Annual Report

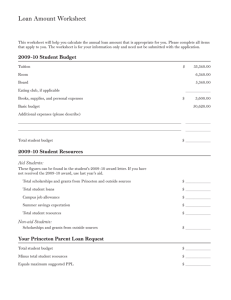

advertisement

l

g

l

c jZ j

;g

Lo

;a n

Annual Report

2011-12

Annual Report

2011/12

-g]kfn /fi6« a}+saf6 ‘s’ ju{sf] Ohfhtkq k|fKt ;+:yf_

‘A’ Class Institution Licensed by Nepal Rastra Bank

Inaguration of Sanima as a Commercial Bank by Governor Dr. Yuba Raj Khatiwada

CONTENTS

Our Mission

4

Capital Structure

4

Shareholding Pattern

4

Profile4

Chairman’s Message

7

Message from CEO

10

Message from Brand Ambassador

13

Financial Highlight

14

Board of Directors

16

Directors’ Report

17

Corporate Social Responsibility/Loyalty Programs

22

Management Team

26

Our Business

28

Training/Development/Sports30

Products and Services

31

Sanima’s footprints across the country

32

Auditor Report

33

Financial Statements

34

Our Mission

To provide customer-focused banking and financial

solutions in a simplified manner and to add value to

stakeholder interests.

Capital Structure

Authorised Capital: Rs. 2,100 million

Issued Capital: Rs. Rs.2, 016 million

Paid-up Capital: Rs. 2,016 million

Shareholding Pattern

Promoters: 70 %

General Public: 30 %

Profile

Sanima Bank Limited (Sanima) started its banking journey in 2004 as

a national level “B” class development bank. The Bank is promoted

by prominent and dynamic non-resident Nepali (NRN) businessmen.

Taking corporate governance as its top priority aside from being customer-oriented, Sanima has been able to establish itself as an “A”

class commercial bank of the country. The vision of the bank is optimum mobilization of resources for national development. Sanima has

progressively continued to be profitable since its operation. Sanima

believes that the “customer is king” and pledges to deliver products

and services in a customized and simplified manner.

Ever since its inception, Sanima has offered a wide range of products

and services best suited to customers’ needs. Dedicated and hospitable professional employees are our strength and they have been able

to win the hearts of customers and stakeholders by ensuring high

standards of quality service and corporate governance. In line with

extending our reach to every citizen of the country, we have today

22 full fledged branches across the country. Our expansion plan is

underway to have more footprints in different parts of the country.

Sanima has always taken the initiative for the wellbeing of the society

in which it operates and has been contributing to different sectors like

health, employment, and education. We assure our commitment to

give continuation to such a noble cause.

Consistency in performance is what

we aim for, and this is why Sanima

is a bank you can depend on.

Annual Report 2011/12

5

Dear Shareholders,

It is with immense pleasure that I welcome you all

to the 8th Annual General Meeting of Sanima Bank

Limited (Sanima) on behalf of the Board of Directors and myself. The Bank has completed eight years

of its operation. Despite the unfavorable situation

in the financial sector, the Bank has been able to

achieve success. For this achievement, I would like to

thank all our stakeholders.

With continuous net profits since the beginning of

our operations, we have continued to expand our

area of functioning as well as our branches in this

fiscal year too. Now, the Bank has 22 branches and

more than 72,000 customers throughout the country. The Bank has opened its new branch at Butwal

(trading hub) in this fiscal year and will be providing

banking services from Baneshwor and Teku shortly.

We have been providing banking services to our

6

Sanima Bank

customers from remote areas like Khandbari of

Sankhuwasabha and Myanglung of Terhathum where

banking access to the people is very low. The same

will be continued in the coming days as well. “Despite the tough competitive banking environment

and the ongoing entry of new banks and financial

institutions, we have been able to establish ourselves

as a commercial bank, thereby increasing our deposits, risk assets, and profit. During Fiscal Year 2068/69,

we could register a net profit of Rs.121.77 million. It

has been proposed to provide 5.50 % cash dividend

out of the net profit to shareholders.

We have set up our own independent internal audit

department which reports directly to the Audit Committee. Our statutory auditor is CSC & Co. We have

ensured an environment where our internal audit can

work independently and our Audit Committee is committed to implement feedbacks and suggestions pro-

Chairman’s Message

“Despite the tough competitive banking environment

and the ongoing entry of new banks and financial

institutions, we have been able to establish ourselves

as a commercial bank, thereby increasing our deposits, risk assets, and profit.”

vided independently by the auditors.The Bank’s success

can be attributed to due attention paid by the Bank in

the area of corporate governance and financial discipline.

Sanima’s management is well aware of the need to make

its operations more participative, dynamic, and scientific.

To strengthen the morale of our valuable employees, we

also ensure increase in remuneration and benefits in line

with the market median.

Regardless of having strong policies for commencing

new commercial banks/upgradation, in FY 2068/69,

Sanima was able to receive the operating license from

Nepal Rastra Bank and came into operation as an “A”

class commercial bank from Falgun 3, 2068. Being in

a tough competitive banking environment, but where

there is immense potential for growth, Sanima, in order to enhance its capabilities, has executed necessary

skill development policies to groom its existing staff

besides recruiting qualified and competent personnel.

For global exposure, Sanima has tied up with 35 international financial institutions which has had a positive

impact in trade finance, remittance, and other transactions. Also, I would like to bring to your notice that

Sanima is providing full fledged services from its own

advanced and highly facilitated building, “Alakapuri”, at

Naxal, Kathmandu.

The Bank has introduced different deposit and lending products to develop all round diversification and

has been giving due importance to mobilizing perpetual resources for sustainable development.

Sanima is always concerned for the betterment and

upliftment of the society/community where it exists

and operates, and has been carrying out different

CSR activities contributing to various social sectors.

Sanima has donated a photocopy machine (facilitated

with scanner and printer) to Nandi Higher Secondary

Annual Report 2011/12

7

School of Nagpokhari, Naxal. To mark its 7th Annual

Day, Sanima provided food and clothing to the children of Nepal Children’s Organization besides carrying out a blood donation program, free health camp,

and eye treatment and dental checkup programs

from its different branches. To provide meaningful

contribution to the poor/under-privileged people in

education, health and employment sectors, Sanima,

through a recommendation committee at the local

level from its 14 branches outside the valley (Khandbari, Myanglung, Damak, Belbari, Inaruwa, Biratnagar,

Narayanghat, Bhandara, Nepalgunj, Birgunj, Butwal,

Pokhara, Naubise, and Dhading), has selected two of

the most eligible candidates from each branch.The 28

students thus nominated have been awarded the Sanima Scholarship for higher secondary level education

in colleges of their own choice and in the interested

faculty. The scholarships provide reimbursement for

colleges fees and books and stationeries along with

a monthly stipend of NPR 2,000. Similarly, Sanima has

been providing free eye treatment by tying up with

Tilganga Eye Hospital in Kathmandu, Ramlal Golcha

Eye Hospital in Biratnagar, Butwal Lion Eye Hospital

in Butwal, and Himalayan Eye Hospital in Pokhara.

Also, Sanima has started providing self employment

trainings to 5 youth each through Dhading, Naubise,

Myanglung, Khandbari, Belbari, Damak, Inaruwa, and

Bhandara branches. Sanima also supported the community police and locals of Naxal, Kathmandu, with

8

Sanima Bank

NPR 150,000 for cleaning and planting trees in Narayanchaur (opposite of ‘Alakapuri’). Sanima is commited to continue such contributions in the coming

days as well.

Prerequisites required for sustainable banking business such as customer-oriented service, enhancement

of loan quality, economy in operating expenses, corporate governance, etc., will be continued as always.

I express my sincere gratitude to all our shareholders and guests for your kind presence and look

forward for your continued support and cooperation. We would like to assure that your suggestions

and recommendations will be guiding factors for us

which shall be given due consideration as appropriate. I look forward for continued directions from the

Board of Directors, dedication and hard work from

our staff members, and valuable advice and support

from all our shareholders and stakeholders.

I once again welcome you all to this 8th Annual General Meeting.

Thank you.

Jibanath Lamichhane

Chairman

A solid foundation is

what makes Sanima a

strong and reliable bank.

Annual Report 2011/12

9

Message

from CEO

“We shall focus on distinguishing ourselves as a

secure market player and

provider of quality services.”

10

Sanima Bank

With immense pleasure and great pride, I would like to

announce that we have achieved a triumph in operating ourselves as an “A” class commercial bank despite

the tough banking scenario and competitive market.

Looking back to the past eight years, Sanima has been

able to be in profitable operation with good corporate

governance and now has a large base of satisfied customers. This has been possible due to the incredible

support we have received from our valuable customers, stakeholders, promoters, shareholders, dedicated

staff, and each and every person directly/indirectly associated with the Bank. I am truly grateful for their unwavering support and trust.

Moving in a bigger way, we have offered a wide range

of products and services, enhanced facilities, extended

networks, and qualified and hospitable human resources. We have introduced our own remittance service,

set up a separate department for trade finance, and

have already started bullion business. In due course,

we will be extending our reach in business areas like

Baneshwor and Teku in Kathmandu.

Being a commercial bank, we continue to ensure

well diversified portfolios—whether it’s in deposits

or in our risk assets. We shall also focus on distinguishing ourselves as a secure market player and

provider of quality services to all our customers

in the spirit of our slogan—“Strong and Reliable”.

We consider our staff as our prime asset and give

high value to selection, training, and development

of skilled staff force.

Sanima is actively participative when it comes to

serving society as it believes that the existence of

any financial organization depends highly upon the

society/community where it operates. Being a responsible member of society, Sanima has been organizing various CSR programs, thus contributing to

different sectors of society.

I would like to reiterate my commitment on behalf

of the management team to take this Bank to even

greater stature in the days to come.

Thank you.

Kumar Lamsal

CEO

Annual Report 2011/12

11

12

Sanima Bank

Message from

Brand Ambassador

Honorable “Ma-Ha Jodi”

Mr. Madan Krishna Shrestha and Mr. Hari Bansha Acharya, popularly known

as “Ma-Ha Jodi”, is the most famous duo of the Nepali film and theatre industry who have been contributing to the field of Nepal’s performing arts

since the last three decades. The talented duo have not limited themselves

to only acting, but have also displayed their prowess in direction and production, as well as in the musical field and in script writing. “Ma-Ha” is an evergreen role model for partnership, as has been proven by their professional

relationship which has lasted successfully for many years.

First of all, we would like to take this opportunity to congratulate Sanima Bank

for its upgradation into a commercial bank.Taking such a big leap is of course not

a one-day work. Seven years of continuous hard work has finally been reaped and

thus Sanima has proven itself to be a “Strong and Reliable” bank. Furthermore,

the Bank is promoted by Non-Resident Nepalese.

An experienced and highly qualified management team, the warm and welcoming behavior of the staff, a range of diversified and unique products, and a highly

modern and spacious corporate building of its own are the main attractions of

Sanima. With its up-gradation, the Bank is likely to come face-to-face with both

opportunities and challenges. New working areas as well as business will increase

accordingly, and we truly believe that Sanima will be successful in its endeavors.

We feel glad to be associated with Sanima Bank as its Brand Ambassador and

wish it continued success.

Madan Krishna Shrestha Hari Bansha Acharya

Annual Report 2011/12

13

Financial Highlight

Composition of Deposit

Composition of Income

0% 4%

1%

4%

16%

Curre nt

Saving

Exchange Fluctua on

FD

31%

Margin

Interest Income

95%

Composition of Expenses

15%

8%

Interest Expenses

Sta Expenses

Other opera ng Expenses

77%

14

Sanima Bank

Fees Commssion &

Discount

Other opera ng Income

Call

49%

0%

495,610

530,725

916,653

6,436,185

5,145,849

508,143

2,533,377

4,036,986

121,770

85,738

21,486

57,760

155,220

9,641,286

2,105,770

All figures in 000’s NRs

2008/09

2009/10

2010/11

2011/12

2008/09

2009/10

2010/11

2011/12

2007/08

Growth in Loans and Advances

2008/09

2009/10

2009/10

2010/11

2011/12

Growth in Reserve and Surplus

2007/08

2009/10

2010/11

Growth in Deposit

2011/12

355,456

2007/08

122,658

81,737

2008/09

2011/12

216,346

6,356,737

5,760,495

4,417,504

2,880,871

102,691

113,581

2008/09

74,795

64,395

47,056

2007/08

2010/11

Growth in Investment

11,178,734

Growth in Profit

2007/08

418,584

2007/08

2008/09

2009/10

2010/11

2011/12

Growth in Net Interest Income

Annual Report 2011/12

15

Board of Directors

1

2

3

4

5

6

7

8

16

1.Chairman

Jibanath Lamichhane

2.Director

Binay Kumar Shrestha

3.Director

Ram Krishna Shah

4.Director

Dr. Biswo Poudel

5.Director

Shamba Lama

6.Director

Mahesh Ghimire

7.Director

Bharat Kumar Pokhrel

8.Company Secretary

Rudra Banjara

Sanima Bank

Directors’ Report

Dear Shareholders,

We are pleased to greet our shareholders at this 8th Annual General Meeting and take this opportunity to present

the report, together with the Balance Sheet, Profit and Loss Account, and Cash Flow Statement for Fiscal Year

2011/12 and Auditor’s Report for necessary discussion and approval.

Snapshot of Last Year’s Performance

A. Country's Economic Condition

According to the preliminary estimates of the Central Bureau of Statistics, the real gross domestic

product (GDP) at basic price grew by 4.6 percent

in FY 2011/12 compared to 3.8 percent last year. In

the review year, the growth rates of agriculture and

non-agriculture sector are estimated at 4.9 percent

and 4.3 percent respectively. In the previous year,

agriculture and non-agriculture sectors grew by 4.5

percent and 3.4 percent respectively.

Total consumption to GDP ratio is estimated to

have dropped to 90.0 percent in FY 2011/12 compared to 91.4 percent in the previous year. Likewise,

total investment to GDP is estimated to have increased marginally to 32.8 percent in the review

year compared to 32.5 percent in the previous year.

The macroeconomic indicators of the country

remained satisfactory in FY 2011/12. Economic

growth remained higher in comparison to the past

two years. Inflation stood at lower level and the

government revenue mobilization remained higher

than the previous year. Budget deficit is within the

desired limit. Export growth remained higher compared to previous year and import growth also

remained at desired level. Despite the high trade

deficit, current account surplus remained at higher

level and BOP surplus reached a historical level,

leading to remarkable increase in foreign exchange

reserve. A positive sign has been seen in the sluggish share market and real estate transactions.

Increased deposit mobilization of BFIs has put an

end to liquidity crunch in the banking system. The

declining trend in the lending rates is creating a

favorable environment for investment.

A provision has been made whereby licensed “A”,

”B” and “C” class BFIs could establish a subsidiary

company with at least 51 percent ownership for

mutual fund or merchant banking activities after ap-

proval from Nepal Stock Exchange Ltd. and following

existing policy provisions on investment.

NRB has been using open market operations as the

main instrument to manage liquidity in the banking

system. Liquidity is managed through open market

operations on the basis of liquidity indicated by

weekly liquidity monitoring and forecasting framework. NRB mopped up net liquidity of Rs. 7.66 billion through open market operations in FY 2011/12

of which Rs. 8.40 billion was mopped up through

outright sale auction and Rs. 0.74 billion was injected

through repo auction.

The average inflation rate during 10 months of FY

2011/12 had stood at 7.8 percent as compared to

the annual average inflation rate of 9.6 percent in the

previous year.The y-o-y inflation in mid-June of 2012

remained at 9.9 percent as against 8.8 percent during the same period of the previous year. As a result,

the average inflation rate during the 11 months of

2011/12 has stood at 8 percent. In the review period,

the inflation rate of food as well as non-food and

services groups remained at 9.9 percent. Such rates

were 14.3 percent and 4.3 percent respectively during the same period of the previous year.

The overall balance of payments (BOP) recorded its

highest ever surplus of Rs. 113.22 billion during the

eleven months of FY 2011/12 due to the noteworthy improvement in the external sector transactions.

The overall BOP had witnessed a deficit of Rs. 335.6

million during the corresponding period of the previous year.The overall BOP surplus stood at its historic

high during the review period mainly due to the improvement in world economic outlook, high surplus

(Rs. 61.56 billion) in the current account arising from

the amelioration in merchandise exports and inflows

of remittances due to the depreciation of Nepalese

rupee against the US dollar and surplus in the net

services coupled with the substantial surplus (Rs.

15.15 billion) in the capital account. Despite an im-

Annual Report 2011/12

17

provement in the merchandise exports due to the

persistent depreciation of Nepalese currency vis-à-vis

US dollar during the review period, trade deficit could

not be checked as expected due to an increase in the

import volume and price of petroleum products and

raw materials.Total trade deficit during the 11 months

of FY 2011/12 reached Rs. 352.36 billion.The share of

India in total trade deficit stood at 64.4 percent.

Review of Financial Position and Operational

Results

Although the political instability still prevalent in the

country has led to lack of opportunities and tough

competition, the Bank has been able to achieve significant growth in terms of deposit, lending and diversification of portfolio. It is well known that the

Bank has been able to earn net profits since its inception and has always operated taking into consideration the overall concern of its stakeholders. We

believe this has been clearly depicted in the summarized table presented below.

Deposit Collection

In this fiscal year, the liquidity in the market eased

somehow although the competition among the

financial institutions remained tough in the market. The Bank has been able to increase total deposits to Rs. 11,178,734,000 with a growth of 76

percent over last year’s deposits. In this fiscal year,

the Bank mainly concentrated on the diversification

of its deposit portfolio, changing its focus to opening of new accounts thus collecting deposits from

individual depositors. As a result, at the end of the

review period, the proportion of individual depositors was 56 percent of the total deposit portfolio.

Major Financial Indicators

S.N. Particulars

1

Paid Up Capital

2

Reserve & Surplus

3Deposits

4

Investment

5

Loans and Advances

6

Net Operating Income

7

Net Operating Expenses

8

Operating Profit

9

Net Profit

18

Sanima Bank

With the same objective, the Bank launched various

new products and services besides re-featuring its

existing products and simplifying its services. A new

saving scheme, Sanima Commitment Saving Scheme,

with its own unique features was launched in this fiscal year. Similarly, the service of unlimited free withdrawals from ATM of SCT Network has become

more popular among customers and has resulted in

a larger increment of accounts.

Loans and Advances

During this fiscal year, the total loans and advances have

increased by 50 percent and reached Rs. 9,641,286,449.

The Bank has always focused on lending to small and

medium scale enterprises, the deprived sector, areas of

national importance and service oriented industries,

with the belief that growth in these sectors leads to

overall growth of the nation.As per the directives given

by Nepal Rastra Bank, the Bank has a portfolio of Rs.

219,232,154 in the deprived sector lending. At the end

of Fiscal Year 2011/12, the portfolio of Real Estate Loan

is 11.21 percent and the portfolio of Real Estate and

Housing Loan is 16.33 percent. Credit to Capital plus

Deposit Ratio of the Bank is 72.82 percent. All the ratios mentioned above are well below the guidelines set

by Nepal Rastra Bank.

Sanima has always thrived on managing a balanced

portfolio of loans and advances due to which it has

always been able to manage its Non Performing Assets (NPA) at low levels. This proves the efficiency of

bank in managing credit risk. The Bank has always focused in the hydropower sector which has a direct

impact on the nation’s development. At this moment,

the Bank would like to emphasize that it will continue

Rs. in thousands

F.Y.

F.Y.

F.Y. F.Y. F.Y. Increase 2007/08

2008/09

2009/10 2010/11 2011/12

%

384,000

805,166

806,400

2,016,000

2,016,000

0

47,056

64,395

74,795

102,691

113,581

11

2,880,8714,417,504 5,760,4956,356,73711,178,734

76

508,143530,725 495,610916,653

2,105,770 130

2,533,377

4,036,986

5,145,849

6,436,185

9,641,286

50

98,020

160,954

256,602

395,369

474,453

20

43,834

62,308

109,842

140,161

232,026

66

33,604

78,701

135,408

241,935

190,613

(21)

21,486

57,759

85,738

155,220

121,770

(22)

to invest in projects having long term impact in the

economic development of the nation.

Profit

Continuing its tradition of being able to earn net

profits every year since its inception, Sanima has

been able to achieve a net profit of Rs. 121,769,566

which is 21.55 percent reduction over last year’s net

profit figure. Accepted reasons behind the stated reduction in the net profit are as follows:

To convey the message of upgradation into “A”

class commercial bank to general public and its

stakeholders along with the purpose of brand

promotion and brand image building, more promotional expenses incurred in this fiscal year over

last year’s promotional expenses. It is believed

that these promotional activities will help the

Bank to create its brand image in future directly

or indirectly.

n

The Bank has started operation from its own

newly constructed building, this also led to

increase in the Bank’s operational cost to some

extent. However, this has helped to create the

perception of a strong bank thus building public

confidence to transact with the Bank.

n

Some additional provisions are to be made for

deficit management.

n

Business growth after being “A” class institution will be mainly reflected in the coming fiscal

year. So, net profit figures seem to be less in

this fiscal year.

n

Capital, Reserve and Surplus

The position of paid-up capital remained unchanged

in this fiscal year. The total statutory and independent

funds plus total reserve and surplus is Rs. 113,580,523.

Net primary and supplementary capital are 19.86 percent and 0.93 percent respectively. New directives issued by Nepal Rastra Bank related to capital adequacy

have been followed in both the cases.

Branch Expansion

In Fiscal Year 2011/12, the Bank has expanded its

branch network at Butwal, which is considered as major trading hubs of Nepal.The Bank is planning to open

four new branches inside and outside Kathmandu Valley. Currently, the Bank is operating with 22 branches

including a branch at the Head Office. The Bank will

give continuity to branch expansion in future as well.

ATM Services

In order to facilitate 24-hours banking service, the

Bank is operating a total of four Automatic Teller

Machines (ATMs) at Nagpokhari and Chuchchepati

in Kathmandu, Naubise in Dhading and Myanglung in

Terhathum. The provision of free withdrawal service

from all the ATMs using our debit cards has received

an overwhelming response. With this, customers

can withdraw freely from over 1,100 ATMs of SCT

Network. To increase its network and cover a wider

area, the Bank has already started a feasibility study

of using ATM cards of VISA network.

Human Resource

A lack of efficient human resource has been felt due to

opening of new banks as well massive network expansion by existing banks.This has also resulted in difficulty

in appointing and developing efficient manpower. After

the upgradation into “A” class Commercial Bank, the

Bank sees this as more challenging and has already initiated a process of managing efficient human resource.At

the end of fiscal year 2010/11, the total number of staff

was 232 (two hundred and thirty-two). Furthermore, in

order to develop and train its current human resource,

the Bank has initiated various in-house and external

trainings. The Bank has also formed a sub-committee

comprising of non-executive directors for appointments, formulation of employee service regulations and

increment in salary and allowances. In order to retain

and motivate staff, the Bank has always sought ways to

strengthen its employee retention policy and to provide

appropriate increment of salary and allowances.

Information and Technology

The Bank has already upgraded to Pumori-IV from

Pumori-III since Fiscal Year 2009/10 which has resulted in a more secure, user-friendly and advanced

system. In addition to this, the Bank has always

sought for customization and up-gradation of its

information technology system for smooth and scientific daily operations. Furthermore, new services

like electronic cheque clearing under Nepal Clearing House Limited and SWIFT for international payments and Letter of Credit (L/C) businesses have

been implemented in the system.

Industrial and business relationship

Sanima is run by experienced bankers.There has been

very smooth and cordial relationship between the

management and the employees of the Bank which

Annual Report 2011/12

19

also shares sound and mutually beneficial relationship

with different business groups and individual customers by providing fast and simplified banking services.

Sanima has been able to gain the trust and confidence

from different social sectors and is always concerned

about fulfilling those expectations.

Changes in Board of Directors

In this fiscal year, Dr. Jugal Bhurtel, Mr.Arun Kumar Ojha,

and Dr. Niraj Govinda Shrestha have resigned from the

post of Directors citing their personal reasons, which

has been approved by the Board of Directors. The

Bank would like to thank Dr. Jugal Bhurtel, Mr. Arun

Kumar Ojha, and Dr. Niraj Govinda Shrestha for their

contribution during their tenure. Mr. Binaya Kumar

Shrestha, Dr. Biswo Poudel, and Mr. Ram Krishna Shah

have been appointed as new members in the Board of

Directors for the remaining period. The Bank would

like to welcome all the new members. The same has

been presented for ratification in this Annual General

Meeting and it is believed that the same will be ratified.

Remittance

In order to provide better and more reliable remittance services and to serve a wide array of customers

living in Nepal and abroad, the Bank has started its own

remittance service in the name of Sanima X-press. For

the same, the Bank has already appointed more than

300 agents in different locations of the country.

In a continuous effort to expand its remittance services, the Bank has entered into agreements with Deniba

International Exchange (UAE), Everest Money Limited

(UK) and Economic Exchange Center (UAE). Such tieups have made our customers living in UAE and UK

easier to send their money to Nepal in a more safe

and convenient manner. The reach of this service will

be made broader in future so that this service will be

available from other countries as well.

Upgradation

As per the consent received from Nepal Rastra

Bank, the Bank has started its operation as “A” class

institution from February 15, 2012. This was a great

achievement for us, the dream to become a commercial bank has been realized. This has also provided us both challenges and opportunities to present better returns to our stakeholders. The Bank is

determined to become a strong, reliable bank of first

choice for its stakeholders and the general public.

20

Sanima Bank

Corporate Building "Alakapuri"

The Bank has already started its operations from its

own new building.The total cost for the construction

of the building was around NPR 203.10 Million.

Corporate Governance

The Bank has been operating by fully complying

with the Bank and Financial Institution Act 2063

and directives of Nepal Rastra Bank. The primary

focus of the Bank has always been good corporate

governance and it has always complied with directives and circulars regarding corporate governance.The Bank has always complied with the Know

Your Customer (KYC) and Anti Money Laundering

(AML) directives. New directives related to capital

adequacy as per Basel-II have been followed rigorously. The Bank has been following all the directions and suggestions given through Nepal Rastra

Bank directives, onsite inspection and internal and

external auditor reports. The Bank has also always

striven for good corporate governance.

Internal Control System

An Audit Committee has been formed for implementation of extensive/internal control procedures.

The committee looks into the suggestions and directions made by external and internal auditors and

directs for its implementation too. The committee

also suggests for making internal control procedures

more stringent. Besides these, for the smooth operation of the Bank, the front and back offices have

been segregated under internal control system.

Finally, on behalf of the Board of Directors, I would

like to express my heartfelt thanks to all shareholders, customers, employees, concerned institutions of

Nepal Government, Nepal Rastra Bank, Nepal Stock

Exchange Limited, Company Registrar’s Office, Security Board, Internal Auditors, statutory auditors,

journalists, and all others for their support and suggestions. We expect the same kind of help and suggestions in the upcoming days as well.

Thank you,

On behalf of the Board of Directors

Jibanath Lamichane

Chairman

Date:

Sanima’s strength lies in its ability

to provide customized financial

solutions to suit the need of each

and every customer.

Annual Report 2011/12

21

Corporate Social Responsibility/

Loyalty Programs

Corporate Social Responsibility (CSR) has always been

an integral part of Sanima. We are very much concerned for the development of the community/society

where we work and are eager to make consistently

meaningful contributions addressing their needs. As a

social duty, this year too, we have served our community/society in different sectors like health, education

and employment. Sanima believes that development of

communities/societies ultimately means development

of the country as a whole.As far as service to our customers is concerned, we have been carrying out several loyalty programs besides marking various occasions

to show our appreciation for the valuable support and

trust they have in us.

Among others, the follwing CSR and loyalty programs

have been conducted during this fiscal year:

Corporate Social

Responsibility

Scholarship/Eye Treatment/Self-Employment

Trainings

With the intention of contributing in whatever

way we can towards the development of society,

Sanima has started providing Scholarships, Free

Eye Treatments and Self Employment Trainings to

poor/under-privileged students/people throughout the country from its branches outside the

Valley. The main objective of this initiative is to

help out those needy people who are financially

unable to achieve these basic foundations of selfgrowth.

Sanima’s Scholarship Program

Eligible students who are unable to manage fees

for their higher secondary level education are

awarded Sanima’s Scholarships. 28 students from

14 branches are reimbursed for full tuition fees

and books and stationeries and provided with a

monthly stipend of NPR 2,000 per student. Students can join colleges of their own choice and in

the interested faculty.

n

For the selection of the most deserving candidates,

Recommendation Committees have been formed in

each branch comprising of reputed and distinguished

figures of the local community. Recommendations

are based on a thorough examination of each applicant which includes a visit to their homes and individual interviews.

Total cost borne for Sanima Scholarship this year is NPR 1.122 Million and expected cost for next year is NPR 2.244 Million.

22

Sanima Bank

n Free Eye Treatment & Self

Employment Trainings

We have tie-ups with several eye hospitals for providing free eye treatment to those people who are unable to bear the expenses. To name a few Tilganga Eye

Hosptal in Kathmandu, Ramlal Golcha Eye Hospital in

Biratnagar, Butwal Lion Eye Hospital in Butwal, Himalayan Eye Hospital in Pokhara and Tilganga Eye Hospital

in Kathmandu. Along with the treatment expenses, patients referred to Tilganga Eye Hospital are also provided with stay and a travelling allowances.

Blood Donation

On the occasion of 8th Annual Day, we organized blood donation programs from our branches

outside and inside the Valley, specifically, Damak,

Belbari, Inaruwa, Biratnagar, Narayangarh, But-

Similarly, with an objective to provide employment opportunity to youth for their career development, we are providing self employment

trainings to five most needy candidates from our

branches, namely Khandbari, Myanglung, Damak,

Belbari, Inaruwa, Dhading, Naubise and Bhandara.

Some of the branches have already started providing trainings available in local institute as per

the candidate’s interest along with the required

materials, certification charges and daily lunch

expenses.

wal, Kumaripati, Chuchchepati and Suryabinayak.

The programs were held successfully with the

full support and participation of the locals. More

than 522 people donated their blood, making the

event meaningful.

Annual Report 2011/12

23

Tree Plantation at Narayanchaur

Sanima has supported Naxal Community Service

Center with NPR 150,000.00 for cleaning and planting different flowering and non-flowering trees at

Narayanchaur (opposite of Sanima Bank). Sanima has

always been supportive of such noble acts.

Gifts to Senior Citizens

Gifts to Nari Account Holder

24

Sanima Bank

Customer Loyalty

Program

With due respect to our customers for their

valuable support and belief in us for such a long

period, we distributed gifts to mark the auspicious occasions of Father’s Day and Teej.

You can rely on Sanima’s welltrained staff to provide fast and

simplified banking services.

Annual Report 2011/12

25

Management Team

From left to right

1. Kumar Lamsal

Chief Executive Officer

2. Sarju Kumar Thapa

Senior Relationship Manager

6. Niraj Dhakal

5. Samir Jung Rayamajhi

Head - GS,BE & Remittance Head - Internal Audit

26

Sanima Bank

3. Sushil Ratna Bajracharya

Head - Information Technology

4. Tej Bahadur Chand

Deputy Chief Executive Officer

10. Roshan Chandra Gautam

9. Rudra Banjara

Company Secretary & Head - Share Head-Liability Marketing

7. Saroj Guragain

Head - Treasury, Finance & Planning

8. Bobby Singh Gadtaula

Head - Central Operations

11. Santosh Koirala

Head - Retail Banking

13. Pawan Kumar Acharya

12. Sugat Manandhar

Senior Relationship Manager Head - Credit Risk & HR

Annual Report 2011/12

27

Our Business

To provide one window financial solutions to our

customers with a wide range of products and services is only our motto. We believe in a mutually

beneficial customer centric relationship and are

committed to exceeding customer expectations

in all areas of our business through consistent

processes, innovations, and improvements. We endeavor to empower each of our employees so as

to make them proactive in supporting continuous

improvement. We are always working to continuously improve products, services and processes to

anticipate and exceed the needs of our customers.

Driven by our new slogan “;an clg ljZj;gLo”,

(Strong and Reliable) we want our customers to

perceive us as a strong bank that they can rely on for

all their financial needs. We believe that this slogan

has created a trustworthy and reliable image of the

Bank in the customers’ mind.

Deposits

The Bank has introduced a variety of deposit

products that are designed to suit the needs of a

wide array of customers. Deposit schemes include

simple and easy savings like “Sanima Sulav Savings”,

high yield savings like “Sanima Premium Savings”,

and specialized products like “Sanima Naari Savings” and “Seniror Citizen”. The Bank also offers

attractive interest rates coupled with a good service package to tap institutional deposits too. Beside these, the Bank also has attractive returns

for those willing to have their funds deposited in

fixed terms deposits, with a wide option of terms

and conditions.

Business Banking

A dedicated Business Banking Department takes care

of the big corporate houses and serves them with customized products and services designed to cater to

their needs. Our large capital base and rich experience

of dealing with big projects gives Sanima the required

lending strength for high volume credit. Sanima is ranked

with a few premier banks in Nepal in terms of volume

in hydropower project finance. Sanima, along with its

sustained growth, looks forward to invest in numerous

big projects in various sectors including hydropower and

infrastructure development. Our Relationship Managers

are always at the customers’ service should there arise

the need for any expert financial advice.

Retail Banking

Retail Banking Department offers a broad range

of products and services to meet the borrowing,

wealth management and transaction needs of individuals and small businesses. Sanima Auto Loan

and Sanima Home Loan are some of our popular

products. Besides, Sanima is catering to the needs of

hundreds of small and medium enterprises (SMEs) as

well. We have also recently introduced Sanima Gold

Loan, a fast and easy loan facility against gold.

Consortium Financing

This is another specialized lending activity of the

Bank. The Bank has a history of engagement in consortium financing in the capacity as the Lead or Colead Bank. The Bank has proper monitoring mechanisms in place to enable prompt actions that ensure

successful implementation and operation of projects

under consortium financing.

United Cement Pvt. Ltd, Naubise Dhading

(A Clinkerisation Unit financed through consortium financing in which Sanima is one of the participating Banks)

28

Sanima Bank

Bhairabkunda small Hydropower Project, Sindhupalchowk

(Hydropower Project of 3MW financed under consortium arrangement under the lead of Sanima)

Shivam Cement Pvt. Ltd, Hatiya-4, Makawanpur

(Financed under consortium in which Sanima is one of the participating Banks)

Annual Report 2011/12

29

Training/Development/Sports

In House Training

Sanima Criket Team

30

Sanima Bank

Products and Services

Deposit Accounts

n Sanima Sulav Savings

n Sanima Naari Savings

n Sanima Senior Citizens Savings

n Sanima Muna Savings

n Sanima Prime Savings

n Sanima Shareholders’ Savings

n Sanima Fixed Deposits

n Sanima Commitment Saving

Loans

Sanima Home Loan

n Sanima Auto Loan

n Sanima Small Business Growth Loan

n Sanima Hire Purchase Loan

n Sanima Project Financing

n Sanima Margin Lending

n Sanima Business Loan

n Sanima Education Loan

n Sanima Tractor Loan

n Micro Finance Loan

n Sanima Gold Loan

n Sanima Awasiya Ghaderi Karja

n

Ancillary Services

SMS Banking

n Sanima Debit Card

n Sanima iBanking

n Sanima Safe Deposit Locker Facilities

n Utility Bill Payments

nRemittance

n Foreign Exchange Transactions

n Any Branch Banking System

n Travelers Cheque

n

Annual Report 2011/12

31

Sanima’s footprints across the country

Head Office

“Alakapuri”, Naxal, Kathmandu

G.P.O. Box: 20394

Phone: +977-1- 4428977, 4428979,

4428980

Fax: +977-1-4428969

SWIFT: SNMANPKA

Email: sanima@sanimabank.com

Damak

Branch Manager -Phanindra Dahal

Main Road, Ward No.13, Damak, Jhapa, Nepal

Phone: 023-585161

Fax: 023-585162

Newroad

Branch Manager -Prakash Karki

KhichaPokhari, New Road, Kathmandu, Nepal

Phone: 01-4233669,01-4233668

Fax: 01-4233673

Dhadingbesi

Branch Manager -Bishnu Lal Shrestha

Bich Bazar, Dhadingbesi, Dhading

Phone: 010-520967

Fax: 010-520968

Kumaripati

Branch Manager -Bimal Bastola

Kumaripati, Lalitpur

Phone: 01-5008597, 01-5008598

Fax: 01-5008596

Pokhara

Branch Manager-Bhabuk Tandukar

New Road, Pokhara, Kaski, Nepal

Phone: 061-525042

Fax: 061-525043

Narayangarh

Branch Manager -Dinesh Gautam

Pulchowk, Narayangarh, Chitwan, Nepal

Phone: 056-571959, 571761

Fax: 056-571968

ATM Available at

Head Office

Naubise Branch

Myanglung Branch

Chuchchepati Branch

32

Sanima Bank

Suryavinayak

Branch Manager -Prabin Jonchhe

Suryavinayak, Bhaktapur, Nepal

Phone: 01-6614515, 6619384

Fax: 01-6619385

Myanglung

Branch Manager-Sanjay Dewan

Bich Bazar, Myanglung-1, Terathum

Phone: 026-460734

Fax: 026-460735

Chuchchepati

Branch Manager -Romila Koirala

Chuchchepati, Kathmandu, Nepal

Phone: 01-4490041, 6222806

Fax: 01-4499507

Nepalgunj

Branch Manager -Ankit Khanal

Dhamboji Chowk, Nepalgunj-1

Phone: 081-521897

Fax: 081-521898

Inaruwa

Branch Manager-Bishal Ghimire

Main Road, Inaruwa, Nepal

Phone: 025-561747

Fax: 025-561748

Khadbari

Branch Manager-Subash Rai

Khandbari, Sankhhuwasabha

Phone: 029-560986

Fax: 029-560987

Belbari

Branch Manager-Lal Babu Shah

Main Road, Ward No. 2,

Belbari, Morang

Phone: 021-546082

Fax: 021-545348

Biratnagar

Branch Manager-Sudip Kumar Halwai

HanumanDas Road Biratnagar-8

Phone: 021-440991/92/93

Fax: 021-440994

Bhandara

Branch Manager -Dhal Bahadur Khadka

Main Road, Ward No. 1,

Bhandara, Chitwan

Phone: 056-550656

Fax: 056-550657

Gongabu

Branch Manager -Kavindra Pal

Gongabu, ward No- 4 'Ga' , Kathmandu

Phone: 01- 4389378, 4389388

Fax: 4389520

Chapagaun

Branch Manager-Samik Dhungana

Chapagaun, ward No-4, Lalitpur

Phone: 01-5574216,5574561

Fax: 5572184

Naubise

Branch Manager-Lok Bahadur Timalsina

Sim Bazaar, Naubise-7 Dhading

Phone: 010-401014

Fax: 010-401036

Birgunj

Branch Manager-Narayan Prasad Khatiwada

Link Road, Birgunj-10, Parsa

Phone: 051-529185/86, 529405

Fax: 051-529406

Butwal

Branch Manager-Niraj Simkhada

Amarpath, Butwal-8, Rupandehi

Phone: 071-545497/98

Fax: 071-543747

Kalanki

Branch Manager -Satya KC

Kalanki, ward No-14, Kathmandu

Phone: 01-4670771,4670772

Fax: 4670773

Free withdrawals from over 1,100 ATMs and 1,341 POS terminals

throughout the country in SCT Network by using Sanima Debit Card.

Sanima Debit Card can be used all over India in ATMs of Punjab National Bank.

Balance Sheet

as on Ashad 31, 2069 (July 15, 2012)

Capital & Liabilities

1

2

3

4

5

6

7

8

9

Schedule Share Capital

Reserves and Funds

Debentures and Bonds

Borrowings

Deposit Liabilities

Bills Payables

Proposed and Payable Dividend Income Tax Liabilities

Other Liabilities

4.1

4.2

4.3

4.4

4.5

4.6

4.7

Total Capital Liabilities

Assets

Schedule 1

2

3

4

5

6

7

8

9

Cash Balance

Balance with NRB

Balance with Banks/Financial Institutions

Money at Call and Short Notice

Investments

Loans Advances and Bills Purchase

Fixed Assets

Non-Banking Assets

Other Assets

Current Year Rs.

2,016,000,000 113,580,523 - 88,250,000 11,178,734,351 - 110,880,000 215,021,267 2,016,000,000

102,690,956

658,000,000

6,356,737,379

131,040,000

13,722,466,141 9,363,380,873

Current Year Rs.

Previous Year Rs.

4.8

4.9

4.10

4.11

4.12

4.13

4.14

4.15

4.16

Total Assets

Previous Year Rs.

256,197,727 1,005,249,544 111,615,471 - 2,105,770,255 9,531,504,834 479,044,422 - 233,083,888 13,722,466,141 Contingent Liabilities

Directors’ Declaration

Statement of Capital Fund

Statement of Risk Weighted Assets

Principal Indicators

Principle Accounting Policies

Notes to Accounts

Statement of Loan taken by Promotors

Comparision Between Unaudited and Audited Financials

Unaudited Financial Highlights certified by Internal Auditor

Schedule

Schedule

Schedule

Schedule

Schedule

Schedule

Schedule

Schedule

Schedule

Schedule

98,912,538

147,095,662

326,975,202

52,235,738

1,049,936,449

916,983,033

6,371,323,985

361,072,445

137,758,359

9,363,380,873

4.17

4.29

4.30

4.30 (A)

4.31

4.32

4.33

4.34

4.35

4(A)

Schedules 4.1 to 4.17, 4.32, 4.33, 4.34 & 4.35 form integral parts of the Balance Sheet.

As per our report of even date

Saroj Guragain

Head Finance & Treasury

Binaya Kumar Shrestha

Director

Shamba Lama

Director

Kumar Lamsal

Chief Executive Officer

L.D. Mahat

Ram Krishna Shah

Dr. Biswo Nath Poudel Partner

DirectorDirector

CSC & Co.

Chartered Accountants

Mahesh Ghimire

Bharat Kumar Pokhrel

Director

Date : 05 October 2012 (19.06.2069)

Place : Kathmandu

34

Sanima Bank

Jibanath Lamichhane

Chairman

Director

Profit and Loss Account

For the period from July 17, 2011 to July 15, 2012 (Shrawan 01, 2068 to Ashad 31, 2069)

Particulars

1.

2.

Interest Income

Interest Expenses

Schedules

Current Year Rs.

Previous Year Rs.

4.18

4.19

1,172,200,388 753,616,780 1,038,456,715

683,000,393

Net Interest Income

3. Commission and Discount 4. Other Operating Income

5. Exchange Fluctuation Income

4.20

4.21

4.22

418,583,608 11,251,196 44,618,555 - 355,456,322

4,949,150

34,805,648

157,502

Total Operating Income

6. Employees Expenses

7. Other Overhead Expenses

8. Exchange Fluctuation Loss

4.23

4.24

4.22

474,453,359 79,987,290 151,863,729 175,238 395,368,622

55,835,896

84,325,436

- Operating Profit Before Provision for Possible Loss

9. Provision for Possible Losses

4.25

242,427,102 52,492,738 255,207,289

13,272,070

Operating Profit

10. Non-operating Income/Expenses

11. Provision Written-Back

4.26

4.27

189,934,364 678,396 - 241,935,219

347,659

2,161,002

Profit from Regular Operations

12. Profit/Loss from extra-ordinary activities

4.28

190,612,760 - 244,443,880

- Net Profit after considering all activities

13. Provision For Staff Bonus

14. Provision For Income Tax

This Year’s Previous Year’s

Deferred Tax Expense/(Income)

190,612,760 17,328,433 51,514,761 51,892,481 108,909 (486,629)

244,443,880

22,222,171

67,001,354

67,105,214

496,779

(600,639)

121,769,566 155,220,355

Net Profit/(Loss)

Schedule No. 4.18 to 4.28, 4.32, 4.33, 4.34 & 4.35 form integral part of this Profit and Loss Account.

As per our report of even date

Saroj Guragain

Head Finance & Treasury

Binaya Kumar Shrestha

Director

Shamba Lama

Director

Kumar Lamsal

Chief Executive Officer

Jibanath Lamichhane

Chairman

L.D. Mahat

Ram Krishna Shah

Dr. Biswo Nath Poudel Partner

DirectorDirector

CSC & Co.

Chartered Accountants

Mahesh Ghimire

Bharat Kumar Pokhrel

Director

Director

Date : 05 October 2012 (19.06.2069)

Place : Kathmandu

Annual Report 2011/12

35

Cash Flow Statement

For the period from July 17, 2011 to July 15, 2012 (Shrawan 01, 2068 to Ashad 31, 2069)

Particulars

Current Year Rs.

(a)

1

1.1

1.2

1.3

1.4

1.5

Cash flow from Operating Activities

Cash Received

Interest Income

Commission and Discount Income

Income from Foreign Exchange Transaction

Recovery of Written-off Loans

Other Incomes

2

2.1

2.2

2.3

2.4

2.5

Cash Payment

998,391,259 Interest Expenses

754,639,756 Staff Expenses

75,868,189 Office Overhead Expenses

110,487,169 Income Tax Paid

57,396,145 Other Expenses

1

2

3

4

Cash Flow Before Working Capital Activities

(Increase)/Decrease of Current Assets

(Increase)/Decrease in Money at Call and Short Notice

(Increase)/Decrease in Short-term Investments

(Increase)/Decrease in Loans and Advances and Bills Purchase

(Increase)/Decrease in Other Assets

1

2

3

4

Increase/(Decrease) of Current Liabilities

Increase/(Decrease) in Deposits Liabilities

Increase/(Decrease) in Certificate of Deposits

Increase/(Decrease) in Short-term Borrowings

Increase/(Decrease) in Other Liabilities

1,093,002,228 (3,571,888,915)

1,049,936,449 (1,341,761,852)

(3,205,101,454)

(74,962,057)

4,664,891,143 4,821,996,971 - (121,750,000)

(35,355,829)

192,346,464

1,051,551,902

1,009,621,512

4,949,150

1,827,933

- 35,153,306

859,205,437

672,832,850

54,539,681

64,766,475

67,066,430

(892,268,662)

(1,512,251,066)

(32,753,334)

(154,843,353)

(1,290,336,050)

(34,318,329)

619,982,404

596,242,017

- 110,000,000

(86,259,613)

(b) Cash flow from Investment Activities

(8,132,450)

1

(Increase)/Decrease in Long-Term Investment

145,402,498.29 2

(Increase)/Decrease in Fixed Assets

(159,348,537.24)

3

Interest Income From Long-Term Investment

5,813,588.819 4

Dividend Income

- 5Others

(317,054,181)

(266,200,000)

(55,128,351)

4,274,171

-

(c)

1

2

3

4

Cash flow from Financing Activities

Increase/(Decrease) in Long-Term Borrowings (Bonds, Debentures etc.)

Increase/(Decrease) in Share Capital

Increase/(Decrease) in Other Liabilities (Share Premium)

Increase/(Decrease) in Refinance/Facilities From Nepal Rastra Bank

(448,000,000)

- - - (448,000,000)

1,316,515,844

1,209,600,000

3,715,844

103,200,000

(d)

(e)

(f)

(g)

Income/Expenses from change in Exchange Rate in Cash and Bank Balances

This Year’s Cash Flow from All Activities

Opening Balance of Cash and Bank Balances

Closing Balance of Cash and Bank Balances

(3,151,432.59)

846,756,139 526,306,602 1,373,062,741 Saroj Guragain

Head Finance & Treasury

Binaya Kumar Shrestha

Director

Shamba Lama

Director

Kumar Lamsal

Chief Executive Officer

Sanima Bank

Jibanath Lamichhane

Chairman

As per our report of even date

Ram Krishna Shah

Dr. Biswo Nath Poudel L.D. Mahat

DirectorDirector

Partner

CSC & Co.

Mahesh Ghimire

Bharat Kumar Pokhrel

Chartered Accountants

Director

Director

Date : 05 October 2012 (19.06.2069)

Place : Kathmandu

36

213,037,794 1,211,429,053 1,151,904,711 11,251,196 2,976,194 - 45,296,951 Previous Year Rs.

(1,670,431)

297,869,034

228,437,569

526,306,602

Annual Report 2011/12

Accumulated

Profit/Loss

General

Reserve Fund

Proposed

Capital

Bonus Share Reserve Fund

Share

Premium

Exchange

Fluctuation Fund

Deferred

Tax Reserve

Other Reserve

and Fund

Total

Amount Rs.

Opening Balance as

2,016,000,000 10,629,661 69,598,577 - - 10,563,747 1,800,753 18,218

- 2,108,610,956

at 17 July 2011

Adjustment for Changes in

- 10,080,000 - - - - - -

-

10,080,000

proposed dividend of last year

due to supervisory instruction

Restated Balance as

2,016,000,000 20,709,661 69,598,577 - - 10,563,747 1,800,753 18,218

- 2,118,690,956 at 17 July 2011

Current Year’s Net Profit

- 121,769,566 - - - - - - - 121,769,566

General Reserve

- (24,353,913)

24,353,913 - - - - - -

Proposed Bonus Share

- - - - - - - - -

Porposed Dividend

- (110,880,000)

- - - - - - - (110,880,000)

Exchange Fluctuation Fund

- - - - - - - - - - Deferred Tax Assets

(486,629)

486,629 Investment Adjustment Reserve

- (555,000)

- - - - - 555,000 Closing Balance

2,016,000,000 6,203,685 93,952,490 - - 10,563,747 1,800,753 504,847 555,000 2,129,580,523

Particulars

Share Capital

Statement of Changes in Equity

Financial Year 2011/12 (2068/69)

37

Profit and Loss Appropriation Account

For the period from July 17, 2011 to July 15, 2012 (Shrawan 01, 2068 to Ashad 31, 2069)

Particulars

Schedule

Current Year Rs.

Previous Year Rs.

Income

1 Accumulated Profit up to the Last Year

2 Current Year’s Profit

3 Exchange Fluctuation Fund

20,709,661 121,769,566 - 27,591,595

155,220,355

- 142,479,227 182,811,950 Expenses

1 Accumulated Loss up to the Last Year

2 This Year’s Loss

3 General Reserve 4 Contingent Reserve 5 Institutional Development Fund

6 Dividend Equalization Fund

7 Employee Related Reserves Funds

8 Proposed Dividend

9 Proposed Issue of Bonus Shares

10 Special Reserve Fund

11 Exchange Fluctuation Fund 12 Capital Redemption Reserve Fund

13 Capital Adjustment Fund

14 Deferred Tax Reserve

15 Investment Adjustment Reserve

- - 24,353,913 - - - - 110,880,000 - - - - - 486,629 555,000 31,044,071

- - - - 131,040,000

- - 18,218

Total (B)

136,275,542 162,102,289 15 Accumulated Profit/(Loss) (A-B)

6,203,685 20,709,661

Total (A)

As per our report of even date

Saroj Guragain

Head Finance & Treasury

Binaya Kumar Shrestha

Director

Shamba Lama

Director

Kumar Lamsal

Chief Executive Officer

L.D. Mahat

Ram Krishna Shah

Dr. Biswo Nath Poudel Partner

DirectorDirector

CSC & Co.

Chartered Accountants

Mahesh Ghimire

Bharat Kumar Pokhrel

Director

Date : 05 October 2012 (19.06.2069)

Place : Kathmandu

38

Sanima Bank

Jibanath Lamichhane

Chairman

Director

Share Capital and Ownership

As on July 15, 2012

Schedule 4.1

Particulars Current Year Rs. Previous Year Rs.

1 Share Capital

1.1 Authorized Capital

2,100,000,000 a) 21,000,000 Ordinary Shares of Rs. 100 each

2,100,000,000 b) …………. Non-redeemable Preference Shares of Rs. … each

- c) …………. Redeemable Preference Shares of Rs. ….. each

- 1.2 Issued Capital 2,016,000,000 a) 20,160,000 Ordinary Shares of Rs.100 each

2,016,000,000 b) …………. Non-redeemable Preference Shares of Rs. …. each

- c) …………. Redeemable Preference Shares of Rs. ……. each

- 1.3 Paid up Capital

2,016,000,000 a) 20,160,000 Ordinary Shares of Rs.100 each

2,016,000,000 b) …………. Non-redeemable Preference Shares of Rs. …. each

- c) …………. Redeemable Preference Shares of Rs. ……… each

1.4 Proposed Bonus Share

- 1.5 Calls in Advance

- 1.6

Total (1.3+1.4+1.5)

2,100,000,000

2,100,000,000

2,016,000,000

2,016,000,000

2,016,000,000

2,016,000,000

-

2,016,000,000 2,016,000,000

Share Ownership As on July 15, 2012

Particulars

This Year

Percent

1 National Ownership

100 1.1 Government of Nepal

1.2 Foreign Institutions

1.3 “A” Class Licensed Institutions

1.4 Other License Institutions

1.5 Other Entities/ Organizations

4.78 1.7 Individuals

95.22 1.6 Others

2 Foreign Ownership

Total Previous Year

Share Capital Rs.

2,016,000,000 - - - - 96,457,500 1,919,542,500 - 2,016,000,000

- - - - 45,400,000 1,970,600,000 - - - - 100

Share Capital Rs.

2,016,000,000 2,016,000,000 Percent

2.25

97.75

- 100

List of Shareholder’s holding 0.5 percent or more of PaidUp Share Capital

S. N. Name of the Shareholders

1

2

3

4

5

6

7

8

9

10

11

12

13

14

Mr. ARUN KUMAR OJHA

Mr. TEKRAJ NIRAULA

Mr. JIBANATH LAMICHHANE

Dr. NIRAJ GOBINDA SHRESTHA

Mr. BINAY KUMAR SHRESTHA

Mr. GHANASHYAM THAPA

Dr. BIRENDRA PRASAD MAHATO

Mr, KHEMRAJ LAMICHHANE

M/s JAI GANESH INVESTMENT COMPANY PVT.LTD.

Mr. RAM KRISHNA SHAH

Mr. DINESHMANI SHRESTHA

Mr, DILIP SHRESTHA

Mrs. INDIRA BHANDARI

Mr. SAMBA LAMA

TOTAL

No. of Shares

Percentage

2,822,400 1735400.0

1,260,000 1,260,000 1,013,000 941,700 945,000 794,000 756,000 633,000 394,900 327,600 176,400 146,790 14.00 8.61 6.25 6.25 5.02 4.67 4.69 3.94 3.75 3.14 1.96 1.63 0.88 0.73 13,206,190 Amount Rs.

282,240,000

173,540,000

126,000,000

126,000,000

101,300,000

94,170,000

94,500,000

79,400,000

75,600,000

63,300,000

39,490,000

32,760,000

17,640,000

14,679,000 65.5 1,320,619,000

Annual Report 2011/12

39

Reserve and Surplus

As on July 15, 2012

Particulars

1

2

3

4

5

6

7

General Reserve Fund

Capital Reserve Fund

Capital Redemption Reserve

Capital Adjustment Fund

Other Resevers

5.1 Contingent Reserve

5.2 Institution Development Fund

5.3 Dividend Equalization Fund

5.4 Special Reserve Fund

5.5 Assets Revaluation Reserve

5.6 Deferred Tax Reserve

5.7 Other Free Reserves

5.8 Other Reserve Funds

5.9 Share Premium

5.10 Investment Adjustment Reserve

Accumulated Profit/(Loss)

Exchange Equalization Fund

Total

Schedule 4.2

Current Year Rs.

93,952,490 - - - - - - - - - 504,847 - - 10,563,747 555,000 6,203,685 1,800,753 113,580,523 Previous Year Rs.

69,598,577

- - - - - 18,218

- 10,563,747

20,709,661

1,800,753

102,690,956

Debentures and Bonds

As on July 15, 2012

Schedule 4.3

Particulars

Current Year Rs.

1

2

3

……………. Percent Bonds/Debentures of Rs. ………… each

Issued on …………… and Matured on …………..

(Outstanding balance of Redemption Reserve Rs. …………….)

……………. Percent Bond/Debentures of Rs. ………… each

Issued on …………… and Matured on …………..

(Outstanding Balance of Redemption Reserve Rs. …………….)

………………

- - - - - - - - - -

Total (1+2+3)

- -

Note : Particulars of securities shall be disclosed in case the Debentures/Bonds are issued with assigned securities.

40

Sanima Bank

Previous Year Rs.

BORROWINGS

As on July 15, 2012

Particulars

Schedule 4.4

Current Year Rs.

Previous Year Rs.

A.

Local

1 Nepal Government

2 Nepal Rastra Bank

3 Repo Obligation

4 Inter Bank and Financial Institutions

5 Other Organized Institutions

6 Others

- - - 88,250,000 - - 448,000,000

210,000,000

- - -

88,250,000 658,000,000 Total

B. Foreign

1Banks

2Others

Total

Total (A+B)

- - - - - -

88,250,000 658,000,000 Deposits

As on July 15, 2012

Particulars

1 Non-Interest Bearing Accounts

Schedule 4.5

Current Year Rs.

Previous Year Rs.

A. Current Deposits

372,586,294 1. Local Currency

371,939,132 1.1 Nepal Government

938,912 1.2 “A” Class Licensed Institutions

7,210,687 1.3 Other Licensed Financial Institutions

141,477,180 1.4 Other Organized Institutions

184,983,527 1.5 Individuals

37,328,825 1.6

Others

2. Foreign Currency

647,163 2.1 Nepal Government

- 2.2 “A” Class Licensed Institutions

- 2.3 Other Licensed Financial Institutions

- 2.4 Other Organized Institutions

638,338 2.5 Individuals

8,825 2.6 Others

- B.

Margin Deposits

1 Employee Guarantees

2 Guarantee Margin

3 Letters of Credit Margin

C. Others 1. Local Currency

1.1 Financial Institutions

1.2 Other Organized Institutions

1.3

Individuals

21,925,312 - 15,393,312 6,532,000 -

131,256,263

130,766,725

71,000

2,842,133

1,066,532

105,444,288

21,342,773

489,538

- - 489,538

9,856,767 9,856,767

- -

Annual Report 2011/12

41

2. Foreign Currency

2.1 Financial Institutions

2.2 Other Organized Institutions

2.3

Individuals

Total Of Non-Interest Bearing Accounts

2 Interest Bearing Accounts

-

394,511,606 141,113,030 - - A. Savings Deposits

1. Local Currency

1.1 Organized Institutions

1.2 Individuals 1.3 Others

2. Foreign Currency

2.1 Organized Institutions

2.2 Individuals

2.3 Others

3,554,886,958 3,534,372,302 3,453,390 3,530,918,913 - 20,514,656 20,514,656 - 2,670,383,929 2,653,178,015

541,427

2,652,636,588

17,205,914

B. Fixed Deposits

1. Local Currency

1.1 Organized Institutions

1.2 Individuals

1.3 Others

2. Foreign Currency

2.1 Organized Institutions

2.2 Individuals

2.3 Others

5,453,987,975 5,425,571,475 2,974,218,003 2,451,353,472 - 28,416,500 28,416,500 - 2,692,287,297

2,644,084,897

1,137,958,918

1,506,125,979

48,202,400

C. Call Deposits

1,775,347,811 1 Local Currency

1,772,659,089 1.1 “A” Class Licensed Institutions

- 1.2 Other Licensed Institutions

560,184,361 1.3 Other Organized Institutions

987,125,217 1.4 Individuals

225,349,511 1.5 Others

- 2. Foreign Currency

2,688,722 2.1 “A” Class Licensed Institutions

- 2.2 Other Licensed Institutions

- 2.3 Other Organized Institutions

2,688,722 2.4 Individuals

2.5 Others

- D.

Certificate of Deposit

1 Organized Institutions

2Individuals

3Others

Total of Interest Bearing Accounts

Total Deposit (1+2)

42

Sanima Bank

- - - - 17,205,914

-

48,202,400

852,953,124 849,904,347

18,242

329,974,309

438,416,703

81,495,093

3,048,778

- - 3,048,778

- -

10,784,222,744 6,215,624,349

11,178,734,351 6,356,737,379

BILLS PAYABLE

As on July 15, 2012

Schedule 4.6

Particulars

Current Year Rs.

Previous Year Rs.

1 Local Currency

2 Foreign Currency

- - -

- - Total OTHER LIABILITIES As on July 15, 2012

Particulars

Schedule 4.7

Current Year Rs. Previous Year Rs.

1

2

3

4

5

6

7

8

9

10

11

12

Pension/Gratuity Fund

Employees Provident Fund

Employees Welfare Fund

Provision for Staff Bonus

Interest Payable on Deposits

Interest Payable on Borrowings

Unearned Discount and Commission

Sundry Creditors

Branch Adjustment Account

Deferred Tax Liability

Dividend Payable

Other Miscellaneous 8,015,720 81,723 - 17,328,433 14,464,799 473,646 719,262 18,369,806 - - 8,893,890 146,673,988 3,896,619

22,222,171

3,627,586

12,333,835

954,683

6,372,536

3,237,685

46,267,422 Total

215,021,267 98,912,538

Cash Balance

As on July 15, 2012

Particulars

1 Local Currency (including coin)

2 Foreign Currency

Total

Schedule 4.8

Current Year Rs.

Previous Year Rs.

253,384,888

143,715,685

2,812,840

3,379,977

256,197,727 147,095,662

Annual Report 2011/12

43

Balance with Nepal Rastra Bank

As on July 15, 2012

Schedule 4.9

Particulars

1

Nepal Rastra Bank

a) Current Account

b) Other Account

Local

Currency

F oreign Currency

Indian Currency

Convertible

1,002,323,227 1,002,323,227 - - - - Total

Current Year

Total Rs.

Previous

Year Rs.

2,926,3162,926,316 1,005,249,544 2,926,316 2,926,316 1,005,249,544 - - - 326,975,202

326,975,202

-

Balance with Banks/Financial Institutions

As on July 15, 2012

Schedule 4.10

Particulars

Local

Currency

Foreign Currency

Indian Currency

Convertible

Current Year

Total Grand Total Rs.

1

2

Local Licensed Institutions

a) Current Account

b) Other Account

Foreign Banks

a) Current Account

b) Other Account

86,155,640 86,155,640 - - - - - - - (18,836,158)

(18,836,158)

- 660,167 660,167 - - 660,167 660,167 43,635,821 24,799,663 43,635,821 24,799,663 - - 86,155,640 (18,836,158)

44,295,989 Total

25,459,831 Previous

Year Rs.

86,815,807 86,155,640 660,167 24,799,663 24,799,663 - 111,615,471 35,438,870

35,438,870

- 16,796,867

16,796,867

52,235,738 Note: Total Balance for which the confirmations are received from the respective licensed institutions is Rs. 144,747,448 and the difference

are subsequently reconciled.

Money at Call and Short Notice

As on July 15, 2012

Schedule 4.11

Particulars

44

Current Year Rs.

Previous Year Rs.

1 Local Currency

2 Foreign Currency

- - 1,030,465,477

19,470,972

Total

- 1,049,936,449

Sanima Bank

Investments

As on July 15, 2012

Schedule 4.12

Particulars

Purpose

Trading Other Current

Year Rs.

Previous

Year Rs.

1

2

3

4

5

6

7

8

9

10

Nepal Government Treasury Bills

Nepal Government Savings Bond

Nepal Government Other Securities

- Nepal Rastra Bank Bonds

- Foreign Securities

- Local Licensed Institutions

- Foreign Banks

- Origanized Insrtitutions Shares

- Corporate Bonds and Debentures

- Other Investments

- 1,910,564,945 - 96,500,310 - - 7,572,132 88,250,000 10,455,000 - - 1,910,564,945 612,928,092

- 96,500,310 58,354,940

- - - 7,572,132 210,000,000

88,250,000 35,600,000

10,455,000 100,000

- - -

Total Investment

- 2,113,342,387 2,113,342,387 916,983,033

Provision

- 7,572,132 7,572,132 -

- 2,105,770,255 2,105,770,255 916,983,033

Net Investment

Investment in Shares, Debentures and Bonds As on July 15, 2012

Schedule 4.12 (A)

Particulars

Cost Price

Market Price Provision Current Year Rs. Previous Year Rs.

1 Investment in Shares

10,455,000 - - 10,455,000 1.1 Nepal Clearing House Company Ltd.

- - - 1000 Ordinary Shares of Rs 100 Paid up

100,000 - - 100,000 1.2 Sanima Mai Hydro Ltd.

- - - - 100,000 Ordinary Shares of Rs. 100 Paid up.

10,000,000 - - 10,000,000 1.3 Sanima Life Insurance Co. Ltd.

350,000 Ordinary Shares of Rs. 1 Paid up

350,000 350,000 (Face Value Rs100 each).

1.4 Sanima Foundation

- - - 5000 Ordinary Shares of Rs. 1 Paid up

5,000 - - 5,000 (Face value Rs 100 each).

2 Investment in Debentures and Bonds

2.1 …….. Co. (Pvt. Ltd./Ltd.)

…….. % ……… Debentures/Bonds of Rs. ……. each

2.2 ………

2.3 ……….

3

Total Investment (1+2)

Provision For Loss

3.1 Provision Up To Previous Year

3.2 Additions This Year

Total Provision

Net Investment

- - - - - - - - - - - - - - - 10,455,000 - - - - - - - - 10,455,000 - - - - - - - - 10,455,000 10,455,000 100,000

100,000

-

-

100,000

100,000

Note : Above companies have not declared the dividend in last three years.

Annual Report 2011/12

45

Held for Trading

As on July 15, 2012

Schedule 4.12.1

Description

Cost Last Market

Current Current Year

Last Year Remarks

Price

Price Market Price Profit/(Loss) Profit/(Loss)

1 Treasury Bills Of Governement Of Nepal

2 Saving Bonds Of Government Of Nepal

3 Other Loan Bonds Of Government Of Nepal

4 Loan Bonds Of Nepal Rastra Bank

5 Foreign Loan Bonds

7 Debenture And Bonds Of Local Licensed Institutions

8 Debenture And Bonds Of Local Organized Institutions

9 Investment In Foreign Banks (Placement)

10 Interbank Lending

11 Other Investment

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

- - - - -

- - - - -

Total Investment

Held to Maturity

As on July 15, 2012

-

-

Schedule 4.12.2

Description

46

Cost Last Market

Current Current Year

Last Year Remarks

Price Rs.

Price Market Price Profit/(Loss) Profit/(Loss)

1. Treasury Bills of Governement of Nepal

2. Saving Bonds of Government of Nepal

3. Other Loan Bonds of Government of Nepal

4. Loan Bonds of Nepal Rastra Bank

5. Foreign Loan Bonds

6. Shares of Local Licensed Institutions

7. Debenture and Bonds of Local

Licensed Institutions

8. Debenture and Bonds of Local

Organized Institutions

9. Investment in Foreign Banks (Placement)

11.Other Investment

1,910,564,945 - 96,500,310 - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - 88,250,000 - - - - - - - - - 2,095,315,255 - - - -

Total Investment

Sanima Bank

Available for Sale

As on July 15, 2012

Schedule 4.12.3

Description

1 Treasury Bills Of Governement Of Nepal

2 Saving Bonds Of Government Of Nepal

3 Other Loan Bonds Of Government Of Nepal

4 Loan Bonds Of Nepal Rastra Bank

5 Foreign Loan Bonds

6 Shares Of Local Licensed Institutions

7 Debenture And Bonds Of Local

Licensed Institutions

8 Debenture And Bonds Of Local

Organized Institutions

9 Investment In Foreign Banks (Placement)

10. Other Investments

10. Other Investments

Cost Last Market

Current Current Year

Last Year

Price Rs.

Price Market Price

Fund Profit/(Loss)

Adjustment

Amount

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

18,027,132 - - - - - 555,000 - - 18,027,132 - - 555,000 - Remarks

Annual Report 2011/12

47

48

Sanima Bank

Insured Domestic

Uninsured