Dealflow.com

Real Estate

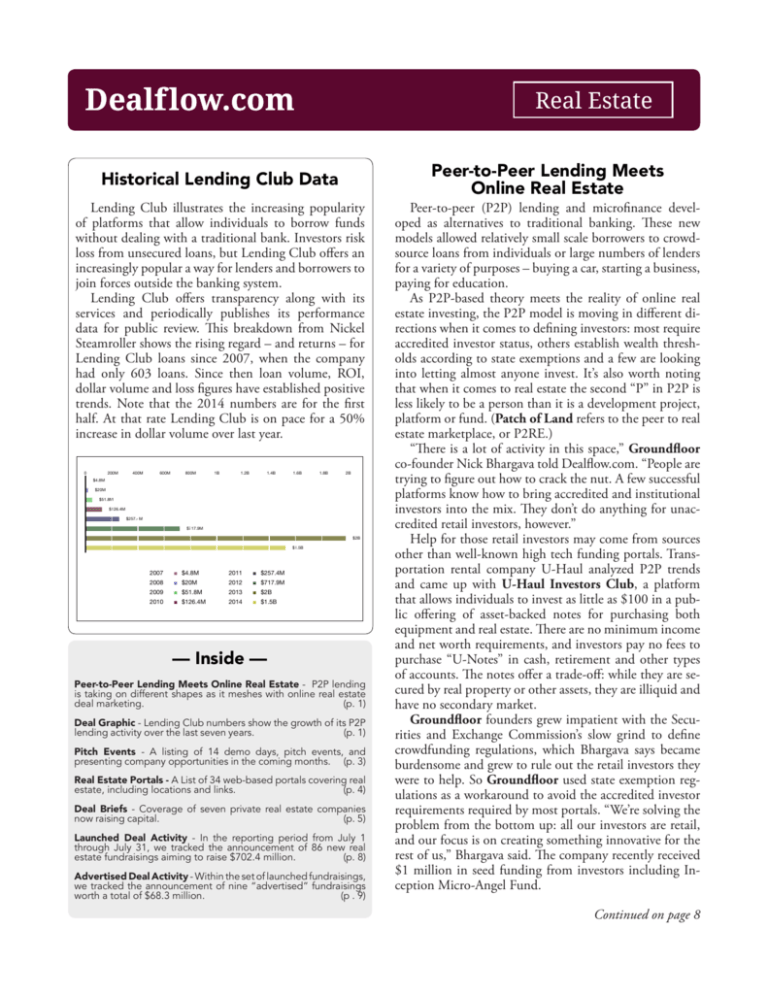

Historical Lending Club Data

Lending Club illustrates the increasing popularity

of platforms that allow individuals to borrow funds

without dealing with a traditional bank. Investors risk

loss from unsecured loans, but Lending Club offers an

increasingly popular a way for lenders and borrowers to

join forces outside the banking system.

Lending Club offers transparency along with its

services and periodically publishes its performance

data for public review. This breakdown from Nickel

Steamroller shows the rising regard – and returns – for

Lending Club loans since 2007, when the company

had only 603 loans. Since then loan volume, ROI,

dollar volume and loss figures have established positive

trends. Note that the 2014 numbers are for the first

half. At that rate Lending Club is on pace for a 50%

increase in dollar volume over last year.

0

200M

400M

600M

800M

1B

1.2B

1.4B

1.6B

1.8B

2B

$4.8M

$20M

$51.8M

$126.4M

$257.4M

$717.9M

$2B

$1.5B

2007

■ $4.8M

2011

■ $257.4M

2008

■ $20M

2012

■ $717.9M

2009

■ $51.8M

2013

■ $2B

2010

■ $126.4M

2014

■ $1.5B

— Inside —

Peer-to-Peer Lending Meets Online Real Estate - P2P lending

is taking on different shapes as it meshes with online real estate

deal marketing.

(p. 1)

Deal Graphic - Lending Club numbers show the growth of its P2P

lending activity over the last seven years.

(p. 1)

Pitch Events - A listing of 14 demo days, pitch events, and

presenting company opportunities in the coming months. (p. 3)

Real Estate Portals - A List of 34 web-based portals covering real

estate, including locations and links.

(p. 4)

Deal Briefs - Coverage of seven private real estate companies

now raising capital.

(p. 5)

Launched Deal Activity - In the reporting period from July 1

through July 31, we tracked the announcement of 86 new real

estate fundraisings aiming to raise $702.4 million.

(p. 8)

Advertised Deal Activity - Within the set of launched fundraisings,

we tracked the announcement of nine “advertised” fundraisings

worth a total of $68.3 million.

(p . 9)

Peer-to-Peer Lending Meets

Online Real Estate

Peer-to-peer (P2P) lending and microfinance developed as alternatives to traditional banking. These new

models allowed relatively small scale borrowers to crowdsource loans from individuals or large numbers of lenders

for a variety of purposes – buying a car, starting a business,

paying for education.

As P2P-based theory meets the reality of online real

estate investing, the P2P model is moving in different directions when it comes to defining investors: most require

accredited investor status, others establish wealth thresholds according to state exemptions and a few are looking

into letting almost anyone invest. It’s also worth noting

that when it comes to real estate the second “P” in P2P is

less likely to be a person than it is a development project,

platform or fund. (Patch of Land refers to the peer to real

estate marketplace, or P2RE.)

“There is a lot of activity in this space,” Groundfloor

co-founder Nick Bhargava told Dealflow.com. “People are

trying to figure out how to crack the nut. A few successful

platforms know how to bring accredited and institutional

investors into the mix. They don’t do anything for unaccredited retail investors, however.”

Help for those retail investors may come from sources

other than well-known high tech funding portals. Transportation rental company U-Haul analyzed P2P trends

and came up with U-Haul Investors Club, a platform

that allows individuals to invest as little as $100 in a public offering of asset-backed notes for purchasing both

equipment and real estate. There are no minimum income

and net worth requirements, and investors pay no fees to

purchase “U-Notes” in cash, retirement and other types

of accounts. The notes offer a trade-off: while they are secured by real property or other assets, they are illiquid and

have no secondary market.

Groundfloor founders grew impatient with the Securities and Exchange Commission’s slow grind to define

crowdfunding regulations, which Bhargava says became

burdensome and grew to rule out the retail investors they

were to help. So Groundfloor used state exemption regulations as a workaround to avoid the accredited investor

requirements required by most portals. “We’re solving the

problem from the bottom up: all our investors are retail,

and our focus is on creating something innovative for the

rest of us,” Bhargava said. The company recently received

$1 million in seed funding from investors including Inception Micro-Angel Fund.

Continued on page 8

Real_Estate/note_to_readers

Real Estate

Dear Reader,

Dealflow.com

P.O. Box 122

Syosset, NY 11791

T (516) 876-8006

F (516) 876-8010

www.dealflow.com

@dealflow

Subscribe: This newsletter is currently free and is published

the 4th Wednesday of each month, except on weeks that

include holidays. You must be an accredited investor to

receive this newsletter. Sign up at http://dealflow.com/

signup.html.

Post your Deal: If you would like to include your deal in this

newsletter, email editor@dealflow.com.

Open Access Policy: Dealflow.com has an open access data

policy and is committed to sharing information with the

markets we serve. If you would like to contribute an article to

this newsletter, email editor@dealflow.com. If you would like

access to our newsletter API, call us.

All rights reserved. © 2014 Dealflow.com. Copying,

distributing electronically by email, or duplicating this

publication in any manner other than one permitted by

agreement with Dealflow.com is prohibited.

In this newsletter, Dealflow.com provides information and

data about companies actively raising capital in reliance on

the exemptions provided by Rule 506 of Regulation D of

the Securities Act of 1933. We provide information to the

investment community, entrepreneurs, and service providers

interested in private placement activity. We are not a funding

portal, hedge fund, broker-dealer or investment advisor.

Dealflow.com has used reasonable effort to ensure that

the information in this publication is accurate and up-todate; however, Dealflow.com makes no representations or

warranties, express or implied, relating to this information,

and Dealflow.com expressly denies any liability direct or

indirect, related to the accuracy or completeness of this

information and to any decisions that may be made based

on this information. By receiving this newsletter you agree

to Dealflow.com’s Terms of Use (http://dealflow.com/terms)

and Privacy Policy (http://dealflow.com/privacy) and agree

that neither Dealflow.com, nor its affiliates has liability

whatsoever for any claim, expense, fee, cost or other type of

loss related to or arising from use of the information, and has

no obligation to correct, refresh, or update any information.

This newsletter is a general circulation publication. The

information herein is not intended to be and should not be

construed to be recommendations to purchase, retain, or sell

securities, or investment advice with regard to the companies

mentioned or advertised. Customers of Dealflow.com may be

discussed or advertised in this publication. Dealflow.com and

its affiliates are not responsible for, and have not undertaken

any effort to verify any information, claim, promise or

statement contained within, any advertisements published

in this newsletter. Dealflow.com, its subsidiaries, and its

employees or contractors may, from time to time, purchase,

own, or sell securities or other investment products of the

companies discussed or advertised in this publication.

Dealflow.com™ is a trademark of Dealflow Analytics, Inc.

(d/b/a Dealflow.com). Dealflow.com is not affiliated with

The DealFlow Report, which is owned and published by The

Deal, LLC. Trademarks, trade names, and logos used in this

publication are the property of their respective owners.

© 2014 Dealflow.com™

This isn’t your typical real estate investment newsletter.

For starters, what you’re going to find in these pages is information about launched, or “actively marketed” real estate

deals, not information about deals that have closed. We’re

aiming to give you insight into what will happen as opposed

to what has happened.

Also notable is that although this newsletter covers deals

in the real estate sector, this is just one of the deal markets

Dealflow.com is focused on. Our objective is to track deals

across the capital markets – regardless of deal type or sector.

So be on the lookout for other newsletters based on the deal

type and sector preferences you selected when you signed up

to Dealflow.com.

As a data-driven company, our editorial agenda is to take

no position, either pro or con, for or against, particular deals

or deal-makers. Nothing in this newsletter (or any of our

products) should be construed as investment advice. Please

read our disclaimer.

Regarding our taking no editorial position on companies

mentioned in this newsletter, you will notice that our deal

briefs and data tables are listed in alphabetical order. Again,

there’s no preference or priority given to the arrangement of

the information in this publication.

We’re publishing this newsletter with a monthly distribution schedule. That means you should expect to receive

this newsletter on the 4th Wednesday of each month (except

during holidays). Dealflow.com newsletters covering other

capital markets will have different publication schedules.

As to the scope of coverage in this newsletter, our reporting periods are based on the frequency of publication. This

newsletter is published every month, and the “reporting period” contains data from the previous month. In this publication, we’re covering real estate-related deals (both companies and investment funds) that are marketed in the United

States, though from time to time we may cover financings in

other venues. Issuers may be physically located overseas, but

selling efforts must be U.S.-based for us to track the deal.

One last note on your subscription: This newsletter is

currently free for accredited investors. Dealflow.com has an

“open access data policy” and is committed to sharing information about the markets we cover with the markets we

serve. That means you’ll get this newsletter for free as long as

you meet the required criteria and agree to our terms of use. If

you would like to contribute to this newsletter, we welcome

your input. You can contact us at editor@dealflow.com.

- Steven Dresner

Dealflow.com

2

Real_Estate/pitch_events

Real Estate

Real Estate Pitch Events + Demo Days + Presenting Company Conferences

The table below includes a listing of demo days, investor meetings, and presenting company opportunities focused on raising capital

in the real estate sector. If you have an event you would like listed in this newsletter, email editor@dealflow.com.

Event

Date

Location

URL

Real Estate Shark Tank

9/3/14

Dania Beach, FL

http://www.breia.com/event/shark-tank/

The Crowdfunding Forum for Real Estate

9/8/14

Santa Monica,

CA

http://www.imn.org/real-estate/conference/Crowdfunding-for-Real-Estate/Home.html

Broadmark Capital Webcast

9/10/14

Webinar

http://broadmark.dealflow.com

Practising Law Institute Hotels 2014: Law and

Practice

9/10/14

New York, NY

http://www.pli.edu/Content/Seminar/Hotels_2014_Law_

and_Practice/_/N-4kZ1z12fbc?ID=174681

Haves and Wants Networking Event and Open

Discussion

9/10/14

Naples, FL

http://www.advantaira.com/events/upcoming/

An In-Depth Look at the New Jersey Real Estate

Market

9/11/14

Roseland, NJ

http://www.rela.org/index.php/en/events/26-new-jersey/116-rela-nj-an-in-depth-look-at-the-new-jersey-realestate-market

Crittenden Real Estate Finance 2014

9/15/14

Miami, FL

http://www.crittendenrealestatefinance.com/crittenden-real-estate-finance-conference1.html

Massey Knakal Brooklyn Real Estate Summit

9/16/14

Brooklyn, NY

http://mkbrooklynsummit.com/

The Second Annual Washington, D.C. & Mid-Atlantic Data Center Summit

9/16/14

Reston, VA

http://cre-events.com/dcdc2014/

Investors Resources Center

9/18/14

Winter Park, FL

http://www.ircflorida.net/

InterFace Conference Group California Commercial Real Estate Trends

9/22/14

Los Angeles, CA

http://interfaceconferencegroup.com/trendsca2014/

Caprate Events The Second Annual Northeast

Industrial Real Estate Summit

9/23/14

Jersey City, NJ

http://cre-events.com/industrialre2014/

IMN's Bank Special Asset Conference on Real

Estate Workouts

9/29/14

Chicago, IL

http://www.imn.org/real-estate/conference/Bank-Financial-Institutions-Special-Assets-Real-Estate-Workouts-Midwest/Home.html

Pension Real Estate Association 24th Annual Institutional Investor Real Estate Conference

9/30/14

Los Angeles, CA

http://www.prea.org/fallconference14/index.cfm

© 2014 Dealflow.com™

3

Real_Estate/portals

Real Estate

Web Based Portals Covering Real Estate

The table below includes a listing of online portals that focus only on real estate investing and are actively showcasing deals and

taking investments. Many other real estate portals are currently preparing to go live. The table also includes each portal’s location

and link.

Portal

Location

URL

AssetAvenue

Los Angeles, CA

https://www.assetavenue.com

Blackhawk Investments

San Francisco, CA

http://blackhawkcorp.com/

CrowdMason

New York, NY

http://crowdmason.com/

CrowdTranche

San Francisco, CA

http://crowdtranche.com/

CrowdStreet

Portland, OR

http://www.crowdstreet.com/

CrowdVested

Atlanta, GA

http://www.crowdvested.com/

CRWD

New York, NY

https://www.crwd.com/

DiversyFund

San Diego, CA

http://diversyfund.com/

EquityHunt

Wheatfield, NY

http://www.equityhunt.com/home

Funding Hamptons

Riverhead, NY

http://www.fundinghamptons.com

Fundrise

Washington, DC

https://fundrise.com/

GlobalGroupFund

Brooklyn, NY

http://www.globalgroupfund.com/

Globerex

New York, NY

http://www.globerex.com

GroundBreaker

San Francisco, CA

http://groundbreaker.co/

GroundFloor

Atlanta, GA

https://www.groundfloor.us

High Income Real Estate

Scottsdale, AZ

http://highincomerealestate.com/

iFunding

New York, NY

https://www.ifunding.co/

Loquidity

Grand Rapids, MI

http://www.loquidity.com/en

Money360

Ladera Ranch, CA

http://www.money360.com/

NXGen Capital

Fair Oaks, CA

https://www.nxgencapital.com/

OpenSource Capital

Ft. Lauderdale, FL

http://opensourcecap.com/

PassiveFlow

San Francisco, CA

http://www.passiveflow.com/

Patch of Land

Century City, CA

http://patchofland.com

Prodigy Network

New York, NY

http://en.prodigynetwork.com/

PropFunds

Malibu, CA

http://propfunds.com/#home

Real Circle

San Francisco, CA

http://www.realcircle.com/

RealCrowd

Palo Alto, CA

https://www.realcrowd.com/

RealRite

San Francisco, CA

http://www.realrite.com/

Realty Mogul

Los Angeles, CA

https://www.realtymogul.com

RealtyShares

San Francisco, CA

https://www.realtyshares.com/

Rich-Uncles

Newport Beach, CA

http://www.rich-uncles.com/#top

ShareStates

New York, NY

https://www.sharestates.com/

Sprovy

Austin, TX

https://sprovy.com/welcome

Tycoon Real Estate

San Francisco, CA

https://www.tycoonre.com/

© 2014 Dealflow.com™

4

Real_Estate/deal_briefs

Real Estate

AKA United Nations

Raising: $9,000,000

Sector: Condominiums

Source: Prodigy Network

Blackhawk Investments

Raising: $1,000,000

Sector: Commercial

Source: AngelList

Prodigy Network is raising $9 million for a $90 million

project in Manhattan on 46th Street between 2nd and

3rd Avenues. The AKA United Nations building is currently

operated by AKA as an Extended Stay venue with furnished

one-bedroom apartments with kitchens. Prodigy plans to work

with Extended Stay to allow condo owners to rent out their

dwellings when they are out of town, thus allowing residents to

offset some of their high Manhattan living costs.

At the same time, individuals eager to visit the popular

area will have new hospitality options available in the form of

serviced apartments. The building is close to Times Square,

Rockefeller Center, and the Grand Central Terminal, as well

as many prominent employers such as Morgan Stanley, A&E

Network and Citibank. The 20-story building features 95 units.

The company plans to capitalize on a shortage of moderately

price condominiums at a time when a surge in luxury condos,

almost half of which sell for over $3,000 per square foot,

has put a damper on the market for lower priced dwellings.

Prodigy plans to acquire the building in September, gradually

upgrade its units and begin selling them in early February of

2015. The deal is being marked to accredited investors on the

Prodigy website, and founder Rodrigo Niño told DealFlow.

com that he is optimistic over the potential of crowdfunding

and general solicitation for making real estate investing in largescale developments available to a wider range of buyers.

The financing consists of $9 million in equity being raised

on the platform plus senior debt from Bank of America and

mezzanine financing from real estate advisory Emmes Asset

Management. Two investment scenarios are based on selling

prices of $1,800 per square foot and $2,000 per square foot.

These scenarios would generate IRRs of 38.3% and 51.6% over

an approximate three-year holding period.

The minimum investment is $50,000.

Blackhawk Investments is a real estate peer-to-peer lending

platform that connects investors and borrowers directly online.

The platform matches investors with loan opportunities that

meet their stated investment criteria. Once a successful match

is made, investors have the option to reserve all or part of the

loan amount. After the loan request is fully reserved, then all

necessary documentation will be prepared by third party

licensed professionals for their review.

“We had $10 million in sales in the fourth quarter of last

year and as of right now we have more than $18 million in

our pipeline to fund,” Blackhawk Investments president and

CEO Michael Ping told Dealflow.com.

Blackhawk has also developed online tools and third

party resources to help educate, provide due diligence and all

necessary documents for peer investors to successfully originate

their own commercial notes secured by the peer borrower’s real

estate.

According to the company, its members can expect to see

annual returns starting at 6% to 11% that are secured by

commercial and investment real estate with a fixed maturity

date of one to three years. The investment minimum is set at

$25,000.

For borrowers, Blackhawk noted that it enables faster

closing times, a transparent lending process and quick and easy

qualification.

“We are in the process of developing strategic partnerships

that will fund loans with more velocity,” said Ping. “These new

partnerships will allow us to get a lot more deals done because

of their expertise, expand our database and one of the joint

ventures will provide equity crowdsource funding, which will

allow us to focus on the debt side.”

Blackhawk stated that it reviews each potential borrower

and property, and it only allows businesses and individuals to

borrow if they have successfully completed a vetting process.

This process is based on validating key up-to-date financial

information and qualifying the integrity of each loan request

posted on the site.

Blackhawk is raising funds to hire additional staff, online

and digital marketing and PR.

Deal Briefs are not recommendations to purchase, retain, or sell securities of the companies mentioned. Deal Briefs are intended to provide a diversified selection

of companies in order to illustrate market trends; however, not all Deal Briefs are announced/open deals from the reporting period covered in this newsletter.

Dealflow.com and its affiliates make no representation or warranty, express or implied, about the accuracy or completeness of the information in any Deal

Brief. Dealflow.com has no obligation to update any information contained in any Deal Brief. If you would like your deal to be considered for Deal Briefs, email

editor@dealflow.com.

© 2014 Dealflow.com™

5

Real_Estate/deal_briefs

Real Estate

Inner Ten Development

1124 Linden

Raising: $450,000

Sector: Residential Properties

Source: iFunding

Inner Ten Development is raising capital for a construction

loan to build a two-unit condo project in Austin, Texas. The

sponsor is making a $155,000 equity investment along with

the $450,000 being raised on the portal. Inner Ten has raised

capital with iFunding for two other ongoing projects on the

same street and has completed a number of other ones in the

same region.

The project will feature 3600 square feet of living space on

an 8712 square foot lot. Demand for real estate in the area is

strong, with many projects selling in as little as ten days. The

East Austin neighborhood is number seven on Forbes’ hippest

hipster neighborhoods in America list. Austin Home Solutions

is the project designer.

The construction costs are $450,000, with land and closing

costs accounting for the remaining $155,000. The one-year

loan is structured for a 10% annualized rate of interest and can

be extended for two 90-day intervals, but the sponsors expect

to complete the units in nine months. The projected return on

the investment is 7.5%. The investment is a promissory note

guaranteed by Inner Ten.

Mobile Home Park Fund V

MHP Funds LLC

Raising: $25,000,000

Sector: Mobile Home

Source: Realty Mogul

Realty Mogul and MHP Funds LLC are raising capital for

Mobile Home Park Fund V, a vehicle that will specialize in

buying and turning around under-valued and under-managed

mobile home parks at locations across the U.S. About 6% of

the U.S. population lives in mobile homes across the country,

and demand remains strong for the moveable dwellings.

Research from Realty Mogul indicates that 60 million

people have annual incomes under $20,000 – a figure that

leaves them with a $500 monthly rent budget according to

federal guidelines. Building new trailerparks faces problems

with zoning and planning, so existing parks are in demand.

Investors who own the actual homes can depreciate them faster

than traditional real property, and those who only own the

land and pads do not have to worry about maintenance costs.

Maintenance is the responsibility of the tenant who owns the

trailer.

The fund plans to acquire 20 to 40 mobile home parks

and hold them for five to 10 years. The fund is designed for

both cash flow and equity growth, and the fund projects 10%

preferred returns. Excess cash flow and appreciation will be split

between the fund and investors, and the fund projects a 16% to

18% IRR. This will be MHP’s eighth mobile home park fund.

Mobile Home Park Fund V currently has three transactions

underway that include a total of six parks. MHP uses several

means of finding new parks, including a database of potential

park candidates, foreclosures and recommendations from

investing seminar attendees. MHP’s existing park portfolio

comprises some 100 parks and 10,000 lots in 16 states.

Pyatt Broadmark Real Estate

Lending Fund I

Sector: Real Estate Lending

Source: Dealflow.com

Pyatt Broadmark Management, LLC, based in Seattle,

Wash., specializes in private, short-term commercial financing

throughout Washington, Oregon and Idaho with a focus on

construction, land acquisition, development, rehab, bridge to

conventional and commercial real estate purchase loans.

In partnership with Broadmark Capital LLC, the firm has

established the Pyatt Broadmark Real Estate Lending Fund

I (PBRELF I), which was created to satisfy an unmet need in

the U.S. credit market, according to the company. The Fund

provides short-term, unleveraged, first position deed of trust

loans with loan to values no greater than 65% issued against

real estate projects in the Pacific Northwest. The loans are

made to home builders, developers, real estate investors and

businesses looking to expand real property facilities.

“After four years of servicing this market, the demand for

PBRELF I loans still outstrips our ability to supply capital,”

said Broadmark Capital managing director Adam Fountain.

“We routinely see high quality lending opportunities from

mortgage brokers, real estate agents, banks and other such

intermediaries.”

The Fund raises capital through the issuance of membership

interests in a limited liability company. There is a $100,000

minimum investment with the current capacity to accept up to

$5 million per month.

As of July, 2014 the fund has $71 million in assets under

management and holds 88 active loans. An investor owns a pro

Deal Briefs are not recommendations to purchase, retain, or sell securities of the companies mentioned. Deal Briefs are intended to provide a diversified selection

of companies in order to illustrate market trends; however, not all Deal Briefs are announced/open deals from the reporting period covered in this newsletter.

Dealflow.com and its affiliates make no representation or warranty, express or implied, about the accuracy or completeness of the information in any Deal

Brief. Dealflow.com has no obligation to update any information contained in any Deal Brief. If you would like your deal to be considered for Deal Briefs, email

editor@dealflow.com.

© 2014 Dealflow.com™

6

Real_Estate/deal_briefs

Real Estate

rata share of each loan in the portfolio through an LLC.

Investors receive 20% of origination fee income and 80% of

interest income (less direct fund expenses, e.g. taxes and audit).

A monthly cash distribution is paid directly to the investor’s

bank account. There is a redemption option available after one

year, and then quarterly.

“The goal of the fund is to provide investors with a highyield debt investment while minimizing the risk of principal

loss and maintaining near-term liquidity,” Fountain said.

PBRELF I was launched in August, 2010 and as of July,

2014 has written 187 loans, 99 of which have been paid in

full. As of July, 2014, the Fund has delivered to investors

an annualized return since inception of 11.64%, assuming

reinvestment.

Saglo Development Corp.

Central Plaza Shopping Center,

St. Petersburg, Fla.

Raising: $3,200,000

Sector: Retail

Source: EarlyShares

Part of the capital for investment in a Florida retail center is

being raised on EarlyShares, where backers can commit up to

$250,000 of the total. Saglo Development Corp. acquired the

Central Plaza Shopping Center property for about $7.3 million

and is raising money for refinancing. The deal offers investors

the opportunity to capitalize on cash flow from a property that

is almost always completely rented out to store tenants with

positive track records when it comes to paying rent. The address

is 3201-3365 Central Avenue in St. Petersburg.

The property is located at a busy intersection along streets

leading variously to downtown St. Petersburg, the Gulf of

Mexico and two suburban counties. Most tenants are national

retailers, including Footlocker, Family Dollar and Rainbow

Kids. The opening of a Wal-Mart nearby in 2011 led to an influx

of customers to other stores in the area, which is surrounded by

a variety of densely populated neighborhoods.

Saglo projects a 13.4% IRR for Central Plaza, and equity

investors will receive an 8% preferred return distributed on a

quarterly basis. Saglo purchased the property at an LTV under

65% and has financing that is fixed at 3.75% for five years and

capped at 5.75% for the remaining five years of the loan.

Miami-based Saglo was founded in 1976 to specialize in

shopping center investment. The company owns and operates

800,000 square feet of centers and also provides management

and leasing services to another 230,000 square feet.

The Thompson Block

Raising: $1,740,000

Sector: Real Estate Management

& Development

Source: EquityHunt

Thompson Block Partners is currently raising an equity

round for the Thompson Block, located on the corner of

Depot Town in Ypsilanti, Mich., by selling 174 shares valued

at $10,000 per share. The investment company plans to use

the funds for the further development of the property, which

will feature about 14,000 square feet of commercial space, 16

luxury lofts and a 26 car surface parking lot.

“We bought this property and created the entity to raise

the necessary funding, which is our seventh project and our

biggest,” Thompson Block Partners president Stewart Beal

told Dealflow.com. “We started the raise in the beginning of

2013 and currently we have 25 shares left. We have also received

state grants for this project.”

The internal rate of return is estimated at 15% to 18% and

the targeted closing date for the deal on EquityHunt is set for

Sept. 1, 2014. The estimated cost of the entire project is about

$5 million.

“Investors will receive 45% immediately after construction

is complete through the historic tax credit,” said Beal. “Then a

quarterly return will follow after that. We will close the entire

raise Sept. 30.”

The pricing for the residential units will begin at $732 per

month for a 610 square-foot studio to $1,424 per month for

a 1,187 square-foot apartment with two bedrooms and two

baths. Parking can be reserved and will be available in the

parking lot at $75 per space.

Thompson Block, built in 1861, was once Civil War barracks.

The property is located within a short distance of restaurants,

shops, festivals, parks and Eastern Michigan University.

Deal Briefs are not recommendations to purchase, retain, or sell securities of the companies mentioned. Deal Briefs are intended to provide a diversified selection

of companies in order to illustrate market trends; however, not all Deal Briefs are announced/open deals from the reporting period covered in this newsletter.

Dealflow.com and its affiliates make no representation or warranty, express or implied, about the accuracy or completeness of the information in any Deal

Brief. Dealflow.com has no obligation to update any information contained in any Deal Brief. If you would like your deal to be considered for Deal Briefs, email

editor@dealflow.com.

© 2014 Dealflow.com™

7

Real_Estate/launched_deals

Real Estate

Launched Real Estate Deals - July 1 to July 31, 2014

In the most recent reporting period, we tracked 86 launched deals seeking to raise a total of $702,423,049. Of these deals nine were

advertised Rule 506(c) offerings totaling $68,290,000.

Issuer

1124 Linden Austin Texas

130 S. Front St., L.P.

220 N.Van Ness Hancock Park

307-311 Union Avenue LLC

8950 North Central Avenue, LLC

Agility Title, LLC

AKA United Nations

Raising

Source

Issuer

iFunding

Community Veterinary Partners

SEC

Dreammation EFX Studios

RealtyShares

Energy Commerce Center 1 LLC

$20,000,000

SEC

First Land Transfer, LLC

$310,000

SEC

Flathead Hospital Development

$75,000

SEC

Great Ajax Corp.

Prodigy Netwrk

Great Falls Apartment, LLC

$450,000

$6,401,540

$820,000

$9,000,000

Raising

Algodon Wines & Luxury Dev Gp

$30,000,000

SEC

GREF III REIT LLC

Alpha Real Estate Holdings I LCC

$10,000,000

Debt

Hamptons Luxury Waterfront Res

Alpha Real Estate Holdings I LCC

$10,000,000

SEC

Houston Multi-Family

$1,200,000

SEC

HUBBELL REALTY Co

American New Homes Holdings LLC

Apollo Storage

$10,710,088

Realty Mogul

Impact Investing San Antonio

Austin CreativeOffice/ATCO

$12,635,000

RealCrowd

Independence Retail West, LLLP

AZ Investment Property Experts

$3,000,000

SEC

BDR Bellevue IV LLC

$600,000

SEC

BDR Kirkland III LLC

$500,000

SEC

BDR Kirkland IV LLC

$600,000

SEC

$3,325,000

SEC

Biltmore Apartment Homes, Ltd.

Bizantu

$750,000

AngelList

BlackRock/Stowe Residences, LLC

$600,000

SEC

Blue Water Development

$2,047,740

EarlyShares

BSREP Marina Village REIT I LLC

$125,000

SEC

BSREP Riverside REIT LLC

$125,000

SEC

Capstone Real Estate Investments

$4,200,000

SEC

CCC Gallery Lofts LLC

$4,375,000

SEC

Central Plaza, Fl.

$3,200,000

EarlyShares

Charles Street Land, LLC

$1,400,000

SEC

$56,500

SEC

COMMUNITY BANK MORTGAGE

$2,000,000

$100,000

Source

SEC

Fundable

$1,600,000

SEC

$50,000

SEC

$6,412,800

SEC

$130,000,000

SEC

$3,500,000

SEC

$125,000

SEC

$1,000,000

Fundrise

$275,000

LinkedIn

$10,000,000

$1,000

$9,650,000

SEC

AngelList

SEC

Advertisement

Broadmark Capital would like to invite

you to their free webcast for accredited

investors on September 10th, 2014:

Pyatt Broadmark Real Estate Lending

Fund I (PBRELF I) has a four (4) year

history of annualized net returns in

excess of 11%*. The goal of PBRELF I

is to provide investors with a

high-yield debt investment while

minimizing the risk of principal loss

and maintaining near-term liquidity.

*Past performance is not indicative of future returns

broadmark.dealflow.com

All data is based on information gathered by Dealflow.com. Data is updated based on the availability of public disclosures and has been obtained from sources

deemed reliable, including online funding portals, social media, corporate communications, regulatory filings with the Securities and Exchange Commission and

certain third party sources. Dealflow.com does not guarantee the accuracy and completeness of this data and makes no representation or warranty, express or

implied about the accuracy or completeness of this data. Data includes private and public company issuers, including issuers filing for an indefinite amount of

securities to be sold. Sector classifications are based on the Global Industry Classification Standard (GICS) and do not take into account issuers addressing multiple

sectors.

© 2014 Dealflow.com™

8

Real_Estate/launched_deals

Real Estate

Issuer

Source

Issuer

$2,750,000

SEC

Rocky Creek Plantation Acquisitions

$40,000,000

SEC

LAMORIA CONDOMINIUMS LLC

$4,000,000

Leonard Oaks Apartments

$1,435,000

Kahala Apartments CC4R, LLC

KWB HOTEL PARTNERS, LLC

LSREF2 Razor REIT (Atlanta), Inc.

LYNK Capital, LLC

Marietta Georgia/Camelot/Signtr H

Medical Center IV at Monument

MHP Mobile Home Fund

Raising

$250,000

$25,000,000

$100,000

$2,000,000

$25,000,000

Raising

$16,168,050

SEC

RSF REIT V SP 2, L.L.C.

$250,000

SEC

SEC

RSF REIT VI PVSL 1, L.L.C.

$500,000

SEC

Loquidity

Santana Village Apartments, LLLP

$6,675,000

SEC

SEC

SFA COMMERCIAL LLC

$30,000,000

SEC

AngelList

SL Water's Edge Apartments, DST

$21,118,000

SEC

CrowdVested

South Campus Land Cnsortium One

$10,400,000

SEC

SEC

Spa Villas at Calitina

$450,000

GoundBreaker

Realty Mogul

Three Property Rehab in NorCal

$660,000

Patch of Land

$500,000

AngelList

Miami Arts District Mixed-Use Rep

$1,850,000

Fundrise

Tycoon Real Estate

Mission Oaks/Xebec Realty

$3,500,000

RealCrowd

University Lofts, L.L.C.

Mortgage Harmony Corp.

$2,000,000

AngelList

US Bank Building

$125,000

SEC

Washington Towers EB-5, LP

$66,000,000

$36,957,331

SEC

WatersViews Assited Living

$2,000,000

MSR GL/DR Mezz D LLC

National Net Lease Portfolio V DST

NB Duck Abbey, DST

Nelson Bros Duck Abbey Sdnt Hsng

Nelson Brothers Meadow View

Nelson Bros Sdnt Hsng & As Liv Hld

Oak Point Vero Properties, L.P.

Osage Place Townhomes, LLC

Our Home Transitional

$2,310,000

$500,000

Advertised Rule 506(c) Offerings

RealCrowd

Issuer

$50,000,000

SEC

Alpha Real Estate Holdings I LCC

$2,400,000

SEC

$800,000

$50,000

$18,300,000

$1,300,000

SEC

RealCrowd

SEC

Dealflow.com

Real Crowd

Crowdstreet

$4,408,000

Source

Raising

Source

$10,000,000

SEC

NB Duck Abbey, DST

$2,310,000

SEC

SEC

Nelson Brothers Meadow View

$4,408,000

SEC

AngelList

Nelson Bros Sdnt Hsng & As Liv Hld

$50,000,000

SEC

Patch of Land, Inc.

$550,000

SEC

Patch of Land, Inc.

$132,000

SEC

Patch of Land, Inc.

$140,000

SEC

Patch of Land, Inc.

$550,000

SEC

Patch of Land, Inc.

$132,000

SEC

Patch of Land, Inc.

$140,000

SEC

Place at Saddle Creek Apartments

$7,050,000

SEC

RSF REIT V SP 2, L.L.C.

$250,000

SEC

Provident Gp - Canton Cove Prprts

$3,450,000

SEC

RSF REIT VI PVSL 1, L.L.C.

$500,000

SEC

$600,000

SEC

Real Estate Buyers Listing Service

Rentah

$5,000,000

AngelList

Rental Owners Group, Inc.

$2,250,000

SEC

Rentscoper

Revesco (USA) Prprties of Sheridan

$25,000

$2,250,000

AngelList

SEC

All data is based on information gathered by Dealflow.com. Data is updated based on the availability of public disclosures and has been obtained from sources

deemed reliable, including online funding portals, social media, corporate communications, regulatory filings with the Securities and Exchange Commission and

certain third party sources. Dealflow.com does not guarantee the accuracy and completeness of this data and makes no representation or warranty, express or

implied about the accuracy or completeness of this data. Data includes private and public company issuers, including issuers filing for an indefinite amount of

securities to be sold. Sector classifications are based on the Global Industry Classification Standard (GICS) and do not take into account issuers addressing multiple

sectors.

© 2014 Dealflow.com™

9

Real_Estate/news

Real Estate

Continued from page 1

Patch of Land is a real estate portal currently serving only accredited investors but considering the retail

market. “Patch of Land operates a powerful data-driven,

e-commerce platform built on full transparency, ease,

speed and reliability of information and funding,” Patch

of Land CMO AdaPia d’Errico told Dealflow.com. “Our

marketplace is primarily single family residential, plus

multifamily and small commercial loans from 30 days to

12 months with annual yields to investors ranging from

10% to 14%.”

While Patch of Land currently only works with accredited investors, d’Errico said that the arrangement already

unlocks new opportunities for both investors and capital

seekers. But the portal is looking at various unaccredited

options according to d’Errico and general counsel Amy

Wan. “I think it’s safe to say that, in line with our motto

of ‘Building Wealth, Growing Communities,’ Patch of

Land sees great potential in democratizing investment

opportunity by opening real estate crowdfunding (or P2P

lending) to everyone–not just accredited investors,” Wan

said. “We eagerly await new regulatory mechanisms that

may allow us to do just that.”

Several unsettled regulatory issues leave it up in the air

as to what options might be available to further democratize online investing in general and for real estate in specific. Some Rule 506(c) proposals are still up unsettled,

but that offering can only be made to accredited investors

anyway. Title III crowdfunding regulations are also still

pending, but the title III scenario will limit the amount

investors can commit – and the amount companies can

seek.

Another option is the Regulation A+ offering proposed

last December – and still under consideration. A Reg A

offering in its current form allows companies to raise up

to $5 million with unaccredited or accredited investors,

but preparing the offering statement to file with the SEC

can be costly in both time and money. The Reg A+ offering would expand the deal amount to $50 million,

but these regulations have also bogged down after being

attacked by parties including state securities regulators

alarmed that the new offering eliminates state oversight

or preemption.

Some members of Congress share this concern and

recently wrote a letter to the SEC essentially pitting the

commission against Congress. “We are alarmed by the

commission’s action,” 20 members of Congress wrote.

“The commission has no authority to substitute its own

preference for the clear judgment of Congress regarding

© 2014 Dealflow.com™

preemption of state law – to do so is both unlawful and

likely unconstitutional.”

While the wrangling over Reg A+ continues, at least

one portal is using the existing Reg A to make investments

available to unaccredited investors: Sharestates, which

variously employs both Reg A and Reg D filings. Even

with its current limitations, Reg A allows general solicitation and non-accredited investors, all of which fits in with

Sharestates’ plan to democratize investing. “We’re trying

to sell a piece of New York City to the folks on Main

Street, instead of the folks on Wall Street,” Sharestates

principal Allen Shayanfekr told Dealflow.com.

Sharestates works mostly with cash flow deals that

start returning distributions more quickly than construction and development projects. Recently funded transactions range from a $30,000 condo in New York to a $3.6

million 24-unit building in Brooklyn. Minimum investments can be as low as $100.

Rich-Uncles.com is another portal intent on making

it possible for non-accredited investors to get involved in

commercial real estate. Rich-Uncles.com principal Harold Hofer told Dealflow.com that the company specializes in making commercial equity investing available to

non-accredited investors. Hofer said the platform does

not charge commissions, while a broker dealer or financial planner would typically levy a 10% fee.

The company offers shares in a private REIT under an

exemption from the California Department of Business

Oversight. Because of its reliance on the state exemption,

Rich-Uncles.com must market to investors who are California residents or non-U.S. residents. “The SEC’s Rule

147 allows for the state exemption in certain instances.)

The state exemption also establishes financial requirements for investors, who must have a family income of

$75,000 or more or a net worth of $250,000 – well below

the requirements for accredited investors.

Shares in a private REIT are valued on the properties it

holds, so the share prices are not vulnerable to the market

volatility that can batter publicly traded REITs. (Private

REIT shareholders have access to a secondary market in

the form of REITbid.)

Rich-Uncles.com’s REIT, which specializes in triple

net lease opportunities, just announced the $3.78 million

acquisition of a Chase Bank building in Antioch, Calif.,

and it also owns 22 Del Taco restaurants in the state. The

vehicle ultimately expects to raise a total of $25 million

for acquisitions.

10