US Regulatory Reform – Impact on the Thrift Industry

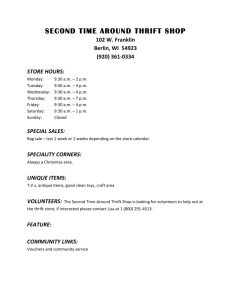

advertisement

U.S. Regulatory Reform – Impact on the Thrift Industry POWERFUL INSIGHTS On July 21, 2010, President Obama signed the Dodd-Frank Wall Street Reform and Consumer Protection Act, the longawaited and much-debated congressional response to the financial crisis. The Act’s many provisions will profoundly affect the financial services industry, in its broadest sense, for many years to come through such sweeping changes as the establishment of the new Bureau of Consumer Financial Protection (BCFP), stricter oversight of systemically important financial institutions and changes to the derivatives market. Issue Besides being subject to the many provisions affecting depository institutions generally, thrifts and thrift holding companies (THCs) also are affected by several specific changes, the most important of which is the dissolution of the Office of Thrift Supervision (OTS). The Act divides the OTS’s supervisory responsibilities among other regulatory agencies as follows: The Office of the Comptroller of the Currency (OCC) will assume rulemaking authority for all thrifts and supervise federally chartered thrifts, the Federal Deposit Insurance Corporation (FDIC) will supervise state chartered thrifts, and the Federal Reserve Board (FRB) will supervise and assume rulemaking authority for thrift holding companies. The BCFP will oversee consumer compliance at organizations with more than $10 billion in assets. Dodd-Frank also imposes new penalties for violating the Qualified Thrift Lender (QTL) test, establishes new rules around the levels and composition of capital for thrifts, and requires thrift holding companies engaging in nonbanking activities permissible for Financial Holding Companies (FHC) to meet the FHC qualifications of having depository institution subsidiaries that are well-managed, wellcapitalized, and have satisfactory Community Reinvestment Act (CRA) ratings. Additionally, for federal thrifts as well as national banks, Dodd-Frank contains important provisions limiting the federal preemption of state consumer law. Challenges and Opportunities While the thrift charter remains nominally intact, the Act puts pressure on thrift organizations to adhere to their residential real estate focus or consider the benefits of converting to a bank charter. Regardless of whether a thrift decides to retain its charter or convert to a bank, it is certain to be subject to more “bank-like” regulation. While some thrifts will be precluded from converting to banks because of their ownership, those which do have the option should undertake a cost/benefit analysis of the thrift charter versus the bank charter to determine the optimal organizational structure, considering QTL compliance requirements, the limitations on federal preemption in the Act, and the organization’s current and future plans. Both charter options require the management of thrifts to consider new technical regulatory requirements and prepare for changes in regulatory oversight. Adjusting to a new regulator likely will be a significant challenge for many thrift organizations. The OTS has a reputation of being more accommodating than other regulators to the institutions it supervises. Critics of the OTS have – justifiably or not – pointed to the failure or near-failure of financial institutions such as IndyMac and Washington Mutual (for all of which the OTS served as the primary federal regulator) as evidence that the agency took an overly lax approach to examinations and enforcement. Regardless of one’s view on that subjective question, it generally is agreed that given the emphasis on residential lending associated with the thrift charter, OTS examiners have tended to specialize in and focus on that particular area. After the transfer of regulatory oversight away from the OTS, thrifts will likely find that other federal bank regulators take a broader and more intensive and critical approach to regulatory examinations, particularly in areas outside of residential lending, such as commercial banking, fiduciary operations and investment activities. Examinations may also be more stringent as newly formed examination teams attempt to prove their worth during the restructuring period and ensure that any problems detected are not on their watch. Our Point of View Thrift organizations must begin to consider and prepare for new regulatory oversight and the effects that the Act’s provisions will have on their operations and strategy. Specific questions these organizations should address include: • What technical differences exist between current OTS and OCC/FDIC/FRB regulations? What governance and operational changes will be needed to close those gaps, and what will be the cost of making those changes (both direct and in terms of lost revenue)? • How will our organization fare under the OCC’s or FDIC’s approach to supervision? Are there “gray areas” from a compliance, control or risk management perspective where we currently take an approach that satisfies OTS expectations but might not satisfy a new regulator? • What will we need to do to meet leverage and capital requirements applicable to bank holding companies? • Are we currently engaged in any nonbanking activities that would require us to meet more stringent FHC qualifications? How do we approach the decision-making process to ensure full consideration of all available options? • What opportunities would be created if we were freed from the residential real estate restrictions currently associated with the thrift charter type? And how do we prepare for changes in our product offerings and the corresponding management of a changing risk profile? PROVEN DELIVERY How We Help Companies Succeed Example Protiviti’s Risk & Compliance professionals, including former bank regulators and professionals who have held management and executive-level positions in financial services organizations, are well-qualified to assist financial organizations adjust to and take advantage of the DoddFrank Act. We can help thrifts prepare for these changes by: Anticipating that pending regulatory reform might result in more rigorous regulatory scrutiny, broader examinations, and higher expectations around managerial, operational, financial and compliance performance, our client, one of the five largest U.S. thrifts, requested that we review its business operations from an OCC perspective to gauge its readiness for a newly proposed regulatory oversight structure. We assembled a cross-functional team to apply the potential new regulator’s standards to a review of key financial, risk management and corporate governance areas. In response to our recommendations to address potential regulatory concerns, our client significantly enhanced its overall governance structure and the capabilities of its risk management activities, revised its credit risk management strategies, and enhanced its internal selfassessment techniques. • Conducting gap assessments between thrifts’ and THCs’ current policies, procedures and business practices and the expectations of the OCC, FDIC and/or FRB • Conducting “mock exams,” utilizing OCC, FDIC and/or FRB examination procedures, to help identify issues that may be subject to regulatory criticism by new examiners • Assisting with the analysis of capital and strengthening the capital planning process for thrifts and their holding companies Contacts Carol Beaumier +1.212.603.8337 carol.beaumier@protiviti.com Cory Gunderson +1.212.708.6313 cory.gunderson@protiviti.com Scott Jones +1.213.327.1442 scott.jones@protiviti.com Patrick Mitchell +1.954.712.3109 patrick.mitchell@protiviti.com Michael Schuchardt +1.312.476.6399 michael.schuchardt@protiviti.com About Protiviti Protiviti (www.protiviti.com) is a global business consulting and internal audit firm composed of experts specializing in risk, advisory and transaction services. The firm helps solve problems in finance and transactions, operations, technology, litigation, governance, risk, and compliance. Protiviti’s highly trained, results-oriented professionals provide a unique perspective on a wide range of critical business issues for clients in the Americas, Asia-Pacific, Europe and the Middle East. Protiviti has more than 60 locations worldwide and is a wholly owned subsidiary of Robert Half International Inc. (NYSE symbol: RHI). Founded in 1948, Robert Half International is a member of the S&P 500 index. © 2011 Protiviti Inc. An Equal Opportunity Employer. PRO-0511-107101 Protiviti is not licensed or registered as a public accounting firm and does not issue opinions on financial statements or offer attestation services.