ppe - examples

advertisement

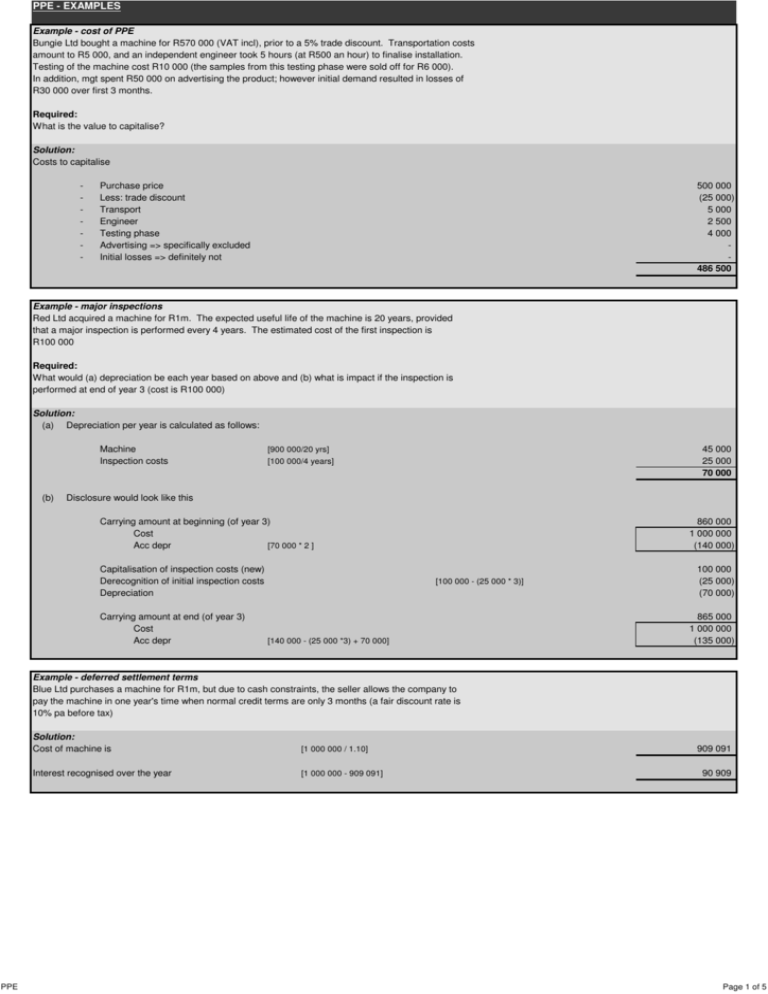

PPE - EXAMPLES Example - cost of PPE Bungie Ltd bought a machine for R570 000 (VAT incl), prior to a 5% trade discount. Transportation costs amount to R5 000, and an independent engineer took 5 hours (at R500 an hour) to finalise installation. Testing of the machine cost R10 000 (the samples from this testing phase were sold off for R6 000). In addition, mgt spent R50 000 on advertising the product; however initial demand resulted in losses of R30 000 over first 3 months. Required: What is the value to capitalise? Solution: Costs to capitalise - Purchase price Less: trade discount Transport Engineer Testing phase Advertising => specifically excluded Initial losses => definitely not 500 000 (25 000) 5 000 2 500 4 000 486 500 Example - major inspections Red Ltd acquired a machine for R1m. The expected useful life of the machine is 20 years, provided that a major inspection is performed every 4 years. The estimated cost of the first inspection is R100 000 Required: What would (a) depreciation be each year based on above and (b) what is impact if the inspection is performed at end of year 3 (cost is R100 000) Solution: (a) Depreciation per year is calculated as follows: Machine Inspection costs (b) 45 000 25 000 70 000 [900 000/20 yrs] [100 000/4 years] Disclosure would look like this Carrying amount at beginning (of year 3) Cost Acc depr [70 000 * 2 ] Capitalisation of inspection costs (new) Derecognition of initial inspection costs Depreciation Carrying amount at end (of year 3) Cost Acc depr 860 000 1 000 000 (140 000) [100 000 - (25 000 * 3)] [140 000 - (25 000 *3) + 70 000] 100 000 (25 000) (70 000) 865 000 1 000 000 (135 000) Example - deferred settlement terms Blue Ltd purchases a machine for R1m, but due to cash constraints, the seller allows the company to pay the machine in one year's time when normal credit terms are only 3 months (a fair discount rate is 10% pa before tax) PPE Solution: Cost of machine is [1 000 000 / 1.10] Interest recognised over the year [1 000 000 - 909 091] 909 091 90 909 Page 1 of 5 Example - exchange of assets Halo Ltd exchanges a machine with Chief Ltd. The respective info for each machine is: Halo Chief 10 000 15 000 Carrying amount Fair value 16 000 Solution: (a) Halo will recognise the new machine at a cost of R15 000 => FV of item GIVEN UP (b) If Chief's machine is considered more relevant than Halo's then would recognise new machine in Halo's books at R16 000 (c) If its not possible to determine the fair value of either machine then new machine would be recognised in Halo books at R10 000 (d) If transaction lacks commercial substance then new machine will also be recognised at R10 000 Example - depreciation methods Cost of equipment Residual value Useful life (in years) 500 000 20 000 4 Required: Determine depreciation using (a) straight line, (b) reducing balance and (c) sum of digits Solution: (a) Straight line (b) (c) Reducing balance Sum of digits [(500000-20000)/4 yrs] 120 000 Year 1 Year 2 Year 3 Year 4 [(500000-20000)/4 yrs] 120 000 90 000 67 500 50 625 Year 1 Year 2 Year 3 Year 4 [(500000-20000)/10*4] [((500000-20000)-120000)/4 yrs] [((500000-20000)-120000-90000)/4 yrs] [((500000-20000)-120000-90000-67500)/4 yrs] [(500000-20000)/10*3] [(500000-20000)/10*2] [(500000-20000)/10*1] 192 000 144 000 96 000 48 000 Example - revaluation : gross v net Information applying to a machine of Master Ltd: Cost price (on 1 Jan 2000) Acc depr to 31 Dec 2001 Useful life (in years, straight line method) Year end 100 000 20 000 10 Dec At the beginning of 2002 the machine was revalued at a net replacement value of R120 000 Show the effect of this revaluation using (a) gross method and (b) net replacement method Solution: (a) Revalued amount Acc depr Revised carrying amount Revaluation surplus (equity) (b) Revalued amount Acc depr Carrying amount Revaluation surplus (equity) PPE [120000/8*10] [150000/10*2] [120000 new value - 80000 carrying amt] 150 000 (30 000) 120 000 40 000 120 000 120 000 40 000 Page 2 of 5 Example - revaluation : gross v net Company purchased PPE 4 years ago for R100 000, which was being depreciated over 10 years. At the end of year 4, the company decides to revalue PPE. The carrying amount then was R60 000 and the net replacement cost was considered to be R75 000 Show the journal entries and disclosure of this revaluation using (a) gross method and (b) net replacement method Solution: (a) Revised gross replacement cost Acc depr Journal entries: Dr PPE Cr Cr (b) 125 000 50 000 [75000/6yrs gone*10 yrs total] [125000/10yrs*4yrs] 25 000 Acc depr Revaluation surplus 10 000 15 000 Journal entries: Dr PPE at revalued amount Dr Acc depr Cr PPE at cost Cr Revaluation surplus 75 000 40 000 100 000 15 000 Disclosure: Carrying amount at beginning of year (year 4) Cost Acc depr Gross 70 000 100 000 (30 000) Net 70 000 100 000 (30 000) Revaluation Depreciation - year 4 15 000 (10 000) 15 000 (10 000) Carrying amount at end of year (year 4) Gross carrying amount Acc depr 75 000 125 000 (50 000) 75 000 75 000 - (12 500) (12 500) 62 500 125 000 (62 500) 62 500 75 000 (12 500) Depreciation - year 5 [125000/10yrs] and [75000/6yrs] Carrying amount at end of year (year 4) Gross carrying amount Acc depr Example - subsequent revaluations A machine with a cost of R200 000 and a useful life of 8 years was acquired at beginning of 2004. The machine is revalued every 2 years. The net replacement values are as follows: Begin - 2006 2008 2010 160 000 95 000 50 000 Solution: Cost Depr 2004 [200000/8yrs] 2005 [200000/8yrs] Carrying value at end of 2005 Revaluation increase - go via revaluation surplus (equity) Revised carrying value at beginning of 2006 Depr 2006 [160000/6yrs] 2007 [160000/6yrs] Carrying value at end of 2007 Revaluation decrease Revised carrying value at beginning of 2008 Depr 2008 [95000/4yrs] 2009 Carrying value at end of 2009 Revaluation increase Revised carrying value at beginning of 2010 Note 1 Note 2 Note 3 200 000 (25 000) (25 000) 150 000 10 000 160 000 (26 667) (26 667) 106 667 (11 667) 95 000 (23 750) (23 750) 47 500 2 500 50 000 Notes 1 This goes to revaluation surplus in changes in equity PPE 2 R10 000 of the decrease goes against the revaluation surplus and the balance of R1 667 goes to income statement 3 R1 667 will go to income statement as income and the remaining R833 will to a revaluation surplus (equity) Page 3 of 5 Example - revaluations and deferred tax MS Ltd extract from TB at 31 Dec 2005 shows: Dr 10 000 000 Land at cost (1 Jan 2001) Buildings at cost (1 Jan 2001) acc depr to 31 Dec 2004 (5% depr pa straight line) Equipment at cost (1 Jan 2001) acc depr to 31 Dec 2004 (10% depr pa straight line) Deferred tax (balance sheet) - 31/12/04 [all due to equipment] Cr 21 000 000 4 200 000 18 000 000 7 200 000 2 088 000 Additional info: (1) Tax rate is 29%; where applicable CGT is applicable (2) Building allowance for wear and tear is 5% pa straight line (3) Equipment wear and tear is 20% pa straight line (4) Tax value of equipment at 31 Dec 2004 = R3.6m (5) PPE is revalued every 4 years and has yet to be done in 2005 - revaluations apply from beginning of the year (6) Gross replacement costs on 1 Jan 2005 are: Land Buildings Equipment (7) Useful lives have not changed and residual values are negligible (8) NDR reserves are only realised when asset is sold/disposed of (9) Company discloses revaluations using the net replacement method 18 000 000 30 000 000 24 000 000 Show the calculations for determination of revalued amounts to disclose as well as the new deferred tax balance at 31 Dec 2005 Solution: Land: CV at 31/12/04 Revaluation CV at 31/12/05 Total Revaluation HC TV Diff 10 000 000 - 10 000 000 10 000 000 - D/tax (BS) - 8 000 000 8 000 000 - - 8 000 000 18 000 000 8 000 000 10 000 000 10 000 000 8 000 000 1 160 000 1 160 000 [8000000*50%*29%] Acc V > Tax V = originating = cr Note: - Deferred tax on land is ALWAYS at CGT rate as you can only ever sell it - It’s the revaluation that gives rise to the deferred tax Building: CV at 31/12/04 Revaluation Total Revaluation HC TV Diff 16 800 000 - 16 800 000 16 800 000 - - 7 200 000 7 200 000 - - 7 200 000 2 088 000 Depr (1 500 000) CV at 31/12/05 22 500 000 (450 000) 6 750 000 (1 050 000) (1 050 000) 15 750 000 15 750 000 (450 000) 6 750 000 D/tax (BS) (130 500) 1 957 500 [6750000*29%] Acc V > Tax V = originating = cr Note: - Deferred tax on a building is usually at the tax rate since its how you USE the asset that determines the tax rate to use for deferred tax purposes => BUT please note if this was an admin building there would be no deferred tax as its exempt - Net replacement value to revalue to is calculated as follows: 30 000 000 Gross replacement 20 Total useful life (in years) 6 000 000 Therefore acc depr to 31 Dec 2004 would have been 24 000 000 Therefore net replacement value - Revaluation calc = 24000000 - 16800000 - Depreciation is: - 1 500 000 Total column [24000000/16yrs] Revaluation [7200000/16yrs] HC [16800000/16yrs] 1 050 000 TV [21000000/20yrs] 1 050 000 450 000 The opening tax value = historic value because SARS and accounting rate the same Equipment: CV at 31/12/04 Revaluation Total Revaluation HC TV Diff 10 800 000 - 10 800 000 3 600 000 7 200 000 2 088 000 3 600 000 3 600 000 - - 3 600 000 1 044 000 Depr (2 400 000) CV at 31/12/05 12 000 000 (600 000) 3 000 000 (1 800 000) 9 000 000 (3 600 000) - D/tax (BS) 1 200 000 348 000 12 000 000 3 480 000 [12000000*29%] Acc V > Tax V = originating = cr PPE Page 4 of 5 Note: - Net replacement value to revalue to is calculated as follows: Gross replacement 24 000 000 Total useful life (in years) 10 Therefore acc depr to 31 Dec 2004 would have been Therefore net replacement value - Revaluation calc = 14400000 - 10800000 - Depreciation is: - 9 600 000 14 400 000 Total column [14400000/6yrs] Revaluation [3600000/6yrs] HC [10800000/6yrs] 1 800 000 TV [18000000/5yrs] 3 600 000 2 400 000 600 000 The opening tax value = historic value because SARS and accounting rate the same Deferred tax balance at end of 2005 Land 1 160 000 Buildings 1 957 500 Equipment 3 480 000 6 597 500 Income statement movement in deferred tax [6597500-land rev1160000-building rev2088000-equip rev10440000-opbal2088000] 217 500 Revaluation surplus (equity) is calculated as follows: Land [8000000-1160000] 6 840 000 Buildings [7200000-2088000] 5 112 000 Equipment [3600000-1044000] 2 556 000 14 508 000 PPE Page 5 of 5