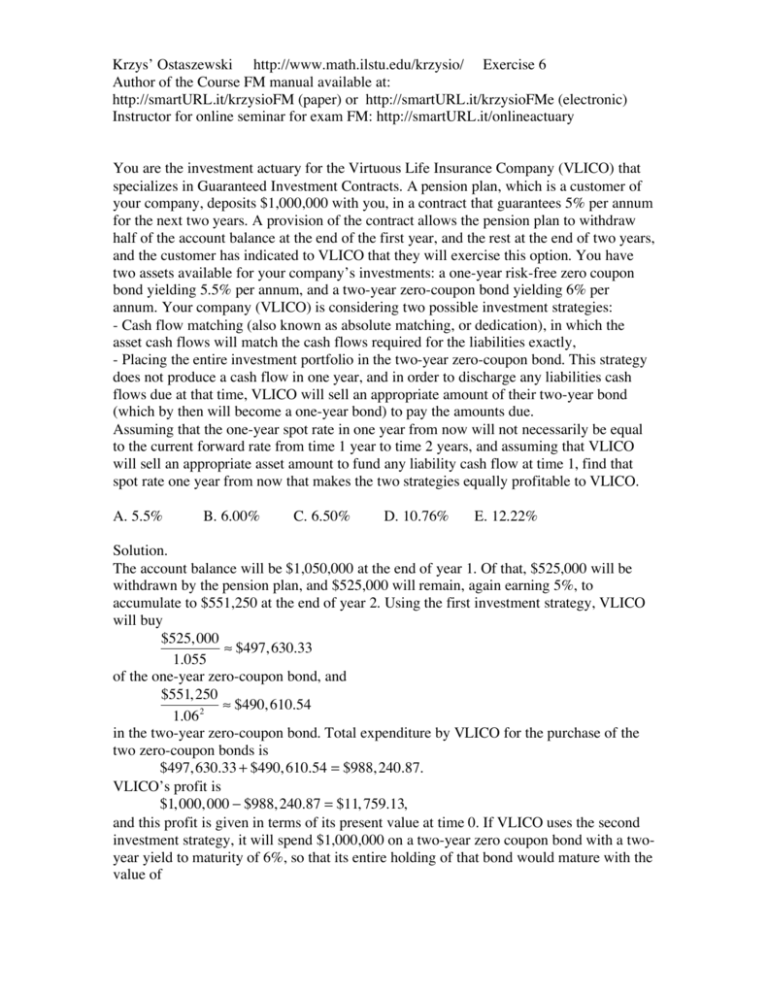

Krzys’ Ostaszewski http://www.math.ilstu.edu/krzysio/ Exercise 6

Author of the Course FM manual available at:

http://smartURL.it/krzysioFM (paper) or http://smartURL.it/krzysioFMe (electronic)

Instructor for online seminar for exam FM: http://smartURL.it/onlineactuary

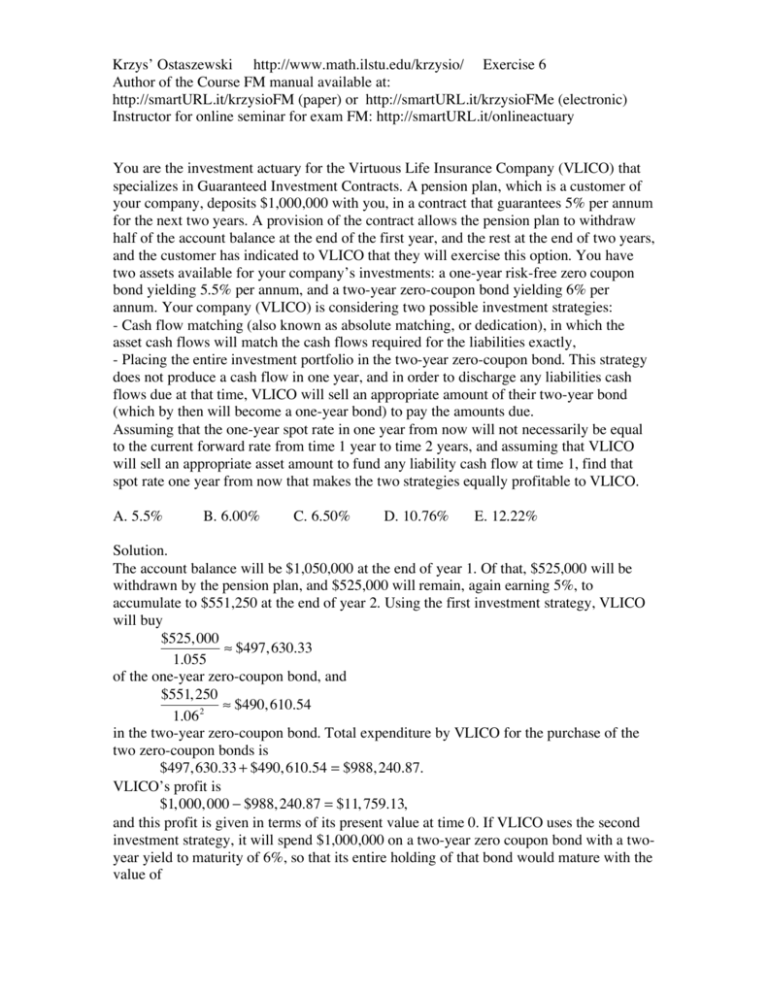

You are the investment actuary for the Virtuous Life Insurance Company (VLICO) that

specializes in Guaranteed Investment Contracts. A pension plan, which is a customer of

your company, deposits $1,000,000 with you, in a contract that guarantees 5% per annum

for the next two years. A provision of the contract allows the pension plan to withdraw

half of the account balance at the end of the first year, and the rest at the end of two years,

and the customer has indicated to VLICO that they will exercise this option. You have

two assets available for your company’s investments: a one-year risk-free zero coupon

bond yielding 5.5% per annum, and a two-year zero-coupon bond yielding 6% per

annum. Your company (VLICO) is considering two possible investment strategies:

- Cash flow matching (also known as absolute matching, or dedication), in which the

asset cash flows will match the cash flows required for the liabilities exactly,

- Placing the entire investment portfolio in the two-year zero-coupon bond. This strategy

does not produce a cash flow in one year, and in order to discharge any liabilities cash

flows due at that time, VLICO will sell an appropriate amount of their two-year bond

(which by then will become a one-year bond) to pay the amounts due.

Assuming that the one-year spot rate in one year from now will not necessarily be equal

to the current forward rate from time 1 year to time 2 years, and assuming that VLICO

will sell an appropriate asset amount to fund any liability cash flow at time 1, find that

spot rate one year from now that makes the two strategies equally profitable to VLICO.

A. 5.5%

B. 6.00%

C. 6.50%

D. 10.76%

E. 12.22%

Solution.

The account balance will be $1,050,000 at the end of year 1. Of that, $525,000 will be

withdrawn by the pension plan, and $525,000 will remain, again earning 5%, to

accumulate to $551,250 at the end of year 2. Using the first investment strategy, VLICO

will buy

$525, 000

! $497, 630.33

1.055

of the one-year zero-coupon bond, and

$551, 250

! $490, 610.54

1.06 2

in the two-year zero-coupon bond. Total expenditure by VLICO for the purchase of the

two zero-coupon bonds is

$497, 630.33 + $490, 610.54 = $988, 240.87.

VLICO’s profit is

$1, 000, 000 ! $988, 240.87 = $11, 759.13,

and this profit is given in terms of its present value at time 0. If VLICO uses the second

investment strategy, it will spend $1,000,000 on a two-year zero coupon bond with a twoyear yield to maturity of 6%, so that its entire holding of that bond would mature with the

value of

$1, 000, 000 !1.06 2 = $1,123, 600.00

if held to maturity. A year from now, VLICO will have a liabilities cash flow of $525,000

to pay and it will have to sell a portion of its bond to meet it. If the one-year spot rate a

year from now is x then the value of that bond a year from now will be

$1,123, 600.00

,

1+ x

and $525,000 of it must be sold to meet the liability, leaving only

$1,123, 600.00

! $525, 000.

1+ x

This will accumulate to

$1,123, 600.00 ! $525, 000 (1 + x )

at maturity. Of that amount $551,250 must be paid to the liability cash flow and the rest,

i.e.,

$1,123, 600.00 ! $525, 000 (1 + x ) ! $521, 250

is the profit. The present value of the profit is

$572, 350 ! $525, 000 (1 + x )

1.06 2

and this is supposed to be equal to $11, 759.13, hence

$572, 350 ! $525, 000 (1 + x )

= $11, 759.13

1.06 2

$559137.44 ! $525, 000 (1 + x ) = 0,

x ! 6.5%.

Answer C.

© Copyright 2005 by Krzysztof Ostaszewski.

All rights reserved. Reproduction in whole or in part without express written

permission from the author is strictly prohibited.