PPT - NCLGBA

advertisement

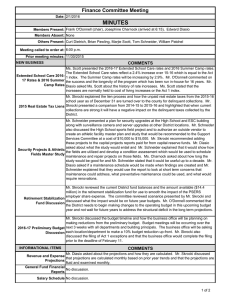

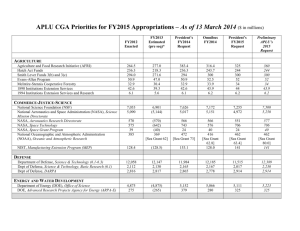

FY 2015 & FY 2016 Revenue Projections Presented by Chris Nida NCLM Director of Research & Policy Analysis Revenue Projections Revenue Source Projected, FY2014 to FY2015 Projected, FY2015 to FY2016 +7.5% +4% N/A <-1% Electricity Sales Tax +30% +2% Telecommunications Sales Tax -1.5% -3% Piped Natural Gas Sales Tax -35% -2% Solid Waste Disposal Tax +5.5% +2.5% Local Video Programming Revenues +1.5% -2% +5% +3% Local Sales Tax Powell Bill Beer & Wine Taxes Caveats • Projections are rough estimates • Not assuming ANY Legislative changes to current revenue structure • Keep up with weekly Legislative Updates Sales Tax • Significant growth statewide • FY 2016 payments: 10/15/15 to 9/15/16 • Utilize calculation spreadsheet – Download from email or NCLM.org – Incorporate county growth rate, and distribution share • Change in County distribution? Powell Bill • SB 20 reduced motor fuel tax rate from 37.5 cents/gallon to 36 cents/gallon on 4/1 • FY 2016 PB Estimate – $146.1 Million – Less than 1% less than FY 2015 • Projected Distributions – $20.39 per capita – $1,629.43 per street mile Electricity/Natural Gas Taxes • Started FY 2015 • Electricity +17% in Q1, +58% in Q2 (compared to FY2014 Franchise Tax) • Project +30% for FY 2015, -35% for Gas • No law change predicted • Project +2% for FY 2016, -2% for Gas Other Taxes • Continued downward trend for Telecomm • Construction activity increasing solid waste disposal • Video upward, contrary to industry trends • Increased beer & wine sales projections • Don’t forget to report boundary changes! Questions? NCLGBA Summer Conference July 8th-10th, Shell Island, Wrightsville Beach $175 for NCLGBA Members, $235 for Non-members $75 Students & First-Timers Hotel Rooms $189/night (+Tax) Speakers Dr. Jim Johnson Lee Roberts, NC Budget Office Director To learn more, visit www.nclgba.org