Krzys’ Ostaszewski, http://www.math.ilstu.edu/krzysio/, Exercise 47, 4/8/6

Author of the Course FM manual available at:

http://smartURL.it/krzysioFM (paper) or http://smartURL.it/krzysioFMe (electronic)

Instructor for online seminar for exam FM: http://smartURL.it/onlineactuary

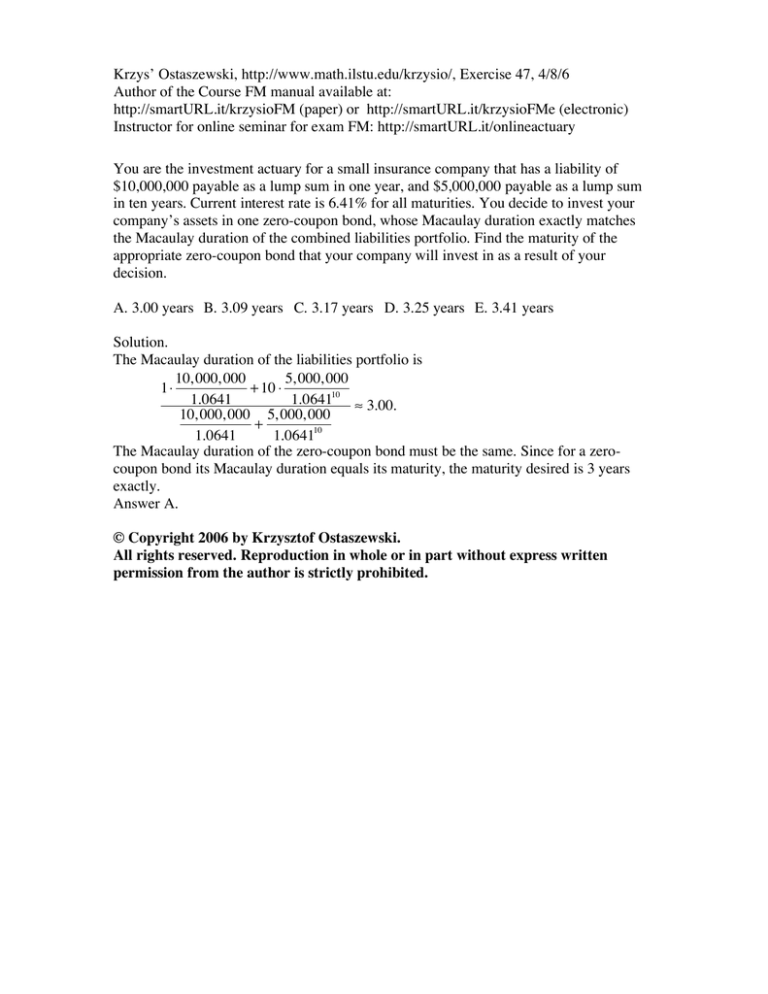

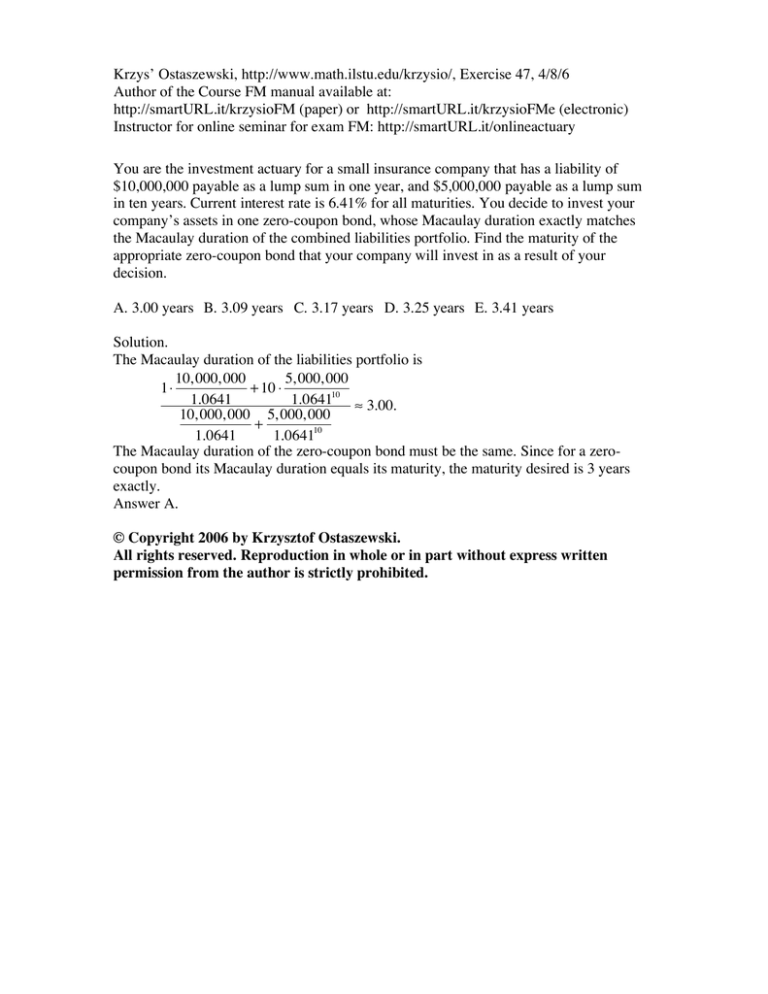

You are the investment actuary for a small insurance company that has a liability of

$10,000,000 payable as a lump sum in one year, and $5,000,000 payable as a lump sum

in ten years. Current interest rate is 6.41% for all maturities. You decide to invest your

company’s assets in one zero-coupon bond, whose Macaulay duration exactly matches

the Macaulay duration of the combined liabilities portfolio. Find the maturity of the

appropriate zero-coupon bond that your company will invest in as a result of your

decision.

A. 3.00 years B. 3.09 years C. 3.17 years D. 3.25 years E. 3.41 years

Solution.

The Macaulay duration of the liabilities portfolio is

10, 000, 000

5, 000, 000

1!

+ 10 !

1.0641

1.064110 " 3.00.

10, 000, 000 5, 000, 000

+

1.064110

1.0641

The Macaulay duration of the zero-coupon bond must be the same. Since for a zerocoupon bond its Macaulay duration equals its maturity, the maturity desired is 3 years

exactly.

Answer A.

© Copyright 2006 by Krzysztof Ostaszewski.

All rights reserved. Reproduction in whole or in part without express written

permission from the author is strictly prohibited.