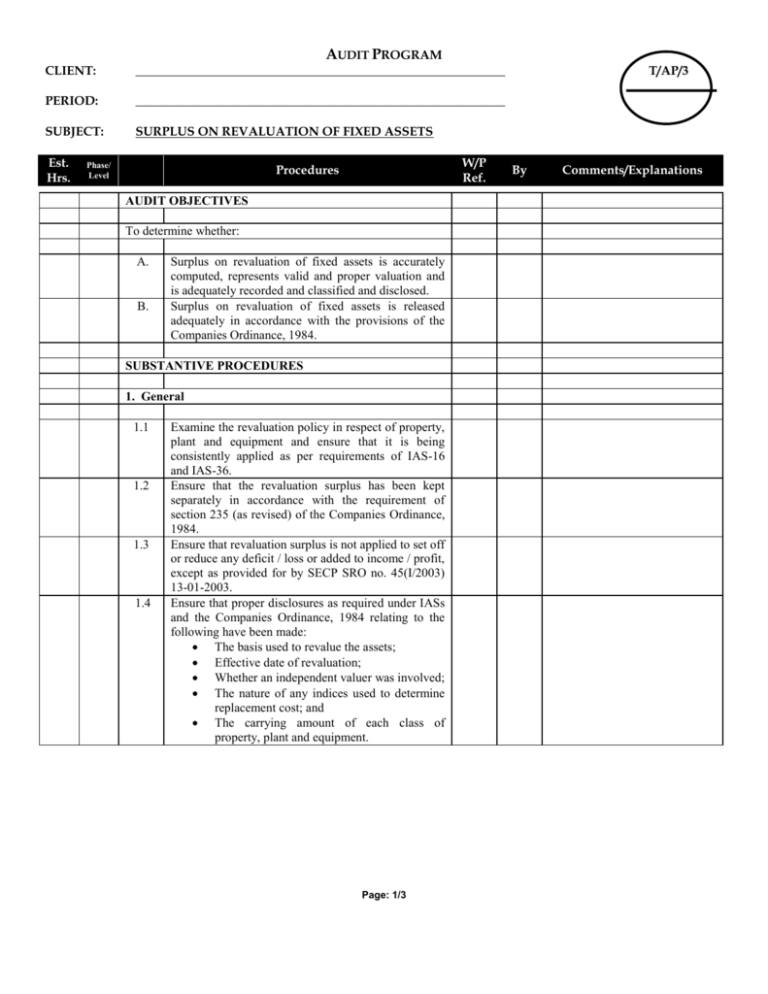

surplus on revaluation of fixed assets

advertisement

CLIENT: AUDIT PROGRAM ___________________________________________________________ PERIOD: ___________________________________________________________ SUBJECT: SURPLUS ON REVALUATION OF FIXED ASSETS Est. Hrs. Phase/ Level W/P Ref. Procedures AUDIT OBJECTIVES To determine whether: A. B. Surplus on revaluation of fixed assets is accurately computed, represents valid and proper valuation and is adequately recorded and classified and disclosed. Surplus on revaluation of fixed assets is released adequately in accordance with the provisions of the Companies Ordinance, 1984. SUBSTANTIVE PROCEDURES 1. General 1.1 1.2 1.3 1.4 Examine the revaluation policy in respect of property, plant and equipment and ensure that it is being consistently applied as per requirements of IAS-16 and IAS-36. Ensure that the revaluation surplus has been kept separately in accordance with the requirement of section 235 (as revised) of the Companies Ordinance, 1984. Ensure that revaluation surplus is not applied to set off or reduce any deficit / loss or added to income / profit, except as provided for by SECP SRO no. 45(I/2003) 13-01-2003. Ensure that proper disclosures as required under IASs and the Companies Ordinance, 1984 relating to the following have been made: The basis used to revalue the assets; Effective date of revaluation; Whether an independent valuer was involved; The nature of any indices used to determine replacement cost; and The carrying amount of each class of property, plant and equipment. Page: 1/3 T/AP/3 By Comments/Explanations CLIENT: AUDIT PROGRAM ___________________________________________________________ PERIOD: ___________________________________________________________ SUBJECT: SURPLUS ON REVALUATION OF FIXED ASSETS Est. Hrs. Phase/ Level W/P Ref. Procedures 2. Revaluation during the year 2.1 2.2 2.3 Obtain a listing of all the assets that have been revalued, if any, and consider the following: Reasons for revaluation; The professional competency and experience of the valuer; Significant assumptions made; Method used; Date and year of revaluation; Amount of revaluation; and Treatment of revaluation surplus / deficit. Obtain copies of revaluation report from the client in case of revaluation. Perform audit tests in accordance with ISA-620 “Using the Work of an Expert”. Have following considered, while considering the valuation reports: Competence and objectivity of the expert; Scope of the expert’s work; and Assessing the work of the expert. Refer to BPRD Circular No.34 dated 13 October 1996 “Approved firm of chartered accountants for the purpose of revaluation of assets” to ensure that the valuer was competent for the purpose. Other tests as deemed necessary Management Letter Prepare management letter points including: Internal control weaknesses; Business improvement opportunities; Legal non-compliance; Accounting system deficiencies; and Errors and irregularities not material at the financial statements level. Disclosure Page: 2/3 T/AP/3 By Comments/Explanations CLIENT: AUDIT PROGRAM ___________________________________________________________ PERIOD: ___________________________________________________________ SUBJECT: SURPLUS ON REVALUATION OF FIXED ASSETS Est. Hrs. Phase/ Level W/P Ref. Procedures T/AP/3 By Comments/Explanations Ensure appropriate disclosure have been made in accordance with the reporting framework and fill relevant portion of FSDCL. Supervision, review and conclusion 1. 2. 3. 4. Perform Senior review and supervision. Resolve Senior review points. Resolve Partner and Manager review points. Conclude response to the audit objectives. Audit conclusion Based on the substantive test procedures, I/we performed as outlined above, it is my/our opinion that the audit objectives set forth at the beginning of this work program have been achieved, except as follows: __________________________________________________________________________________________________ __________________________________________________________________________________________________ __________________________________________________________________________________________________ Date:____________ __________ Signature _____________ Job Incharge Page: 3/3 _________ Manager ________ Partner