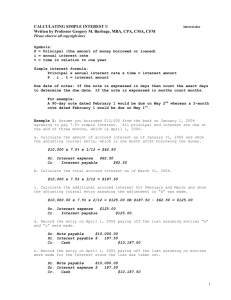

Statement of Cash Flows

advertisement

Year-ended 5/31/12

Statement of Cash Flows

x

PRIOR YEAR BALANCE

CASH FLOW FROM OPERATING ACTIVITIES:

Increase/(Decrease) in net assets before change in accounting principle

Adjust to reconcile increase in net assets to net cash used in operating

activities

Depreciation

Accretion of asset retirement obligation

Amortization of prepaid bond costs

Amortization of lease intangibles

Provision for bad debt

Discount on contribution receivable

Forgiveness of employee notes

Net realized and unrealized (gains)/losses on investments

Change in value of split interest agreements

Change in (benefit) liability under interest rate swap

Gain on extiguishment of debt

(Gain)/Loss on disposal of assets

Contributions restricted for investment in endowment and plant

Distributions of interest in trust

Gifts in kind/equipment donations

Gifts of real estate and investments

Changes in:

Student accounts receivable

Contributions receivable

Other receivables

Prepaid expenses and other assets

Accounts Payable and Accrued Liabilities

Asset Retirement Obligation

Liability under split interest agreements

Deferred revenues

Net cash (used in) provided by Operating Activities

Cash

Restricted

Cash

Student

Account

Receivable

Contribution

Receivable

Student

Loan

Receivable

Other

Receivable

110,000

0

7,000

25,000

10,000

5,826

14,992

16,000

(500)

(2,000)

400

570

(100)

150

10,050

1,100

9,419

0

(220)

(5,100)

200

0

(1,200)

(301)

(3,100)

(2,195)

194

(1,510)

0

(52)

787

37,584

CASH FLOW FROM INVESTING ACTIVITIES:

Acquisition of property, plant, and equipment

Proceeds from disposal of assets

Proceeds from sales of investments

Purchases of investments

Restricted cash deposits

Proceeds from (issuance of) student loans

Student loan repayments

Issuance of employee notes

Employee notes repayments

Net cash (used in) provided by Investing Activities

(82,600)

220

61,200

(52,950)

0

(1,200)

1,700

(155)

200

(73,585)

CASH FLOW FROM FINANCING ACTIVITIES:

Proceeds from LOC

Payments on LOC

Proceeds from issuance of bonds payable

Proceeds from issuance of notes payable

Payments on bonds payable

Payments on notes payable

Premium on Bonds Payable

Debt issuance costs

Contributions restricted for investment in endowment and plant

Net change in federal student loan funds

Net cash (used in) provided by Financing Activities

0

0

0

30,000

(3,000)

0

0

(63)

5,100

199

32,236

Net (decrease)Increase in Cash and Cash Equivalents

Cash and Cash Equivalents--Beginning of year

Cash and Cash Equivalents--End of year

(3,765)

110,000

106,235

Supplemental disclosure of cash flow info--interest paid

Supplemental disclosure of noncash investing activities:

Accrued acquisition of property, plant, and equipment

Cumulative effects on prior years due to change in accounting principles:

Valuation of real estate held for investment

Valuation of asset retirement obligation

Addition to property related to asset retirement obligation

5/31/2012 EXPECTED YEAR-END BALANCE

5/31/2012 YEAR END BALANCE

Difference

(600)

301

{m}

30

100

(150)

{n}

2,195

{k}

155

(200)

{n}

{n}

{k}

3,100

0

{h}

{h}

{h}

{k}

1,200

(1,700)

{a}

{a}

0

0

0

0

0

106,235

106,235

0

0

0

0

Supplemental Disclosure of Cashflow Information - Interest Paid

8,716

{l}

Supplemental Disclosure of Cashflow Information - Accrued additions to PPE

3,900

{e}

6,701

6,701

0

28,230

28,230

0

9,500

9,500

0

7,826

7,826

0

x

x

Beneficial

Interest in

Trusts

Investments

and Restricted

Investments

Benefit Under

Interest Rate

Swaps

Prepaids &

Other Assets

PP&E

A/P &

Accrued

Expenses

14,000

240,000

0

7,635

325,376

(39,775)

(16,000)

Other

Liabilities

(Assets

Retirement

Obligation)

Liability

Under Split

Interest

Agreement

Liability

Under

Interest Rate

Swaps

Deferred

Revenue

(2,106)

(2,040)

(11,350)

(28,726)

{f}

500

0

0

(50)

(400)

{c}

{c}

(10,000)

(700)

(100)

{c}

700

{c}

500

(400)

{j}

{q}

{b}

{b}

0

2,600

(100)

{l}

{q}

{g}

{b}

{b}

{k}

(9,419)

(194)

220

2,500

{e}

{g}

0

{e}

{k}

{k}

1,510

{k}

52

{k}

(787)

14,150

14,150

0

(61,200)

52,950

{b}

{b}

(2,600)

{g}

221,450

221,450

0

0

0

0

1,300

{q}

63

{l}

8,804

8,804

0

82,800

(220)

{e}

{e}

(2,500)

{g}

1,200

{e}

393,376

393,376

0

0

(1,500)

{q}

(1,200)

{e}

(41,365)

(41,365)

0

(1,606)

(1,606)

0

(1,988)

(1,988)

0

(20,769)

(20,769)

0

(29,513)

(29,513)

0

Federal

Student

Loans

Line of

Credit

Bonds

Payable

Notes

Payable

Net Assets

Check

(10,007)

0

(160,000)

0

(490,833)

0

(14,992)

2,000

{p}

0

{k}

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

{d}

{k}

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

{o}

{o}

(199)

0

{p}

3,000

{p}

(30,000)

{d}

0

{d}

{k}

0

(10,206)

(10,206)

0

0

0

0

(155,000)

(155,000)

0

(30,000)

(30,000)

0

(505,825)

(505,825)

0

0

0

0

0

0

0

0

0

0

0

0

0

Tickmarks

{a}

The student loan payments consist of the following:

Rollforward of Loans Receivable

Balance - 5/31/2011

Add: New loans awarded

Less: Loan repayments

Less: Change in allowance

Less: Cancellations

Balance - 5/31/2012

Balance - 5/31/2012 RPT

{b}

{c}

Total investment activity consists of the following:

Rollforward of Investments

Balance - 5/31/2011

Add: Purchases

240,000

50,000

Add: Gifts of stock/real estate Trustee

Add: Interest/Dividends & Distribution

Add: Distribution of Int/Div/Real Gain

Less: Xfr from Invests to Cash/CashEqu

Less: Distributions of Trusts

Add: Increase in appreciation/gains

Add: Change in value of trusts

Less: Sales

500

2,950

(5,800)

(2,400)

(100)

(10,000)

(700)

(53,000)

Balance - 5/31/2012

Balance - 5/31/2012 RPT

221,450

221,450

-

Gain/(Loss) on Disposal of Asset

Acct # 590050

(30,000)

(30,000)

(30,000)

-

466,023

84,000

(20,023)

530,000

530,000

-

220

See below for the current year depreciation:

Change in Depreciation:

Accum. Dep. Balance - 5/31/2011

Add: Depreciation Exp

Less: Disposals

Balance - 5/31/2011

Balance - 5/31/2011 RPT

{g}

14,000

700

(100)

(400)

(50)

14,150

14,150

-

See below for a rollforward of fixed assets:

Rollforward of fixed assets

Balance - 5/31/2011

Add: Plant additions

Add: Gifts in Kind capitalized

Add: Post Close JV Plant Additions

Less: FY12 Adjustment to PPE

Less: Disposals

Balance - 5/31/2012

Balance - 5/31/2012 RPT

{f}

(140,647)

(16,000)

1,647

(155,000)

(155,000)

(0)

See below for the current year contributions used for long-term purposes:

Contributions to be used for long-term purposes:

Plant fund gifts

2,500

Endowment Gifts

2,600

Balance - 5/31/2012

5,100

{h}

Contribution Receivable Rollforward from General Ledger:

Rollforward of Contributions Receivable

Balance - 5/31/2011

Change in Pledge Balance

Change in Bquest Receivable Bal

Less: Change in Discount

Less: Change in Allowance

Balance - 5/31/2012

Balance - 5/31/2012 RPT

{i}

200

250

(50)

Total notes payable activity consists of the following:

Rollforward of long-term debt

Balance - 5/31/2011

Add: New borrowings

Less: Principal payments

Add: Premium on New Loan

Less: Amort of Premium on New Loan

Balance - 5/31/2012

Balance - 5/31/2012 RPT

{e}

Trust PY Cash Balance

Trust CY Cash Balance

Trust Net xfr to Cash

Total Beneficial Interest in Trust Activity consists of the following:

Rollforward of Beneficial Interest in Trusts

Balance - 5/31/2011

Gifts of Real Estate/Investments

Distributions

Add/(Less): Change in value of trusts

Gains/(Losses) on Outside Trusts

Balance - 5/31/2012

Balance - 5/31/2011 RPT

{d}

10,000

1,200

(1,400)

(100)

(200)

9,500

9,500

- check

25,000

(2,900)

6,000

100

30

28,230

28,230

-

Total Cap Interest

Total Additions

500

83,500

84,000

Total Cash Plant Additions

84,000

(3,900)

2,700

82,800

Less: CY Accrued CIP

Add: PY Accrued CIP

Total Cash Plant Additions

Change Accr CIP

(1,200)

{j}

See below for the current year ARO activity:

400

(900)

(500)

ARO Accretion in CY

ARO Retirement in CY

{k}

Amount is mathematically derived as the change in account balance at 5/31/2012.

{l}

Actual cash paid for interest is displayed on the statement of cashflows as follows:

Interest Expense

Letter of Credit Fees

Prepaid Bond Expense Amortization

SWAP Fixed Interest Expense

SWAP LIBOR Interest Expense

Miscellaneous Bond Expenses

Total Interest Expense

4,400,000

500,000

2,900,000

(130,000)

146,000

7,816,000

Rounded Total Interest Expense

Less: CY Accrued Interest

Add: PY Accrued Interest

Add: Capitalized Interest

Total Cash Paid for Interest

7,816

(1,100)

1,500

500 {e}

8,716

Total FY12 Prepaid Cost of Issuance

63

{m}

Bad Debt Expense for the Year

Bad Debt Expense

{n}

FY12

600

FY11

800

Employee notes are typically issued every year. As these are loans provided to employees, and per review of FAS 95, loans issued must be

shown as an investing activity. Further, note that many of the loans are not repayed but, rather, the loan agreement states that a portion will

be forgiven over a certain set period of the loans life. See below for break-out of employee note amounts.

Employee Notes (166010 & 166210) Beg Bal

CY Notes & Interest Added

CY Notes & Interest Repaid

CY Forgiveness

Employee notes Ending Balance

{o}

2,145

155

(200)

(150)

1,950

Total Line-of-Credit activity consists of the following:

Rollforward of short-term debt

Balance - 5/31/2011

Add: drawdowns

Less: Principal payments

Balance - 5/31/2012

Balance - 5/31/2012 RPT

{p}

-

Total bonds payable activity consists of the following:

Rollforward of long-term debt

Balance - 5/31/2011

Add: New borrowings

Less: Principal payments

Add: Premium on New Loan

Less: Amort of Premium on New Loan

Balance - 5/31/2012

Balance - 5/31/2012 RPT

{q}

[6]

(160,000)

3,000

2,000

(155,000)

(155,000)

-

Amortization of lease intangible assets and liabilities (below-market leases, leases in place, etc).

Rollforward of Leashold Assets

Balance - 5/31/2011

Leasehold Assets Additions

Leasehold Assets Depreciation

Balance - 5/31/2012

Rollforward of Leashold Liabilities

Balance - 5/31/2011

Leasehold Liabilities Additions

Leasehold Liabilities Amortization

Balance - 5/31/2012

1,300

1,300

(1,500)

400

(1,100)