case study

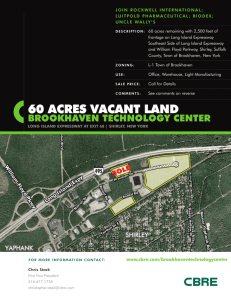

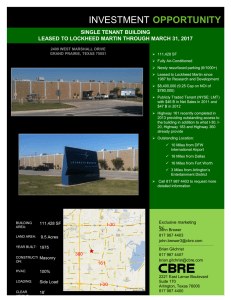

advertisement

CASE STUDY HIGHWOODS Challenge GREG WILSON, CCIM, SIOR Executive Vice President T: +1 336 331 9399 F: +1 336 373 0603 Greg.wilson@cbre-triad.com QUICK FACTS 1.9 million SF office portfolio Renewed over 90% of current tenants Notable transactions with Krispy Kreme, BB&T, Merrill Lynch, Essent Guaranty and U.S. Airways In mid-2007, Highwoods Properties, Inc. announced its intention of exiting the Winston-Salem market by selling its 1.9 M SF office portfolio that consisted of two office parks and seven additional office buildings. The CBRE investment sale teams in Atlanta and the Triad were engaged to market the portfolio. When the capital markets deteriorated to a point in late 2007 and early 2008 that a portfolio transaction was not achievable, Highwoods was faced with the challenge of how to maintain and enhance value in a portfolio where their stated intention was to exit the market. Although Highwoods self-performs leasing throughout the company, they ultimately decided to continue to manage the properties but to hire the CBRE|Triad leasing team of Greg Wilson and Rich Mossman to handle the leasing of the entire portfolio until such time as the market improved to a point where the disposition of the properties was prudent. Solutions Despite challenging headwinds during the economic downturn, the CBRE|Triad team focused on maintaining existing occupancy and capitalizing on Highwoods strong balance sheet to recruit new tenants to the properties while other landlords were capital constrained. CBRE|Triad used a team approach to make sure that every tenant in the market was being contacted while also leveraging numerous strategic senior level relationships to drive value for the client. Results During this period, CBRE|Triad was able to renew over 90% of the current tenants and was successful in executing the following notable transactions: Renewed, restacked and expanded Krispy Kreme Doughnut Corporation at 370 Knollwood (90,000 SF) through 2026. Brokered the sale of 150 Stratford (135,000 SF) to the anchor tenant, BB&T, whose lease was expiring in six months. Sold Madison Park to entrepreneurial opportunity fund using Seller financing. Sold Consolidated Center (179,000 SF) to local investor group in 2012. Renewed and downsized Novant Health in 25,000 SF at 2000 Frontis Plaza and re-leased space that was given back (25,000 SF) to Gentiva Health in less than 12 months. Subsequently sold building to a local investor in 2013. Recruited Merrill Lynch (15,000 SF) from 150 Stratford to 380 Knollwood when their lease expired knowing Merrill Lynch did not want to be in a building owned by a competitor. At 101 Stratford, CBRE|Triad successfully negotiated and transitioned the anchor tenant lease from Triad Guaranty, a casualty of the housing crisis, to a newly formed PMI company, Essent Guaranty over a 3 year period. This process culminated in a long term lease for over 50,000 SF in a highly competitive process. As a direct result of this transaction, CBRE|Triad sold the property in late 2014 to a local investor group. Successfully renewed USAIR / American Airlines in a 105,000 SF, single tenant building at 799 Hanes Mall Blvd in late 2014. Secured owner/user to purchase 3901 Westpoint with an expected closing in first quarter 2015. CLIENT TESTIMONIAL “Highwoods typically self performs leasing but when we realized it was important to have local leasing representation of our Winston-Salem office portfolio, we turned to the CBRE|Triad team to help us accomplish our objectives. The differentiator is their team approach and the fact they think like landlords and developers when it comes to leasing. It has been a great partnership for over five years.” - Rick Dehnert, Vice President of Highwoods Properties Part of the CBRE affiliate network