News Flash

Hong Kong Tax

April 2012 Issue 5

Our Hong Kong Corporate Tax

Team Contacts

Peter Yu

Partner

Tel: +852 2289 3122

peter.sh.yu@hk.pwc.com

Tim Leung

Partner

Tel: +852 2289 3055

tim.leung@hk.pwc.com

Reynold Hung

Partner

Tel: +852 2289 3604

reynold.hung@hk.pwc.com

Our Hong Kong Corporate Tax

team provides a full range of

integrated professional services in

tax consulting and compliance.

Our tax specialists provide

technically robust, industry specific

and pragmatic solutions to our

clients on Hong Kong, PRC and

international tax issues.

Source rule in ING Baring

upheld by the Court of Appeal

in the Li & Fung case

The Court of Appeal (“COA”) handed down its

judgment in Li & Fung (Trading) Limited v CIR

on 19 March 2012. This was an appeal lodged by

the Commissioner of Inland Revenue (“CIR”)

against the judgment of the Court of First

Instance (“CFI”) handed down in April 2011. In

that judgment, the CFI upheld the Board of

Review’s decision and ruled that the commission

income derived by the taxpayer from sourcing

goods from overseas suppliers on behalf of its

customers was offshore and not subject to Hong

Kong profits tax. The COA upheld the CFI’s

judgment and dismissed the CIR’s appeal.

The case

The taxpayer provided services to its overseas

customers in connection with the sourcing of

products from suppliers (manufacturers) outside

Hong Kong and overseeing their manufacturing

process, etc. to ensure that satisfactory goods are

supplied to its customers. Both the customers

and suppliers are unrelated to the taxpayer.

Upon delivery of the finished goods to its

customers, the taxpayer was usually paid a

commission equal to 6% of the total FOB value of

the customer’s export sales. In most cases, the

taxpayer entered into contracts with its overseas

affiliates under which the latter performed the

above services for the taxpayer outside Hong

Kong. The taxpayer paid its affiliates a certain

percentage (say 4%) of the FOB value of the

customer’s export sales in consideration for their

services. The taxpayer has its headquarters in

Hong Kong and entered into agency agreements

with its customers as a result of the efforts of its

senior staff based in Hong Kong.

The taxpayer treated the commission earned on

orders from overseas customers which were

handled by non-Hong Kong based affiliates as foreign sourced and not chargeable to Hong Kong profits tax.

In contrast, the CIR put forward different arguments before the Board and the CFI to argue that the taxpayer’s

profits should be subject to Hong Kong profits tax. Before the Board, the CIR argued that the taxpayer

operated a “supply chain management business” and earned the 2% net amount from managing its own

activities and those of its affiliates in Hong Kong. Before the CFI, the CIR adopted a reformulated argument

and claimed that the Board had erred in not apportioning the 6% gross profits of the taxpayer that were

earned from activities carried out both in Hong Kong and overseas.

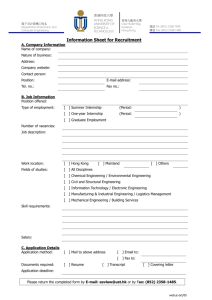

The case is summarised in the diagram below.

The decisions of the Board and the CFI

Both the Board and the CFI ruled in favor of the taxpayer and held that the sourcing commission income was

offshore and not taxable. For a detailed discussion of the decisions of the Board and the CFI, please refer to

our Hong Kong Tax News Flash, Issue 3, May 2011 accessible through the following link:

http://www.pwchk.com/home/eng/hktax_news_may2011_3.html

In a nutshell, the CFI agreed with the Board’s approach of applying the principle established in ING Baring

Securities (Hong Kong) Ltd. v CIR (“the ING Baring case”) in determining the source of commission income

derived by the taxpayer. The CFI considered that the Board was correct in focusing on the services performed

by the taxpayer’s overseas affiliates on its behalf outside Hong Kong as the relevant profit producing activities

of the taxpayer. In the CFI’s view, the Board was also entitled to disregard the activities performed by the

senior management in Hong Kong as “antecedent activities”.

The judgment of the COA

At the COA, the CIR put forward a refined version of the reformulated argument adopted before the CFI. In

its refined argument, the CIR argued that since the services performed by the taxpayer in Hong Kong were

expressly agreed to be part of the services giving rise to the commission income in the agency agreements

between the taxpayer and its customers, those activities could not be regarded as antecedent or incidental but

should be treated as part of the profit producing transactions.

The counsel for the CIR argued that what the group chairman of the taxpayer had said in an interview (which

suggested that some of the activities stated in the agency agreements were performed in Hong Kong) should

be accepted as facts. The CIR contended that as the Board failed to apportion part of the taxpayer’s profits as

attributable to the services performed in Hong Kong, the COA should remit the case to the Board for further

consideration.

News Flash – Hong Kong Tax

2

The COA rejected the CIR’s argument and considered that it is not a case for remission. The key points

mentioned in the COA’s judgment are:

1.

The refined argument was not raised before the Board at its hearing so the Board cannot be blamed for

not dealing with such argument. At the Board’s hearing in 2006, the CIR contended that the taxpayer

engaged in a “supply-chain management” instead of “commission agent” business and earned the 2% net

commission income as its profits. As such, the whole 2% amount should be subject to tax and there was

not an issue for apportionment. In the COA’s view, there is no basis to remit the case to the Board for the

CIR to advance a new case on apportionment.

2. The Board’s decision contained a careful consideration of the authorities on source of profits and correctly

applied the established principles in the ING Baring case, namely, one has to focus on “establishing the

geographical location of the taxpayer’s profit producing transactions themselves as distinct from

activities antecedent or incidental to those transactions”.

3. There is an important distinction between the taxpayer managing its business in Hong Kong and

performing its profit producing activities (through the services rendered by its overseas affiliates) outside

Hong Kong. Only the latter is relevant in determining the source of profits of the taxpayer.

4. Referring to the group chairman’s interview reported in the Harvard Business Review, the COA found that

(1) the CFI was correct to accept the interview itself as an agreed fact but reject the CIR’s request to add

the contents of the interview as agreed facts and (2) since the issue of whether the contents of the

interview was agreed facts had not been taken before the Board, it would not be right to remit the case to

Board to enable the CIR to raise this new point which most probably would require further evidence.

Based on the above, the COA agreed with the Board and the CFI that all the profit producing activities of the

taxpayer were done outside Hong Kong and dismissed the CIR’s appeal.

PwC observations

Commercially essential operations vs profit producing activities

The COA’s judgment once again underlines the important distinction between “activities that are

commercially essential to the operations and profitability of a taxpayer” and “activities that provide the legal

test for ascertaining the source of profits”. In this case, it was concluded that the taxpayer derived its profits

from provision of sourcing services based on the terms of the standard agency agreement between the

taxpayer and its customers. Once it has been determined that the taxpayer’s income is in the nature of service

fee income, the relevant activities that should be looked at in determining the source of profits are the

performance of the said services. The other activities performed by the senior management of the taxpayer in

Hong Kong, no matter how important they are to the taxpayer’s business operations, will be regarded as

“antecedent or incidental” as far as the source of profits is concerned.

Submission of facts and formulation of arguments

The present case also highlights the importance of including all relevant facts and formulating the proper

arguments at the early stage of a proceeding (i.e. during the hearing of the Board). It is equally important to

understand the meaning of “agreed facts”. In this case, although the reporting of the group chairman’s

interview is part of the agreed facts, the contents of the interview were not accepted as agreed facts. The COA

rejected the CIR’s request of remitting the case to the Board for it to further consider the new facts and revised

arguments raised by the CIR at the courts on the basis that they were not taken to the Board in the first place,

leaving aside the question of whether those new facts and revised arguments would be helpful to the CIR’s

case had they been run before the Board.

Concluding remarks

Given the unanimous decision of the COA and the difficulty in raising additional / new facts or arguments in a

further appeal, it is expected that the IRD will unlikely lodge an appeal to the Court of Final Appeal against the

COA’s decision. Taxpayers with business operations similar to those of Li & Fung and who have not lodged an

offshore claim in prior years should review their tax filing position where necessary.

News Flash – Hong Kong Tax

3

In the context of this News Flash, China, Mainland China or the PRC refers to the People’s Republic of China but excludes Hong Kong Special Administrative Region,

Macao Special Administrative Region and Taiwan Region.

The information contained in this publication is for general guidance on matters of interest only and is not meant to be comprehensive. The application and impact of

laws can vary widely based on the specific facts involved. Before taking any action, please ensure that you obtain advice specific to your circumstances from your

usual PricewaterhouseCoopers client service team or your other tax advisers. The materials contained in this publication were assembled on 19 April 2012 and were

based on the law enforceable and information available at that time.

To make enquiries about our Hong Kong tax and business advisory services, please feel free to contact the following lead specialist partners:

Entertainment & Media

Colin Farrell

Tel: +852 2289 3800

colin.farrell@hk.pwc.com

Industrial Products

Medinah Ip

Tel: +852 2289 3022

medinah.ip@hk.pwc.com

Info-Comms

Suzanne Wat

Tel: +852 2289 3002

suzanne.wat@hk.pwc.com

Financial Services

Florence Yip

Tel: +852 2289 1833

florence.kf.yip@hk.pwc.com

Logistics & Transportation

Reynold Hung

Tel: +852 2289 3604

reynold.hung@hk.pwc.com

Real Estate

KK So

Tel: +852 2289 3789

kk.so@hk.pwc.com

Retail & Consumer Products

Tim Leung

Tel: +852 2289 3055

tim.leung@hk.pwc.com

Investigation Services

Tim Lui

Tel: +852 2289 3088

tim.lui@hk.pwc.com

International Assignment Services

Mandy Kwok

Tel: +852 2289 3900

mandy.kwok@hk.pwc.com

Personal Financial Services

John Wong

Tel: +852 2289 1810

john.cw.wong@hk.pwc.com

Merger & Acquisition

Nick Dignan

Tel: +852 2289 3702

nick.dignan@hk.pwc.com

Transfer Pricing

Cecilia Lee

Tel: +852 2289 5690

cecilia.sk.lee@hk.pwc.com

Company Fiduciary & Administration Services

Isabelle Young

Tel: +852 2289 1877

isabelle.a.young@hk.pwc.com

Customs & International Trade

Colbert Lam

Tel: +852 2289 3323

colbert.ky.lam@hk.pwc.com

International Tax Advisory

Nick Dignan

Tel: +852 2289 3702

nick.dignan@hk.pwc.com

Tax Accounting Services

Suzanne Wat

Tel: +852 2289 3002

suzanne.wat@hk.pwc.com

Value Chain Transformation

Tim Leung

Tel: +852 2289 3055

tim.leung@hk.pwc.com

Beijing

Edward Shum

Tel: +86 (10) 6533 2866

edward.shum@cn.pwc.com

Chongqing

Robert Li

Tel: +86 (23) 6393 7888

robert.li@cn.pwc.com

Dalian

Rex Chan

Tel: +86 (411) 8379 1888

rex.c.chan@cn.pwc.com

Guangzhou

Daisy Kwun

Tel: +86 (20) 3819 2338

daisy.kwun@cn.pwc.com

Hangzhou

Jenny Chong

Tel: +86 (21) 2323 3219

j.chong@cn.pwc.com

Hong Kong

Peter Yu

Tel: +852 2289 3122

peter.sh.yu@hk.pwc.com

Macao

Pat Wong

Tel: +853 8799 5122

pat.lk.wong@hk.pwc.com

Nanjing

Jane Wang

Tel: +86 (25) 6608 6288

jane.y.wang@cn.pwc.com

Ningbo

Ray Zhu

Tel: +86 (21) 2323 3071

ray.zhu@cn.pwc.com

Qingdao

Steven Wong

Tel: +86 (532) 8089 1888

steven.wong@cn.pwc.com

Shanghai

Peter Ng

Tel: +86 (21) 2323 1828

peter.ng@cn.pwc.com

Shenzhen

Charles Lee

Tel: +86 (755) 8261 8899

charles.lee@cn.pwc.com

Singapore

Lennon Lee

Tel: +65 6236 3728

lennon.kl.lee@sg.pwc.com

Suzhou

Linjun Shen

Tel: +86 (512) 6273 1888

linjun.shen@cn.pwc.com

Taiwan

Steven Go

Tel: +886 (2) 2729 6666

steven.go@tw.pwc.com

Tianjin

Kelvin Lee

Tel: +86 (22) 2318 3068

kelvin.lee@cn.pwc.com

Xiamen

Mike Chiang

Tel: +86 (592) 210 7888

mike.chiang@cn.pwc.com

Xian

Elton Huang

Tel: +86 (29) 8720 3336

elton.huang@cn.pwc.com

Our regional contacts:

This Hong Kong Tax News Flash is issued by the PwC TAX Knowledge Management Centre in Hong Kong and China, which comprises of a team of

experienced professionals dedicated to monitoring, studying and analysing the existing and evolving policies in taxation and other business regulations in China,

Hong Kong, Singapore and Taiwan. They support the PricewaterhouseCoopers partners and staff in their provision of quality professional services to businesses and

maintain thought-leadership by sharing knowledge with the relevant tax and other regulatory authorities, academies, business communities, professionals and other

interested parties.

For more information, please contact:

Matthew Mui

Tel: +86 (10) 6533 3028

matthew.mui@cn.pwc.com

Please visit PricewaterhouseCoopers websites at http://www.pwccn.com (China Home) or http://www.pwchk.com (Hong Kong Home) for practical insights and

professional solutions to current and emerging business issues.

© 2012 PricewaterhouseCoopers Ltd. All rights reserved. In this document, “PwC” refers to PricewaterhouseCoopers Ltd. which is a member

firm of PricewaterhouseCoopers International Limited, each member firm of which is a separate legal entity.