Int. J. Production Economics 135 (2012) 116–124

Contents lists available at ScienceDirect

Int. J. Production Economics

journal homepage: www.elsevier.com/locate/ijpe

Inventory control in a two-level supply chain with risk pooling effect

Jae-Hun Kang, Yeong-Dae Kim n

Department of Industrial Engineering, Korea Advanced Institute of Science and Technology, Yusong-gu, Daejon 305-701, Korea

a r t i c l e i n f o

a b s t r a c t

Article history:

Received 24 November 2009

Accepted 15 November 2010

Available online 23 November 2010

We consider an inventory control problem in a supply chain consisting of a single supplier, with a central

distribution center (CDC) and multiple regional warehouses, and multiple retailers. We focus on the

problem of selecting warehouses to be used among a set of candidate warehouses, assigning each retailer

to one of the selected warehouses and determining replenishment plans for the warehouses and the

retailers. For the problem with the objective of minimizing the sum of warehouse operation costs,

inventory holding costs at the warehouses and the retailers, and transportation costs from the CDC to

warehouses as well as from warehouses to retailers, we present a non-linear mixed integer programming

model and develop a heuristic algorithm based on Lagrangian relaxation and subgradient optimization

methods. A series of computational experiments on randomly generated test problems shows that the

heuristic algorithm gives relatively good solutions in a reasonable computation time.

& 2010 Elsevier B.V. All rights reserved.

Keywords:

Supply chain

Inventory control

Risk pooling

Lagrangian relaxation

Heuristic

1. Introduction

We consider a two-level supply chain consisting of a single

supplier and multiple retailers. In the supply chain, the supplier is

composed of a central distribution center (CDC) and multiple

candidate regional warehouses, from which up to a given number

of warehouses are selected and actually used. It is assumed that the

supplier is authorized to manage inventory levels of the retailers by

a vendor-managed inventory (VMI) contract. In a VMI system, the

supplier monitors inventory levels of the retailers as well as

demands from final customers, and determines when and how

much to deliver to the retailers as well as when and how much to

replenish its own inventory at the warehouses. That is, the retailers

do not place orders to the supplier, but the supplier controls the

inventory levels of the retailers by determining replenishment

timing and quantities for the retailers. It is known that by employing the VMI system, one can reduce the operating cost of the supply

chain and maintain or improve the service level for the customers

(C

- etinkaya and Lee, 2000).

The problem considered here is to select warehouses to be

actually used among a set of candidate warehouses, to assign each

retailer to one of the selected warehouses, and to determine

replenishment plans for the warehouses and the retailers, in the

two-level supply chain that employs the VMI system. The warehouses and the retailers are assumed to use the (r, q) policy. That is,

when the inventory level falls down to the reorder point, denoted

by r, an order for q units is issued. Also, it is assumed that demands

(per unit time) at the retailers (from final customers) are independent of each other and they follow normal distributions with

n

Corresponding author. Fax: + 82 42 350 3110.

E-mail address: ydkim@kaist.ac.kr (Y.-D. Kim).

0925-5273/$ - see front matter & 2010 Elsevier B.V. All rights reserved.

doi:10.1016/j.ijpe.2010.11.014

mean mj and variance vj for retailer j, and that distances and lead

times from CDC to warehouses as well as those from warehouses to

retailers are known and fixed.

As the safety stock is generally set to be proportional to the

standard deviation of the demand during the lead time, the safety

stock can be reduced if the demand variation is reduced. Also, since

demands from different retailers are independent, the variance of

the sum of the demands from a set of retailers is smaller than the

sum of the variances of the demands from those retailers. As a

result, the safety stock needed for the pooled demands is generally

less than the sum of the safety stocks for the individual demands.

Therefore, to reduce operating costs of the supply chain, especially

inventory holding costs, one may use the risk pooling strategy, the

strategy of reducing the demand variability by aggregating

demands from multiple retailers. Such aggregation can be done

by allocating more retailers to each warehouse or reducing the

number of warehouses to be selected and used.

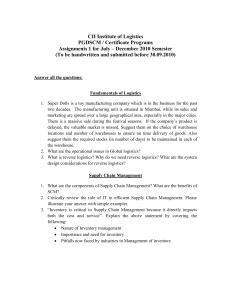

In the example given in Fig. 1, which illustrates the supply chain

considered in this study, safety stocks of warehouses 1 and 2 are set

pffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

pffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

to kw ðv1 þ v2 ÞL1 and kw ðv3 þ v4 ÞL2 , respectively. Here, Li and kw

denote the lead time from CDC to warehouse i and the safety factor

at the warehouses, respectively. Assume L1 rL2. If we assign

retailers 3 and 4 to warehouse 1 by not using warehouse 2, the

safety stock of the supply chain can be reduced since the safety

pffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

stock of warehouse 1 is set to kw ðv1 þ v2 þ v3 þv4 ÞL1 , which is not

p

ffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

p

ffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

greater than kw ðv1 þ v2 ÞL1 + kw ðv3 þ v4 ÞL2 .

The risk pooling strategy should be carefully applied since it may

increase inventory levels of the retailers. As the number of warehouses that are selected and used is decreased, warehouse operation

costs may be decreased and so may the safety stocks at the

warehouses. However, lead times from the warehouses to the

retailers may increase due to the increase of transportation distances

J.-H. Kang, Y.-D. Kim / Int. J. Production Economics 135 (2012) 116–124

117

(r1, q1)

Retailer 1

(R1, Q1)

~ N (m1, v1)

(r2, q2)

Warehouse 1

Retailer 2

~ N (m2, v2)

(r3, q3)

(R2, Q2)

Retailer 3

Warehouse 2

~ N (m3, v3)

(r4, q4)

……

Central

distribution

center

Retailer 4

~ N (m4, v4)

……

(Ri, Qi)

Warehouse i

(rj,qj)

Retailer j

~ N (mj, vj)

Fig. 1. Network diagram of the supply chain.

between the selected warehouses and the retailers, and hence the

safety stocks at the retailers may be increased. Therefore, it is

necessary to determine the optimal level of risk pooling, i.e., the

optimal number of warehouses to be used, with the consideration of

the trade-off between the decrease in the inventory holding costs at

the warehouses and the warehouse operation costs and the increase

in the inventory holding costs at the retailers.

Fry et al. (2001), De Toni and Zamolo (2005), Hong and Park

(2006), Gumus et al. (2008), and Southard and Swenseth (2008)

show benefits of a VMI system by comparing it with a traditional

retailer-managed inventory system, and Wong et al. (2009) show

that the performance of a supply chain can be improved through a

sales rebate contract, which is devised to help centralize and

coordinate decentralized decisions of a supply chain. Also,

Szmerekovsky and Zhang (2008) investigated the effect of attaching radio frequency identification (RFID) tags at items on VMI

system consisting of one manufacturer and one retailer, and Xu and

Leung (2009) presented a stocking policy in VMI system with a

limit on the shelf space. In addition, C

- etinkaya and Lee (2000) and

Axsäter (2001) presented analytical results for the coordination

problem between inventory and transportation decisions in VMI

systems, where a supplier has information on the demands from a

group of retailers located in a given geographic region. On the other

hand, Bertazzi et al. (2005) considered a production and distribution planning problem in VMI system and presented a decomposition approach to the problem, and Kang and Kim (2010) develop

heuristic algorithms for an integrated inventory and transportation

problem, in which a supplier determines the replenishment

quantities and timing for retailers as well as the amount of products

to be delivered by each vehicle with limited capacity.

As mentioned earlier, the benefit of risk pooling can be obtained

through the consolidation of inventories of multiple locations into a

single one. Eppen (1979), Chen and Lin (1989), and Chang and Lin

(1991) show that a pooled system incurs less cost than a distributed

system, and the difference of the costs of the two systems depends

on the variance of demands and the correlation among the

demands. Also, Alfaro and Corbett (2003), Gerchak and He

(2003), and Benjaafar et al. (2005) investigated the benefits and

costs of inventory pooling, and Kulkarni et al. (2005) evaluated

trade-offs between logistics costs and risk pooling benefits in a

manufacturing network with component commonality. In addition, Shen et al. (2003), Miranda and Garrido (2004), and Romeijn

et al. (2007) used the risk pooling strategy in network design

problems. However, their decisions are made only from the

supplier’s point of view since they do not consider the inventory

holding costs at retailers. Also, without considering the inventory

holding costs at the retailers, Miranda and Garrido (2004) show

that as the inventory holding cost at warehouses, the variability of

demands at retailers, and/or the service level increase the effect of

risk pooling, i.e., cost reduction, increases. On the other hand, Gaur

and Ravindran (2006) determined the best level of inventory

aggregation for two conflicting objectives, maximizing responsiveness to customers’ demands and minimizing the total cost of a

supply chain, without considering inventory holding costs at the

retailers.

As another alternative for reducing inventory of the supply

chain, one can employ the policy of transshipment, i.e., replenishing inventories from locations at the same echelon level instead of a

location at an upper level, since lead times can be reduced by

employing the policy. Schwarz (1989) and Glasserman and Wang

(1998) investigated the relationship between the lead time and the

inventory level required for achieving a given service level for

customers. Also, Grahovac and Chakravarty (2001) show that

inventory sharing and lateral transshipment in a supply chain

often reduce inventory holding costs and waiting costs of customers. In addition, Tagaras (1989), Archibald et al. (1997), Herer and

Rashit (1999), Herer and Tzur (2001), Rudi et al. (2001), and Olsson

(2009) dealt with transshipment problems in two-location inventory systems, while Tagaras (1999), Kukreja et al. (2001), Herer and

Tzur (2003), Hu et al. (2005), Kukreja and Schmidt (2005), and

Archibald (2007) developed inventory stocking policies in multiple-location inventory systems considering transshipments. Meanwhile, Lee (1987) and Axsäter (1990) presented lateral

transshipment models for repairable items, and Evers (2001) and

Minner et al. (2003) provided heuristic algorithms for determining

transshipment timing.

In this study, we consider the problem of selecting warehouses

from a given set of candidate warehouses, assigning retailers to the

selected warehouses and determining replenishment plans at the

warehouses and the retailers in a two-level supply chain, in which

each member uses the (r, q) policy. We present a non-linear mixed

integer programming model for the problem and develop a

Lagrangian heuristic algorithm. In the next section, the problem

considered in this study is described in more detail and a non-linear

118

J.-H. Kang, Y.-D. Kim / Int. J. Production Economics 135 (2012) 116–124

mixed integer programming formulation is given, and Section 3

presents the heuristic algorithm for the problem. For evaluation of

the performance of the suggested algorithm, a series of computational experiments are performed and results are reported in

Section 4. Finally, Section 5 concludes the paper with a short

summary.

2. Problem description

There are a supplier, composed of a central distribution center

(CDC) and multiple (candidate) regional warehouses, and multiple

retailers in a two-level supply chain, in which the supplier and the

retailers are under VMI contract. It is assumed that the supply chain

adopts an inventory management strategy, in which the costs

incurred at the supplier’s side as well as the retailers’ side are

considered simultaneously, since the partnership of the members

needs to be maintained or improved. In the problem considered

here, we select warehouses that are to be actually used from a given

set of candidate warehouses and assign the retailers to the selected

warehouses. In addition, we determine the reorder points and

the order quantities of the warehouses and the retailers for the

objective of minimizing the sum of warehouse operation costs, and

inventory holding costs and transportation costs of the whole

supply chain.

In this study, the following assumptions are made. Note that real

situations of a typical VMI system are reflected in these

assumptions.

(a) The cost resulting from the selection and operation of each

regional warehouse is given, and the cost may be different for

different candidate warehouses. Once a warehouse is selected,

it is used indefinitely (throughout the planning horizon).

(b) The transportation cost is composed of a fixed cost and a

variable cost proportional to the quantity and distance.

(It includes the wage of the driver of the vehicle, the material

handling costs for loading and unloading, and the fuel cost of

the vehicles, or shipping charges paid to third-party shipping

companies.)

(c) Lead times from CDC to warehouses as well as those from

warehouses to retailers are given as integer multiples of a unit

time, and may be different from each other.

(d) The per-unit-time demands at each retailer are independent

and identically distributed. They follow normal distributions

with means of integer values. Therefore, the mean and the

variance of the demand that occurs for n time-units are n times

those of the demand that occurs for a unit time.

(e) The demands at the retailers are independent of each other.

(f ) The demand information is known to the supplier (as a result of

VMI contract). Therefore, the demands at the retailers assigned

to a warehouse can be pooled at the warehouse.

(g) Each member of the supply chain uses the (r, q) policy.

(h) Safety factors for the warehouses and the retailers are given.

These safety factors are computed from the required service

levels, which are determined by the management policy of the

supply chain. Reorder points can be computed from the safety

factors.

Assumptions (a)–(c) reflect real situations in the supply chain

considered in this study. The cost structure stated in (b) is

commonly found in real supply chains as well as in many academic

studies, and lead times are generally managed by the days in

practice, which are the units for time periods in this study. In an

assumption (d), we use a normal distribution for the distribution

form of demands since demand quantities may be approximated

with normal distributions if the parameter values are appropriately

estimated, although the normal distributions do not closely fit the

demands. The normal distribution has useful properties that can be

used for mathematical handling of inventory models. The (r, q)

policy is assumed to be used, since it is one of the most commonly

used policies for inventory replenishment.

For a clearer description of the problem, we present a non-linear

mixed integer programming formulation. For the formulation, we

use the following notation.

Ar

Aw

Ci

D

drij

dw

i

hrj

hw

i

i

j

kr

kw

Li

lij

Mi

mj

MS

Oi

Qi

qj

Ri

rj

Vi

vj

VS

Xij

Yi

fixed transportation cost for a delivery to a retailer (from a

warehouse)

fixed transportation cost for a delivery to a warehouse (from

CDC)

storage capacity of warehouse i

variable transportation cost per unit distance

distance between warehouse i and retailer j

distance between CDC and warehouse i

inventory holding cost at retailer j per unit time

inventory holding cost at warehouse i per unit time

index for warehouses (i¼1, 2, y, I)

index for retailers (j¼ 1, 2, y, J)

safety factor corresponding to the required service level at

the retailers

safety factor corresponding to the required service level at

the warehouses

lead time for an order issued by warehouse i to CDC

lead time for an order issued by retailer j to warehouse i

mean of the demand per unit time at warehouse i

P

(Mi ¼ j mj Xij )

mean of the demand per unit time for retailer j

P

sum of the mean demands over all retailers (MS ¼ j mj )

fixed operation cost for warehouse i

order quantity of warehouse i

order quantity of retailer j

reorder point of warehouse i

reorder point of retailer j

variance of the demand per unit time at warehouse i

P

(Vi ¼ j vj Xij )

variance of the demand per unit time for retailer j

sum of the variances of the demands over all retailers

P

(V S ¼ j vj )

a binary variable that is equal to 1 if retailer j is served by

warehouse i, and 0 otherwise

a binary variable that is equal to 1 if warehouse i is open, and

0 otherwise

In the formulation for the problem, the expected values for the

inventory holding costs and the transportation costs of the supply

chain are approximated as follows.

2.1. Average inventory holding cost of a regional warehouse

The reorder

pffiffiffiffiffiffiffiffi point of warehouse i, denoted by Ri, is set to

Mi Li þkw Vi Li since the mean and the standard deviation p

of ffiffiffiffiffiffiffiffi

the

demand during the lead time at the warehouse are MiLi and Vi Li ,

respectively. Also, since the minimum and the maximumpinventory

ffiffiffiffiffiffiffiffi

levels p

atffiffiffiffiffiffiffiffi

the warehouse are approximated as kw Vi Li and

w

Qi þk

Vi Li , respectively, the expected value of the

inventory

pffiffiffiffiffiffiffiffi

level of the warehouse can be estimated as Qi =2 þ kw Vi Li . Therefore, the expected inventory holding

pffiffiffiffiffiffiffiffi cost of the warehouse can be

w

approximated as hw

Vi Li Þ.

ðQ

=2þ

k

i

i

The above approximation of the expected inventory level may

be inaccurate, if there are lumpy demands from the retailers and if

not many retailers are assigned to the warehouse. However, in

J.-H. Kang, Y.-D. Kim / Int. J. Production Economics 135 (2012) 116–124

many practical applications including a supply chain for personal

computers, by which this research was motivated, the order sizes

from the retailers are not very large because of relatively high

inventory holding cost. Also, in many cases, demands at the

retailers are mutually independent, and so are the order cycles

of the retailers. In such cases, there is no specific time period (in an

order cycle of the warehouse) with very high frequencies of orders

from the retailers. Since the inventory level decreases somewhat

linearly in those cases, the above approximation will not result in a

large error.

2.2. Average transportation cost from CDC to a regional warehouse

When an order for Qi units is delivered from CDC to warehouse i,

the transportation cost for a single delivery is Aw þ DQi dw

i . Also,

since the expected number of deliveries per unit time is Mi/Qi, the

expected transportation cost to warehouse i is given as

ðAw þDQi dw

i ÞMi =Qi .

2.3. Average inventory holding cost of a retailer

If we assume that retailer j is assigned to regional warehouse i,

the reorder point of the retailer, denoted by rj, is set to

qffiffiffiffiffiffiffiffi

mj lij þ kr vj lij , since the mean and the standard deviation of the

qffiffiffiffiffiffiffiffi

demand during the lead time at the retailer are mjlij and vj lij ,

respectively. Also, since the minimum and the maximum inventory

qffiffiffiffiffiffiffiffi

qffiffiffiffiffiffiffiffi

levels at the retailer are approximated as kr vj lij and qj þ kr vj lij ,

respectively, the expected value of the inventory level of the

qffiffiffiffiffiffiffiffi

retailer can be estimated as qj =2 þkr vj lij . Therefore, the expected

qffiffiffiffiffiffiffiffi

inventory holding cost at the retailer is given as hrj ðqj =2 þ kr vj lij Þ.

2.4. Average transportation cost from a warehouse to a retailer

Assume retailer j is assigned to the regional warehouse i. The

transportation cost from the warehouse to the retailer for a single

delivery is given as Ar þDqj drij , when the delivery quantity is qj. Also,

the expected number of deliveries per unit time is mj/qj. Hence, the

expected transportation cost to the retailer can be given as

ðAr þDqj drij Þmj =qj .

Note that the reorder points of the warehouses and the retailers

are affected by the assignment of the retailers to the warehouses

since the mean and the variance of the demand for a warehouse as

well as the lead time to a retailer are determined by the assignment.

Using the above costs, we can formulate the problem considered

in this paper as the following non-linear mixed integer program.

X

pffiffiffiffiffiffiffiffi

w

w

½P Min

½Oi þðAw þ DQi dw

Vi Li ÞYi

i ÞMi =Qi þ hi ðQi =2 þk

i

qffiffiffiffiffiffiffiffi

XX

þ

½ðAr þ Dqj drij Þmj =qj þ hrj ðqj =2 þ kr vj lij ÞXj

i

ð1Þ

j

X

mj Xij ¼ Mi

subject to

8i

ð2Þ

j

X

vj Xij ¼ Vi

8i

ð3Þ

j

X

mj Xij rCi Yi

8i

ð4Þ

j

X

Xij ¼ 1

i

8j

119

Yi A f0, 1g

8i

ð6Þ

Xij A f0, 1g

8i,j

ð7Þ

Mi Z 0

8i

Vi Z 0

8i

ð8Þ

ð9Þ

w

þDQi dw

i ÞMi =Qi

In the objective function, Oi, ðA

and

pffiffiffiffiffiffiffiffi

w

hw

ðQ

=2

þk

L

V

Þ

denote

the

operation

cost

of

the

warehouse

i,

i

i i

i

the transportation cost from CDC to the warehouse and the

inventory holding cost at the warehouse, respectively, while

qffiffiffiffiffiffiffiffi

ðAr þDqj drij Þmj =qj and hrj ðqj =2 þ kr vj lij Þ represent the transportation cost from warehouse i to retailer j and the inventory holding

cost at the retailer, respectively. Constraint sets (2) and (3) ensure

that the mean and the variance of the demand at a warehouse are

the sums of the means and the variances of the demands at the

retailers assigned to the warehouse, respectively. Also, constraint

set (4) is the capacity constraint related to the warehouses, while

(5) ensures that each retailer can be assigned to one and only one

P

P

warehouse. Here, constraints i Mi ¼ M S and i Vi ¼ V S are intentionally omitted since they are redundant, i.e., they are always

satisfied in a solution that satisfies (2), (3), and (5).

3. Solution method

Since it is not easy to find optimal solutions for problem [P], in

which approximated costs are used, and it takes an excessive

amount of time to obtain optimal solutions using commercial

software even for small-sized problems without non-linear cost

terms, we present a heuristic algorithm in this study. The suggested

heuristic algorithm is based on Lagrangian relaxation and subgradient optimization methods, i.e., problem [P] is relaxed by using

Lagrangian multipliers and the solution of the problem is obtained

by finding the best Lagrangian multipliers with the subgradient

optimization method. In the algorithm, we modify the objective

function by replacing order quantities for warehouses and retailers

with the well-known economic order quantities (EOQs) of the

deterministic lot size model. After the replacements, the problem is

relaxed by dualizing a set of constraints with Lagrangian multipliers, and then the relaxed problem is decomposed into three

subproblems. Each subproblem is solved through updates of the

Lagrangian multipliers, until one of the following termination

conditions is satisfied: (1) the iteration count reaches a predetermined limit (to be denoted by U or U1); (2) the gap between an

upper and a lower bounds becomes less than a predetermined limit

(to be denoted by e or e1); or (3) the lower bound has not been

improved for a predetermined number of iterations (to be denoted

by B or B1).

We can obtain the EOQ for each warehouse by differentiation of

related terms in the objective function, i.e., AwMi/Qi +hw

i Qi/2. For

warehouse i, the EOQ is given as

qffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

ð10Þ

Qi ¼ 2Aw Mi =hw

i

Note that the second derivative of the cost function is always

greater than 0. Also, note that the order quantity of a warehouse is

determined by the assignment of retailers to the warehouse since

the mean of the demand at the warehouse is determined by the

assignment.

Similarly, the EOQ for retailer j can be given as

qffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

qj ¼ 2Ar mj =hrj

ð11Þ

ð5Þ

and the second derivative is 40 as well.

120

J.-H. Kang, Y.-D. Kim / Int. J. Production Economics 135 (2012) 116–124

By the replacements of these EOQs for Qi and qj, the objective

function to be minimized is modified to

Xnqffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

XX

X

pffiffiffiffiffiffiffiffio

w w

2Aw Mi hw

þ DMi dw

Vi Li Yi þ

Oi Y i þ

eij Xij

i þ hi k

i

i

i

i

j

qffiffiffiffiffiffiffiffi

qffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

where eij ¼ 2Ar mj hrj þ Dmj drij þ hrj kr vj lij . Also, since the values of

Mi and Vi are equal to 0 when Yi ¼0 in feasible solutions of [P], the

above objective function can be replaced with

Xnqffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

X

pffiffiffiffiffiffiffiffio XX

w

w w

2Aw Mi hw

Vi Li þ

Oi Y i þ

eij Xij

i þ DMi di þ hi k

i

i

i

j

ð1uÞ

In addition, we replace constraints (2) and (3), which are

equality constraints, with the following inequality constraints,

(20 ) and (30 ), respectively.

X

mj Xij rMi 8i

ð2uÞ

Note that the first subproblem, [SP1], is the problem for

determining values of Yi and Xij, while [SP2] and [SP3] are the

problems for determining values of Mi and Vi for the given k and l,

respectively. In the following, we describe the methods used to

obtain upper and lower bounds for [P].

The upper bound on the solution value of [P] at iteration k,

k

denoted by Z , is given as

k

k

k1

, Z~ g

qffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

qffiffiffiffiffiffiffiffiffiffi

P

P

k

~ k hw þDM

~ k dw þ hw kw V~ k Li þ

where Z~ ¼ i Oi Yik þ i

2Aw M

i i

i i

i

i

PP

k

i

j eij Xij ,

X

~k¼

mj Xijk

M

i

Z ¼ Min fZ

j

and

k

V~ i ¼

X

vj Xijk

j

j

X

vj Xij r Vi

8i

ð3uÞ

j

Note that the optimal solution of the problem with Eqs. (20 ) and

(30 ) instead of Eqs. (2) and (3) is also optimal for the original

problem, as discussed in Miranda and Garrido (2004). Among the

solutions that satisfy Eqs. (20 ), (30 ), and (4)–(9), only the solution in

P

P

which

j mj Xij ¼ Mi and

j vj Xij ¼ Vi are satisfied minimizes the

0

objective function, (1 ). That is, since Eqs. (2) and (3) are always

satisfied by an optimal solution of the problem with inequality

constraints, they are replaced with Eqs. (20 ) and (30 ) in this study. In

addition, inequality constraints can be more effectively used in

Lagrangian relaxation methods.

The solution approach suggested in this research for problem

[P], after replacements of Eqs. (1), (2) and (3), is based on

Lagrangian relaxation and subgradient optimization methods. In

the solution approach, upper and lower bounds for the problem are

obtained iteratively until one of the aforementioned three termination conditions is satisfied. First, we derive the following relaxed

problem, [LR], by relaxing constraints (20 ) and (30 ) with Lagrangian

multipliers k and l, where k and l are vectors with nonnegative

elements, i.e., li Z0 and mi Z0.

Xnqffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

X

pffiffiffiffiffiffiffiffi

w

w w

2Aw Mi hw

Oi Yi þ

Vi Li li Mi

½LR Min

i þ DMi di þhi k

i

i

XX

mi Vi þ

ðeij þ li mj þ mi vj ÞXij

i

j

subject to Eqs. (4)–(9)

Then, [LR] is decomposed into three subproblems as follows:

X

XX

½SP1 Min

Oi Y i þ

ðeij þ li mj þ mi vj ÞXij

i

i

j

subject to (4)–(7)

o

Xnqffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

w

2Aw Mi hw

½SP2 Min

i þ DMi di li Mi

Here, Yki and Xkij denote the solution of [SP1] at iteration k.

On the other hand, the lower bound on the solution value for [P]

at iteration k, denoted by Z k , is obtained as the sum of the lower

bound (or the optimal solution value) of [SP1] and the optimal

solution values of [SP2] and [SP3], since the subproblems are

mutually independent and can be solved independently without

consideration of the others. In the following, we describe the

methods used to solve the three subproblems in the suggested

solution approach.

Solving [SP1] for the given k and l

For the given k and l, [SP1] is solved by Lagrangian relaxation

and subgradient optimization methods. That is, [SP1] is relaxed by

using Lagrangian multipliers, and the best values for the Lagrangian

multipliers are found by using the subgradient optimization

method, as described below. By dualizing constraint set (5) with

Lagrangian multipliers ht, the vector of which the jth element, ytj ,

corresponds to retailer j at iteration t, and adding another constraint, we obtain the following problem.

X

XX

X t

t

½LRðqt Þ Min

Oi Yi þ

ðeij þ li mj þ mi vj þ yj ÞXij yj

i

Min

Xn

i

ð14Þ

j

Note that the additional constraint, (14), can provide tighter

lower bounds for the problem although it is redundant, as shown in

Nauss (1978).

Bitran et al. (1981) show that [LR(ht)] can be decomposed into I

independent (0,1) knapsack problems for the I warehouses, and the

problem corresponding to warehouse i, denoted by [LR0 i(ht)], can be

solved with a dynamic programming approach. The ith knapsack

problem can be given as follows:

X

t

ðeij þ li mj þ mi vj þ yj ÞXij

½LRui ðqt Þ Min Oi þ

subject to

X

mj Xij rCi

ð4uÞ

j

ð12Þ

w

hw

i K

o

pffiffiffiffiffiffiffiffi

Vi Li mi Vi

Xij A f0, 1g

8j

ð7uÞ

By using solutions for the above problems, we can restate

[LR(ht)] as follows. Here, Z() denotes the optimal solution value of

the problem [].

X

X t

ZðLRui ðht ÞÞYi yj

½LR3 ðqt Þ Min

i

subject to Eq. (9)

X

Vi ¼ V S

i

j

j

i

½SP3

j

subject to Eqs. (4), (6), (7) and

X

X

Ci Yi Z

mj

i

subject to (8)

X

Mi ¼ M S

i

ð13Þ

i

subject to Eqs. (6) and (14)

j

J.-H. Kang, Y.-D. Kim / Int. J. Production Economics 135 (2012) 116–124

Note that this new expression for [LR(ht)] is also in the form of

the knapsack problem, and this can be solved with a dynamic

programming method.

From the optimal solutions (X0 ij) for the independent I knapsack

problems, [LR0 i(ht)], i¼1, y, I, and the optimal solution (Y0 i) for the

t

t

knapsack problem, [LR1(ht)], the optimal solution (X^ and Y^ ) of

ij

i

[LR(ht)] at iteration t can be obtained as follows:

t

t

if Y0 i ¼1, Y^ ¼Y0 i and X^ ¼ X0 ij; and

i

ij

t

if Y0 i ¼0, X^ ij ¼ 0

As a result, a lower bound on the optimal solution value of [SP1]

at iteration t can be given as

X

XX

t

t X t

t

Oi Y^ i þ

ðeij þ li mj þ mi vj þ yj ÞX^ ij yj

ð15Þ

i

i

j

j

which is the optimal solution value of [LR(ht)].

A feasible solution (Yti and Xtij) for [SP1] can be found from the

solution of [LR(ht)] as follows. Before describing the procedure for

obtaining a feasible solution for [SP1] at iteration t, we define the

t

t

following sets, using the solution (X^ and Y^ ) of [LR(ht)]:

ij

IO ¼

t

fi A I9Y^ i

i

¼ 1g;

t

IC ¼ fi A I9Y^ i ¼ 0g;

X t

J L ¼ fj A J9 X^ ij ¼ 0g;

i

X t

J E ¼ fj A J9 X^ ij ¼ 1g; and

i

X t

J M ¼ fj A J9 X^ ij 4 1g

i

Also, let Di denote the leftover capacity of warehouse i, i.e.,

P

t

Di ¼ Ci j mj X^ ij . Then, a feasible solution for [SP1] can be obtained

with the following procedure.

Procedure 1. (Obtaining feasible solutions for [SP1])

t

Step 1. Assign retailer jAJE to warehouse i for i–j pairs with X^ ij ¼ 1.

Step 2. If JM ¼ +, go to step 4. Otherwise, assign retailers j’s in JM

to a warehouse with the minimum value of eij + limj + mivj among

t

warehouses i’s with X^ ij ¼ 1.

L

Step 3. If J ¼+, terminate. Otherwise, for a retailer with the maximum mean demand among retailers in JL, say retailer jn, check if there

are warehouses i’s with Di mnj Z0 among the warehouses in IO.

3.1) If there exist open warehouses with Di mnj Z0, assign

retailer jn to a warehouse with the minimum value of

enij + limnj + mivnj among warehouses iAIO with Di mnj Z0, say warehouse in. Set Dni ’Dni mnj and JL’JL\{jn}, and go to step 4.

3.2) If there is no open warehouse with Di mnj Z0, assign retailer

jn to a warehouse with the minimum value of enij + limnj + mivnj among

nn

n L

L

n

warehouses iAIC, say warehouse inn. Set Dnn

i ’Di mj , J ’J \{j }

t

and Y^ i ’1, and go to step 4.

Step 4. If JL ¼+, terminate. Otherwise, go to step 3.

The subgradient method is used to find the best Lagrangian multipliers. For a given multiplier corresponding to retailer j at iteration t, ytj,

the Lagrangian multiplier at the next iteration is set as

P t

ytj + 1 ¼ ytj + bt( i X^ ij 1), in which bt is a positive step size set as

. P t

2

bt ¼ rt ðzt ZðLRðht ÞÞ 99 i X^ ij 199 , where zt is the best upper bound,

i.e., the solution value of the best feasible solution obtained so far. The

value of rt 40 is set to 2 initially and is reduced by a half when the

121

lower bound of [SP1] is not improved for a given number of iterations

(20 iterations, in the algorithm suggested in this research). The

procedure for solving [SP1] can be summarized as follows. In the

procedure, U, e, and B are parameters needed for the stopping

conditions mentioned earlier. Also, U0 is another parameter that

specifies the number of times the relaxed problem of [SP1] is to be

solved for the given h.

Procedure 2. (Solving [SP1])

Step 0. Set u ¼0, b ¼0, and h ¼0.

Step 1. If u 4U or b4B, stop; otherwise, go to step 2.

Step 2. Obtain an optimal solution of [LR(h)], and let u’u+ 1. If

the solution is feasible to [SP1], terminate. The current solution is

optimal. Otherwise, go to step 3.

Step 3. Obtain a lower bound from the solution obtained in step 2.

If the lower bound is better than the best lower bound obtained so

far, let b’0; otherwise, let b’b+ 1 and update Lagrangian multipliers using the subgradient optimization method. If u is a multiple

of U0 , go to step 4; otherwise, go to step 1.

Step 4. Find a feasible solution for [SP1]. Let UBn and LBn be the

solution value of the best feasible solution and the best lower bound

obtained so far. If (UBn LBn)/LBn o e, stop; otherwise, go to step 1.

Solving [SP2] for the given k

qffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

S w

S

To solve [SP2], we compute 2Aw M S hw

i þDM di li M for each

warehouse i, and find a warehouse with the minimum value, say

warehouse in. If the minimum value is less than or equal to 0, the value

of Mi is set to MS for i¼in, and 0 for iain. If the minimum value is

positive, the value of Mi is set to 0 for all warehouses. Therefore,

the optimal solution value of the problem is equal to min

qffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffiffi

S w

S

[ 2Aw M S hw

i þ DM di li M , 0]. Note that the optimality of the

solution can be proven by induction as in Miranda and Garrido (2004).

Solving [SP3] for the given l

First, we select a warehouse with the minimum value of

pffiffiffiffiffiffiffiffiffi

w

hw

V S Li mi V S among all warehouses, say warehouse in. If the

i k

minimum value is less than or equal to 0, the value of Vi is set to VS

for i¼in, and 0 for iain. If the value is positive, the value of Vi is set to

0 for all i. The optimality of the resulting solution can be proven as

in Miranda and Garrido (2004). The optimal solution value is equal

pffiffiffiffiffiffiffiffiffiffiffi

w

V S Li mi V S , 0].

to min[hw

i k

Overall procedure

The overall procedure for solving the original problem is given

below. Here, U1, e1, and B1 are parameters needed for stopping

conditions, and U00 is another parameter that specifies number of

times the three subproblems are to be solved for the given k and l.

Procedure 3. (Solving [P])

Step 0. Set u’0, b’0, k’0, and l’0.

Step 1. If u 4U1 or b4B1, stop; otherwise, go to step 2.

Step 2. Solve [LR], and let u’u + 1. If the solution is feasible to [P],

stop. The current solution is optimal. Otherwise, go to step 3.

Step 3. Obtain a lower bound by adding the optimal solution

values of the subproblems. If the lower bound is better than the best

lower bound obtained so far, let b’0; otherwise, let b’b+ 1 and

update Lagrangian multipliers with the subgradient optimization

method. If u is a multiple of U00 , go to step 4; otherwise, go to step 1.

Step 4. Obtain a feasible solution for [P]. Let UBn and LBn be the

solution value of the best feasible solution and the best lower

bound obtained so far, respectively. If (UBn LBn)/LBn o e1, stop;

otherwise, go to step 1.

122

J.-H. Kang, Y.-D. Kim / Int. J. Production Economics 135 (2012) 116–124

In the above procedure, the Lagrangian multipliers are updated

as follows. For the given multipliers of warehouse i at iteration k, lki ,

and mki , the Lagrangian multipliers at the next iteration are set as

X

lki þ 1 ¼ maxf0, lki þ ak ð mj Xijk Mik Þg

j

and

mki þ 1 ¼ maxf0, mki þ ak ð

X

vj Xijk Vik Þg

j

P

P

k

2

2

where ak ¼ rk ðZ Z k Þ=ð99 j mj Xijk Mik 99 þ 99 j vj Xijk Vik 99 Þ, and Mki

and Vki denote the solutions of [SP2] and [SP3], respectively, at

iteration k. The value of rk is set to 2 initially and halved when the

lower bound of the problem is not improved for a given number of

iterations (20 iterations, in the suggested algorithm).

4. Computational experiments

To evaluate the performance of the heuristic algorithm suggested in

this study, we compare results of the algorithm with those obtained

from the method, currently used in a real logistics system for personal

computers in Korea, as well as lower bounds on the optimal solutions.

For the comparison, we tested the algorithm on two sets of problems: a

set of smaller problems with 5 warehouses and 20 retailers and a set of

larger problems with 10 warehouses and 40 retailers. Note that the

larger problems represent the real system more closely. For each

problem set, we generated 128 test problems, 3 problems for each of all

combinations of two levels (high and low) for the fixed transportation

cost from the central distribution center (CDC) to a warehouse, the

fixed transportation cost from a warehouse to a retailer, the unit

inventory holding cost at a warehouse, the unit inventory holding cost

at a retailer, the mean of the demand at a retailer, the variance of the

demand at a retailer, and the lead time. Other related data were

generated as follows. Here, U(x, y) and DU(x, y) denote the uniform

distribution with range (x, y) and the discrete uniform distribution with

range [x, y], respectively.

(1) Locations of the (candidate) warehouses and the retailers

were generated randomly as follows: x-coordinates of the

locations were generated from U(–400, 400) and y-coordinates of the locations were generated from U(–500, 500). The

location of CDC was set to (0, 0).

(2) The fixed operation costs of the warehouses were generated

from U(300000, 500000).

(3) The mean of the demand at a retailer was generated from

DU(20, 40) and DU(40, 60) for low and high levels, respectively.

(4) The variance of the demand at a retailer was generated from

U(20, 40) and U(60, 80) for low and high levels, respectively.

(5) The unit inventory holding cost at a warehouse was generated

from U(60, 80) and U(120, 160) for low and high levels,

respectively.

(6) The unit inventory holding cost at a retailer was generated

from U(200, 250) and U(400, 500) for low and high levels,

respectively.

(7) The distances between CDC and regional warehouses as well

as those between regional warehouses and retailers were

given as the Euclidean distance between them.

(8) The fixed transportation cost from CDC to a warehouse was

generated from U(1000, 2000) and U(2000, 4000) for low and

high levels, respectively.

(9) The fixed transportation cost from a warehouse to a retailer

was generated from U(300, 500) and U(600, 1000) for low and

high levels, respectively.

(10) The variable transportation cost per unit distance was generated from U(1, 5).

(11) The lead time was generated from DU(0.01d0 , 0.03d0 ) and

DU(0.04d0 , 0.06d0 ) for low and high levels, respectively, where

d0 is the distance between locations, i.e., between CDC and a

warehouse or between a warehouse and a retailer.

(12) The storage capacity of a warehouse was generated from

J

J

P

P

DU(3

mj =I, 5

mj =I).

j¼1

j¼1

(13) The safety factors for the warehouses and the retailers were

set to 1.96, representing 97.5% service level.

The heuristic algorithm was coded in C programming language,

and computational experiments were performed on a personal

computer with Pentium 4 processor operating at 3.2 GHz clock speed.

We set the values of parameters needed for stopping conditions after a

series of tests on several candidate values for them. Although detailed

results of these tests are not given here, selected values were: U¼300,

e ¼0.01, B¼100, and U0 ¼25 for procedure 2; and U1¼600, e1¼0.01,

B1¼200, and U00 ¼25 for procedure 3.

The performance of the suggested algorithm was shown with

the percentage of cost reduction from the cost resulting from the

method currently used in a real system. In that system, the retailers

are assigned to the nearest warehouses of which the storage

capacity constraint is not violated by the assignment. Also, to

see the absolute performance of, or the quality of the solutions

obtained from, the algorithm, we show the results in terms of

percentage gap of heuristic solutions from the lower bounds that

are obtained from the Lagrangian relaxation method.

Results of the test on smaller-sized problems (5 warehouses and

20 retailers) are given in Table 1. The average percentage gap of the

solution values of the suggested algorithm from lower bounds was

o4%. Also, the suggested algorithm could save over 24% of the costs

compared with the currently used method. This may be because in

the suggested algorithm, we take account of the warehouse

operation costs as well as the inventory holding costs and the

transportation costs of the whole supply chain simultaneously to

select warehouses to be used and to assign the retailers to the

selected warehouses. Note that in the currently used method, the

retailers are assigned to the warehouses by considering only

distances between retailers and warehouses and demand quantities (from the customers) at the retailers. The suggested heuristic

algorithm required 1 h of CPU time on an average for a problem.

Table 2 shows the results of the test on larger-sized problems

(10 warehouses and 40 retailers). The average percentage gap from

lower bounds was o8%, and the average percentage reduction of

solutions from those of the currently used method was about 45%.

The outperformance of the heuristic algorithm over the currently

used method was more significant in these larger-sized problems,

possibly because the benefit of employing the risk pooling strategy

becomes more significant when the numbers of candidate warehouses and retailers are larger. In other words, the risk pooling

strategy can be more effectively used in supply chains with more

candidate warehouses and retailers. It took about 4 h of CPU time

on an average to solve a problem with the suggested heuristic

algorithm. Although the computation time does not seem to be

very short, it may be reasonable since the problem does not have to

be solved very quickly or on a real-time basis in practice. From the

above results, one can argue Lagrangian heuristic algorithm

suggested in this study is a viable tool for inventory management

in the supply chain considered in this study.

To see which factors affect the relative performance (percentage

reduction) of the heuristic algorithm, analyses of variance were

performed on results of tests on two problem sets, and the results

are given in Table 3. The results show that the relative performance

was affected by the unit inventory holding costs of the retailers, the

lead time, and the mean and the variance of the demands at the

J.-H. Kang, Y.-D. Kim / Int. J. Production Economics 135 (2012) 116–124

123

Table 1

Performance of the algorithm on smaller-sized problems.

Factors

Levels

Percentage gapa (%)

Percentage reductionb (%)

Average CPU time (s)

Fixed transportation cost to a warehouse (Aw)

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

3.35

3.34

3.45

3.25

3.33

3.36

3.47

3.23

4.44

2.26

1.58

5.11

3.33

3.36

24.84

24.92

24.95

24.80

24.76

24.99

25.85

23.90

27.16

22.60

25.60

24.16

25.46

24.30

(6.17)

(6.12)

(6.16)

(6.12)

(6.18)

(6.10)

(6.07)

(6.06)

(6.29)

(5.05)

(6.03)

(6.18)

(6.19)

(6.05)

3065

3101

3226

2940

3015

3151

3160

3005

2721

3445

2500

3666

3058

3107

24.88 (6.14)

3083

Fixed transportation cost to a retailer (Ar)

Unit inventory holding cost at a warehouse (hw

i )

Unit inventory holding cost at a retailer (hrj )

Mean of the demand at a retailer (mj)

Variance of the demand at a retailer (vj)

Lead time

Average

a

b

(2.74)

(2.67)

(2.66)

(2.75)

(2.74)

(2.67)

(2.79)

(2.62)

(3.04)

(1.72)

(1.20)

(2.63)

(2.73)

(2.68)

3.35 (2.70)

Average and standard deviation (in parentheses) of the percentage gap of the heuristic solution value from the best lower bound.

Average and standard deviation (in parentheses) of the percentage reduction of the cost obtained with the heuristic from the cost obtained with the current method.

Table 2

Performance of the algorithm on larger-sized problems.

Factors

Levels

Percentage gapa (%)

Percentage reductionb (%)

Average CPU time (s)

Aw

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

Low

High

7.31

8.01

7.58

7.74

7.47

7.85

7.83

7.49

9.65

5.67

3.34

11.98

7.87

7.45

45.40

45.24

45.49

45.16

45.30

45.34

47.17

43.48

48.02

42.62

46.87

43.77

46.40

44.24

(5.72)

(5.81)

(5.80)

(5.73)

(5.77)

(5.76)

(5.50)

(5.43)

(4.80)

(5.38)

(5.68)

(5.43)

(5.63)

(5.70)

14,000

15,320

16,228

13,092

13,655

15,665

16,024

13,296

12,518

16,802

13,146

16,174

13,937

15,383

45.32 (5.76)

14,660

Ar

hw

i

hrj

mj

vj

Lead time

Average

a

b

(6.23)

(6.36)

(6.16)

(6.45)

(6.26)

(6.35)

(6.34)

(6.27)

(6.85)

(4.97)

(2.93)

(5.78)

(6.45)

(6.15)

7.66 (6.30)

Average and standard deviation (in parentheses) of the percentage gap of the heuristic solution value from the best lower bound.

Average and standard deviation (in parentheses) of the percentage reduction of the cost obtained with the heuristic from the cost obtained with the current method.

Table 3

Results of the analyses of variance.

Source of variation

Sum of squared error

Mean squared error

(a) Results for smaller-sized problems

Aw

1

Ar

1

hw

1

i

hrj

1

mj

1

vj

1

Lead time

1

Error

376

Total

383

0.54

2.06

5.16

363.96

1997.71

198.28

129.51

11,723.03

14,420.25

0.54

2.06

5.16

363.96

1997.71

198.28

129.51

31.18

0.02

0.07

0.17

11.67b

64.07b

6.36a

4.15a

(b) Results for larger-sized problems

Aw

1

Ar

1

w

hi

1

hrj

1

mj

1

vj

1

Lead time

1

Error

376

Total

383

2.29

10.51

0.21

1306.32

2792.92

924.26

450.23

7228.38

12,715.11

2.29

10.51

0.21

1306.32

2792.92

924.26

450.23

19.22

0.12

0.55

0.01

67.95b

145.28b

48.08b

23.42b

a

b

Degree of freedom

There is difference in the effects at the significance level of 0.05.

There is difference in the effects at the significance level of 0.01.

F-value

124

J.-H. Kang, Y.-D. Kim / Int. J. Production Economics 135 (2012) 116–124

retailers for both problem sets. That is, the percentage reduction is

larger when the unit inventory holding costs of the retailers, the

lead time, and/or the mean and the variance of the demands at the

retailers are smaller. This may be due to the fact that the increase in

the inventory holding costs of the retailers (that are supposed to

increase due to the risk pooling strategy) is smaller when values of

the above factors are smaller.

5. Concluding remarks

In this paper, we considered an inventory management problem

in a two-level supply chain, in which there are a single supplier

(composed of a central distribution center and multiple regional

warehouses) and multiple retailers. Assuming the supply chain is

operated under a vendor-managed inventory contract, we presented

a heuristic algorithm based on Lagrangian relaxation and subgradient optimization methods for the problem of selecting warehouses

to be used among a set of candidate warehouses, assigning each

retailer to one of the selected warehouses, and determining replenishment plans of the warehouses and the retailers. Results of

computational experiments showed that the heuristic algorithm

gave relatively good solutions in a reasonable computation time.

To the best of our knowledge, this research is the first attempt to

solve a supply chain planning problem considering the risk pooling

strategy and the trade-offs between the inventory holding costs at

the retailers and the inventory holding costs and operation costs at

the warehouses. Although the risk pooling strategy is considered

for supply chain management in the previous research such as

Gerchak and He (2003), Shen et al. (2003), and Miranda and Garrido

(2004), they do not consider the inventory holding costs at retailers,

and argue that the effect of risk pooling becomes more significant

as the inventory holding costs at the warehouses and the variances

of the demands increase. Note that the risk pooling strategy may

cause an increase in the inventory holding costs at the retailers and

the transportation costs from the warehouses to the retailers, since

the lead times of the retailers and the distances between warehouses and retailers may be increased. Since the bargaining power

of the retailers is not negligible but rather significant nowadays, the

costs incurred at both the retailers’ side and the supplier’s side

should be considered simultaneously (as was done in this study) to

reduce the overall cost of the whole supply chain and to improve

the partnership between the supplier and retailers.

References

Alfaro, J.A., Corbett, C.J., 2003. The value of SKU rationalization in practice (the

pooling effect under suboptimal inventory policies and nonnormal demand).

Production and Operations Management 12 (1), 12–29.

Archibald, T.W., Sassen, S.A.E., Thomas, L.C., 1997. An optimal policy for a two depot

inventory problem with stock transfer. Management Science 43 (2), 173–183.

Archibald, T.W., 2007. Modelling replenishment and transshipment decisions in

periodic review multilocation inventory systems. Journal of the Operational

Research Society 58 (7), 948–956.

Axsäter, S., 1990. Modeling emergency lateral transshipments in inventory systems.

Management Science 36 (11), 1329–1338.

Axsäter, S., 2001. A note on stock replenishment and shipment scheduling for

vendor-managed inventory systems. Management Science 47 (9), 1306–1310.

Benjaafar, S., Cooper, W.L., Kim, J-S., 2005. On the benefits of pooling in productioninventory systems. Management Science 51 (4), 548–565.

Bertazzi, L., Paletta, G., Spenranze, M.G., 2005. Minimizing the total cost in an integrated

vendor-managed inventory system. Journal of Heuristics 11 (5–6), 393–419.

Bitran, G.R., Chandru, V., Sempolinski, D.E., Shapiro, J.F., 1981. Inverse optimization:

an application to the capacitated plant location problem. Management Science

27 (10), 1120–1141.

C

- etinkaya, S., Lee, C-Y., 2000. Stock replenishment and shipment scheduling for

vendor managed inventory systems. Management Science 46 (2), 217–232.

Chang, P-L., Lin, C-T., 1991. On the effect of centralization on expected costs in a

multi-location newsboy problem. Journal of the Operational Research Society

42 (11), 1025–1030.

Chen, M-S., Lin, C-T., 1989. Effects of centralization on expected costs in a multi-location

newsboy problem. Journal of the Operational Research Society 40 (6), 597–602.

De Toni, A.F., Zamolo, E., 2005. From a traditional replenishment system to vendormanaged inventory: a case study from the household electrical appliances

sector. International Journal of Production Economics 96 (1), 63–79.

Eppen, G.D., 1979. Effects of centralization on expected costs in a multi-location

newsboy problem. Management Science 25 (5), 498–501.

Evers, P.T., 2001. Heuristics for assessing emergency transshipments. European

Journal of Operational Research 129 (2), 311–316.

Fry, M.J., Kapuscinski, R., Olsen, T.L., 2001. Coordinating production and delivery

under a (z, Z)-type vendor-managed inventory contract. Manufacturing and

Service Operations Management 3 (2), 151–173.

Gaur, S., Ravindran, A.R., 2006. A bi-criteria model for the inventory aggregation

problem under risk pooling. Computers and Industrial Engineering 51 (3), 482–501.

Gerchak, Y., He, Q-M., 2003. On the relation between the benefits of risk pooling and

the variability of demand. IIE Transactions 35 (11), 1027–1031.

Glasserman, P., Wang, Y., 1998. Leadtime-inventory trade-offs in assemble-to-order

systems. Operations Research 46 (6), 858–871.

Grahovac, J., Chakravarty, A., 2001. Sharing and lateral transshipment of inventory in

a supply chain with expensive low-demand items. Management Science 47 (4),

579–594.

Gumus, M., Jewkes, E.M., Bookbinder, J.H., 2008. Impact of consignment inventory

and vendor-managed inventory for a two-party supply chain. International

Journal of Production Economics 113 (2), 502–517.

Herer, Y.T., Rashit, A., 1999. Lateral stock transshipment in a two-location inventory

system with fixed and joint replenishment costs. Naval Research Logistics 46 (5),

525–547.

Herer, Y.T., Tzur, M., 2001. The dynamic transshipment problem. Naval Research

Logistics 48 (5), 386–408.

Herer, Y.T., Tzur, M., 2003. Optimal and heuristic algorithms for the multi-location

dynamic transshipment problem with fixed transshipment costs. IIE Transactions 35 (5), 419–432.

Hong, S-C., Park, Y-B., 2006. A comparison study on retailer-managed and vendormanaged inventory policies in the retailer supply chain. Journal of the Korean

Institute of Industrial Engineers 32 (4), 382–392.

Hu, J., Watson, E., Schneider, H., 2005. Approximate solutions for multi-location

inventory systems with transshipments. International Journal of Production

Economics 97 (1), 31–43.

Kang, J-H., Kim, Y-D., 2010. Coordination of inventory and transportation managements in a two-level supply chain. International Journal of Production Economics 123 (1), 137–145.

Kukreja, A., Schmidt, C.P., Miller, D.M., 2001. Stocking decisions for low-usage items

in a multilocation inventory system. Management Science 47 (10), 1371–1383.

Kukreja, A., Schmidt, C.P., 2005. A model for lumpy demand parts in a multi-location

inventory system with transshipments. Computers and Operations Research 32

(8), 2059–2075.

Kulkarni, S.S., Magazine, M.J., Raturi, A.S., 2005. On the trade-offs between risk

pooling and logistics costs in a multi-plant network with commonality. IIE

Transactions 37 (3), 247–265.

Lee, H.L., 1987. A multi-echelon inventory model for repairable items with

emergency lateral transshipments. Management Science 33 (10), 1302–1316.

Minner, S., Silver, E.A., Robb, D.J., 2003. An improved heuristic for deciding on emergency

transshipments. European Journal of Operational Research 148 (2), 384–400.

Miranda, P.A., Garrido, R.A., 2004. Incorporating inventory control decisions into a

strategic distribution network design model with stochastic demand. Transportation Research Part E, Logistics and Transportation Review 40 (3), 183–207.

Nauss, R.M., 1978. An improved algorithm for the capacitated facility location

problem. Journal of the Operational Research Society 29 (12), 1195–1201.

Olsson, F., 2009. Optimal policies for inventory systems with lateral transshipments.

International Journal of Production Economics 118 (1), 175–184.

Romeijn, H.E., Shu, J., Teo, C-P., 2007. Designing two-echelon supply networks.

European Journal of Operational Research 178 (2), 449–462.

Rudi, N., Kapur, S., Pyke, D.F., 2001. A two-location inventory model with transshipment and local decision making. Management Science 47 (12), 1668–1680.

Schwarz, L.B., 1989. A model for assessing the value of warehouse risk-pooling: riskpooling over outside-supplier leadtimes. Management Science 35 (7), 828–842.

Shen, Z-J.M., Coullard, C., Daskin, M.S., 2003. A joint location-inventory model.

Transportation Science 37 (1), 40–55.

Southard, P.B., Swenseth, S.R., 2008. Evaluating vendor-managed inventory (VMI) in

non-traditional environments using simulation. International Journal of Production Economics 116 (2), 275–287.

Szmerekovsky, J.G., Zhang, J., 2008. Coordination and adoption of item-level RFID

with vendor managed inventory. International Journal of Production Economics

114 (1), 388–398.

Tagaras, G., 1989. Effects of pooling on the optimization and service levels of twolocation inventory systems. IIE Transactions 21 (3), 250–257.

Tagaras, G., 1999. Pooling in multi-location periodic inventory distribution systems.

Omega 27 (1), 39–59.

Wong, W.K., Qi, J., Leung, S.Y.S., 2009. Coordinating supply chains with sales rebate

contracts and vendor-managed inventory. International Journal of Production

Economics 120 (1), 151–161.

Xu, K., Leung, M.T., 2009. Stocking policy in a two-party vendor managed channel

with space restrictions. International Journal of Production Economics 117 (2),

271–285.