Yield, Profitability and Valuation

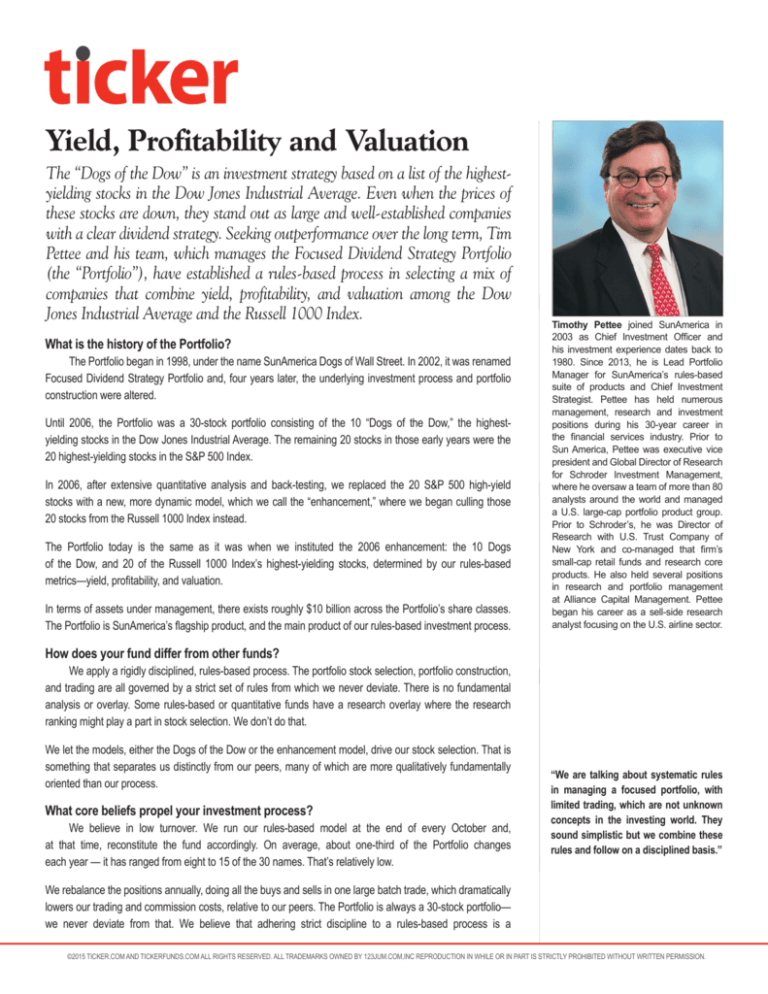

The “Dogs of the Dow” is an investment strategy based on a list of the highestyielding stocks in the Dow Jones Industrial Average. Even when the prices of

these stocks are down, they stand out as large and well-established companies

with a clear dividend strategy. Seeking outperformance over the long term, Tim

Pettee and his team, which manages the Focused Dividend Strategy Portfolio

(the “Portfolio”), have established a rules-based process in selecting a mix of

companies that combine yield, profitability, and valuation among the Dow

Jones Industrial Average and the Russell 1000 Index.

What is the history of the Portfolio?

The Portfolio began in 1998, under the name SunAmerica Dogs of Wall Street. In 2002, it was renamed

Focused Dividend Strategy Portfolio and, four years later, the underlying investment process and portfolio

construction were altered.

Until 2006, the Portfolio was a 30-stock portfolio consisting of the 10 “Dogs of the Dow,” the highestyielding stocks in the Dow Jones Industrial Average. The remaining 20 stocks in those early years were the

20 highest-yielding stocks in the S&P 500 Index.

In 2006, after extensive quantitative analysis and back-testing, we replaced the 20 S&P 500 high-yield

stocks with a new, more dynamic model, which we call the “enhancement,” where we began culling those

20 stocks from the Russell 1000 Index instead.

The Portfolio today is the same as it was when we instituted the 2006 enhancement: the 10 Dogs

of the Dow, and 20 of the Russell 1000 Index’s highest-yielding stocks, determined by our rules-based

metrics—yield, profitability, and valuation.

In terms of assets under management, there exists roughly $10 billion across the Portfolio’s share classes.

The Portfolio is SunAmerica’s flagship product, and the main product of our rules-based investment process.

Timothy Pettee joined SunAmerica in

2003 as Chief Investment Officer and

his investment experience dates back to

1980. Since 2013, he is Lead Portfolio

Manager for SunAmerica’s rules-based

suite of products and Chief Investment

Strategist. Pettee has held numerous

management, research and investment

positions during his 30-year career in

the financial services industry. Prior to

Sun America, Pettee was executive vice

president and Global Director of Research

for Schroder Investment Management,

where he oversaw a team of more than 80

analysts around the world and managed

a U.S. large-cap portfolio product group.

Prior to Schroder’s, he was Director of

Research with U.S. Trust Company of

New York and co-managed that firm’s

small-cap retail funds and research core

products. He also held several positions

in research and portfolio management

at Alliance Capital Management. Pettee

began his career as a sell-side research

analyst focusing on the U.S. airline sector.

How does your fund differ from other funds?

We apply a rigidly disciplined, rules-based process. The portfolio stock selection, portfolio construction,

and trading are all governed by a strict set of rules from which we never deviate. There is no fundamental

analysis or overlay. Some rules-based or quantitative funds have a research overlay where the research

ranking might play a part in stock selection. We don’t do that.

We let the models, either the Dogs of the Dow or the enhancement model, drive our stock selection. That is

something that separates us distinctly from our peers, many of which are more qualitatively fundamentally

oriented than our process.

What core beliefs propel your investment process?

We believe in low turnover. We run our rules-based model at the end of every October and,

at that time, reconstitute the fund accordingly. On average, about one-third of the Portfolio changes

each year — it has ranged from eight to 15 of the 30 names. That’s relatively low.

“We are talking about systematic rules

in managing a focused portfolio, with

limited trading, which are not unknown

concepts in the investing world. They

sound simplistic but we combine these

rules and follow on a disciplined basis.”

We rebalance the positions annually, doing all the buys and sells in one large batch trade, which dramatically

lowers our trading and commission costs, relative to our peers. The Portfolio is always a 30-stock portfolio—

we never deviate from that. We believe that adhering strict discipline to a rules-based process is a

©2015 TICKER.COM AND TICKERFUNDS.COM ALL RIGHTS RESERVED. ALL TRADEMARKS OWNED BY 123JUM.COM,INC REPRODUCTION IN WHILE OR IN PART IS STRICTLY PROHIBITED WITHOUT WRITTEN PERMISSION.

winning formula in today’s marketplace. We have a rule for everything that

might occur in the Portfolio.

our process, discipline, and low turnover, have historically served our

shareholders well.

What is your investment strategy?

We are talking about systematic rules, focused portfolio, and limited trading,

which are not unknown concepts in the investing world. They sound simplistic

but are difficult to follow on a regular basis. When the market is selling off and

you have a position that’s down significantly, it’s very hard to resist selling

the position.

The yield metric is anything equal to or above the median of the S&P

500’s dividend-paying securities.

Our rules-based process takes the emotion out of such decisions. A lot of

investors, both retail and institutional, end up selling low and buying high.

Adhering strictly to our rules means we avoid doing that.

In addition to the 10 Dogs of the Dow portion of the Portfolio, the other

part of our process and strategy is a rules-based model, which excludes

financials and utilities, and screens the Russell 1000 Index for yield,

profitability, and valuation.

The other metrics are more proprietary in nature. Generally speaking,

the profitability metric is a high return on capital, and we screen for low

valuations on cash flow.

Those three metrics are equally-weighted in our screening process.

From there, we take the top 20 ranked stocks from that screen and

combine them with the 10 Dogs of the Dow to create our 30-stock portfolio.

There’s no portfolio management bias in that respect, and no research analyst

overlay. It is strictly a rules-based strategy, which, as I said, is uncommon in

the marketplace.

What constitutes the “Dogs of the Dow” strategy?

It’s a well-known strategy comprising the Dow Jones Industrial

Average’s highest-yielding stocks. Those top 10 stocks may give us

a premium yield. The principal investment strategy of the Portfolio is

value and the principal investment technique is to employ a “buy and

hold” strategy with up to 30 high dividend yielding equity securities

selected annually from the DJIA and broader market.

All 10 are mega-cap companies, all high-quality U.S. companies, which

may afford us downside protection. These 10 Dogs of the Dow tend to act

as a governor in the Portfolio during what we refer to as drafty markets.

Whether it be a significant downturn—such as we experienced in 2008, or

less significant downturns but no less downwardly-biased markets, like we

saw in 2010 and 2012—with 5% to 10% corrections in the market.

The Dogs of the Dow have performed well in those environments, so they

are part of our risk mitigation process. That’s why we left them in there

from inception and following the 2006 enhancement.

In three of the last five years, the Dogs of the Dow have outperformed the

S&P 500. Compare that with the previous seven years, when they

significantly outperformed the S&P 500 only twice. These are quality

companies that have historically provided us yield, downside protection,

and more recently, they’ve been performing well in all markets. But of

course, past performance does not guarantee future results.

What are the advantages of rule-based investing?

In the industry, we hear repeatedly that active management has

underperformed, and there are a lot of reasons for that. When you compare

our philosophy to those of the broader investing community, the tenets of

This discipline permits us to see how this decision impacts our investment

returns in various market developments. We are not going to win every day,

every month, or even every year, but we’re playing a long-term game. Our

goal is to find good value stocks that outperform the market over time.

In terms of turnover, longer holding periods generally tend to correlate

with higher returns. Yet, the market has seen holding periods decrease

dramatically. Once measured in years, holding periods are now often

measured in minutes.

With our annual reconstitution, we have very low turnover. Our average

holding period is two to three years, which is longer than the broader

investing community. We think that this is another way to potentially achieve

higher returns relative to the market.

How do you create your rules?

We have a robust quantitative analysis function within the investment

department. Our rules were derived from extensive quantitative analysis

before being implemented. We test the metrics and, after back-testing,

we go with what we believe to be an appropriate mix of metrics and rules.

How do you tackle portfolio construction?

The Portfolio’s broad-based securities index is only the S&P 500,

not the Russell 1000. However, the Portfolio’s holdings are selected

from the Dow Jones Industrial Average and the Russell 1000.

On or about every first of November, we rebalance to our target weight,

which is 3.3%. New names in the Portfolio each represent 3.3%, and

everything that is to remain in the portfolio is rebalanced to 3.3%.

A name that has appreciated to, say, a 4% position, we trim back to our

target of 3.3%. Conversely, if something has underperformed over the

course of the year, we move the position back up to 3.3%. That is the only

time of year we rebalance to target.

In terms of diversification, we do not employ a quantitative optimizer.

We do not have caps or limits on sector weights or diversification. Technology

has been a significant overweight in the Portfolio.

We let the model dictate portfolio construction, often resulting in significant

stock-specific selection or overweights in various market sectors.

©2015 TICKER.COM AND TICKERFUNDS.COM ALL RIGHTS RESERVED. ALL TRADEMARKS OWNED BY 123JUM.COM,INC REPRODUCTION IN WHILE OR IN PART IS STRICTLY PROHIBITED WITHOUT WRITTEN PERMISSION.

We believe that diversification benefits start to decline in portfolios

greater than 30 to 40 names. We think a 30-stock portfolio is optimal for

portfolio diversification.

name in the Portfolio. More often, names move from growth to value, or

from value to growth; this does not impact the Portfolio.

Accordingly, we believe the Portfolio has definition. It has higher tracking

error than some, but not excessively. In terms of active share, which is a

more recent characteristic that quantifies the differences in the concentration

of holdings between a fund and its benchmark index, the Portfolio has

consistently been north of 80%. The greater the difference in concentration,

the higher the active share and the more potential the Portfolio has to

generate alpha, or the amount a fund outperforms or under performs its

benchmark index. For instance, a fund with an active share of 0% has a

portfolio that exactly matches its benchmark, while an active share of

100% means that the fund and benchmark have no overlapping holdings.

In practice, an active share of 60% or higher is considered a “truly active”

portfolio, while over 80% is highly active. Currently, active share for the

Portfolio is approximately 85%, which suggests it clearly differs from its

benchmark, far from a closet index strategy.

We have a portfolio policy committee consisting of the Chief

Investment Officer, analysts, and a few portfolio managers, including me.

The committee meets at least twice a year for each portfolio and then as

needed. We run extensive analytics on performance to establish where

performance is coming from in terms of individual stocks and sectors

and weightings.

What is your sell discipline?

In addition to our annual reconstitution, we have a yield hurdle rule.

We check each position in the Portfolio every month to determine its yield.

If the yield has fallen below our yield hurdle, defined as the median

of the dividend-paying securities of the S&P 500, we sell the position and

replace it with the next highest-ranking stock.

So, our yield hurdle is a sell discipline. It happens infrequently, only eight

times since 2006. Seven out of those eight were cases where the stock’s

price went up and the yield went down. Once it violated our yield hurdle,

we sold it. Those were typically situations where a company got taken over or

a takeover deal occurred and the stock rose significantly.

The second rule is in the case of a takeover or corporate action, as we

saw recently with one of our positions in the tobacco sector. Again, we ran

the model and replaced that name with the next highest-ranking stock.

No matter what, we always have 30 stocks.

How does the process of bringing in new stocks work?

Our annual reconstitution begins in late October, where we use our

single, rather complex model to determine the current 10 highest-yielding

stocks in the Dow Jones industrial Average and the 20 highest from the

Russell 1000, using our yield/profitability valuation metrics.

We then send that 30-stock portfolio to trading around November 1st,

because our fiscal year ends October 31st. By doing these trades on or about

November 1st, we can better manage our tax situation.

In some cases we might do trades in October, perhaps if there’s a

loss position, so we can reduce our capital gain. In other cases, such

as a position with a short-term gain, we defer trading until it goes

long term. It is very rare for us to book a short-term gain.

We do look at some of the issues with respect to the changing Russell,

but it’s rare that a name comes out of the Russell that would affect a

How do you define risk and how do you control it?

We also look at risk over time. Speaking generally, we look at stock

selection, factor tilt, data, valuation, etc., to identify not just where

our performance is coming from, but also where most of our risk

is concentrated. We analyze the portfolio characteristics—valuation,

growth, and profitability are all metrics in our selection of individual

holdings, but we want to analyze, too, how the Portfolio looks relative

to the benchmark.

Other things we do are to break down the Portfolio by things like market

cap and P/E ratio. We look at the percentage of the Portfolio that’s at

a very high P/E bucket relative to the benchmark to determine where

our risk lies.

We also perform a returns-based analysis, relative to peers and relative

to the index, to see what kind of valuation tilt we have, what kind of style

box we end up in, and how our various risk characteristics compare to peers.

So, we look at things like Sharpe ratio and track it over time.

Are there other ways you tackle risk?

Our investment process is consistent; we don’t change it over

time. In terms of the Portfolio and the creation of the model, a lot of risk

analysis was applied to the methods we employ: the relationship

between the enhancement and the Dogs of the Dow. There is an ongoing

assessment of risk, but the model was designed with risk in mind.

The factors, the metrics—yield, profitability, and valuation—we didn’t

invent them, but they do complement one another in terms of stock

selection, performance, and risk. If we were to use just yield and

valuation, we would probably have a deep value type of portfolio.

Ours is not a deep value strategy. We like what the profitability metric

does in the model, because it has tended to lift the quality of the name

and stock selection, thereby offsetting some of the risk characteristics one

might get from a deep value.

We think our three chosen metrics complement one another well.

The Dogs of the Dow is an important component of our risk mitigation

strategy. As they are the highest-yielding names in the Portfolio, we get

a premium yield. Along with a potential premium yield, the Dogs of the

Dow, being among the largest mega cap names in the U.S. marketplace

today, may help mitigate risk for us. They are one of the reasons why

our downside capture has been low.

©2015 TICKER.COM AND TICKERFUNDS.COM ALL RIGHTS RESERVED. ALL TRADEMARKS OWNED BY 123JUM.COM,INC REPRODUCTION IN WHILE OR IN PART IS STRICTLY PROHIBITED WITHOUT WRITTEN PERMISSION.

Our process has not changed since 2006. We managed to outperform the benchmark on the way

down during the financial crisis and on the way up in 2009, when the market rallied. We believe that

these metrics can work well, no matter what the market conditions are. Again, past performance

does not guarantee future results.

Part of the challenge in marketing the Portfolio is that, in the ’90s, the Dogs of the Dow were not great

companies. Today, however, the Dogs of the Dow are great American companies that are not merely

high-yielding because their prices are down. They are high-yield because many corporate CFOs know

that the key to a premium multiple on your stock is a very balanced capital plan that includes a

healthy dividend growth program and a dividend strategy.

Dividends are an important part of investing, and have been for a long time. However, our strategy

extends beyond dividends. Otherwise, we would have a lot of utilities and financials. We specifically

avoid those areas of the market.

Focused Dividend

Strategy Portfolio

Company SunAmerica Asset

Management

Symbol

FDSAX (Class A)

Address

Harborside Financial Center

3200 Plaza 5

Jersey City, NJ 07311

Phone

800-858-8850

Websitewww.safunds.com

Source: Company Documents

Quality works over the long term in many market cycles. That’s what we’re after—what we have

achieved historically in the Portfolio. We identify high-quality attractive companies. We believe that

combination is what may lead to out performance over time.

Important information:

Past performance is not indicative of future results.

The Sharpe Ratio uses a fund’s standard deviation and its excess return (the difference between the fund’s return and

the risk-free return of 90-day Treasury Bills) to determine reward per unit of risk.

Focused funds are less diversified than typical mutual funds; therefore the performance of each holding in a focused

fund has a greater impact upon the overall portfolio, which increases risk.

The Portfolio employs a Disciplined Strategy and will not deviate from its strategy (except to the extent necessary to

comply with federal tax laws or other applicable laws). Because the Portfolio will not use certain techniques available

to other mutual funds to reduce stock market exposure (e.g., derivatives), the Portfolio may be more susceptible to

general market declines than other mutual funds.

Stocks of small-cap and mid-cap companies are generally more volatile than and not as readily marketable as those

of larger companies, and may have less resources and a greater risk of business failure than do large companies.

The Dow Jones Industrial Average is the most widely used indicator of the overall condition of the stock market,

a price-weighted average of 30 actively traded blue chip stocks, primarily industrials.

The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset

of the Russell 3000 Index and includes approximately 1000 of the largest securities in that index.

The S&P 500 Index is an unmanaged, broad-based, market-cap weighted index of 500 U.S. stocks.

Investors should carefully consider the investment objectives, risks, charges, and expenses of any mutual

fund before investing. This and other important information is contained in the prospectus, which can

be obtained from your financial advisor or from the SunAmerica Sales Desk at 800-858-8850, ext. 6003.

Read the prospectus carefully before investing.

Funds distributed by AIG Capital Services, Inc. Member FINRA. Harborside Financial Center, 3200 Plaza 5,

Jersey City, NJ 07311, 800-858-8850, ext. 6003

About Ticker Q&A

T

Our research staff analyzes and selects

funds based on their consistency

in performance and durability of

investment style.

You can find more fund profiles and

view our other publications on

Ticker.com and TickerFunds.com

©2015 TICKER.COM AND TICKERFUNDS.COM ALL RIGHTS RESERVED. ALL TRADEMARKS OWNED BY 123JUM.COM,INC REPRODUCTION IN WHILE OR IN PART IS STRICTLY PROHIBITED WITHOUT WRITTEN PERMISSION.

S5110AR4 (11/15)