Selected Topics from Chapter 5: International

advertisement

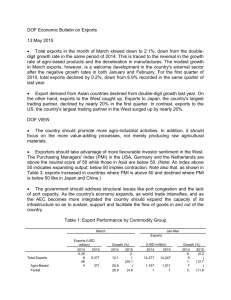

Selected Topics from Chapter 5: International Markets and Trade Y " C " G = I + NX S " I = NX Small Open Economies and the Worldwide Interest Rate In the closed economy, domestic savings and investment determined the interest rate in our economy. But now, we’re in a world where international borrowing and lending is possible, and the worldwide interest rate is determined by the levels of worldwide savings and worldwide investment. If we’re a small economy, we can’t really change either of those variables. So we’re stuck taking the interest rate that’s given to us. Our level of investment is now determined by where the investment demand curve meets the worldwide interest rate. This means savings and investment no longer have to be equal – if we demand more money for investment that we have in savings, we just borrow from abroad. If we have more savings that people want to use to invest, we lend abroad.1 Sw r Sd r In words, the difference between savings and investment will always equal net exports (net capital outflow = net exports). As such, in our situation above, where we had more savings than investment, ! we’re going to have a positive net exports, and we’re running a trade surplus. Okay, keep that in the back of your minds for later. Exchange Rates Just like there’s a real and nominal GDP, and a real and nominal interest rate, now there’s a real and nominal exchange rate. The nominal exchange rate is just the relative price of currency (for example, right now 100 dollars will buy you 54.59 British Pounds). Basically, it tells you how much of one currency you can buy with another. The real exchange rate takes that nominal interest rate, and then factors in price differences. It’s given by pd "r = en * f p r* Iw(r*) Id(r*) S, I S, I I S, I (note: w subscripts indicate “world” rates, d subscripts indicate “domestic”) In the above case, our savings is greater than our investment, thus, we will lend abroad. But there’s something else there. Recall that Y = C + I + G + (X " M) NX = (X " M) where NX is net exports (exports minus imports). Well, with a little rearranging, we can show that ! 1 What prevents our little economy from using our own interest rate? Logical consumers. Imagine you’re a borrower, and the worldwide interest rate was lower than the interest rate determined in our little economy. You could just borrow from abroad at that lower rate. If you were a lender, and the worldwide interest rate was higher than our domestic one, then you would lend abroad. These two forces insure that the going rate in our economy will be the worldwide interest rate. Prepared by Nick Sanders, UC Davis Graduate Department of Economics 2005 where !r is the real exchange rate, en is the nominal exchange rate, and pd and pf are domestic and foreign prices, respectively. ! The real exchange rate tells us how many goods we can actually purchase in foreign countries. Mankiw uses cars as an example. Say an American car costs $10,000, and a Japanese car costs 2,400,000 yen. How expensive is the Japanese car compared to the American car if the exchange rate is 120 yen to the dollar? (120 yen/dollar) X (10,000 dollars/American car) (2,400,000 yen/Japanese car) Run the math, and we find that one Japanese car will buy about two American cars. Thus, the real exchange rate for this product is 2:1 (with American cars being listed first). The real exchange rate is the relative price of foreign to domestic goods. Great. What does this have to do with the price of tea in China? Wait . . . it does actually have something to do with the price of tea in China. Who saw that coming? Well, I guess we’d better move on then. The Real Exchange Rate and Net Exports Isn’t it wonderful how in economics everything just ties together? We’ve learned about net exports, and about the real exchange rate. Remember how I said to keep that net Prepared by Nick Sanders, UC Davis Graduate Department of Economics 2005 export stuff in the back of your head? Bring it back to the front. Now let’s see what happens when they start dating (in a purely economic sense, of course . . . neither is looking for a commitment right now). The higher the real exchange rate, the more powerful the dollar. As such, it’s cheaper for us to buy foreign goods, and more expensive for other countries to buy American goods. Logically, the higher the real exchange rate, the lower our net exports (we’ll be importing lots and not exporting much). So just like the investment demand curve was downward sloping due to the interest rate, the NX curve is downward sloping relative to the real exchange rate. We saw before that net exports need to equal S – I. That means we can build another graph. Yay, pretty pictures! ! S-I Large Open Economies and the Worldwide Interest Rate Logically, we can’t assume that a large worldwide economy like that of the US can be analyzed in the same way as a smaller economy like that of, say, French Guinea. Why not? The largest difference is that the United States is enough of a world player to actually influence the level of worldwide savings and investment, which means the whole “take the interest rate as unchanged and given” really isn’t going to fly. We’ll have to change the model a little bit to have this make sense. First, we add an additional component, Net Capital Outflows (called CF in class). CF allows us to examine the model when people prefer to invest in one country above another, for any variety of reasons (higher interest rate, lower risk, etc.). It measures the amount of money that flows in and out of the country. When CF is positive, it means that more money is flowing OUT of the country than IN. When CF is negative, it means that more money is flowing IN than OUT.3 All else held constant, a higher interest rate in a country will make people want to put more of their money into said country. Suppose, for example, that the interest rate in the US is 7%, while the interest rate in Argentina is 4%. We would assume that more investors, both foreign and domestic, would want to put their money into the US over Argentina. ! NX (!) Thus we arrive at the result that CF is negatively related to the interest rate . . . the higher the interest rate in a large open economy, the lower CF, and vice versa. The interest rate is determined much like it was before (the loanable funds market). But now, we have to take into consideration CF as well as I . . . so instead of S = I(r), we have S = I(r) + CF(r). NX Sd r Looks pretty similar to our old Savings/Investment graph, no? That’s no coincidence. The old one told us that the real interest rate makes sure savings always equals investment. This one tells us that the real exchange rate makes sure S – I always equals NX.2 Why? Think of it this way. In order to buy our exports, countries have to buy our dollars first. How many dollars they can buy is based on our capital outflow. The more dollars there are flowing out (the higher the supply of dollars to foreign consumers) the lower the cost to buy them (i.e. the exchange rate). The lower the real exchange rate, the more foreigners want to buy our goods (because they’re cheaper relative to their domestic goods) and the less we want to buy their goods (because they’re more expensive compared to our domestic goods). The real exchange rate keeps changing until the demand for exports exactly equals the demand for outflowing capital dollars, and we have equilibrium again. Ta da! r Id(r) + CF(r) S, I + CF Note again the subscripts . . . we’re talking about domestic savings and investment, here. 2 Why is S - I a straight line? Because investment is determined by the real worldwide interest rate and savings is fixed by the consumption function. So neither of them change when the real exchange rate changes. Prepared by Nick Sanders, UC Davis Graduate Department of Economics 2005 3 Sound familiar? Kind of like NX, perhaps? Prepared by Nick Sanders, UC Davis Graduate Department of Economics 2005 Now, even though we’re in an open economy, we can’t be out of equilibrium. Why not? Because if there is any difference between S and I, it will be accounted for in CF. Imagine we have less domestic savings than domestic investment. That means that we’re importing investment moolah, and thus CF is NEGATIVE (i.e. the amount of money flowing OUT of the country is lower than the amount flowing IN). The opposite effect will hold if S > I. Now we need to carry this over into the world of net exports. We know that NX = S – I, and that S = I + CF. Substitution then gives us These three graphs will tell you quite a few stories. For example, say our domestic S decreases . . . what happens to NX, or to the real exchange rate? What if a risk factor makes our economy less desirable for investment at all given interest rates? What will happen to NX then? NX = S " I# % & NX = I + CF " I = CF S = I + CF $ Aha! CF equals NX. No wonder their stories were looking so similar. And they’ll always equal each other, due to that little variable we call the real exchange rate . . . just like ! S – I. That’s how we’ll connect our interest rate differential with the before with NX = real exchange rate and net exports. Sd r r FURTHER STUDY Mankiw has some great examples of what policy changes can do to net exports and the real exchange rate. Try to run through them, follow them along, and recognize the patterns in movement (in both the small and large open economy). What does an increase in taxes do to our real exchange rate? What does an increase in government spending do to our net exports? If you can follow these patterns, you’re darn close to getting this stuff down. Also, take a good long look at the relationship between the nominal exchange rate and inflation. What does a domestic inflation do to our real and nominal exchange rates? What about net exports? r r It makes sense that an increase in CF, all else held constant, would decrease our real exchange rate. Why? If CF is going up, it means more dollars are being purchased with foreign currency, which means more dollars are floating around in the market for international currency exchange. Using our old “supply and demand” theory, we can expect that the more of a good there is in the market, the lower its price, which is just what we’re seeing here. CF(r) Id(r) + CF(r) S, I + CF CF ! CF ! NX (!) NX NX Prepared by Nick Sanders, UC Davis Graduate Department of Economics 2005 Prepared by Nick Sanders, UC Davis Graduate Department of Economics 2005