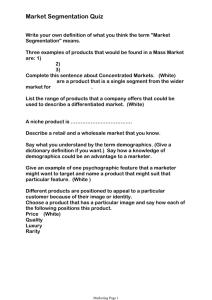

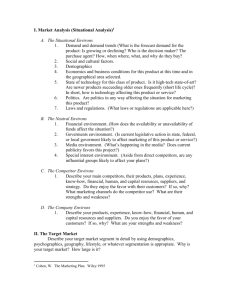

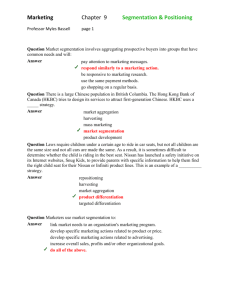

Translating Segmentation Findings into Strategy

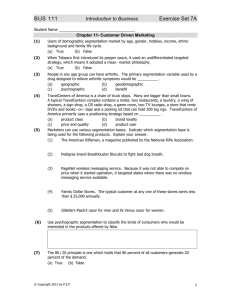

advertisement