Shipping-as-a-Service

advertisement

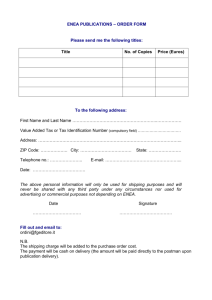

Dushan Batrovic, Vice President dbatrovic@differencecapital.com Shipping-as-a-Service Sorry, we couldn’t help but pile on to the “…as-a-service” theme April 2015 With barbecue season fast approaching, we felt compelled to splurge on a special new cutting board worthy of our masterful steak. Reminded of its recent IPO, we start browsing on Etsy and found the most wonderful Heisenberg cutting board. For the non-Breaking Bad fans, we offer our sympathies. Salivating at the prospect of cutting meat on our new board, we hit the checkout button and to our horror, the shipping costs come in at $44.06, which is more than the actual cutting board. How can this be? Everything is supposed to be instantaneous in the digital age. Where are those fancy drones that Amazon has been working on? After recovering from our post Heisenberg cutting board depression, we started doing some digging on how shipping and fulfillment actually works in the world of eCommerce. Fortunately, we found some intriguing new tech startups that have the potential to really disrupt today’s shipping and logistics infrastructure. Dare we call them “Shipping-as-a-Service” pioneers. The Horror of the Shipping Cost Source: Etsy Difference Capital – Quick Insights Page 1 of 6 Digital Money – April 2015 Dushan Batrovic, Vice President dbatrovic@differencecapital.com Interesting Fact #1 Amazon spends a lot of money on shipping and that amount has been consistently growing, even as a percentage of revenue. In 2010, Amazon had $2.6 billion in shipping costs or 7.5% of revenue. In 2014, the number was $8.7 billion or 9.8% of revenue. We would have expected that a giant the size of Amazon would see increasing shipping cost leverage as it scales. Not the case. Amazon Shipping Costs as a Percentage of Revenue Source: Amazon Interesting Fact #2 The leading cause for cart abandonment in the online world is high shipping costs. A comScore survey from 2012 indicated that 57% of consumers had abandoned their purchase due to high shipping fees. And costs aren’t the only problem. Another report from StellaService said that 52% of survey respondents would abandon a holiday purchase if the delivery estimate exceeded 7 days. So the conclusion is that consumers deem fast and cheap delivery as a meaningful differentiator when considering where to purchase their online goods. One of our portfolio companies, Shop.ca has figured this out. They offer standard free shipping across Canada. Difference Capital – Quick Insights Page 2 of 6 Digital Money – April 2015 Dushan Batrovic, Vice President dbatrovic@differencecapital.com Interesting Fact #3 The free shipping threshold is getting higher, not lower. Again, we would have expected thresholds to come down over time as ecommerce volumes increase and online players look to build loyalty with their customers. Nope. A StellaService survey of 113 major retailers in the US showed that the average minimum spend to qualify for free shipping has increased to $82 from $76 last year. Amazon raised their cut-off to $35 from $25, which is still reasonable. Others like JCPenny at $99 or J. Crew at $150 are on the higher end of the spectrum, although these pricing decisions may be strategic. Consumers have been known to raise their order size to qualify for free shipping. A WSJ article suggested that a survey of 5,800 US online shoppers showed that half have abandoned their cart if they didn’t qualify for free shipping. Interesting Fact #4 It’s not just about cost and speed. A European survey conducted by Copenhagen Economics showed that delivery is a more nuanced consideration for online purchasers. Low prices are still at the top of the list but things like convenient return options, flexible delivery, date accuracy and electronic notification are all very important. In order to address these issues, online retailers are seeking better delivery options. The same study from above indicated that about 95% of retailers would like to be able to offer evening delivery to shoppers but are unable to because it is simply not available or is price prohibitive. Saturday delivery is also high on the wish list with 85% of retailers wanting to offer this feature. Important Features for Shopping from Same Web Shop Again Source: Copenhagen Economics Difference Capital – Quick Insights Page 3 of 6 Digital Money – April 2015 Dushan Batrovic, Vice President dbatrovic@differencecapital.com Interesting Fact #5 There are already a number of budding startups that are tackling this shipping and logistics problem in the marketplace. The largest is probably Instacart, which you might recall is that $2 billion grocery app. Actually, Instacart is really a supply chain/logistics company that has found a cheap and easy way to get groceries delivered to your front door. No expensive trucks or warehouses. Instacart simply connects consumers with a bunch of ordinary people that go to existing supermarkets to purchase groceries on your behalf and deliver them to your door. The company is in 15 cities and contracts with over 4,000 personal shoppers. Beats the old Grocery Gateway failure that our Toronto readers will remember. Sales for Instacart have risen from $10 million in 2013 to $100 million in 2014. We list a few other interesting companies following the same theme below: Shyp – an on-demand shipping app that lets you simply take a picture of the item you want delivered, enter a destination and request a pickup. Somebody shows up at your door, packages your item and has it delivered using existing shipping networks like UPS, FedEx, and the post office. We think this is an interesting idea but if you’re relying on existing shipping infrastructure, can you get the best prices and delivery times? Or maybe that’s not the point. Maybe Shyp’s value add is simply convenience – not having to wait in line or find the right box for your item. Perhaps that’s enough of a differentiator. Some big VCs seem to think so, having just invested $50 million into Shyp at a $250 million valuation. Roadie – this one is kind of neat. It’s like a carpooling for cargo app that connects ordinary travelers with people who want to ship something. The founder of the company, in a TechCrunch article recently said, “I think to myself… somebody is leaving Birmingham right now and heading to Florida…that person, would probably be willing to pick up some tile and drop it off at Perdido Key for the promise of a little extra money, especially since they’d be making the trip anyway, he reasoned. And so, Roadie was born.” The company claims that roughly 115,000 people have already applied to be Roadie drivers. We are intrigued by this opportunity because it creates a virtual shipping and logistics network outside of the traditional incumbents. ShipHawk – its differentiator is shipping large, heavy or unusually shaped items. ShipHawk knows that simple, small items can be handled pretty effectively by FedEx and UPS. But when items don’t fit the standard mould, a bunch of specialized regional carriers need to be employed, which raises costs, increases delivery times and generally reduces transparency. The company’s secret sauce is a backend software platform and APIs that allow merchants to figure out the most effective method to ship something. The company recently raised $5 million and our sense is they are growing quickly. Incidentally, our portfolio company, BuildDirect, knows all too well the issues of shipping large complex orders. A core element of its value proposition is its proprietary warehousing and logistics network along with big data analytics so that it can avoid the perils of the standard large freight network. Cargomatic – this one is similar to Roadie but applies to truckers and B2B shippers. Truckers often have excess capacity and shippers often need to make an ad hoc delivery that is out of sync with standard schedules. Cargomatic fills in to close the gap. So my store needs to deliver a pallet of goods across town. The app will notify a series of local truckers that have capacity to make the trip. One of the truckers will accept and problem solved. It’s an intriguing idea. The company raised $8 million recently. Difference Capital – Quick Insights Page 4 of 6 Digital Money – April 2015 Dushan Batrovic, Vice President dbatrovic@differencecapital.com Shipbeat – this is an earlier stage European company that recently raised a $1.6 million seed round. They seem to be somewhat similar to ShipHawk in that they are seeking to more intelligently connect many of the existing shipping incumbents from UPS and FedEx to Deutsche Post and DHL. With visibility into everyone’s delivery service and pricing, merchants should be able to make the best shipping decisions for their customers. We’ve tried to segment a few of the above companies and a few others below. The x-axis differentiates between consumer-focused companies and business-facing companies. The y-axis differentiates by whether these vendors rely on existing shipping and logistics infrastructure or create a virtual infrastructure through crowdsourcing and other means. Landscape of Shipping as a Service Vendors Source: Difference Capital Conclusion Ecommerce has changed the game for so many industries that it shouldn’t be a surprise that existing logistics and shipping infrastructure isn’t equipped to handle the online tidal wave. We pay close attention to this theme because eCommerce represents about 10% of our asset base. Perhaps the most encouraging takeaway from our note is the number of cool companies that have already begun to take on the challenge of meeting ever increasing consumer demands for lower prices and faster deliveries. We are optimistic that it won’t be too long until we are able to order our Heisenberg cutting board for a few extra bucks in shipping and handling, not the 100% premium noted above. Difference Capital – Quick Insights Page 5 of 6 Digital Money – April 2015 Dushan Batrovic, Vice President dbatrovic@differencecapital.com About the Authors Dushan Batrovic, Vice President, Difference Capital Mr. Batrovic brings over 10 years’ experience in capital markets and equity research. He is recognized as a technology industry thought leader, having published reports related to software, networking, wireless and digital media and making regular appearances in news media including the Financial Post, Globe and Mail and BNN. Prior to joining Difference, Mr. Batrovic was a co-founder of 4Front Capital Partners and was a Vice-President of Equity Research. Previously, Dushan was a senior technology analyst with Dundee Securities and an equity research analyst at Canaccord Capital. Dushan graduated with a Bachelor of Applied Science and Engineering from the University of Toronto, where he ranked top of his senior year class. Dushan has a Master of Business Administration from the University of Toronto, where he earned Deans’ List Honours status in both years of the program. About Difference Capital Financial Inc. Difference Capital Financial Inc. invests in and advises growth companies. We leverage our capital market expertise to help unlock the value in technology, media and healthcare companies as they approach important milestones in their business lifecycle. Difference Capital Financial Inc. is traded under the Toronto Stock Exchange under the symbol “DCF”. www.differencecapital.com Legal Disclaimer This report is provided for informational purposes only and does not constitute an offer or solicitation to buy or sell any of the securities discussed here. The securities mentioned in this report may not be suitable for all types of investors. This report does not take into account the investment objectives, financial situation or specific needs of any particular client. Individuals should consult with an independent financial advisor prior to making any investment decision. Difference Capital – Quick Insights Page 6 of 6