Status of Co-operatives in Canada

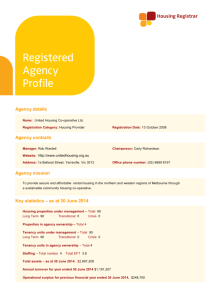

advertisement