030 How to profit from forex

advertisement

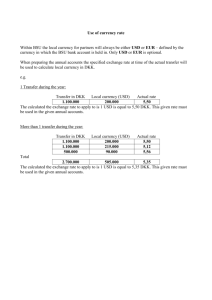

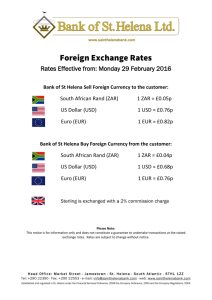

Lesson 3: How to profit from forex Objective To learn the mechanics of the foreign exchange market and how profit can be made from speculation. Introduction Trading forex is about buying and selling currencies. Since every currency exchange involves two different currencies, we refer to Currency pairs, or simply Pairs, when talking about particular markets. Let's use some simplified examples. Say you have $10,000 in Australian dollars. Example 1 You wish to convert some Australian dollars into US dollars (i.e. trade the AUD/USD pair) because you think the AUD may fall against the USD. At your bank, you sell $A10,000 in exchange for USD. The exchange rate is currently 0.9000. Your new bank account now looks like this: AUD 0 USD 9,000 ($A10,000 at 0.9000) For some time the price of the AUD falls against the USD and when it reaches 0.7200, you convert your $US back into AUD. You now have your initial $A10,000 back in your account but there is more: AUD 12,500 ($US9,000 at 0.7200) USD 0 You have made a profit of $A2,500 from the transaction. - 1 of 3 - Example 2 The most traded currency pair is the Euro and US dollar (EUR/USD). It is important to understand that brokers allows us to trade this or any other pair they offer without actually holding either currency in physical terms. In this example there is again $A10,000 starting balance, this time in your trading account. You think the EUR may appreciate against the USD, and want to purchase €5000. If the exchange rate for this pair is 1.4800, you will need $US1.4800 for each Euro you purchase. Your account now looks like this: AUD 10,000 EUR 5,000 USD -7,400 (1.4800 * €5,000) The US dollar balance is negative. This is all right because the net value of the account if the trade was closed immediately would still be positive – it would still be $A10,000. Over time the exchange rate changes to 1.5000. You can now get $US1.5000 for each Euro you hold. So you change back to $US, i.e. sell your €5000. Your account is now: AUD 10,000 EUR 0 USD 100 (-7,400 + 1.5000 * €5,000) You have made a profit of $US100 from the 0.2000 move in the exchange rate. The broker performs these calculations and presents a simplified view on your account screen. Leverage The profits can be much larger using leverage. You are not required to hold all the money you wish to trade in your account; you can trade with just a deposit (called a margin). Using the above example, with leverage you could have bought €50,000 instead of just €5000, so your account would instead look like: AUD 10,000 EUR 50,000 USD -74,000 (1.4800 * €50,000) Now profit can be made from a much smaller move. Let's say the rate quickly changed from 1.4800 to 1.4850, and you closed the trade, i.e. converted your €50,000 back into US dollars. You account is now: AUD 10,000 EUR 0 USD 250 (-74,000 + 1.4850 * €50,000) Compared with the previous example, you have made a 2½ times larger profit, $US250, from a smaller change in the market rate. Brokers can require as little as a $50 deposit in your account to leverage, or trade, $10,000 of currency. This is why quick and large profits can be made trading forex. But if the exchange rate moves in the opposite direction, quick and large losses can also occur. Exercising the full leverage provided is very risky and we do not advise doing so. The Wealth Accelerator training will teach you when the price is more likely to move in one - 2 of 3 - direction than the other, giving a good probability of repeated successful trading. Buying and Selling As the examples show, the stock market concept of buying low first and selling high later is the same in forex, except there is also a second type of transaction: we can sell high first and buy low later. This is because every transaction involves buying one currency and simultaneously selling another – in any pair, either way is acceptable. The notion of buying or selling applies to the first named currency, so when trading the AUD/USD we call it buying if we buy AUD, and selling if we sell AUD. Of course the reverse is true for the US dollar in this transaction. So when we Buy the EUR/USD pair, we are looking for the Euro to get stronger against the $US – we are buying Euros and selling US dollars concurrently. When we Sell the EUR/USD pair, we are looking for the US dollar to get stronger against the Euro. In this case we are buying US dollars and selling the Euro. This happens automatically and very simply when you just click the Buy or Sell button. - 3 of 3 -