December 8, 2015

2015 Analyst

conference Takeaways

Growth and productivity were the key themes running through Home Depot’s Investor and Analyst Conference on December 8, 2015. As he kicked off the conference, Chairman, CEO and President Craig Menear noted that Home Depot has recently been focusing on: • Identifying potential disruptors to its industry. • Generating ideas to expand sales across the next three to eight years. • Coming up with new productivity ideas. The result has been a “solidified” focus on growth and productivity. Craig Menear, Chairman CEO & President – Key Points: •

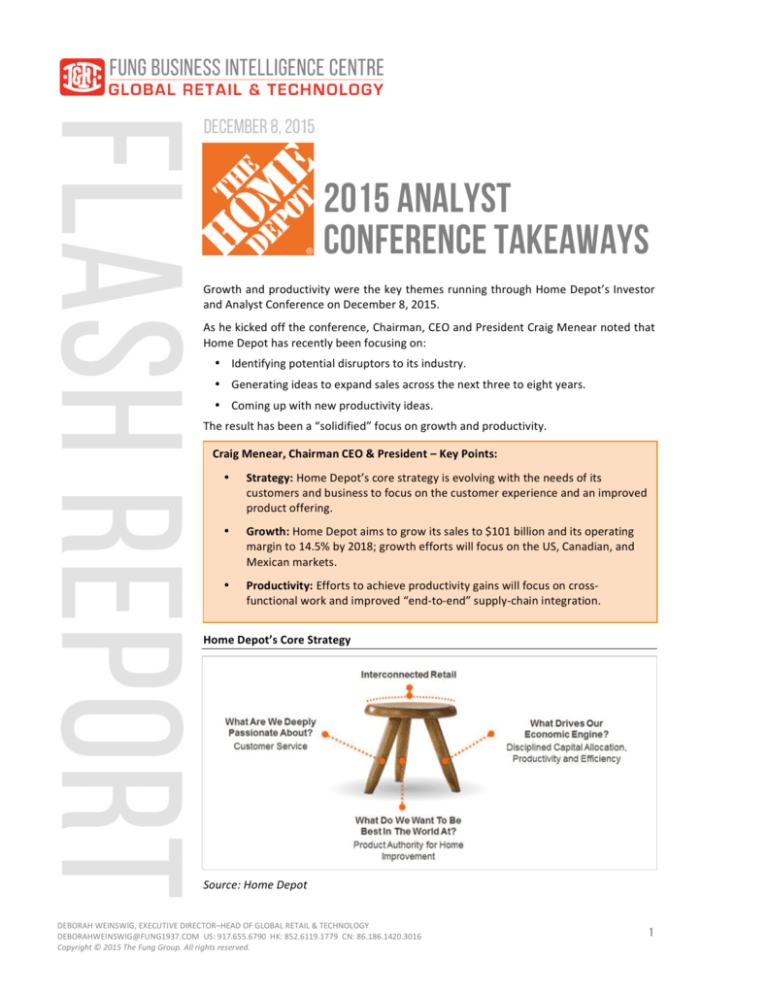

Strategy: Home Depot’s core strategy is evolving with the needs of its customers and business to focus on the customer experience and an improved product offering. •

Growth: Home Depot aims to grow its sales to $101 billion and its operating margin to 14.5% by 2018; growth efforts will focus on the US, Canadian, and Mexican markets. •

Productivity: Efforts to achieve productivity gains will focus on cross-­‐

functional work and improved “end-­‐to-­‐end” supply-­‐chain integration. Home Depot’s Core Strategy Source: Home Depot DEBORAH WEINSWIG, EXECUTIVE DIRECTOR–HEAD OF GLOBAL RETAIL & TECHNOLOGY DEBORAHWEINSWIG@FUNG1937.COM US: 917.655.6790 H K: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2015 The Fung Group. All rights reserved. 1

Growth and Productivity The US still holds substantial growth potential for Home Depot, according to Menear, and the company aims to grow to $101 billion in sales by 2018, up from $83 billion in the year ending February 2015. The company’s share of the total addressable market in the US is still only around 15%, he told analysts. Adding spending on consumer home improvement to spending on professional maintenance, repair and operations (MRO) and “do-­‐it-­‐for-­‐me” services creates a total potential US market of $550 billion. So, there looks to be much opportunity still for $80-­‐

billion Home Depot to pursue. However, there are a number of choices that are currently off limits for Home Depot, Menear said. These include small-­‐store formats: Home Depot has “gone down that road before” and did not succeed in that space, the CEO told analysts. The company will also not expand into new international markets nor make acquisitions in order to buy sales—

although it will make strategic acquisitions to add capability, such as it did with its purchase of Blinds.com. Menear noted two particular areas of opportunity: • Professional customers, i.e., tradespeople. Home Depot has been leaning into this segment, Menear said, because the aging population (which has a “do-­‐it-­‐for-­‐me” bent) and growth in the number of multifamily households (which require MRO) have made it a growth segment. The company has reorganized in order to have one group dedicated to professional customers’ needs. • Interconnected retail, i.e., multi-­‐channel retail. Home Depot’s digital business will grow by nearly $1 billion in sales in 2015, we were told. And some 10% of digital orders are being placed by a device in use within an actual Home Depot store—

confirming the extent to which shoppers are browsing and buying across channels. The company is deepening its curated online and in-­‐store assortments by leveraging data to tailor assortments at the local level. Alongside growth, productivity allows Home Depot to “give value to customers” as well as “creat[e] shareholder value,” Menear said. Key productivity initiatives span delivery (such as shipping online orders to stores more cost effectively), supply chain synchronization (boosting speed to market) and assortment optimization (including localization). Productivity was a theme revisited in more detail by other speakers later during the day. Following Craig Meaner, Marc Powers, Home Depot’s Executive President of US Stores, took the stage to expand on the opportunity afforded by a greater focus on professional customers. Marc Powers, EVP of US Stores – Key Points: •

The Baby Boomer Customer: expectations are changing from “do-­‐it-­‐yourself” to “do-­‐it-­‐for-­‐me”. •

The Millennial Customers: showing delayed first time home purchase, but expectations for an experiential shopping experience and a connection with the brand are aligned with Home Depot’s values and culture. •

Customers across all segments are becoming m ore interconnected, driving Home Depot to simplify operational processes and generate productivity. DEBORAH WEINSWIG, EXECUTIVE DIRECTOR–HEAD OF GLOBAL RETAIL & TECHNOLOGY DEBORAHWEINSWIG@FUNG1937.COM US: 917.655.6790 H K: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2015 The Fung Group. All rights reserved. 2

Stores to Serve More Pro Customers Professionals make up just 3% of Home Depot shoppers, Powers said, but contribute fully 40% of sales. The average annual spend by a consumer at Home Depot is $330; for a professional, it is $6,500. Later in the conference, Bill Lennie, Executive Vice President of Outside Sales and Service, returned to the subject of targeting professional customers. In the past, Home Depot “acted like a 7-­‐Eleven for bigger pros,” Lennie said. The company wants to move on from that positioning, and become a true one-­‐stop shop for even bigger professional customers. The acquisition of Interline, a seller of products to professional customers, is intended to bolster Home Depot’s penetration of this segment. Lennie also noted that delivery, credit, sales reps for professional customers and the Pro Xtra loyalty program are key areas of focus that will attract professional customers. Professionals are not the company’s only focus. Alongside pros, baby boomers and millennials make up the identified core customer segments for Home Depot, said Powers. The needs of these groups are different: affluent-­‐but-­‐unenergetic boomers are keen to pay for “do-­‐it-­‐for-­‐me” services, while first-­‐time-­‐buyer millennials want an experience with a company that cares about its impact on communities and its associates. DEBORAH WEINSWIG, EXECUTIVE DIRECTOR–HEAD OF GLOBAL RETAIL & TECHNOLOGY DEBORAHWEINSWIG@FUNG1937.COM US: 917.655.6790 H K: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2015 The Fung Group. All rights reserved. 3

Their needs are different, but for all these groups, services such as buy online, pick up in-­‐store (BOPIS) and buy online, deliver from store are simply new iterations of existing shopping habits, Powers said. Shoppers across segments are looking for “old things done a new way.” Home Depot is anticipating significant growth in the online channel and Kevin Hoffman, President of Online Home Depot, discussed the company’s approach to digital retail. Ted Decker, EVP of Merchandising – Key Points: •

Home Depot has three merchandising objectives: maintaining momentum, balance the art & science and end-­‐to-­‐end collaboration. •

Smart home category is key to m aintaining momentum. •

End-­‐to-­‐end supply chain collaboration includes direct shipping from suppliers, rapid deployment centers and enhanced optimization through its “project Sync”initiative. “Protect, Convenience, and Conserve” Are Three Pillars for a Smarter Home Home Depot is seeing great demand for smart home products. Decker estimates that a typical smart household will have about 500 smart products by 2020. To accelerate adoption rate, Home Depot provides open platform products so customers do not have to be locked in to specific systems at early stage. Decker also shared three principles for Home Depot’s smart home categories. • Protect: customers increasingly need to feel safe at home and away from home. Smart home security products such as smart smoke detectors, smart doorbells/locks, and smart cameras are popular selling items. • Convenience: with the popularity of telecommute, people will spend more time at home and will invest in making their homes more comfortable and enjoyable. • Conserve: smart water heaters, thermostat, LED lighting can help consumers save on their energy bills in the long run. Purchases of energy conserving smart home products have a clear return on investment. DEBORAH WEINSWIG, EXECUTIVE DIRECTOR–HEAD OF GLOBAL RETAIL & TECHNOLOGY DEBORAHWEINSWIG@FUNG1937.COM US: 917.655.6790 H K: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2015 The Fung Group. All rights reserved. 4

Kevin Hoffman, President of Online – Key Points: •

The blending of digital and physical into a seamless shopping experience provides a tremendous opportunity to show the power of Home Depot. •

Home Depot’s online business has tripled in size over the last three years and now represents a little over 5% of a ll sales. •

Home Depot will “do old things in new ways” to match the evolving needs of shoppers. “Orange Aprons in the Digital Aisle” “Old things done a new way” was a theme reiterated by Kevin Hofmann, President of Online at Home Depot. The company will deliver convenience, product authority and an end-­‐to-­‐end customer experience in its digital and store channels, Hofmann said. Home Depot’s digital efforts include: • Expanding assortments and reach into underpenetrated categories. • Rolling out a new BOPIS system in 2016. • Using data to leverage the customer journey. • Offering online content, curation, ratings, reviews and room scenes. • Undertaking 40–50 digital category resets each year. Investments in digital retail will help get customers to a “place of confidence” when choosing from the company’s 1 million SKUs online. And they will help the company grow digital sales by around $1 billion in the current fiscal year, Hofmann said. But changing expectations require a relentless simplification of operations, with efficiencies allowing Home Depot to reinvest in its proposition. Productivity is core for the company, Hofmann said, but improvements must positively impact the customer experience. Next, Bill Lennie, Home Depot’s EVP of Outside Sales and Services, talked through Home Depot’s logistics initiatives in the wake of heightened customer demand for more collection and delivery options. DEBORAH WEINSWIG, EXECUTIVE DIRECTOR–HEAD OF GLOBAL RETAIL & TECHNOLOGY DEBORAHWEINSWIG@FUNG1937.COM US: 917.655.6790 H K: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2015 The Fung Group. All rights reserved. 5

Bill Lennie, EVP of Outside Sales & Services – Key Points: •

Home Depot aims to become the primary source for the professional customer by creating a unique, competitive offering that’s difficult to replicate. It is a $370 billion opportunity. •

Home Depot’s strategy focuses on three types of professional customers: renovation and remodelers, installation providers, and MRO service providers. •

Interline Brands acquisition enhances Home Depot’s capability to service professional customers. Huge Professional Customer Opportunity Of the total $550 billion addressable US market for Home Depot, $370 billion is with professional customers, including $120 billion in home improvement retail, $200 billion in services (product pull through and labor), and $50 billion in MRO (maintenance, repair and operations). Home Depot’s recent acquisition of Interline Brands, a national direct marketer and distributor of MRO products, will help the company to better service pro customers through added core competency in b2b purchases, expanded assortment, and enhanced last-­‐mile distribution capability. Interline has 100,000 skus of products and owns significant number of delivery trucks. DEBORAH WEINSWIG, EXECUTIVE DIRECTOR–HEAD OF GLOBAL RETAIL & TECHNOLOGY DEBORAHWEINSWIG@FUNG1937.COM US: 917.655.6790 H K: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2015 The Fung Group. All rights reserved. 6

Mark Holifield, EVP of Supply Chain & Product Development – Key Points: •

Home Depot’s supply chain optimization continues in two areas: direct fulfilment and supply chain synchronization. •

Enabling direct fulfilment means creating a global view of inventory, fulfilment channels and transportation assets •

In 2015, Home Depot’s supply chain optimization focuses on synchronization or “project synch”, which can shorten lead time from 11 days to five days. Improving Logistics Home Depot’s logistics initiatives include: • Developing a global view of where inventory is, from fulfilment centers to stores. • New capabilities for buy online, ship to store, where customer orders for in-­‐store collection are shipped via a rapid distribution center and dispatched to the store along with a core store shipment instead of being shipped directly to the store separately, resulting in reduced shipping costs. • Ability to offer buy online, deliver from store—which can narrow delivery windows and prove particularly useful to professional customers. • Three new direct fulfilment centers, which enable delivery to 90% of Home Depot’s US business customers within two days, and which can hold up to 100,000 SKUs each. • Project Sync, which optimizes distribution from supplier to store, cutting the total shipping time from around 11 days to as few as five, and resulting in a more predictable, steady flow of freight for stores to handle. Home Depot’s distribution network is still relatively young: until 2008, when it introduced rapid distribution centers, the company was relying on suppliers shipping direct to stores. Project Sync represents the second phase of the distribution network’s evolution. The company is, Holifield concluded, “well positioned to drive profitable growth in direct fulfilment.” Chief Financial Officer Carole Tomé wrapped up the conference, highlighting the company’s recent performance and looking ahead to Home Depot’s financial estimates for fiscal year 2018. DEBORAH WEINSWIG, EXECUTIVE DIRECTOR–HEAD OF GLOBAL RETAIL & TECHNOLOGY DEBORAHWEINSWIG@FUNG1937.COM US: 917.655.6790 H K: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2015 The Fung Group. All rights reserved. 7

Carol Tomé, CFO & EVP of Corporate Services – Key Points: • Three positive underlying macroeconomic factors are working in Home Depot’s favor: a modest economic recovery, housing metrics trending in the right direction and changing demographics. • New value proposition for professional shoppers: 365 day returns, 60 days to pay, and a new fuel reward program. • Home Depot’s productivity efforts will likely offset m ost, but not all, of the anticipated increases in costs related to interconnected retail. A Look Ahead to 2018 Tomé reiterated the company’s guidance for the current fiscal year: 4.9% comparable sales growth, 5.7% total sales growth (to $88 billion), an operating margin of 13.2% and diluted EPS of $5.36, up by around 14% year over year. The strength of the dollar will hit total sales growth by around $1.4 billion in 2015, Tomé noted. Looking ahead, Tomé said that three positive underlying forces bode well for the company: a modest economic recovery, housing metrics trending in the right direction and changing demographics. Underlying shifts include more renter households and more multifamily households, and Home Depot’s attempt to strengthen its sales to professionals is a response to these trends. Between 2015 and 2018, Home Depot expects: • To grow sales by $13 billion in total, taking sales to $101 billion; this is the same sales growth, in absolute terms, that was seen between 2012 and 2015. • Comp growth to average around 4%. • Total sales to increase at a compound annual growth rate of around 4.7%, helped by the Interline acquisition and modest new store growth. Meanwhile, inventory turnover is expected to grow from 4.8 times estimated for the current fiscal year to 5.7 times in fiscal year 2018. Also looking ahead, Tomé said that by 2018, the cost of goods should fall, as the company will have made continued efforts to drive out costs. But gross margins will be broadly flat as it reinvests the costs savings into lower-­‐margin categories. Moreover, expenses are expected to grow at around 50% of sales growth as “people costs” rise. DEBORAH WEINSWIG, EXECUTIVE DIRECTOR–HEAD OF GLOBAL RETAIL & TECHNOLOGY DEBORAHWEINSWIG@FUNG1937.COM US: 917.655.6790 H K: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2015 The Fung Group. All rights reserved. 8

Tomé returned to a theme mentioned by several speakers across the day: productivity. For Home Depot, she said, productivity is a “virtuous cycle,” whereby savings can be reinvested in the proposition, such as in staff and in “interconnected retail,” which should deliver further top-­‐line growth. Deborah Weinswig, CPA Executive Director—Head of Global Retail & Technology Fung Business Intelligence Centre New York: 917.655.6790 Hong Kong: 852.6119.1779 deborahweinswig@fung1937.com Filippo Battaini filippobattaini@fung1937.com Marie Driscoll, CFA mariedriscoll@fung1937.com John Harmon, CFA johnharmon@fung1937.com Aragorn Ho aragornho@fung1937.com John Mercer johnmercer@fung1937.com Shoshana Pollack shoshanapollack@fung1937.com Kiril Popov kirilpopov@fung1937.com Jing Wang jingwang@fung1937.com Steven Winnick stevenwinnick@fung1937.com HONG KONG: 10th Floor, LiFung Tower 888 Cheung Sha Wan Road, Kowloon Hong Kong Tel: 852 2300 2470 LONDON: 242-­‐246 Marylebone Road London, NW1 6JQ United Kingdom Tel: 44 (0)20 7616 8988 NEW YORK: th

1359 Broadway, 9 Floor New York, NY 10018 Tel: 646 839 7017 FBICGROUP.COM DEBORAH WEINSWIG, EXECUTIVE DIRECTOR–HEAD OF GLOBAL RETAIL & TECHNOLOGY DEBORAHWEINSWIG@FUNG1937.COM US: 917.655.6790 H K: 852.6119.1779 CN: 86.186.1420.3016 Copyright © 2015 The Fung Group. All rights reserved. 9