SiriusXM Canada Reports Record Total Subscribers and Revenue

advertisement

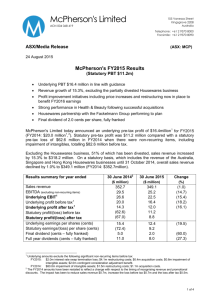

SiriusXM Canada Reports Record Total Subscribers and Revenue for Fiscal 2015 Year-End and Fourth Quarter –Net self-pay subscriber growth for the year fuels total subscriber all-time high, top-line improvements and increased profitability – Toronto, ON – October 29, 2015 – Sirius XM Canada Holdings Inc. (“SiriusXM Canada” or the “Company”) (TSX: XSR), parent of Sirius XM Canada Inc., today released financial results for its fiscal year 2015 ("FY2015") and fourth quarter ("Q4 FY2015") ended August 31, 2015 prepared in accordance with International Financial Reporting Standards (IFRS). A summary of IFRS financial results for Q4 FY2015 and FY2015 is attached. All results are reported in Canadian dollars unless otherwise stated. Q4 and Year-End FY2015 Financial and Operating Metrics The figures below include certain non-GAAP measures and industry metrics. These figures are subject to the qualification and assumptions set out in the Company’s notes to such results. For easier comparability, the table and financial review below exclude the impact of income tax expense and withholding tax expense due to Canada Revenue Agency reassessments in FY2015 and the impact of the Company’s debt refinancing in FY2014. Please see the Company’s reconciliation table below or the Company’s MD&A for more detail. Financial1 Q4 FY2015 Aug 31, 2015 Q4 FY2014 % Change Aug 31, 2014 FY2015 FY2014 Aug 31, 2015 Aug 31, 2014 % Change (Restated) Revenue 83,709 77,121 8.5% 325,874 303,500 Adjusted EBITDA2 12,792 12,202 4.8% 79,214 79,025 0.2% 2,406 1,200 100.5% 28,227 19,708 43.2% 15,817 10,501 50.6% 55,157 45,944 20.1% Self-Paying Subscribers 1,925 1,852 4.0% 1,925 1,852 4.0% Total Subscribers 2,726 2,612 4.4% 2,726 2,612 4.4% Normalized net income3 Normalized free cash flow4 Operating 1 5 Self-Pay ARPU 1 7.4% $12.69 $12.25 3.6% $12.61 $12.15 3.8% Subscriber Acquisition Cost (SAC) $40 $38 5.3% $39 $38 2.6% Cost Per Gross Addition (CPGA) $71 $66 7.6% $66 $64 3.1% All figures in the table above are in thousands except, ARPU, SAC and CPGA. 2 Adjusted EBITDA is a non-GAAP measure. A reconciliation of income (loss) before taxes to both EBITDA and Adjusted EBITDA, including a one-time $15.9 million withholding tax in FY2015 is provided below. 3 Adjusted for a one-time after-tax $12.2 million debt refinancing charge in FY2014 as well as a $15.9 million withholding tax expense and a $19.1 million, non-cash income tax expense for FY2015. Please refer to the reconciliation tables below and the Company’s MD&A for more detail. 4 FY2014 adjusted for $10.4 million call premium related to the Company’s debt refinancing. 5 Self-Pay ARPU is derived from the total of earned subscription revenue from Self-Pay subscribers and the music royalty and regulatory fee and activation fees, divided by the monthly weighted average number of Self-Paying subscribers. Please see the Company’s MD&A for a more detailed description. “Fiscal 2015 ended on a high note, with us delivering growth across all of our key metrics,” said Mark Redmond, President and CEO, SiriusXM Canada. “Total subscribers reached at an all-time high, and we delivered record quarterly and annual revenue. Supported by substantial net self-pay subscriber additions in Q4, we achieved our stated goal of mid-single digit growth for the year. We also generated year-overyear improvements in Adjusted EBITDA and normalized free cash flow. This was despite a much larger cost base due to higher copyright fees and increasing foreign exchange headwinds as we moved through the year. As expected, we saw churn continue to improve in Q2, Q3 and Q4, with it coming in particularly strong at 1.76 per cent for the quarter.” Mr. Redmond continued: “With the superior overall audio entertainment experience we provide and our growing addressable market, our long-term opportunities are significant. Our content is a major competitive advantage. It is unrivaled. As we continue to demonstrate with the launch of new shows and channels, we are committed to further enhancing our programming line-up to attract even more listeners. We remain confident in our ability to continue to deliver top-line growth, strong Adjusted EBITDA and free cash flow.” Key Factors Affecting FY2015 and FY2014 Reported Results For FY2014 and FY2015 periods, there were one-time events that affected the Company’s results. In Q3 FY2014, the Company redeemed $130.8 million outstanding 9.75% senior notes that were due 2018. This resulted in a total pre-tax debt refinancing charge of $16.6 million (after-tax - $12.2 million) including $10.4 million call premium for early redemption of debt. For FY2015, the company recognized a one-time, noncash $19.1 million income tax expense and a $15.9 million withholding tax expense in Q2 2015 related to Canada Revenue Agency reassessments that the Company is currently disputing. For the discussion below, the Company has compared normalized results as it believes this approach provides a more accurate depiction of its year-over-year performance. Please refer to the reconciliation tables below and the Company’s MD&A for more detail. Q4 and Year-End FY2015 Results Financial Review For Q4 FY2015, revenue was $83.7 million, up $6.6 million, or 8.5%, from $77.1 million in Q4 FY2014. The year-over-year improvement reflects growth in the Company’s self-paying subscriber base and an increase in Self-Pay ARPU. Q4 FY2015 Self-Pay ARPU was $12.69, up 3.6% from $12.25 in Q4 FY2014 driven by the Company’s implementation of its increased Music Royalty and Regulatory Fee (MRF) on renewing subscribers. For FY2015, revenue was $325.9 million, up $22.4 million, or 7.4%, from $303.5 million for FY2014. Self-Pay ARPU for FY2015 was $12.61, up 3.8% compared to $12.15 for FY2014. Adjusted EBITDA for Q4 FY2015, increased $0.6 million, or 4.8%, to $12.8 million from $12.2 million in Q4 FY2014. The year-over-year increase was a result of revenue growth partially offset by an increase in the Company’s copyright fees and higher overall marketing costs due to increased volumes and penetration rates, investments in the pre-owned vehicle market and product development costs. For FY2015, Adjusted EBITDA, which excludes a one-time adjustment related to the withholding tax provision the Company took, was $79.2 million, an increase of $0.2 million, or 0.2%, from $79.0 million for the same period in FY2014. The Company recorded net income of $2.4 million in Q4 FY2015, up $1.2 million, or 100.5%, compared to net income of $1.2 million in Q4 FY2014. For FY2015, net income was $28.2 million, excluding a one-time income tax expense and withholding tax expense. This was up $8.5 million, or 43.2%, from net income of $19.7 million for FY2014, after normalizing for the after-tax debt refinancing charge the Company incurred in FY2014. SAC for Q4 FY2015 was $40, up from $38 in Q4 FY2014 as a result of higher subsidy costs and an unfavorable impact of a weakened Canadian dollar versus the US dollar. SAC increased marginally to $39 in FY2015 from $38 in FY2014. CPGA was $71 in Q4 FY2015, up from $66 in Q4 FY2014, reflecting higher subsidy and marketing costs, offset, in part, by higher gross additions from the pre-owned vehicle channel. CPGA increased to $66 in FY2015 from $64 in FY2014. In Q4 FY2015, the Company generated $18.3 million in cash from operating activities, up $4.1 million, or 29.0%, from $14.2 million in cash from operating activities in Q4 FY2014. As a result of year-over-year changes in working capital and lower interest payments in FY2015, the Company generated $71.0 million in cash from operating activities, up $11.0 million, or 18.3%, from $60.0 million in cash from operating activities in FY2014, after adjusting for the call premium of $10.4 million related to the Company’s debt refinancing. The Company generated free cash flow of $15.8 million in Q4 FY2015, up $5.3 million, or 50.6%, from $10.5 million in Q4 FY2014 reflecting a $4.1 million increase in cash from operations coupled with a $1.2 million decrease in capital spending, as the Company completed the implementation of its unified Subscriber Management System, in Q3 FY2015. For FY2015, the Company generated $55.2 million of free cash flow, up $9.2 million, or 20.1%, compared to $45.9 million in FY2014, after adjusting for call premium for repayment of debt. The year-over-year increase reflects higher cash from operations offset by higher capital expenditures in FY2015. As at August 31, 2015, the Company had total cash and cash equivalents of $26.1 million compared to $23.8 million as at May 31, 2015. The increase is primarily due to cash flow from operating activities of $18.3 million in Q4 FY2015 offset by dividend payments of $13.5 million and capital expenditures of $2.5 million. Conference Call and Webcast Details SiriusXM Canada will hold a conference call to discuss the Company’s Q4 and year-end FY2015 results on Friday, October 30, 2015 at 8:30 a.m. ET. All interested parties can join the call by dialing 647-427-7450, or 1-888-231-8191. Please dial in 15 minutes prior to the call to secure a line. The conference will be archived for replay until Friday, November 6, 2015 at midnight. To access the archived conference call, please dial 416-849-0833 or 1-855-859-2056 and enter reservation code: 56558816. A live audio webcast of the conference call will be available here: http://bit.ly/1juTkrt . Please connect at least 15 minutes prior to the conference call top ensure adequate time for any software downloads that may be required. An archived replay will be available for 90 days. Reconciliations The following is a reconciliation of EBITDA and Adjusted EBITDA to Income (loss) before income taxes. Adjusted EBITDA: Reconciliation Three months ended August 31, In ($ 000’s) Fiscal year ended August 31, 2015 2014 2015 2014 Q4 2015 Q4 2014 FY 2015 FY 2014 (Restated) Income (loss) before income taxes 3,564 2,029 24,416 11,373 Interest expense & income 3,071 2,888 12,213 14,407 — — — 16,636 280 13 331 265 5,514 6,837 22,936 33,727 12,429 11,767 59,896 76,408 — — 15,887 — 363 431 3,427 2,550 — 4 4 67 Adjusted EBITDA 12,792 79,214 12,202 * Fair value adjustment relates to reduction in revenue due to valuation of deferred revenue as per purchase price accounting 79,025 Loss on debt repayment Foreign exchange loss Amortization EBITDA Withholding tax expense Stock-based compensation Fair value adjustments * For easier comparability, the table below shows the normalized results for fiscal FY2015 and FY2014 after adjusting for income tax expense and withholding tax expense in FY2015 and early redemption of debt in FY2014. FY 2015 FY 2014 Change As Reported CRA Tax Reassessment FY 2015 Normalized As Reported Loss on Debt FY 2014 Normalized Revenue 325,874 — 325,874 303,500 — 303,500 22,374 7.4 % Operating costs 250,091 — 250,091 227,093 — 227,093 22,998 10.1 % Depreciation and amortization 22,936 — 22,936 33,727 — 33,727 (10,791) (32.0)% Operating income 52,847 — 52,847 42,680 — 42,680 10,167 23.8 % Withholding tax expense (15,887) 15,887 — — — — — —% Finance costs, net (12,544) — (12,544) (31,307) 16,636 (14,671) 2,127 (14.5)% Income tax expense (recovery) (31,164) 19,088 (12,076) (3,892) (4,409) (8,301) (3,775) 45.5 % (6,748) 34,975 28,227 7,481 12,227 19,708 8,519 43.2 % (14.5)% in ($000’s) Net income (loss) $ % Add back: Finance costs, net (12,544) — (12,544) (31,307) 16,636 (14,671) 2,127 Income tax expense (recovery) (31,164) 19,088 (12,076) (3,892) (4,409) (8,301) (3,775) 45.5 % Depreciation and amortization 22,936 — 22,936 33,727 — 33,727 (10,791) (32.0)% EBITDA 59,896 15,887 75,783 76,408 — 76,408 (625) (0.8)% (15,887) (15,887) — — 3,427 — 3,427 2,550 — — 4 — 4 67 79,214 — 79,214 79,025 Withholding tax expense Stock based compensation Fair value adjustments Adjusted EBITDA — — — — —% 2,550 877 34.4 % 67 (63) (94.0)% 79,025 189 0.2 % For complete definition of non-GAAP measures and for more details on the Company’s Q4 and FY2015 results, please see the Company’s Annual Management Discussion & Analysis filed October 29, 2015 which is incorporated herein by reference. The non-GAAP measures used in this press release should be used in addition to, but not as a substitute for, the analysis provided in the condensed consolidated financial statements for FY 2015. Forward-Looking Statements Certain statements included above may be forward-looking in nature. Such statements can be identified by the use of forward-looking terminology such as "expects," "may," "will," "should," "intend," "plan," or "anticipates" or the negative thereof or comparable terminology, or by discussions of strategy. Forwardlooking statements include estimates, plans, expectations, opinions, forecasts, projections, targets, guidance, or other statements that are not statements of fact, including with respect to the payment of dividends in the future and future performance. Although SiriusXM Canada believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct, including with respect to the ability of the Company to pay dividends in the future, the redemption of Sirius XM Canada’s 5.625% Senior Unsecured Notes, and the terms, timing and conditions of any refinancing of such notes. SiriusXM Canada's forward-looking statements are expressly qualified in their entirety by this cautionary statement. SiriusXM Canada makes no commitment to revise or update any forward-looking statements in order to reflect events or circumstances after the date any such statement is made, except as required by applicable law. Additional information identifying risks and uncertainties is contained in Sirius XM Canada Holdings Inc.'s filings with the Canadian securities regulators, available at www.sedar.com. About SiriusXM Canada Sirius XM Canada Holdings Inc. (TSX: XSR) operates as SiriusXM Canada. SiriusXM Canada, with more than 2.7 million subscribers, is the country's leading audio entertainment company and broadcasts more than 120 satellite radio channels featuring premier sports, news, talk, entertainment and commercial-free music. SiriusXM Canada offers an array of content from the most recognized news, entertainment and major sports brands including the NHL, NFL, NBA, NASCAR, CNN, CBC, FOX, BBC, Howard Stern, Disney, Comedy Central and more. SiriusXM programming is available on a variety of devices including pre-installed and after-market radios in cars, trucks and boats, smartphones and mobile devices, and consumer electronics products for homes and offices. SiriusXM programming is also available online at www.siriusxm.ca and on Apple and Androidpowered mobile devices. SiriusXM Canada has partnerships with every major automaker and its radio products are available at more than 2,500 retail locations nationwide. To find out more about SiriusXM Canada, visit our website at www.siriusxm.ca. SiriusXM Canada has been designated one of Canada's 50 Best Managed Companies six years in a row and 2013, 2014 and 2015 rankings in PROFIT 500's list of Canada's Fastest Growing Companies. Join SiriusXM Canada on Facebook at facebook.com/siriusxmcanada, twitter.com/siriusxmcanada and on Youtube at youtube.com/siriusxmcanada. For further information, please contact: Robbie Sra SiriusXM Canada Tel: 416-513-7407 Robbie.Sra@siriusxm.ca Kristen Dickson NATIONAL Equicom 416-848-1429 kdickson@national.ca on Twitter at CONSOLIDATED BALANCE SHEETS August 31, August 31, 2015 2014 26,128 23,868 Accounts receivable 9,436 13,455 Prepaid expenses 5,337 4,251 35 559 40,936 42,133 305 4,285 456 4,508 At (in thousands of Canadian dollars) ASSETS Current assets Cash and cash equivalents Inventory Total current assets Long-term prepaid expenses Property and equipment Intangible assets 131,410 134,971 Deferred tax assets 19,428 50,592 Goodwill 96,733 96,733 293,097 329,393 Trade and other payables 52,545 44,121 Due to related parties 15,950 9,146 3,966 3,966 153,076 146,111 983 506 226,520 203,850 12,033 651 15,076 533 1,208 1,324 196,036 195,464 95 374 436,543 416,621 178,479 176,862 8,817 6,067 Total assets LIABILITIES AND SHAREHOLDERS' DEFICIENCY Current liabilities Interest payable Deferred revenue Provisions Total current liabilities Deferred revenue Other long-term liabilities Due to related parties Long-term debt Provisions Total liabilities Shareholders' deficiency Share capital Contributed surplus Accumulated deficit (330,742) (270,157) Total shareholders' deficiency (143,446) (87,228) 293,097 329,393 Total liabilities and shareholders’ deficiency Approved by the Board of Directors (signed) Christine Magee (signed) Anthony Viner Christine Magee, Director Anthony Viner, Director CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY (DEFICIENCY) Total For the year ended August 31, (in thousands of Canadian dollars) Balance, September 1 , 2013 Net income for the period Stock-based compensation Dividends Stock options exercised Share Contributed Accumulated Shareholders' Capital Surplus Deficit Equity (Deficiency) 151,795 — 6,161 — — 2,550 — — (149,713) 7,481 — (127,925) 8,243 7,481 2,550 (127,925) 3,528 (1,105) — 2,423 21,539 (1,539) — 20,000 Balance at August 31, 2014 176,862 6,067 (270,157) (87,228) Balance, September 1 , 2014 176,862 6,067 (270,157) (87,228) (6,748) (6,748) Conversion of convertible notes Net loss for the period — — Stock-based compensation — 3,427 Dividends — — Stock options exercised Balance at August 31, 2015 1,617 178,479 (677) 8,817 — (53,837) — (330,742) 3,427 (53,837) 940 (143,446) CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) For the year ended August 31, (in thousands of Canadian dollars, except per share amounts) Revenue 2015 2014 325,874 303,500 250,091 227,093 22,936 33,727 52,847 42,680 Operating expenses Operating costs Depreciation and amortization Operating income Withholding tax recovery (expense) (15,887) — Finance costs, net Interest income Interest expense 288 (12,501) 843 (15,249) Loss on debt repayment — (13,196) Change in fair value of embedded derivative — (3,440) Foreign exchange loss Finance costs, net Net income before income tax Income tax expense Net income (loss) and comprehensive income (loss) Earnings (loss) per share - basic and diluted (331) (265) (12,544) (31,307) 24,416 11,373 (31,164) (3,892) (6,748) 7,481 (0.05) 0.06 CONSOLIDATED STATEMENTS OF CASH FLOWS For the year ended August 31, (in thousands of Canadian dollars) 2015 2014 (6,748) 7,481 21,013 30,861 1,923 2,866 31,164 3,892 3,427 2,550 Accrued interest — 1,261 Interest accretion 572 3,821 — 3,440 Cash provided by (used in) OPERATING ACTIVITIES Net income (loss) for the period Add (deduct) items not involving cash Amortization of intangible assets Depreciation of property and equipment Income tax expense Stock-based compensation Change in fair value of embedded derivative Foreign exchange loss 583 171 Net change in non-cash working capital and deferred revenue related to operations 19,021 (6,778) Cash provided by operating activities 70,955 49,565 (1,845) (1,148) (13,098) (12,884) INVESTING ACTIVITIES Purchase of property and equipment Purchase of intangible assets Prepayment for property and equipment (855) — Maturity of short-term investments — 5,063 Interest received on short-term investments — 199 Cash used in investing activities (15,798) (8,770) (53,837) (127,925) FINANCING ACTIVITIES Payment of dividends Proceeds from issuance of debt — Debt financing fees — (4,733) Repayment of debt — (130,771) Proceeds from exercise of stock options Cash used in financing activities 940 200,000 2,424 (52,897) (61,005) 2,260 (20,210) Cash and cash equivalents, beginning of year 23,868 44,078 Cash and cash equivalents, end of year 26,128 23,868 Net increase (decrease) in cash and cash equivalents during the year