunities, attractions and events/festivals/activities available to them. TACTIC: Segment by season and by visitor interest – and add information about events that may occur in the same season to extend visitor stay. Gunnison‐Crested Butte Tourism Association TACTIC: Employ niche marketing initiatives to detail offerings to specific target audiences. STRATEGY: Work toward creating a market‐driven organization to solidify and strengthen our competitive advantage. TACTIC: Promote easy access to the drive and fly markets using eMarketing, electronic, web, print and collateral. TACTIC: Build a destination experience for the visitor by looking beyond a specific interest, such as skiing, to include many more activities and attractions such as Nordic skiing, dog sledding, hay rides, dining, nightlife, and lodging. Employ the same tactic in spring, summer and fall seasons to entice consumers to stay longer and spend more. TACTIC: Promote easy access via direct flights to local and regional airports by including travel options in all forms of advertising and a link to purchase lodging/air packages. 14 STRATEGY: Work with industry to coordinate marketing roles and responsibilities to reduce overlap and enhance impact. TACTIC: Through strategic marketing partnerships, coordinated campaigns and innovative use of emerging marketing tools, to reach new customers and drive long‐ term growth. TACTIC: Compile industry partner data to reinforce clear and mutual target markets. GOAL #2: GROW VISITATION FROM HIGH‐POTENTIAL, UNDERPERFORMING MARKETS o OBJECTIVE #1: Each year, identify new opportunities to expand our key geographic market presence. STRATEGY: Employ primary and secondary research to identify and capitalize on new opportunities in markets where consumer are expressing an interest in our destination but where we haven’t yet concentrated our marketing efforts. TACTIC: Conduct Online Surveys, Visitor Intercepts, and Brand Awareness studies. STRATEGY: Formulate strategic marketing campaigns and media designed to reach new visitors in key fly/drive markets who have the highest propensity to visit based on seasonality and niche interests. TACTIC: Work closely with RTA to identify travel trends, fly markets and available airline seats. Initiate geo‐targeted marketing efforts to message to fly markets. TACTIC: Launched a NEW mobile version of our visitor website in 2013 to keep pace with consumer demand. o OBJECTIVE #2: Each year, grow market share in the top 3 by 1% aggregate. STRATEGY: Develop marketing strategies for the top 3 markets. TACTIC: Expand our public relations initiatives to invite two key journalists to visit annually. TACTIC: Employ guerilla marketing tactics to create top‐of‐mind awareness. Gunnison‐Crested Butte Tourism Association GOAL #3: EXPAND TOP‐OF‐MIND BRAND AWARENESS o OBJECTIVE #1: Establish brand awareness benchmark through credible, 3rd party research. STRATEGY Define funding source to outsource research. TACTIC: Stay ahead of industry trends and identify key funding sources to ensure funding for destination marketing. TACTIC: Conduct bi‐annual research studies STRATEGY: Conduct Brand Awareness Study to Determine our Brand Image in the Minds of the Consumer. TACTIC: Identify necessary resources, financial needs, staff involvement and prospective contractor(s) and deploy appropriate resources. STRATEGY: Review brand attributes, brand promise and creative assets each year TACTIC: Engage the traveling public to provide our consumers with an opportunity to respond to our marketing messages and adjust messaging and mediums accordingly. TACTIC: Work off establish benchmarks to update/evolve annual strategic marketing plan. o OBJECTIVE #2: By December 2014, measure the brand affinity of our loyal visitors (the goodwill that our customers have about us as a destination) and develop a program to empower them as brand ambassadors (influence others to buy). STRATEGY: Develop program to establish brand ambassadors that bring other visitors back to GCB with them (how do we get them to do the behavior we want them to do). TACTIC: Initiate a loyalty/rewards program to reward brand ambassadors (show them the value/incentivize). TACTIC: Create market awareness of, and preference for, the affinity program. o OBJECTIVE #3: Expand our reach and frequency though aligned and integrated programs. STRATEGY: Make sure that all of our efforts (PR, marketing, social media, videos) have a common thread/tone that ties through everything. TACTIC: Integrate public relations with social media, eMarketing, traditional and other non‐traditional media buys. GOAL #4: INFLUENCE INCREASES IN VISITOR SPENDING o 15 OBJECTIVE #1: By June 1, 2014, establish seasonal benchmarks for average length of stay and daily Visitor Spending. STRATEGY: Gather, analyze and employ primary (fresh information) and secondary data (already in existence) to establish the benchmark. TACTIC: Acquire and analyze data received from the Colorado Tourism Office, Dean Runyan, MTrip, AAA and other credible sources. Gunnison‐Crested Butte Tourism Association o TACTIC: Use online metrics captured in Internet Honey to develop consumer profiles for use in the benchmark. OBJECTIVE #2: By June 2014, develop a long‐term program designed to shift brand affinity (preference) to become brand ambassadors (influencers) STRATEGY: Build a strong customer brand affinity over the period of 12 months TACTIC: Engage the public – and the community – in a multi‐media campaign, tackling one geographic market at a time while creating interest from the next community. TACTIC Reward brand ambassadors: website presence, blogs, public relations efforts o OBJECTIVE #4: By December 30, 2015, increase overnight visitors to Gunnison County by 2% STRATEGY: Package and/or cross‐promote like‐minded activities/events to create a bigger presence to extend visitor stay TACTIC: Employ travel incentives (not price‐related) to motivate our customers to buy more as well as more often. Travel incentives are an inexpensive way to significantly increase the value of a destination sale. 16 Gunnison‐Crested Butte Tourism Association