Job order costing

advertisement

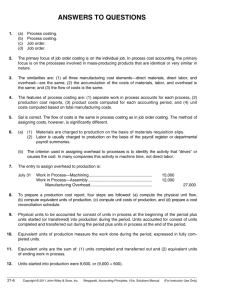

Job order costing In job order costing, or job costing, production costs are accumulated for each separate job ; a job is the output identified to fill a certain customer order or replenish an item of stock on hand. Mulyadi: Metode harga pokok pesanan merupakan metode pengumpulan biaya yang memperlakukan pesanan sebagai suatu unit keluaran yang unik dan membebankan biaya biaya aktivitas ke setiap pesanan. • For job costing to be effective, jobs must be seperately identifiable. For the detail of job costing to be worth the effort, there must be important differences in unit costs from one job to another. Job-Costing: system accounting for distinct cost objects called Jobs. Each job may be different from the next, and consumes different resources. – Wedding announcements, aircraft, advertising Ciri-ciri dari Perusahaan yang menerapkan metode harga pokok pesanan: 1. Berproduksi untuk memenuhi pesanan 2. Produk yang dihasilkan heterogen 3. Pola produksi secara terputus-putus Costing Approaches • Normal Costing – allocates: – Indirect costs based on the budgeted indirect-cost rates times the actual activity consumption Seven-step Job Costing 1. Identify the Job to be costed 2. Identify the Direct Costs of the Job 3. Select the Cost-Allocation base(s) to use for allocating Indirect Costs to the Job 4. Match Indirect Costs to their respective Cost-Allocation base(s) 5. Calculate an Overhead Allocation Rate: OH Costs ÷ OH Allocation Base 6. Allocate Overhead Costs to the Job: OH Allocation Rate x Actual Base Activity For the Job 7. Compute Total Job Costs by adding all direct and indirect costs together Ciri-ciri dari Metode Harga Pokok Pesanan: 1. 2. 3. harga pokok ditentukan secara individual untuk setiap produk biaya produksi dipisahkan ke dalam biaya produksi langsung (bahan baku & upah langsung) dan biaya produksi tak langsung (BOP) pembebanan biaya produksi langsung (bahan baku & upah langsung) dengan biaya sesungguhnya, sedangkan pembebanan BOP dengan tarif yang ditentukan dimuka 4. harga pokok ditentukan setelah produk/pesanan/pekerjaan selesai diproses dan harga pokok per satuan dihitung dengan cara membagi jumlah biaya produksi untuk suatu produk/pesanan/pekerjaan dengan jumlah satuan yang dihasilkan untuk produk/pesanan/pekerjaan tersebut Job Costing Overview Direct Materials: $100 The Cost Object: Direct Labor: $200 Indirect Cost Pool: All Manufacturing Costs $1,000 Indirect Cost-Allocation Base: Direct Manufacturing Labor-Hours 100 hours Job #123 Overhead Allocation Rate: Overhead Applied to Job #123: $1,000 ÷ 100 DLhrs = $10/DLhr $10/DLhr X 5 hours used in Job #123 = $50 DM DL OH $100 $200 $50 Total Cost: $250 P 161: 4-17 Budget for 2009: - Direct materials $ 2,150,000 - Direct labor $ 1,450,000 - Overhead costs $ 2,755,000 Job cost record for Job 195: - Direct materials used $ 50,000 - Direct labor $ 40,000 4-18 Laguna Model Construction period Direct materials Direct labor costs Direct labor hours Mission Model Feb – June 2008 May – Oct 2008 $ 106,450 $ 127,604 $ 36,276 $ 41,410 900 1,010 Support costs rate : • Normal costing/based on budgeted, $ 50 per direct labor hour • Actual costing, $ 42 per direct labor hour • The 2008 Actual support costs were $ 6,888,000 and the actual direct labor hours were 164,000. Journal Entries • Journal entries are made at each step of the production process • The purpose is to have the accounting system closely reflect the actual state of the business, its inventories and its production processes • All Product Costs are accumulated in the Work-in-Process Control account – Direct Materials used – Direct Labor incurred – Factory Overhead allocated or applied • Actual Indirect Costs (overhead) are accumulated in the Manufacturing Overhead Control account • Purchase of Materials on credit: – Materials Control Accounts Payable Control XX XX • Requisition of Direct and Indirect Materials (OH) into production: – Work-in-Process Control Manufacturing Overhead Control Y Materials Control X Z • Incurred Direct and Indirect (OH) Labor Wages – Work-in-Process Control X Manufacturing Overhead Control Y Wages Payable Control Z • Incurring or recording of various actual Indirect Costs: – Manufacturing Overhead Control X Salaries Payable Control Accounts Payable Control Accumulated Depreciation Control Prepaid Expenses Control A B C D • Allocation or application of Indirect Costs (overhead) to the Work-in-Process account is based on a predetermined overhead rate – Work-in-Process Control X Manufacturing Overhead Allocated X • Products are completed and transferred out of production in preparation for being sold – Finished Goods Control Work-in-Process Control X X • Products are sold to customers on credit – Accounts Receivable Control Sales X X • And the associated costs are transferred to an expense (cost) account – Cost of Goods Sold Finished Goods Control Y Y • Details about a job are recorded on a job order cost sheet, or cost sheet. • Job costing accumulates the costs of direct materials, direct labor and overhead charged to each job. The basics of Job Costing involve only eight types of accounting entries, one for each of the following: 1. 2. 3. 4. 5. 6. 7. 8. Materials purchased Factory labor costs incurred Factory overhead costs incurred Materials used Factory labor costs distributed Estimated Factory overhead applied Jobs completed Products sold