Name of the course MONEY AND CAPITAL MARKET Objectives of

advertisement

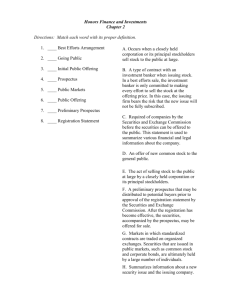

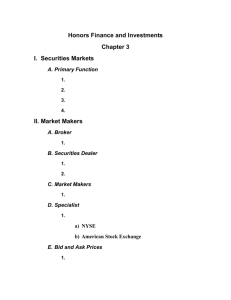

Name of the course Status of the course: MONEY AND CAPITAL MARKET Optional Year: 2 (III. semester) ECTS: 4 Number of hours in a semester: 45 Objectives of the course The objective of the course is to inform the students of the course about the basic characteristics and the functions of the capital market. The capital market offers the insufficiently used resources for the extension of the economic activities in transition countries. The knowledge of the mechanism of the primary issuing of shares and institutional investing will enable easier inclusion of every individual into shareholders’ economy – regardless of its function as a responsible person with the share issuers or its work with the agents in the sale of securities or it appears as an independent investor leading the own portfolio. Contents of the course Financial market: the concept, function and types of financial markets. Money market: Role of money market and its component parts. Market of short-term securities. Short-term credits’ market. Inter-bank money market. Foreign currency market. Capital market: Role of capital market and its components. Legal frame and regulation of capital market. Market of bonds. Market of shares. Market of long-term credits. Other markets of long-term securities. Secondary markets in the Republic of Croatia. International financial institutions: World bank. Financial institutions of European Union: European investment bank, European investment fund, European central bank, European bank for reconstruction and development, European Union funds (European Social Fund, European Fund of management and guarantee in agriculture, European fund for regional development, Cohesion fund). International Monetary Fund. The most important world stock exchanges. Institutions at domestic financial market: Financial institutions: depositary and nondepository financial institutions. Depositary institutions: banks, saving banks, saving-credit cooperatives. Non-depositary financial institutions-investment funds, pension funds, insurance companies and other financial institutions. Institutions at the capital market: Exchanges: elementary kinds, stock exchanges, equity exchanges, securities exchanges and service exchanges, public and private. Central Depositary Agency. Securities Commission. Position and role of Commission in capital market. Participants and agents of financial markets brokers and dealers. Brokers and their associations. Broker companies in the Republic of Croatia. Characteristics of domestic capital market. Investment funds – institutional investors: Kinds and role of investment funds (open, close-end and privatisation). Calculating NAV – net value of the fund. Privatisation processes in Croatia: Croatian model of privatisation. Voucher privatisation in transition countries and Republic of Croatia and its influence on the development of privatisation investment funds. PIF-s as institutional investors. Securities: Proprietary securities – shares (ordinary, privileged). Debt securities – bonds. Concept of securities and legal nature of securities. Economic function of securities. Lien of securities for insurance. Fiduciary transfer of securities for puirpose of insurance. Securities in transition countries and Republic of Croatia. Issuing of securities: Reasons for coming to the public – economic grounds, personal grounds. Methods of issuing to public. Issuing of bonds (state, municipal, corporation). Issuing of shares. Role of investments of bankers. The first public issue of shares - IPO. Introduction. Prospect. Sponsor. Entry into official quotation. Specificities of evaluation of the first public issue of shares. Evaluation of a private-state-owner firm. Ascertaining the prices of a first public offer. Market creation. Secondary trading. Securities analysis: Methods of bond value analysis. Methods of stock value analysis. Models of market capitalisation. Evaluation of political risk. Methods of analysis of derived securities. Basic fundamental and technical analyses. Establishing of risk and portfolio return. Portfolio risk and CAPM model. Speculative markets. Evaluation of investing into bonds and shares. Independent rating defining agencies. Financial derivatives (hybrid securities) : Futures financial markets. Options, date bills, swaps, warrants, rights. Causes of creation financial derivatives. Estimation values of options. Black – School’s model of option evaluation. Contemporary phenomena in finances: Securitisation. Internationalisation of finances. Deregulation – regulation. Financial innovations. Technologic revolution and finances. Disintermediation – reducing the role of financial intermediaries. Globalisation of finances.