The IRA Distribution Manual

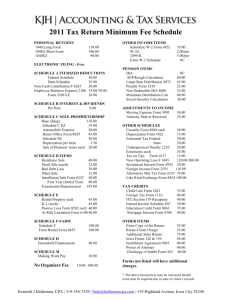

advertisement

SEPTEMBER 2010 The IRA Distribution Manual A Guide to Receiving Benefits From Your IRA Contents 1. Retirement Income.................................................................2 2. Early Retirement.....................................................................3 3. Required Minimum Distributions..............................6 4. Your Beneficiary Election..............................................9 5. Tax and Possible Penalties..........................................14 6. Estate Planning and Your IRA...................................18 7. Beneficiary Distribution Rules...............................20 8. Life Expectancy Tables.....................................................21 Morgan Stanley Smith Barney IRA Distribution Manual The IRA Distribution Manual Over the course of your career, your IRA may have served as a cornerstone of your long-term investment plan. Its ability to shelter personal contributions from annual taxation, and to continue the tax-deferred status of retirement plan rollovers means that your IRA now represents the fruits of your labors and investment acumen. Structuring a distribution strategy that best meets your income needs, while keeping in mind the future needs of your spouse or other beneficiaries, requires some thoughtful advance planning. Morgan Stanley Smith Barney produces this manual to make you aware of the numerous interrelated issues that could affect your decisions. Please take some time to read carefully the sections that are pertinent to you. Since the regulations governing IRA distributions are complex and change from time to time, and Morgan Stanley Smith Barney cannot serve as your legal or tax advisor in interpreting these rules, you will undoubtedly want to solicit your tax and legal advisors’ opinions on these matters as well. Of course, it is impossible for a manual to describe every situation. For specific questions and guidance, feel free to ask your Financial Advisor about our complimentary financial planning analysis to help you and your advisors in the decision-making process. Tax laws are complex and subject to change. Morgan Stanley Smith Barney LLC, its affiliates, and Morgan Stanley Smith Barney Financial Advisors do not provide tax or legal advice and are not “fiduciaries” (under ERISA, the Internal Revenue Code or otherwise) with respect to the services or activities described herein except as otherwise agreed to in writing by Morgan Stanley Smith Barney. This material was not intended or written to be used for the purpose of avoiding tax penalties that may be imposed on the taxpayer. Individuals are urged to consult their tax or legal advisors before engaging in any transaction involving IRAs or other tax advantaged investment vehicles. Morgan stanley Smith Barney 1 1. Retirement Income The primary reason for funding your IRA and adding rollover amounts to it during the course of your career is to provide income during your retirement years. Retirement Withdrawal Options For IRA distribution purposes in this Manual, retirement is defined as the time after you reach age 59½, whether or not you continue to work. Your IRA offers considerable flexibility in arranging withdrawals. Some of the most popular withdrawal options are: Withdrawal Rules • A total or partial distribution of cash and/or securities at any time. Beginning at age 59½, there are no restrictions on the frequency or size of withdrawals from your IRA. At any time you may request a partial or total distribution from your IRA. Taxation of Withdrawals, Traditional IRAs Depending on the type of contributions in your Traditional IRA, withdrawals will be partially or totally subject to ordinary income taxes. Deductible IRA contributions and all IRA earnings are taxed as ordinary income upon distribution. Nondeductible contributions made since 1987—and after-tax rollover contributions made in 2002 and later—generally are not taxable when withdrawn. However, for purposes of determining the taxable portion of a particular distribution, all Traditional IRAs must be aggregated and before-and after-tax contribution amounts removed on a proportionate basis under Internal Revenue Code requirements. In order to exempt nondeductible contributions from taxation, it is important that you document each nondeductible contribution by attaching IRS Form 8606 to your tax return for the year the nondeductible contribution was made. Your IRA statement tracks the amount of deductible and nondeductible contributions you have made to assist with this recordkeeping requirement. Roth IRAs Roth IRA distributions generally are not taxable, unless they are removed from the Roth IRA within the first five years of the Roth IRA’s existence and you are under age 59½, in which case the earnings component of the distribution would be taxable. A Roth IRA withdrawal of earnings before age 59½ will trigger taxes, plus a premature distribution penalty. FMA® is a registered service mark of Citigroup Global Markets Inc. 2 • Regularly scheduled distributions of a specific amount, or dividends and income only. • Scheduled or ad hoc distributions delivered to you, transferred to your Morgan Stanley Smith Barney retail brokerage account, or transferred directly to your bank checking account through our Automatic Funds Transfer service. • The convenience of a checkbook with our IRA/FMA® service. • Auto-RMD to ease the concerns about receiving Required Minimum Distributions on time, every time. Your Financial Advisor can provide you with additional information about the benefits and features of any of our distribution options, and facilitate the processing of your withdrawal request. Go to Section 5, “Taxes and Possible Penalties,” for information on how to calculate the taxable and nontaxable portion of an IRA distribution as well as for more Roth IRA information. Morgan Stanley Smith Barney IRA Distribution Manual 2. Early Retirement While the primary purpose of an IRA is to accumulate and conserve your assets for retirement, the realities of modern life sometimes run counter to the typical definition of “retirement years.” So while the tax laws discourage distributions before age 59½ by imposing an additional 10% penalty tax on early withdrawals, the laws also recognize an increasing number of penalty-free exceptions. EARLY RETIREMENT Substantially Equal Periodic Payments Early retirement for IRA distribution purposes in this Manual refers to distributions received prior to age 59½, regardless of whether or not you are working. Substantially Equal Periodic Payments (also known as “Section 72(t) Distributions,” after the section of the Internal Revenue Code permitting their use) are a way for you to receive periodic distributions from your IRA before age 59½ without the usual 10% premature distribution penalty tax. You may select one of three permitted calculation methods for determining the amounts you may receive. There are, however, some important restrictions. Nonpenalized Distributions The 10% premature distribution penalty tax is only waived under the tax rules for: • Death distributions paid to a beneficiary • Disability • Medical expenses exceeding 7.5% of adjusted gross income • College tuition expenses for yourself or family members • Purchase of a first home ($10,000 lifetime maximum) per eligible “qualified first time home buyer” • Payment of medical insurance premiums after receiving unemployment compensation for more than 12 weeks • Qualified disaster distribution for limited geographic areas for limited time periods as declared by the President or defined by law • Qualified Reservist distribution for individuals called into active duty for more than 179 days • “Substantially Equal Periodic Payments” as outlined below: The following rules apply to Substantially Equal Periodic Payments: • Payments must be made at least once a year until age 59½, or for five years, whichever period is longer. If you stop (or change, except as described below), the penalty tax is imposed. • In general, you may not change the method or calculation assumptions after payments have begun, except in the case of death or disability. See the limited exception to this “no-change” rule on page 4. • If you have more than one IRA, you may elect Substantially Equal Payments from one or more accounts. Or, if you have one large IRA, you may wish to divide the account and receive Substantially Equal Payments from one account only. • If you begin Substantially Equal Payments in the middle of the year, you may prorate the first year’s distribution amount. Morgan stanley Smith Barney 3 • You must use IRS-stipulated interest rate assumptions and the IRS-approved life expectancy factors when determining Substantially Equal Payments. • If you have made deductible and nondeductible contributions, see Section 5, “Taxes and Possible Penalties,” for information on how to calculate the taxable portion of each year’s Substantially Equal Payments. Substantially Equal PERIODIC Payment Methods IRS Revenue Ruling 2002-62 contains details on each component of determining a Substantially Equal Periodic Payment: determining the account balance, the correct interest rate assumption and life expectancy factors and the three methods for calculating Substantially Equal Periodic Payments. Life Expectancy Method The first calculation method is commonly known as the Life Expectancy Method or the required minimum distribution method. This method uses the most recent life expectancy factors issued by the IRS and the value of your IRA as of any available valuation date prior to that year’s distribution, but not earlier than the previous year-end value. Therefore, if the value of your IRA increases, so will the amount distributed. Conversely, if the value of your IRA declines, your distribution for the year will be reduced. Generally, this method of calculating the series of Substantially Equal Payments will provide for the smallest distribution of the three allowable methods, and unlike the other two distribution methods, the amount will change each year based on the IRS life expectancy tables without being deemed an impermissible modification. EXAMPLE If you are age 50 when you initiate a Substantially Equal Payments program, you must receive distributions at least annually until age 59½. However, if you are age 57 when you begin, you will need to take payments for five years until age 62. For illustrative purposes only. 4 FIXED Annuitization Method The Annuitization Method substitutes a present value annuity factor for the life expectancy factor used in the other two methods. In the Annuitization Method, the value of the IRA is divided by an annuity factor (the present value of an annuity of $1 per year beginning at your attained age in the first year and continuing for life) to yield the fixed distribution amount. The annuity factor must be determined using the IRS-provided mortality tables. In spite of its name, there is no need to actually invest in an annuity to choose this option. Once the dollar amount is determined, it will not change for the duration of the payout period unless you make a one-time election to switch to the Life Expectancy Method. See the section below for details on this election. FIXED Amortization Method The Amortization Method employs the same rules as the Life Expectancy Method for determining the account balance and life expectancy factor but adds a third component—a growth rate assumption. The 2002 Revenue Ruling stipulates that the highest rate that may be used is 120% of the federal midterm rate for either of the two months immediately preceding the initial month of distribution. This rate is published monthly by the IRS and may be found at the IRS web site www.irs.gov. In September 2010, 120% of the federal mid-term rate was 2.33%. Once the dollar amount is determined, it will not change for the duration of the payout period unless you make a one-time election to switch to the Life Expectancy Method. See the section on page 5 for details on this election. Limited Exception to the “No Change” Rule In general, once a withdrawal method schedule is determined, it cannot be changed without risking the retroactive imposition of the 10% premature distribution tax on all prior distributions before age 59½, plus interest. The only exceptions to this rule are for disability or death, or as outlined in the next paragraph. Morgan Stanley Smith Barney IRA Distribution Manual EXAMPLE A 50-year-old wishes to receive Substantially Equal Payments from his $200,000 IRA. Payments would need to continue for 11 years until age 59½. The chosen amortization or annuitization rate is a recent calculation of 120% of the federal mid-term rate. For this example, this assumed rate is 3.2%. The single life expectancy table is applied. Annual Distribution Initial Life Expectancy Payout $5,848 Amortization Method $9,705 Annuitization Method $9,663 Source: Morgan Stanley Smith Barney. For illustrative purposes only. Since 2003, individuals using either the Fixed Amortization or Fixed Annuitization Methods may exercise a one-time election to switch to the Life Expectancy Method. Once this switch is made, the Life Expectancy Method must be used to calculate all future Substantially Equal Periodic Payments. No other options are permitted, such as switching from the Life Expectancy to the Amortization or Annuitization Methods, or from the Annuitization to the Amortization Method. This is an irrevocable choice, and may substantially decrease your income, so please be sure to work closely with your Financial Advisor as well as your tax advisor to carefully model the elections used to determine the revised distributions. Upon request, your Financial Advisor can prepare a customized distribution analysis that calculates the permissible distribution amounts under the three substantially equal payment methods, shows you the number of years you must receive the payments, and highlights their impact on your long-term retirement finances. Trustee-To-Trustee Transfers May Result In Penalties In 2007, an IRS Private Letter Ruling imposed the 10% premature distribution penalty plus interest on a taxpayer who was receiving the correct amount of Substantially Equal Periodic Payments, but, who, during that time, elected to transfer assets between IRA custodians for the purpose of diversifying his investments. The IRS viewed this as an impermissible modification of the Substantially Equal Distribution regulations. While this Private Letter Ruling represents the IRS’ first ruling on this specific issue, it should act as a cautionary warning to consult your tax or legal advisor about the management of an account paying out early distributions or any division or movement of such accounts once a Substantially Equal Periodic Payment has commenced. Morgan stanley Smith Barney 5 3. Required Minimum Distributions Up until age 70½, you may decide whether or not to take distributions from your IRAs. After age 70½, however, regulations governing IRAs generally require that you remove a certain minimum amount from your Traditional IRA, SEP IRA or SIMPLE IRA every year. The minimum amount is calculated using a life expectancy factor and the fair market value of the IRA. Required Beginning Date Roth IRAs April 1 of the year following the year in which you attained age 70½ is your Required Beginning Date. Roth IRAs are exempt from Required Minimum Distributions during your lifetime but nonspouse beneficiaries are required to receive annual payments from the Roth IRA. See Section 4 for more details. Beginning to Receive Distributions The requirement to begin receiving withdrawals from your Traditional IRA, SEP IRA or SIMPLE IRA by December 31 in the year you turn 70½ may be postponed for your first Required Minimum Distribution until no later than April 1 of the calendar year following the year in which you reach age 70½. Subsequent withdrawals of the required minimum amount must be received by December 31 of every year. If you elect to postpone your first distribution until the following April 1, this will result in the first and second required distribution being made in one taxable year. Also, the second distribution will be somewhat larger than necessary, since the year-end value will include the undistributed Required Minimum Distribution. No adjustment to the yearend value is permitted. NOTE: In 2009, the IRS permitted a one-time waiver of the RMD requirements, but that waiver has not been continued for tax years 2010 and beyond. EXAMPLE If your date of birth is August 4, 1939, you will attain age 70½ on February 4, 2010. You may elect to begin distribution of your required minimum amount anytime during 2010 or defer the first withdrawal until as late as April 1, 2011. The second required minimum withdrawal must be received no later than December 31, 2011. The first withdrawal would be based upon the fair market value of your IRA on December 31, 2009. The required amount for the second withdrawal would be based on the December 31, 2010, fair market value of the IRA. (No fair market value adjustment is permitted if you postpone your first distribution.) For illustrative purposes only. 6 Requesting a Required Minimum Distribution To initiate a distribution, contact your Financial Advisor for either the IRA Distribution Request form or the Auto-RMD Request form. You may also download these forms from our web site, www.morganstanleysmithbarney.com. The AutoRMD Distribution Request form will assure that your RMD payments as calculated and displayed on your statements are paid correctly every year, on time without any last-minute paperwork. Complete either form and return it to the office servicing your account. Transfers or Rollovers After Age 70½ If you transfer or roll over your IRA from one custodian to another after age 70½, it may be necessary to recalculate your RMD. The recalculation would adjust your IRA’s year-end value by the amount of any transfer, rollover or recharacterization that did not settle by the previous December 31. You may satisfy your RMD from any IRA account or accounts except Roth IRAs. See special considerations for a Roth conversion after age 70½ on page 17. Please note that annual RMDs may not be converted to a Roth IRA. Morgan Stanley Smith Barney IRA Distribution Manual Insufficient or Late Required Minimum Distributions Determining Your Required Minimum Distribution If you take less than the required minimum amount, you may be liable for a penalty tax equal to 50% of the difference between the amount that should have been withdrawn and the amount actually removed from the IRA. Traditional and Roth IRA beneficiaries who are required to receive annual payments are also subject to the 50% penalty. To determine your distribution period factor, you must use the life expectancy tables published by the Internal Revenue Service. The tables, most recently revised in 2002, are included in Section 8 of this manual. The only tables that apply to IRA account owners are: Your IRA Statement • Joint Life Expectancy Table—only used when a spouse beneficiary is more than ten years younger than you and is the sole beneficiary of your account To help you meet your obligation to receive Required Minimum Distributions from your IRA, an additional section is included in your IRA statement beginning in the year you attain age 70½. Each statement includes information about your Required Minimum Distributions and your primary beneficiary designations. Your statement displays your Required Minimum Distribution amount for the current year based upon these factors: • Your age; • Your IRA’s prior year-end account balance; and • Your beneficiary. If your spouse is your sole beneficiary, the calculated RMD takes into account whether he or she is more or less than ten years younger than you. • Uniform Lifetime Table—most people will use this table Uniform Life Expectancy The Uniform Lifetime Table will be used by IRA owners who are: • Married with a spouse beneficiary who is less than ten years younger • Married with both spouse and nonspouse beneficiaries • Married with nonspouse beneficiaries • Unmarried with or without designated beneficiaries IRS regulations require IRA custodians to report to the IRS which accounts are subject to Required Minimum Distributions. Actual dollar amounts are not reported. Morgan stanley Smith Barney 7 Joint Life Expectancy You may use a joint life expectancy factor only if you have named your spouse (or certain types of trusts for the benefit of your spouse) as the sole beneficiary of your IRA and your spouse is more than ten years younger than you. This life expectancy factor is located on the Joint Life and Last Survivor Life Expectancy Table found in Section 8. If your designated beneficiary is not your spouse (regardless of the beneficiary’s age), or if you name your spouse along with other primary beneficiaries, you must use the Uniform Life Expectancy Table when determining required distributions. GO TO Section 4, “Your Beneficiary Election,” for more details on naming a trust as beneficiary. Calculating Required Minimum Distributions Always use your age as of your birthday for the current calendar year for which you are calculating the distribution. If you use the Joint Life Expectancy Table, use your age and that of your spouse at the end of the year. This means for your first distribution you will use either age 70 or 71, depending on the month of your birth. If you take your first Required Minimum Distribution between January 1 and April 1 of the next year, use your age (and your spouse’s age, if applicable) on your birthday(s) in the previous year to calculate the first distribution, but your age (and your spouse’s age, if applicable) in the current year to calculate your second distribution that is due by December 31. If you were: • Born between January 1 and June 30, use age 70 • Born between July 1 and December 31, use age 71 The dollar amount of your Required Minimum Distribution is determined by dividing your account balance at the end of the previous calendar year by the appropriate distribution period factor. EXAMPLE This is the basic formula for calculating a Required Minimum Distribution using the Internal Revenue Service life expectancy tables: Account Balance, Prior 12/31 = Required Minimum Distribution in Dollars for Current Year Life Expectancy Factor Account Balance, Prior 12/31 = $150,000 Uniform Life Expectancy For illustrative purposes only. 8 27.4 = $5,475 Morgan Stanley Smith Barney IRA Distribution Manual 4. Your Beneficiary Election Your IRA is designed primarily to provide you with retirement income, but it may also help provide a source of income for your designated beneficiaries. You should consider your options carefully in consultation with your tax and legal advisors. Selecting Your Beneficiary It is important to specifically indicate in writing who your IRA beneficiaries are for the following reasons: • The disposition of your IRA assets are not controlled by your will. States with community property (or similar-type) laws include: • Arizona • Louisiana • Texas • California • Nevada • Washington • Idaho • New Mexico • Wisconsin • The calculation of your Required Minimum Distribution may depend upon whom you name as beneficiary. In Alaska, spouses can sign an agreement making specific assets community property. Morgan Stanley Smith Barney recommends that you periodically reconfirm your beneficiary designations. To assist you in remembering who your beneficiaries are, your IRA statement includes this information. In addition, Puerto Rico is a community property jurisdiction. You may designate anyone as the beneficiary of your IRA. However, there are additional considerations if you live in a community property state, or if you name a minor as a beneficiary. If you designate a minor as beneficiary of your IRA, the local probate court may appoint a guardian for the minor’s property. Therefore, it is generally advisable to name as the IRA beneficiary a Custodian under the Uniform Transfers to Minors Act (UTMA). The UTMA Custodian would have more flexibility in applying IRA distributions for the use and benefit of the minor than would a court-appointed guardian. Of course, the minor will control the IRA at either age 18 or 21, depending on state law. If that isn’t advisable, another alternative is to name a special trust as IRA beneficiary. A trust has the further advantage of allowing payments over an extended number of years. Community Property If you are married and currently live or have ever lived in a community property state, all or a portion of your IRA might be considered community property. If this is so, and you have named someone other than your spouse as sole beneficiary of your IRA, your spouse will be required to sign the beneficiary designation form as proof of consent and acknowledgment that he or she has no claim to your IRA assets. As of the publication date of this manual, the states listed here are community property states. Since state laws may change, you should contact a tax or legal advisor in your state for the most up-to-date information. Minors as IRA Beneficiaries Multiple Beneficiaries You may designate more than one primary beneficiary for your IRA. You may specify a percentage or dollar amount that is to be paid to each beneficiary. Morgan stanley Smith Barney 9 You may also indicate whether a beneficiary’s share will end if he or she predeceases you or if that share will pass to his or her children. This situation typically comes into play when you designate equal shares to all your children. These explanations of the more common designations should be reviewed for state variations, since terminology and definitions may differ somewhat from state to state. Beneficiary designations are important. Please be sure you understand your choices. It is equally important to review your designations periodically and whenever you have a change in family circumstances, such as marriage, divorce, birth, adoption or death. All My Children If you use this term or name each child specifically, your IRA assets will be divided among your surviving children only. If one of your children dies before you, the remaining children will share equally in the deceased child’s portion. Per Stirpes If you indicate that death distributions will be per stirpes (in some states the term used is “Rights of Representation”), it means that the children of a beneficiary who predeceases you will share equally in that portion of your IRA originally left to the now-deceased child. For example, if you designate that your three children will share your IRA equally, but one son predeceases you, that one-third share would be divided equally among his surviving children. Per Capita This method divides your IRA assets among your beneficiaries and the descendants of any beneficiary who dies before you. For example, if you name your three daughters as your primary beneficiaries and one of them dies before you, each of her three children will receive a share equal to that of your other two daughters—splitting the IRA into five equal parts. 10 Contingent Beneficiaries In addition to naming one or more primary beneficiaries to receive the assets in your IRA, you may also name contingent beneficiaries. A contingent beneficiary is someone you designate to receive your IRA only if all primary beneficiaries predecease you, die simultaneously with you or disclaim their rights to the IRA assets. These are the only circumstances under which a contingent beneficiary would be entitled to the assets in your IRA. Determining Your Designated Beneficiary IRS Regulations specify that after your death the designated beneficiaries must be identified by the September 30th of the year following your death. The concept of determining your designated beneficiaries after you die does not mean that beneficiaries will be added or eliminated. What will be possible is for each beneficiary to decide what his or her best distribution strategy is (such as receiving a lump-sum payment or disclaiming) without impinging on the other beneficiaries’ elections to receive annual payments based on each beneficiary’s single life expectancy. For example, assume your two children and a charity are your primary beneficiaries. First, the charity could elect an immediate distribution of its share. The other two beneficiaries may elect to receive payments over their own single life expectancies. In this case, two separate beneficiary accounts must be established (separate ones for each child) by December 31 of the year following the year of your death. The beneficiaries who wish to receive payments based on their life expectancies will need to receive the first payment by December 31 of the year after the year of your death. If a beneficiary dies prior to the September 30 date, the deceased beneficiary’s life expectancy would still be used to determine distributions, thus avoiding an unintended accelerated payout of your IRA. Morgan Stanley Smith Barney IRA Distribution Manual After Your Death A NonSpouse as Your Beneficiary If you die after your Required Beginning Date and did not receive your total Required Minimum Distribution for that year, then the balance of the Required Minimum Distribution for the year of your death must be paid to your beneficiary, and he or she will not be able to roll that amount over to an IRA in his or her own name. If you designate a nonspouse beneficiary (for example, children, grandchildren, friends, charities, colleges), your Required Minimum Distribution amount will be determined using the Uniform Lifetime Method. Your beneficiary will be required to receive annual distributions after your death based on his or her own remaining single life expectancy reduced by one each year. Nonspouse beneficiaries are not allowed to roll inherited IRAs into their own IRAs. However, they are permitted to maintain separate “beneficiary IRAs” for an extended period of time from which they receive annual Required Minimum Distributions. At the beneficiary’s option, new beneficiaries may be named to continue to receive distributions of any remaining balance based on the original beneficiary’s life expectancy at the death of your designated beneficiary. Your Spouse as Beneficiary After you die, your surviving spouse has several special distribution options from which to choose. Specifically, your spouse has the opportunity to roll over your IRA into an IRA in his or her own name, and to designate new beneficiaries. A surviving spouse can do this regardless of current age or whether or not you were receiving Required Minimum Distributions. If you were receiving Required Minimum Distributions at the time of your death, the distribution for that year must be made to your surviving spouse if it wasn’t distributed prior to your death. Any required distributions from the new IRA would commence at your spouse’s Required Beginning Date calculated with a uniform life expectancy factor. Other Distribution Options for a Spouse Beneficiary • If your surviving spouse does not elect to roll over your IRA into an IRA in his or her own name as described above, he or she may treat your IRA as his or her own IRA so long as your spouse is the sole beneficiary of the account and so long as your spouse withdraws your Required Minimum Distribution for the year of your death, if necessary. Alternatively, if you die before your Required Beginning Date, your spouse, so long as he or she is your sole beneficiary, may postpone distributions until the year you would have reached age 70½ or the December 31 of the year following the year of your death, whichever is later. In either case, the surviving spouse will receive distributions based on his or her own single life expectancy (recalculated annually) even if he or she designates new beneficiaries. Beneficiaries may not aggregate Required Minimum Distributions from a beneficiary IRA with distributions from other IRAs they may have. Each nonspouse beneficiary may ask Morgan Stanley Smith Barney to calculate his or her annual minimum distribution. This amount will be displayed on the beneficiary’s IRA statement. GO TO Section 7 “Beneficiary Distribution Rules” for more information about distribution options for all beneficiary types. Your Estate or Trust as Your Beneficiary Generally, if you designate your estate, a Q-TIP or credit shelter trust, a charity or any other legal entity with no life expectancy as your IRA beneficiary, your Required Minimum Distributions after age 70½ must be calculated using the Uniform Life Expectancy Table. Limited exceptions to this rule are possible. For example, if specific guidelines are followed, you may designate certain types of trusts as the primary beneficiary of your IRA, and the beneficiaries of the trust may be viewed as the beneficiaries of your IRA for purposes of determining your Required Minimum Distributions. Morgan stanley Smith Barney 11 The rules for establishing a trust that will meet the requirements for naming a trust as designated beneficiary of an IRA are: • The trust must be valid under state law; • The trust must be irrevocable, or a revocable trust that becomes irrevocable no later than your date of death; • The beneficiaries of the trust must be identifiable from the trust document; and • A copy of the trust must be provided to the custodian or trustee of your IRA. Alternatively, a certification as to the identity of the beneficiaries may be provided, and subsequently the trust document must be provided to the IRA Custodian no later than October 31 of the year after your death. The trust must meet these conditions as of the later of the date in which the trust is named as a beneficiary or the September 30 of the year after your death. A Trust Beneficiary If you die before or after your Required Beginning Date, and assuming the trust meets the requirements listed above, the trustee of your trust may elect one of the following payout options: • Single-sum distribution • Scheduled withdrawals over the life expectancy of the oldest beneficiary named in the trust 12 The trust receives the distributions for the trust’s beneficiaries. Please note that if the beneficiary of your trust is your surviving spouse, he or she will not be able to roll over the proceeds of your IRA, as would be possible if your spouse were named directly as the designated beneficiary. The payment options are different if the trust you designate as beneficiary does NOT meet the requirements listed above to allow the trust beneficiaries to receive payments over the life expectancy of the oldest trust beneficiary. Instead the choices are: • If you die before the Required Beginning Date, beneficiaries must deplete the IRA during a five-year period that begins on the December 31 following your death. The entire amount must be distributed by the end of the fifth year. • If you die after the Required Beginning Date, beneficiaries may receive annual payments over the IRA owner’s remaining life expectancy. Your Estate as Beneficiary • If you die before your Required Beginning Date, and your estate is the beneficiary, the personal representative of your estate would be empowered to request either a single-sum payment, or periodic distributions over no more than five years. If the estate administration is to be terminated, it may be possible to have payments assigned directly to the beneficiaries of the estate, but there are limits on such beneficiaries’ ability to defer taxation on the amounts. • If you die after your Required Beginning Date, the personal representative may elect to continue your remaining termcertain schedule until the IRA is depleted. Morgan Stanley Smith Barney IRA Distribution Manual Probate If your estate is your IRA beneficiary, the IRA proceeds may be subject to probate. EXAMPLES Husband dies at age 68. After his death, his wife rolls his Roth IRA into her own new Roth IRA and names new beneficiaries. No distributions need to be taken by the wife. Roth IRA owner dies when his son, the named beneficiary, is 45 years old. His son’s life expectancy is 38.8 years. The son may elect to begin receiving annual payments over the next 38.8 years using a term-certain calculation method. For illustrative purposes only. Qualified Disclaimers An IRA beneficiary may choose to make a qualified disclaimer by refusing to take ownership of any part of your IRA. By making a qualified disclaimer, your beneficiary is considered not to have made a taxable gift. However, the disclaiming beneficiary may not direct to whom the money should go, and must disclaim within nine months of your death. A disclaiming beneficiary may receive the undistributed Required Minimum Distribution, if any, in the year of your death, without jeopardizing the ability to disclaim any part of your IRA assets. Disclaimed amounts will pass to any remaining designated primary or contingent beneficiaries, or, if none, the custodial or trust document’s default provisions will dictate final disposition of disclaimed amounts. For example, Citigroup Global Markets Inc.’s IRA for clients of Morgan Stanley Smith Barney would first recognize a surviving spouse, then surviving children, per stirpes; surviving parents; and, finally, the estate of IRA owner. Qualified disclaimers are often used for estate planning purposes. A typical situation is where the spouse is the primary beneficiary and a Credit Shelter Trust is the contingent beneficiary. If the spouse disclaims, the IRA assets default to the Credit Shelter Trust. The rationale for using a qualified disclaimer in this situation is that after the IRA owner’s death the Credit Shelter Trust could be funded with the remaining IRA assets to take advantage of the IRA owner’s federal estate applicable exclusion amount when the IRA owner does not have sufficient assets outside the IRA to fund the trust. After Your Death: Roth IRAs One of the attractive features of a Roth IRA or Roth IRA rollover is that the account owner need not receive any Required Minimum Distributions. After the account owner dies, the named beneficiaries must determine whether or not they are required to receive distributions based upon their life expectancies. If the beneficiary of the Roth IRA is the surviving spouse, the spouse may elect to roll the Roth IRA over to his or her own Roth IRA and designate new beneficiaries. The spouse would not be required to take any distributions during his or her lifetime. After the death of the surviving spouse, or in the event that the original account owner named a nonspouse beneficiary for the Roth IRA, distributions to the beneficiaries must begin by the December 31 of the year following death. These required distributions would be calculated using the life expectancy factor of each designated beneficiary reduced by one each year. Morgan stanley Smith Barney 13 5. Tax and Possible Penalties The general rule is that distributions from Traditional IRAs are subject to ordinary income taxes. However, if you made both deductible and nondeductible contributions, or rolled over after-tax contributions from an employer-sponsored retirement plan, you or your beneficiaries must determine the taxable portion of every IRA distribution. Also, distributions may be penalized in certain circumstances. Calculating the Taxable Portion of IRA Distributions 4. MULTIPLY the distribution amount by the tax exclusion percentage. Fully Taxable Distributions—If you only made deductible IRA contributions to all the Traditional IRAs you own, each distribution will be fully taxable as ordinary income in the year you or your beneficiaries receive the distribution. Before-tax amounts that you may have rolled over from your employer’s qualified retirement plans would also be fully taxable upon withdrawal from your Traditional IRA. 5. SUBTRACT the amount excludable from income from the distribution amount to determine the amount of the distribution that is taxable. Partially Taxable Distributions—If some or all of your Traditional IRA contributions were nondeductible, or if you rolled over after-tax contributions from an employersponsored plan, a portion of each distribution will be considered a tax-free return of your nondeductible contributions. You or your beneficiaries are required to aggregate the value of all your Traditional IRAs if you have more than one IRA when determining the taxable portion of a particular distribution. You may not remove your nondeductible or after-tax rollover contributions first. Do not include the value of any Roth IRAs in this calculation. Calculating the Tax Exclusion Percentage 1. ADD together all your nondeductible IRA contributions and after-tax rollovers, excluding Roth IRAs. 2. ADD together the total value of all your IRAs, excluding Roth IRAs, as of the end of the current year, plus the amount of any distributions received this year. 3. DIVIDE the total amount determined in Step One by the total value of all your IRAs plus distributions determined in Step Two. This is the tax exclusion percentage. 14 EXAMPLE An IRA owner withdraws $5,000 this year. At the end of the year, the balances in the person’s IRA accounts, including earnings, total $17,500. The IRAs include $6,000 in nondeductible contributions. There were no prior tax-free withdrawals. The amount includable in income is figured as follows: 1. Amount withdrawn from IRAs during the year $5,000 2. Net amount of all nondeductible contributions to IRAs (gross amount, less any tax-free withdrawals in prior years) $6,000 3. Balance of all IRAs at end of year plus item (1) amount $22,500 4. Exclusion percentage — (2) divided by (3) .27 5. Amount excludable from income — (1) multiplied by (4) $1,350 6. Amount includable in income — subtract (5) from (1) $3,650 For illustrative purposes only. Tax-Free Distributions Most Roth IRA distributions are not subject to income taxes if they meet the requirements of a “qualified IRA distribution.” See page 16 for special taxation rules for different types of IRAs. Morgan Stanley Smith Barney IRA Distribution Manual Tax Withholding, Federal Taxes Potential Penalty Taxes By law the taxable portion of any Traditional or Roth IRA distribution is subject to automatic withholding of federal income taxes. However, you may instruct that you do not want automatic withholding. Premature Distributions—If you withdraw all or any portion of your Traditional IRA or SEP-IRA prior to age 59½, the taxable portion of the distribution (see example on page 14 to determine this amount) will be subject to a 10% premature distribution penalty tax in addition to regular income taxes. Separate premature distribution penalties apply to SIMPLE IRAs. See the discussion at the end of this section. Check with your tax advisor about the impact of the quarterly estimated tax rules, including underpayment penalties, if you decline the automatic withholding. State Taxes At your request state income taxes can also be withheld from most types of distributions, unless your state of residence does not accept tax-withholding payments on retirement distributions. State and Local Income Taxes There are numerous exemptions from the premature distribution penalty tax, although regular income taxes will still apply: 1. Substantially Equal Payments See Section 2 for the details of this distribution option. 2. Rollovers It is important to consult with your tax advisor and local tax authorities for current information about the taxability of any IRA distributions. Some states follow the federal tax rules outlined above but some do not. Also, some states have annual exemption amounts for IRA and other retirement plan distributions. You are not liable for the penalty tax when you make a timely rollover deposit of a lump-sum distribution or an eligible IRA distribution. In order to be considered timely, you must deposit your rollover distribution with an IRA custodian or trustee no later than the 60th calendar day from the time distributed. Separate rollover rules apply to SIMPLE IRAs. See the discussion later in this section. Estate Taxes 3. Disability If your spouse is your IRA beneficiary and is a U.S. citizen, the disposition of your IRA qualifies for the marital deduction, and thus is not subject to estate taxes at your death. If your spouse is not a U.S. citizen, without special planning the IRA assets are subject to estate taxes at your death. If you become totally and permanently disabled at any age, you may draw upon your IRA in any manner you choose without a premature distribution penalty. If your IRA is to be distributed to nonspouse beneficiaries, generally estate taxes would be due, whether or not they are U.S. citizens. 4. Large Medical Expenses If in any year your unreimbursed medical expenses exceed 7.5% of your adjusted gross income, you may request a penalty-free withdrawal equal to these expenses. 5. College Tuition Penalty-free withdrawals for tuition, room and board, and related expenses are permitted for you or a family member (including grandchildren). Morgan stanley Smith Barney 15 6. Purchase of a New Home If you or your spouse have not had an ownership interest in a primary residence in the past two years, you may withdraw a lifetime maximum of $10,000 to buy, build or reconstruct a residence for: a. you b. your spouse c. your or your spouse’s child d. your or your spouse’s grandchild e. your or your spouse’s parent or other ancestor. 7. Medical Insurance Premiums After receiving unemployment compensation for at least 12 weeks, you may request a penalty-free withdrawal from your IRA to pay medical insurance premiums. 8. Death Distributions made to designated beneficiaries after your death are not subject to a premature withdrawal penalty, regardless of your age or the age of your beneficiary when you die or when the distributions occur. 9. Active Reservist Distributions may be made to a reservist who is called to active duty between September 11, 2001 and December 31, 2007 for a period in excess of 179 days or for an indefinite period. Distributions must occur during the period beginning on the date of such call to duty and ending on the close of the active duty period. Special “recontribution” rules pertain. 10. Disaster Distribution Qualified disaster distributions are declared by the President or defined by law for limited time; for example, Hurricane Katrina. Late or Insufficient Required Minimum Distributions Penalties also apply to amounts that should have been distributed, but were not. The IRS imposes a substantial excise tax for withdrawals of less than the Required Minimum Distribution amount from an IRA each year after age 70½ or from a nonspouse Roth IRA Beneficiary account. Unless you can provide a reasonable cause, a 50% excise tax will be 16 levied on the difference between the Required Minimum Distribution and the actual distribution received. You may request a waiver of the additional tax using IRS Form 5329. IRA custodians are required to report to the IRS those IRA owners subject to Required Minimum Distributions. Tax Withholding The custodian of your IRA is required by law to withhold federal income taxes from all IRA distributions paid to you unless you are eligible to specifically elect not to have these taxes withheld and you do, in fact, elect to have no withholding. You may decline this tax withholding by completing the Morgan Stanley Smith Barney IRA Distribution Request form. You are not eligible to decline the tax withholding if you are a US citizen or resident alien and your home address is outside the US or its possessions. Before deciding whether or not to have taxes withheld, you should review with your accountant or tax advisor how you might be affected by these tax-withholding requirements and by IRS estimated income tax payment rules. Special Taxation Rules for Different Types of IRAs Roth IRAs Roth IRAs were created in 1998. Roth IRAs allow annual nondeductible contributions, subject to certain income limits. Distributions that do not exceed amounts contributed are always eligible for tax-free and penalty-free withdrawals regardless of your age or the number of years in the Roth IRA. Tax-free distributions of earnings from the Roth IRA are subject to restrictions. If you and the Roth IRA meet these specific requirements, the earnings will be tax-free and penalty-free even if you are under age 59½: • Attainment of age 59½ and the Roth IRA has been established for at least five years • Disability and the Roth IRA has been established for at least five years • Purchase of a first home ($10,000 lifetime maximum) and the Roth IRA has been established for at least five years Morgan Stanley Smith Barney IRA Distribution Manual • Payment to a beneficiary after the Roth IRA has been established for at least five years Distributions of earnings from a Roth IRA that do not match one of the above reasons will be considered taxable income. A distribution of earnings for one of the following reasons will be subject to ordinary income tax, but no 10% premature distribution tax if you are under age 59½ when withdrawn: • Medical expenses exceeding 7.5% of adjusted gross income • Purchase of medical insurance after receiving more than 12 weeks of unemployment compensation • College tuition and related expenses for yourself or a family member Withdrawals of earnings before age 59½ for any other reason besides those specifically listed above will be subject to ordinary income tax and a 10% premature distribution tax. Taxation Of Traditional IRA To Roth IRA Conversions Roth IRA Conversions After Age 70½ There are additional considerations to be aware of if you plan a Roth conversion in the year you attain age 70½ or in a subsequent year. In the year of conversion, you may not convert your Required Minimum Distribution. You must either withdraw it before the conversion, or, alternatively, if you do not wish to accelerate the payment, you must leave the Required Minimum Distribution amount in your Traditional IRA and remove it by the end of the year or April 1 if you elect the first-year postponement. The amount of your Required Minimum Distribution will not be included in the AGI threshold calculation used to determine your eligibility to convert from a Traditional to a Roth IRA. Additional taxation rules may apply to distributions from a conversion Roth IRA that has not been in existence for five taxable years, or if you are under age 59½. If you wish, you may convert your existing Traditional IRA to a Roth IRA. GO TO the Morgan Stanley Smith Barney brochure, IRAs: Powering Your Retirement for specifics. Beginning in 2010, the $100,000 income ceiling for a Roth conversion is eliminated. Also, in 2010 you are able to convert to a Roth IRA, and pay the taxes due on one-half of the additional income over the next two years in 2011 and 2012. Conversions after 2010 will follow the regular tax rules, meaning that earnings and any deductible contributions will be taxable in the year of conversion. SIMPLE IRAs Also, beginning in 2010 married taxpayers filing separately will be allowed for the first time to convert a Traditional IRA to a Roth IRA. The same distribution rules that apply to Traditional IRAs also apply to SIMPLE IRAs, with the following exception: • Distributions prior to age 59½, and within two years following the first contribution to the SIMPLE IRA, are subject to a 25% penalty tax, unless the distribution is rolled over to another SIMPLE IRA, or one of the pre-age 59½ exceptions applies. Morgan stanley Smith Barney 17 6. Estate Planning and Your IRA IRAs can be an effective means of transferring wealth to future generations. How you coordinate your IRA into your overall estate plan is an increasingly important consideration. More and more, affluent IRA owners are looking for ways to obtain the greatest possible IRA benefits for their heirs. Certainly, the issues that have been discussed in other sections of this manual are critical to meeting this objective. Selecting your primary and contingent beneficiaries carefully is still the foundation of good estate planning for your IRA. However, there are additional, related techniques that can carry your IRA further than you may have thought possible. Consider these issues: • “Stretch IRAs” to help stretch tax-deferred growth to the maximum • Using trusts as IRA beneficiaries • Cost-efficient ways to pay anticipated estate taxes • Professional money management of your IRA assets during your lifetime or for your beneficiaries The “Stretch IRA” Helps To Stretch Tax-Deferred Growth to the Maximum A popular planning concept that has gained currency is known as the Stretch IRA. A Stretch IRA election allows your Traditional or Roth IRA to be inherited by children, grandchildren or even great-grandchildren. Upon your death, your beneficiary’s actual life expectancy would determine a new, much-prolonged schedule of annual payments. This means that more of your IRA stays income-tax-deferred for an extended period, greatly increasing the opportunity for tax-deferred growth, and the potential value of the IRA to your beneficiaries. Beginning in 2007, it is also possible in some situations for a nonspouse beneficiary to transfer assets that were held in your employer’s qualified plan (such as a 401(k), profit sharing, 18 governmental 457 plan, 403(b), or pension plan) to a Stretch IRA after your death. However, it may still be advisable to affect the direct rollover to an IRA during your lifetime if your wealth transfer plan calls for the Stretch IRA strategy. If the Stretch IRA is an option for you, you need to be sure that young beneficiaries have professional guidance for their investments and that the terms of the IRA are administered correctly over many years. Using a Trust as Your IRA Beneficiary Now that the Internal Revenue Service permits the use of revocable trusts (that become irrevocable at the death of the account holder) as designated IRA beneficiaries, this option is popular with individuals whose wealth is concentrated in their retirement plans and IRAs. For instance, a Credit Shelter Trust/Marital Deduction Trust combination is frequently used when assets to fund the trusts are in your IRA. The Credit Shelter Trust is typically funded at the death of the first spouse. It assures that both spouses are able to use their Applicable Exclusion Amounts. The Marital Deduction Trust would be used if there were excess property remaining after the funding of the Credit Shelter Trust. In both situations, special care is needed to assure that Required Minimum Distributions are withdrawn to avoid an excise tax. This consideration is a part of estate and income tax planning and how they relate to trusts. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters. Morgan Stanley Smith Barney IRA Distribution Manual Payment of Estate and Annual Income Taxes One often-overlooked consequence of being a Traditional IRA beneficiary is having to pay additional income tax every year. However, a beneficiary receiving what is called “income in respect of a decedent” (IRD) from a Traditional IRA may be able to deduct each year that part of the federal estate tax attributable to your IRA. This deduction can help offset the additional annual income tax. The IRD deduction is available to all beneficiaries of your IRA, regardless of who actually paid the estate tax. If you would like to pass your IRA to a beneficiary without its value being reduced by estate tax, you may wish to specify in your will that non-IRA assets should be used to pay estate taxes (so long as the marital deduction is not reduced). One way to provide the needed cash to pay estate tax without tapping your IRA is to purchase either a single life or second-to-die life insurance policy. If you are over age 70½, you may opt to use part or all of your Required Minimum Distributions to pay the annual premiums. To further leverage your dollars, you may consider implementing this strategy within an Irrevocable Life Insurance Trust. Distributions through the trust will be completely free of income and estate taxes. Clients should consult their tax advisor for matters involving taxation and tax planning and their attorney for matters involving trust and estate planning and other legal matters. Professional Investment Management You may wish to consider the services and advantages provided to you and your heirs by professional investment managers. Currently, you may have the expertise, inclination and time to manage your own IRA investments. However, you may at some point wish to reduce your day-to-day involvement in the business of managing your account. Or you may feel that your surviving spouse or other beneficiaries should not be left with this demanding task. They may not be equipped with the experience or temperament to handle these responsibilities on a long-term, ongoing basis. If you expect them to manage your accounts themselves, who will be their advisors? Will you be creating unforeseen conflict? For example, if you employ a Credit Shelter Trust as part of your estate plan, your surviving spouse is permitted to manage the assets in the trust, even though the assets ultimately belong to your heirs. This could create intergenerational conflict that you would prefer to avoid. Professional asset managers represent the full spectrum of investment styles. Your Financial Advisor will work with you or your beneficiaries to identify managers who meet the investment risk parameters that you or they establish under one of Morgan Stanley Smith Barney’s various advisory programs. Your Financial Advisor can also initiate a management search for you, as well as provide up-to-date manager profiles and performance data. Morgan stanley Smith Barney 19 7. Beneficiary Distribution Rules Beneficiary Owner Dies BEFORE the Required Beginning Date Owner Dies AFTER the Required Beginning Date Spouse—Inherited IRA Spouse’s Life Expectancy Spouse’s Life Expectancy Spouse—IRA Rollover Permitted Permitted Nonspouse Beneficiary Beneficiary’s Life Expectancy reduced by 1 each year is the default provision; fiveyear rule* is the optional election Beneficiary’s Life Expectancy reduced by 1 each year Multiple Designated Beneficiaries (i.e., individuals only) Individual’s Life Expectancy if the account is divided by December 31 of the year after death; otherwise, life expectancy of the oldest beneficiary Individual’s Life Expectancy if the account is divided by December 31 of the year after death; otherwise, life expectancy of the oldest beneficiary Multiple Beneficiaries (includes individuals and legal entities, such as trusts, estates, charities or foundations) If legal entities receive a single-sum payment by September 30th of the year after death, individuals may refer to Multiple Designated Beneficiaries above; otherwise, five-year rule* If legal entities receive a single-sum payment by September 30th of the year after death, individuals may refer to Multiple Designated Beneficiaries above; otherwise, remaining term-certain period of the IRA owner Trust as Designated Beneficiary Life Expectancy of oldest trust beneficiary reduced by 1 each year Life Expectancy of oldest trust beneficiary reduced by 1 each year Trust Not a Designated Beneficiary Five-year rule* Remaining term-certain period of the IRA owner Charity Five-year rule* Remaining term-certain period of the IRA owner Estate Five-year rule* Remaining term-certain period of the IRA owner *The five-year rule requires a beneficiary to deplete the IRA during a five-year period that begins on the December 31 following the death of the IRA holder. The entire account must be distributed by the end of the fifth year. 20 Morgan Stanley Smith Barney IRA Distribution Manual 8. Life Expectancy Tables Spousal Joint Life and Last Survivor Life Expectancy Table AGES 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 39.4 38.6 37.7 36.8 35.9 35.1 34.3 33.4 32.6 31.8 31.1 30.3 29.5 28.8 28.1 27.4 26.7 26.1 25.4 24.8 24.3 23.7 23.2 22.7 22.2 21.8 21.3 20.9 20.6 20.2 19.9 19.6 19.4 19.1 18.9 18.7 18.5 18.3 18.2 18.0 17.9 17.8 17.7 17.6 17.6 17.5 39.4 38.5 37.6 36.7 35.9 35.0 34.2 33.3 32.5 31.7 30.9 30.1 29.4 28.6 27.9 27.2 26.5 25.8 25.2 24.5 23.9 23.4 22.8 22.3 21.8 21.3 20.9 20.5 20.1 19.7 19.4 19.1 18.8 18.5 18.3 18.1 17.9 17.7 17.5 17.4 17.3 17.1 17.0 16.9 16.9 16.8 39.3 38.4 37.5 36.6 35.8 34.9 34.1 33.2 32.4 31.6 30.8 30.0 29.2 28.4 27.7 27.0 26.3 25.6 24.9 24.3 23.7 23.1 22.5 22.0 21.4 20.9 20.5 20.0 19.6 19.3 18.9 18.6 18.3 18.0 17.7 17.5 17.3 17.1 16.9 16.7 16.6 16.5 16.4 16.3 16.2 16.1 39.3 38.4 37.5 36.6 35.7 34.8 34.0 33.1 32.3 31.5 30.6 29.8 29.1 28.3 27.5 26.8 26.1 25.4 24.7 24.0 23.4 22.8 22.2 21.6 21.1 20.6 20.1 19.6 19.2 18.8 18.4 18.1 17.8 17.5 17.2 16.9 16.7 16.5 16.3 16.1 16.0 15.8 15.7 15.6 15.5 15.4 39.2 38.3 37.4 36.5 35.6 34.8 33.9 33.0 32.2 31.4 30.5 29.7 28.9 28.1 27.4 26.6 25.9 25.2 24.5 23.8 23.1 22.5 21.9 21.3 20.8 20.2 19.7 19.3 18.8 18.4 18.0 17.6 17.3 17.0 16.7 16.4 16.2 15.9 15.7 15.5 15.4 15.2 15.1 15.0 14.9 14.8 39.2 38.3 37.4 36.5 35.6 34.7 33.8 33.0 32.1 31.3 30.4 29.6 28.8 28.0 27.2 26.5 25.7 25.0 24.3 23.6 22.9 22.3 21.6 21.0 20.5 19.9 19.4 18.9 18.4 18.0 17.6 17.2 16.8 16.5 16.2 15.9 15.6 15.4 15.2 15.0 14.8 14.6 14.5 14.4 14.3 14.2 39.1 38.2 37.3 36.4 35.5 34.6 33.8 32.9 32.0 31.2 30.3 29.5 28.7 27.9 27.1 26.3 25.6 24.8 24.1 23.4 22.7 22.0 21.4 20.8 20.2 19.6 19.1 18.6 18.1 17.6 17.2 16.8 16.4 16.0 15.7 15.4 15.1 14.9 14.7 14.4 14.3 14.1 13.9 13.8 13.7 13.6 39.1 38.2 37.3 36.4 35.5 34.6 33.7 32.8 32.0 31.1 30.3 29.4 28.6 27.8 27.0 26.2 25.4 24.7 23.9 23.2 22.5 21.8 21.2 20.6 19.9 19.4 18.8 18.3 17.8 17.3 16.8 16.4 16.0 15.6 15.3 15.0 14.7 14.4 14.2 13.9 13.7 13.5 13.4 13.2 13.1 13.0 39.1 38.2 37.2 36.3 35.4 34.5 33.6 32.8 31.9 31.0 30.2 29.3 28.5 27.7 26.9 26.1 25.3 24.6 23.8 23.1 22.4 21.7 21.0 20.3 19.7 19.1 18.5 18.0 17.5 17.0 16.5 16.0 15.6 15.2 14.9 14.5 14.2 13.9 13.7 13.4 13.2 13.0 12.9 12.7 12.6 12.4 39.1 38.1 37.2 36.3 35.4 34.5 33.6 32.7 31.8 31.0 30.1 29.3 28.4 27.6 26.8 26.0 25.2 24.4 23.7 22.9 22.2 21.5 20.8 20.1 19.5 18.9 18.3 17.7 17.2 16.7 16.2 15.7 15.3 14.9 14.5 14.1 13.8 13.5 13.2 13.0 12.8 12.5 12.4 12.2 12.0 11.9 39.0 38.1 37.2 36.3 35.4 34.5 33.6 32.7 31.8 30.9 30.1 29.2 28.4 27.5 26.7 25.9 25.1 24.3 23.6 22.8 22.1 21.3 20.6 20.0 19.3 18.7 18.1 17.5 16.9 16.4 15.9 15.4 15.0 14.5 14.1 13.8 13.4 13.1 12.8 12.6 12.3 12.1 11.9 11.7 11.5 11.4 39.0 38.1 37.2 36.2 35.3 34.4 33.5 32.6 31.8 30.9 30.0 29.2 28.3 27.5 26.6 25.8 25.0 24.2 23.4 22.7 21.9 21.2 20.5 19.8 19.1 18.5 17.9 17.3 16.7 16.2 15.6 15.1 14.7 14.2 13.8 13.4 13.1 12.7 12.4 12.2 11.9 11.7 11.4 11.3 11.1 10.9 39.0 38.1 37.1 36.2 35.3 34.4 33.5 32.6 31.7 30.8 30.0 29.1 28.3 27.4 26.6 25.8 24.9 24.1 23.4 22.6 21.8 21.1 20.4 19.7 19.0 18.3 17.7 17.1 16.5 15.9 15.4 14.9 14.4 13.9 13.5 13.1 12.7 12.4 12.1 11.8 11.5 11.3 11.0 10.8 10.6 10.5 39.0 38.0 37.1 36.2 35.3 34.4 33.5 32.6 31.7 30.8 29.9 29.1 28.2 27.4 26.5 25.7 24.9 24.1 23.3 22.5 21.7 21.0 20.2 19.5 18.8 18.2 17.5 16.9 16.3 15.7 15.2 14.7 14.2 13.7 13.2 12.8 12.4 12.1 11.7 11.4 11.1 10.9 10.6 10.4 10.2 10.1 39.0 38.0 37.1 36.2 35.3 34.3 33.4 32.5 31.7 30.8 29.9 29.0 28.2 27.3 26.5 25.6 24.8 24.0 23.2 22.4 21.6 20.9 20.1 19.4 18.7 18.0 17.4 16.7 16.1 15.5 15.0 14.4 13.9 13.4 13.0 12.6 12.2 11.8 11.4 11.1 10.8 10.5 10.3 10.1 9.9 9.7 38.9 38.0 37.1 36.2 35.2 34.3 33.4 32.5 31.6 30.7 29.9 29.0 28.1 27.3 26.4 25.6 24.8 23.9 23.1 22.3 21.6 20.8 20.1 19.3 18.6 17.9 17.3 16.6 16.0 15.4 14.8 14.3 13.7 13.2 12.8 12.3 11.9 11.5 11.1 10.8 10.5 10.2 9.9 9.7 9.5 9.3 Source: Internal Revenue Service, 2010 Morgan stanley Smith Barney 21 Spousal Joint Life and Last Survivor Life Expectancy Table (continued) AGES 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 38.9 38.0 37.1 36.1 35.2 34.3 33.4 32.5 31.6 30.7 29.8 29.0 28.1 27.2 26.4 25.5 24.7 23.9 23.1 22.3 21.5 20.7 20.0 19.2 18.5 17.8 17.1 16.5 15.8 15.2 14.6 14.1 13.5 13.0 12.5 12.1 11.7 11.3 10.9 10.5 10.2 9.9 9.6 9.4 9.2 9.0 38.9 38.0 37.0 36.1 35.2 34.3 33.4 32.5 31.6 30.7 29.8 28.9 28.1 27.2 26.4 25.5 24.7 23.8 23.0 22.2 21.4 20.7 19.9 19.2 18.4 17.7 17.0 16.4 15.7 15.1 14.5 13.9 13.4 12.9 12.4 11.9 11.4 11.0 10.6 10.3 9.9 9.6 9.4 9.1 8.9 8.6 38.9 38.0 37.0 36.1 35.2 34.3 33.4 32.5 31.6 30.7 29.8 28.9 28.0 27.2 26.3 25.5 24.6 23.8 23.0 22.2 21.4 20.6 19.8 19.1 18.3 17.6 16.9 16.3 15.6 15.0 14.4 13.8 13.2 12.7 12.2 11.7 11.3 10.8 10.4 10.1 9.7 9.4 9.1 8.8 8.6 8.3 38.9 38.0 37.0 36.1 35.2 34.3 33.3 32.4 31.5 30.7 29.8 28.9 28.0 27.2 26.3 25.4 24.6 23.8 22.9 22.1 21.3 20.5 19.8 19.0 18.3 17.6 16.9 16.2 15.5 14.9 14.3 13.7 13.1 12.6 12.0 11.5 11.1 10.6 10.2 9.9 9.5 9.2 8.9 8.6 8.3 8.1 38.9 38.0 37.0 36.1 35.2 34.2 33.3 32.4 31.5 30.6 29.8 28.9 28.0 27.1 26.3 25.4 24.6 23.7 22.9 22.1 21.3 20.5 19.7 19.0 18.2 17.5 16.8 16.1 15.4 14.8 14.2 13.6 13.0 12.4 11.9 11.4 10.9 10.5 10.1 9.7 9.3 9.0 8.6 8.3 8.1 7.8 38.9 37.9 37.0 36.1 35.2 34.2 33.3 32.4 31.5 30.6 29.7 28.9 28.0 27.1 26.3 25.4 24.5 23.7 22.9 22.1 21.3 20.5 19.7 18.9 18.2 17.4 16.7 16.0 15.4 14.7 14.1 13.5 12.9 12.3 11.8 11.3 10.8 10.3 9.9 9.5 9.1 8.8 8.4 8.1 7.9 7.6 38.9 37.9 37.0 36.1 35.1 34.2 33.3 32.4 31.5 30.6 29.7 28.8 28.0 27.1 26.2 25.4 24.5 23.7 22.9 22.0 21.2 20.4 19.6 18.9 18.1 17.4 16.7 16.0 15.3 14.6 14.0 13.4 12.8 12.2 11.7 11.2 10.7 10.2 9.8 9.3 9.0 8.6 8.3 8.0 7.7 7.4 38.9 37.9 37.0 36.1 35.1 34.2 33.3 32.4 31.5 30.6 29.7 28.8 28.0 27.1 26.2 25.4 24.5 23.7 22.8 22.0 21.2 20.4 19.6 18.8 18.1 17.3 16.6 15.9 15.2 14.6 13.9 13.3 12.7 12.1 11.6 11.1 10.6 10.1 9.6 9.2 8.8 8.5 8.1 7.8 7.5 7.2 38.9 37.9 37.0 36.1 35.1 34.2 33.3 32.4 31.5 30.6 29.7 28.8 27.9 27.1 26.2 25.3 24.5 23.6 22.8 22.0 21.2 20.4 19.6 18.8 18.0 17.3 16.6 15.9 15.2 14.5 13.9 13.2 12.6 12.0 11.5 11.0 10.5 10.0 9.5 9.1 8.7 8.3 8.0 7.6 7.3 7.1 38.9 37.9 37.0 36.1 35.1 34.2 33.3 32.4 31.5 30.6 29.7 28.8 27.9 27.1 26.2 25.3 24.5 23.6 22.8 22.0 21.1 20.3 19.6 18.8 18.0 17.3 16.5 15.8 15.1 14.5 13.8 13.2 12.6 12.0 11.4 10.9 10.4 9.9 9.4 9.0 8.6 8.2 7.8 7.5 7.2 6.9 38.9 37.9 37.0 36.1 35.1 34.2 33.3 32.4 31.5 30.6 29.7 28.8 27.9 27.0 26.2 25.3 24.5 23.6 22.8 21.9 21.1 20.3 19.5 18.8 18.0 17.2 16.5 15.8 15.1 14.4 13.8 13.1 12.5 11.9 11.3 10.8 10.3 9.8 9.3 8.9 8.5 8.1 7.7 7.4 7.1 6.8 38.9 37.9 37.0 36.1 35.1 34.2 33.3 32.4 31.5 30.6 29.7 28.8 27.9 27.0 26.2 25.3 24.5 23.6 22.8 21.9 21.1 20.3 19.5 18.7 18.0 17.2 16.5 15.8 15.1 14.4 13.7 13.1 12.5 11.9 11.3 10.7 10.2 9.7 9.2 8.8 8.4 8.0 7.6 7.3 6.9 6.6 38.9 37.9 37.0 36.0 35.1 34.2 33.3 32.4 31.5 30.6 29.7 28.8 27.9 27.0 26.2 25.3 24.4 23.6 22.8 21.9 21.1 20.3 19.5 18.7 17.9 17.2 16.4 15.7 15.0 14.3 13.7 13.0 12.4 11.8 11.2 10.7 10.1 9.6 9.2 8.7 8.3 7.9 7.5 7.1 6.8 6.5 38.9 37.9 37.0 36.0 35.1 34.2 33.3 32.4 31.5 30.6 29.7 28.8 27.9 27.0 26.2 25.3 24.4 23.6 22.7 21.9 21.1 20.3 19.5 18.7 17.9 17.2 16.4 15.7 15.0 14.3 13.6 13.0 12.4 11.8 11.2 10.6 10.1 9.6 9.1 8.6 8.2 7.8 7.4 7.0 6.7 6.4 38.9 37.9 37.0 36.0 35.1 34.2 33.3 32.4 31.5 30.6 29.7 28.8 27.9 27.0 26.1 25.3 24.4 23.6 22.7 21.9 21.1 20.3 19.5 18.7 17.9 17.1 16.4 15.7 15.0 14.3 13.6 12.9 12.3 11.7 11.1 10.6 10.0 9.5 9.0 8.5 8.1 7.7 7.3 6.9 6.6 6.3 Source: Internal Revenue Service, 2010 22 Morgan Stanley Smith Barney IRA Distribution Manual Uniform Lifetime Distribution Table Age 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 Distribution Period 27.4 26.5 25.6 24.7 23.8 22.9 22.0 21.2 20.3 19.5 18.7 17.9 17.1 16.3 15.5 14.8 14.1 13.4 12.7 12.0 11.4 10.8 10.2 Age 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 Distribution Period 9.6 9.1 8.6 8.1 7.6 7.1 6.7 6.3 5.9 5.5 5.2 4.9 4.5 4.2 3.9 3.7 3.4 3.1 2.9 2.6 2.4 2.1 1.9 Source: Internal Revenue Service, 2010 Single Life Expectancy Table Age 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 MULTIPLE 82.4 81.6 80.6 79.7 78.7 77.7 76.7 75.8 74.8 73.8 72.8 71.8 70.8 69.9 68.9 67.9 66.9 66.0 65.0 64.0 63.0 62.1 61.1 Age 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 MULTIPLE 60.1 59.1 58.2 57.2 56.2 55.3 54.3 53.3 52.4 51.4 50.4 49.4 48.5 47.5 46.5 45.6 44.6 43.6 42.7 41.7 40.7 39.8 38.8 Age 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 MULTIPLE 37.9 37.0 36.0 35.1 34.2 33.3 32.3 31.4 30.5 29.6 28.7 27.9 27.0 26.1 25.2 24.4 23.5 22.7 21.8 21.0 20.2 19.4 18.6 Age 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 MULTIPLE 17.8 17.0 16.3 15.5 14.8 14.1 13.4 12.7 12.1 11.4 10.8 10.2 9.7 9.1 8.6 8.1 7.6 7.1 6.7 6.3 5.9 5.5 5.2 Age 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111+ MULTIPLE 4.9 4.6 4.3 4.1 3.8 3.6 3.4 3.1 2.9 2.7 2.5 2.3 2.1 1.9 1.7 1.5 1.4 1.2 1.1 1.0 Source: Internal Revenue Service, 2010 Morgan stanley Smith Barney 23 Tax laws are complex and subject to change. Morgan Stanley Smith Barney LLC, its affiliates and Morgan Stanley Smith Barney Financial Advisors do not provide tax or legal advice. This material was not intended or written to be used for the purpose of avoiding tax penalties that may be imposed on the taxpayer. Individuals are urged to consult their personal tax or legal advisors to understand the tax and related consequences of any actions or investments described herein. © 2010 Morgan Stanley Smith Barney LLC. Member SIPC. 3594 09/10 PS2055 GP10-01956P-N09/10