LEARNING OBJECTIVES LEARNING OBJECTIVES Job

advertisement

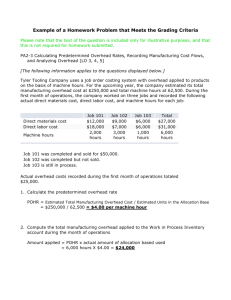

3-1 3-1 LEARNING OBJECTIVES 1. Distinguish between process costing and job-order costing and identify companies that would use each costing method. 2. Compute predetermined overhead rates and explain why estimated overhead costs are used in the costing process. 3. Record the journal entries that reflect the flow of costs in a job-order costing system. 4. Apply overhead cost to Work in Process using a predetermined overhead rate. 3-2 LEARNING OBJECTIVES 5. Compute under- or overapplied overhead cost and prepare the journal entry to close the balance in Manufacturing Overhead to the appropriate accounts. 6. (Appendix 3A) Explain the implications of basing the predetermined overhead rate on activity at capacity rather than on estimated activity for the period. 3-3 Job-Order vs. Process Costing Characteristics of product & production process: Characteristics of accounting system: 3-2 3-4 Exercise 3-1 3-5 Accumulating Costs in a Job-Order Costing System Manufacturing overhead (OH) Direct materials Applied to each job using a predetermined rate Tra ced dire to e ctly ach job THE JOB Direct labor tly irec ed d job c a Tr ach to e 3-6 Overhead Application: An Overview Overhead Pool Job 1 Job 2 Job 3 3-3 3-7 Overhead Application Example Ron Company applies overhead based on direct- labor hours. Total estimated overhead for the year is $640,000. Total estimated labor cost is $1,400,000 and total estimated labor hours are 160,000. What is Ron Company’s predetermined overhead rate? 3-8 Overhead Application Example POHR = Budgeted manufacturing overhead cost Budgeted amount of cost driver (or activity base) Why use a POHR in stead of actual overhead? 3-9 Exercise 3-10 3-4 3-10 Overhead Application Example Ron Company’s actual overhead for the year was $650,000 and a total of 170,000 directlabor hours were worked. Using Ron Company’s predetermined overhead rate of $4.00 per direct-labor hour, how much overhead was applied to all of RoseCo’s jobs during the year? 3-11 Ron Company Overapplied/Underapplied Manufacturing Overhead Mfg. Overhead Options for Overapplied/ Underapplied Manufacturing Overhead May be allocated to these accounts. May be closed directly to cost of goods sold. OR Work in Process Finished Goods Cost of Goods Sold Cost of Goods Sold 3-12 3-5 3-13 Problem 3-20 Problem 3-22 3-14 Why Use Departmental O/H Rates? z z z 3-15 z Problem 3-25 3-6 Appendix 3A The Predetermined Overhead Rate and Capacity 3-17 The Capacity Issue When estimated activity is less than activity at capacity, two problems arise: 1. Unit product costs will fluctuate depending on the budgeted level of activity for the period. As budget levels decrease, overhead cost per unit (and unit product costs) will increase. 2. Products will be charged for resources they did not use. 3-18 Problem 3-23 Case 3-32