PART I

advertisement

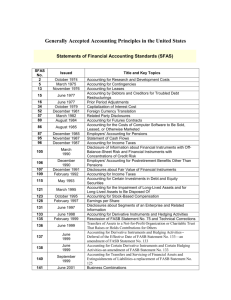

F-10 FASB ASC 260-10-45, “Earnings Per Share” (“FASB ASC 260-10-45”) states that unvested awards of share-based payments with rights to receive dividends or dividend equivalents are considered participating securities for purposes of calculating earnings per share. As a result, these participating securities will be included in the weighted average number of shares outstanding as disclosed on the face of the income statement. FASB ASC 260-10-45 is effective for fiscal years beginning after December 15, 2008, and interim periods within those years. All prior period earnings per share data presented in financial reports after the effective date shall be adjusted retrospectively to conform to the provisions of FASB ASC 260-10-45. Early application is not permitted. The Company adopted FASB ASC 260-10-45 in the first quarter of 2009. The Company does not have any unvested awards or payments with nonforfeitable rights to dividends. FASB ASC 715-20-65, “Compensation – Retirement Benefits” (“FASB ASC 715-20-65”) is intended to improve disclosures about a company’s postretirement benefit plan assets by requiring more information about how investment allocation decisions are made, major categories of plan assets, fair value assumptions and concentrations of risk. The disclosures required by FASB ASC 715-20-65 have been included in the Company’s December 31, 2009 financial statements. This statement did not impact the consolidated financial results of operations, as the requirements are disclosure-only in nature. Please see Note 11 for disclosures relating to the Company’s retirement plans. FASB ASC 825-10-65, “Financial Instruments” (“FASB ASC 825-10-65”) requires disclosures about fair value of financial instruments for interim periods as well as in annual financial statements. The disclosures required by FASB ASC 825-10-65 are required for interim periods ending after June 15, 2009. This ASC did not impact the consolidated financial results of operations, as the requirements are disclosure-only in nature. FASB ASC 320-10-65 “Investments – Debt and Equity Securities” (“FASB ASC 320-10-65”) amends the other-thantemporary impairment guidance for debt securities and improves the presentation and disclosure of other-thantemporary impairments for both debt and equity securities. This ASC became effective for interim and annual reporting periods ending after June 15, 2009. The adoption of this standard did not have an impact on the Company’s operations, financial position or cash flows. FASB ASC 860 “Transfers and Servicing” (“FASB ASC 860”) improves the relevance and comparability of information that a reporting entity provides in its financial statements about transfers of financial assets. The provisions of FASB ASC 860 are applicable on January 1, 2010 and will be applied prospectively to transfer of financial assets completed after December 31, 2009. The Company does not anticipate these provisions will have a material impact on its financial statements. FASB ASC 810 “Consolidation” (“FASB ASC 810”) amends the consolidation guidance for variable interest entities. The provisions are applicable on January 1, 2010. The Company does not anticipate these provisions will have a material impact on its financial statements. In August 2009, the FASB issued ASU 2009-5, “Fair Value Measurements and Disclosures (Topic 820) – Measuring Liabilities at Fair Value” (“FASB ASU 2009-5”). This update provides clarification of the fair value measurement of financial liabilities when a quoted price in an active market for an identical liability (level 1 input of the valuation hierarchy) is not available. FASB ASU 2009-5 is effective in the fourth quarter of 2009. The adoption of this update did not have a material impact on the Company’s financial statements or disclosures. In January 2010, the FASB issued ASU 2010-06, “Fair Value Measurements and Disclosures (Topic 820): Improving Disclosures about Fair Value Measurements” (“ASU 2010-06”). This update will require additional information to be disclosed principally in respect to Level 3 fair value measurements and transfers to and from Level 1 and Level 2 measurements. In addition, enhanced disclosures will be required concerning inputs and valuation techniques used to determine Level 2 and Level 3 fair value measurements. ASU 2010-06 is effective for interim and annual reporting periods beginning after December 1, 2009, however, the requirements to disclose separately purchases, sales, issuances, and settlements in the Level 3 reconciliation are effective for fiscal years beginning after December 15, 2010. The Company does not anticipate this update will have a material impact on its financial statements or disclosures. NOTE 2: INCOME TAX EXPENSE Under ASC 740, we must recognize the tax benefit from an uncertain tax position only if it is more likely than not that the tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. The tax benefits recognized in the financial statements from such a position are measured based on the largest benefit that has a greater than 50% likelihood of being realized upon ultimate resolution. The reassessment of our tax positions did not have an impact on our results of operations, financial condition or liquidity. From time to time, the Company is assessed interest and penalties by taxing authorities. In those cases, the charges would appear on the Other line item on the Income Statement. During 2007, the Company was charged approximately $2,000 in interest relating to the 2003 federal tax examination. There were no such charges for the years ending December 31, 2009 and 2008. Additionally, there were no accruals relating to interest or penalties as of December 31, 2009 and 2008. The Company remains subject to examination by federal authorities for the 2006 through 2008 tax years and by state authorities for the tax years 2006 through 2008. CONNECTICUT WATER SERVICE, INC. AND SUBSIDIARIES