SAMPLE DOCUMENT - City and County of Denver

advertisement

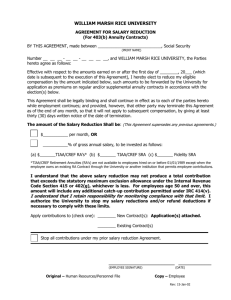

Agreement for Salary Reduction Under the Section 457(b) Plan Employee Name:__________________________ Employee ID No.____________________________ Last 4 digits of SSN:_____________________ Contact Phone No.:__________________________ BY THIS AGREEMENT, made between the Participant named above and The City and County of Denver (the Employer), we agree as follows: Effective for amounts paid on or after 1 _______________________ (date) which date is no earlier than the first day of the month following execution of this Agreement, the Participant’s salary will be reduced by the amount indicated below. This Agreement shall be legally binding and irrevocable for both the Employer and the Participant while employment continues. However, either party may modify this Agreement as of the first pay period beginning with or during the first month following satisfactory written notice of such modification. The Participant may terminate the Agreement by giving at least 10 days written notice so that this Agreement will not apply to salary subsequently paid. The amount of the salary reduction shall be (contributions must be in a whole % (percent) or whole dollar amount, can combine pre-tax and ROTH contributions): __________ % of gross salary per pay period Pre-tax __________ % of gross salary per pay period ROTH (after-tax) $_________ dollars per pay period Pre-tax $_________ dollars per pay period ROTH (after-tax) Contribution type 2 (elect one): Regular 50+ Catch-Up Special 3-Year Catch-Up Cancel my contribution ________________________________________________ _______________________ (Participant Signature) (Date) SUBMIT 1 If no effective date entered the contribution will be effective with the next regular pay cycle. 2 Regular contributions must not exceed the statutory limitation under IRC §457(b)(2). 50+ Catch-Up Contributions must not exceed the statutory limitation under IRC 414(v). The 3-Year Catch-Up feature must not exceed the statutory limitation under IRC §457(b)(3) and employees cannot elect the Age-50 and the 3-Year Catch-Up feature in the same year. rev 01/14 Page 1 of 2 SECTION 457(b) AGREEMENT FOR SALARY REDUCTION This form allows you to indicate how much you would like to contribute to your 457(b) account annually by choosing a combination of the following options: Percentage Per Pay Period – This amount will be a percentage of your salary per-pay-period. Contributions will remain the same unless your salary is adjusted, i.e. receive a raise or earn overtime. OR Flat Dollar Amount Per Pay Period – This amount will be a flat dollar deduction of your salary per-pay-period. Contributions will not change dependent on gross salary. Pre-Tax 457(b) Contributions – Contributions are taken on a pre-tax basis, effectively reducing your taxable gross income in the year of the contributions. Taxes are withheld on these funds at the time of withdrawal from the 457 account. AND/OR Designated ROTH 457(b) Contributions – if permitted under the terms of the plan, beginning in 2012 you must choose between pre-tax annual deferrals and after-tax ROTH contributions. You may choose either or both, but your election must not exceed the statutory limitations per the IRC. If you fail to elect to contribute to ROTH your entire contribution will be contributed on a pre-tax basis. Catch-Up Election for Participants Age 50 or Older – If you will be age 50 or older in the current calendar year, you may make an additional contribution of up to $5,500. In order to elect this contribution, you must also elect to make the maximum salary deferral allowed. The age-50 catch-up may not be combined with the special 457(b) 3-Year Catch-Up in any year. Instead, the catch-up election that produces the largest deferral amount is used. Special 3-Year Catch-Up Election – If permitted under the terms of the plan and to the extent that you have not contributed the maximum permitted under the IRC in each year you were eligible to participate in the 457(b) plan, you may make an additional contribution of the lesser of twice the annual maximum amount or the annual maximum amount plus any unused contributions from prior years in any one or each of the last three years before the year you attain Normal Retirement Age (as defined under the 457(b) plan). In order to elect this contribution, you must also elect to make the maximum deferral allowed. The Special 3-Year Catch-Up may not be combined with the age-50 catch-up in any year. Instead, the catch-up election that produces the largest deferral amount is used. New Enrollee in the Plan – This form will be used to begin the salary deferral/contribution deductions. Once TIAA-CREF receives your first contribution they will send a Welcome Kit welcoming you to the plan. This kit will include additional information necessary for you to administer your account; how to obtain online access at www.tiaa-cref.org/denver, beneficiary designation and investment election information, etc. Be aware that until an investment election is made your contributions will be defaulted in to the appropriate target-date fund based on your birth-date and calculated year of Normal Retirement Age. Questions – If you have questions regarding this form or need to manually submit this form via mail, scan and email or fax please contact: OHR Benefits Unit 201 W. Colfax Ave., Dept 412 Denver, CO 80202 FAX: 720-913-5548 Phone: 720-913-5697 Email: benefits@denvergov.org *Please keep a copy of this form for your records. rev 01/14 Page 2 of 2