Annual report 2007-08

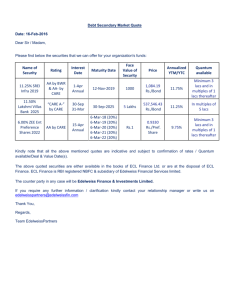

advertisement

Tomorrow's Answers Today

An AkzoNobel Company

ICI India Limited

Performance Trends: 1998-2008

Sales

Profit before Tax from Operations

120

1200

109.0 109.1

219

1000

574

Rs cr

800

274

375

96.5

100

942

216

510

1062

80

69.4

774

290

Rs cr

547

65

640

600

60

60.3

49.4

502

400

200

286

299

308

54.3

40.5

40

411

49.6

47.1

340

20

0

0

98-99 99-00

2001-02

2003-04

Continuing Businesses

2005-06

2007-08

98-99 99-00

2001-02

2003-04

2005-06

2007-08

Discontinued Businesses

Employee Productivity

Asset Productivity

7.0

2500

2,022

2000

1,657

1500

1,107

1,223

961

1000

780

733

685

6.0

Sales / Net Operating Assets

Value added per employee (Rs 000)

6.8

2,070

753

500

5.3

5.0

4.6

4.0

3.8

3.0

2.0

3.2

2.1

2.3

2.5

2.3

2.5

1.0

0

0.0

98-99 99-00

2001-02

2003-04

2005-06

2007-08

Value added = Operating Profit + Depreciation + Manpower Costs

98-99 99-00

2001-02

2003-04

2005-06

2007-08

ICI India Limited

Annual Report 2007-08

CONTENTS

Page

ICI INDIA LIMITED

BOARD OF DIRECTORS

3

DIRECTORS' REPORT

4

CORPORATE GOVERNANCE REPORT

8

AUDITORS' REPORT

14

BALANCE SHEET

16

PROFIT & LOSS ACCOUNT

17

CASH FLOW STATEMENT

18

SCHEDULES TO THE ACCOUNTS

19

• SIGNIFICANT ACCOUNTING POLICIES

29

• NOTES TO THE ACCOUNTS

31

BALANCE SHEET ABSTRACT ETC.

43

STATEMENT REGARDING SUBSIDIARY COMPANY

44

CONSOLIDATED ACCOUNTS

45

NOTICE OF ANNUAL GENERAL MEETING

68

TEN YEARS AT A GLANCE

72

ATTENDANCE SLIP / PROXY FORM

Enclosed

Annual Report 2007-08 – ICI India Limited

1

Our commitment

As an organization, we are committed to:

helping our customers make their businesses

a success

providing the most competitive returns for our

shareholders

creating an attractive working environment for

our people

conducting all our activities in the most socially

responsible manner.

We strive to be:

• the first choice of customers, shareholders

and employees

• a respected member of society.

BOARD OF DIRECTORS

CHAIRMAN

Mr Aditya Narayan

MANAGING DIRECTOR

Mr Rajiv Jain

DIRECTORS

Mr Sandeep Batra (Wholetime Director)

Mr A J Britt (w.e.f. 12 May 2008)

Mr R Gopalakrishnan

Ms R S Karnad

Mr M R Rajaram

Mr A M Ransom (upto 28 April 2008)

Mr M V Subbiah

COMPANY SECRETARY

Mr R Guha

REGISTERED OFFICE

Geetanjali Apartment, 1st floor,

8-B, Middleton Street, Kolkata 700 071

Tel : 033-22267462 Fax: 033-22277925

CORPORATE OFFICE

10th Floor, DLF Plaza Tower

DLF Qutab Enclave, Phase-1

Gurgaon 122 002

Tel : 0124-2540400

Fax : 0124-2540849

WEBSITE

www.iciindia.com

KEY COMMITTEES OF THE BOARD

Audit Committee

Ms R S Karnad (Chairperson)

Mr A J Britt

Mr R Gopalakrishnan

Mr M V Subbiah

Remuneration and

Nominations Committee

Mr M V Subbiah (Chairman)

Mr A J Britt

Mr R Gopalakrishnan

Ms R S Karnad

Shareholders/Investors

Grievance Committee

Mr A J Britt (Chairman)

Mr Rajiv Jain

Mr M R Rajaram

AUDITORS

BSR & Associates

BANKERS

Citibank NA

Deutsche Bank AG

HDFC Bank Limited

Hongkong & Shanghai Banking Corpn.

Standard Chartered Bank

State Bank of India

REGISTRAR AND SHARE

TRANSFER AGENT

C B Management Services (P) Ltd

P-22, Bondel Road

Kolkata 700 019

Tel : 033-22806692-94

Fax : 033-22870263

Email : cbmsl1@cal2.vsnl.net.in

Annual Report 2007-08 – ICI India Limited

3

DIRECTORS' REPORT

Your Directors have pleasure in presenting their report for the

year ended 31 March 2008.

Appropriations

Transfer to General Reserve

(54.0)

BUSINESS ENVIRONMENT

Proposed Dividend

(30.7)

The business environment in India remained positive during

2007-08 with the GDP growing by nearly 9%, keeping up the

trend established in the recent years. However the global

slowdown, soaring international crude oil prices and spurt in

inflation rate in early 2008 dampened the growth momentum.

Tax on Dividend

Going forward, while the growth fundamentals of the Indian

economy continue to be intact, the rate of growth in 2008-09 is

likely to be tempered compared to the past few years.

During 2007-08 sales and profit from businesses on a comparable

basis grew by 19% and 26% respectively. However, due to

changes in the portfolio of businesses, the total income at

Rs 964 cr and PBIT from operations at Rs 109 cr were only

marginally higher than last year.

Exceptional items during the year amounting to a net charge of

Rs 18.7 cr consist mainly of refund of part of the purchase

consideration for Advanced Refinish business divested in March

2007, whereas the previous year had an exceptional income of

Rs 446 cr from divestments. Consequently, the Profit after tax of

Rs 60.2 cr for the year is not comparable with the previous year's

corresponding figure of Rs 448.4 cr.

Following its prudent dividend policy, the Board has

recommended a dividend of Rs 8.00 per share for the year 200708 (previous year: Rs 7.00 per share, plus an additional one off

special dividend of Rs 20.00 per share), which will paid after the

approval of the members at the forthcoming Annual General

Meeting.

The performance highlights for the year are:

2007-08

964.3

131.1

(22.5)

0.5

109.1

(Rs cr)

2006-07

954.3

133.8

(22.5)

(2.3)

109.0

–

(18.7)

90.4

(30.2)

60.2

31.1

446.1

586.2

(137.8)

448.4

The appropriations from the profit are as follows:

Balance in Profit & Loss Account

brought forward from previous year

Profit after tax for the year

Total available for appropriation

4

(5.2)

443.0

No fresh public deposits were accepted by the Company during the

year. Unclaimed deposits and unclaimed dividends amounting to

Rs 0.18 cr were remitted into the Investor Education and Protection

Fund of the Central Government as required under section 205C of

the Companies Act, 1956.

SHARE BUY BACK

FINANCE AND ACCOUNTS

Total income

Operating profit

Depreciation

Interest

Profit before tax from operations

Dividend from subsidiary company

prior to divestment

Exceptional items

Profit before tax

Tax

Profit after tax

Balance carried to Balance Sheet

472.7

60.2

532.9

Annual Report 2007-08 – ICI India Limited

The share buyback through market operations, which was

approved by the members through postal ballot on 12 July 2007,

was pursued during the year. Till 31 March 2008, a total of

24.91 lac shares have been bought back, constituting 6.1% of

the pre-buyback paid up capital of the Company, at an average

price of Rs 528 per share.

The premium paid over the face value of the shares bought back

and other costs of the buyback amounting to Rs 131.00 cr have

been adjusted against Share Premium (Rs 1.15 cr) and General

Reserve (129.85 cr). In addition, as required under the provisions

of the Companies Act 1956, a Capital Redemption Reserve has

been created to the extent of Rs 2.49 cr by adjustment to the

General Reserve.

SIGNIFICANT DEVELOPMENTS

With effect from 2 January 2008, AkzoNobel NV, Netherlands

has become the owner of the entire equity capital of Imperial

Chemical Industries, UK, the majority shareholder of your

Company, through a scheme of arrangement under section 425

of the UK Companies Act, 1985. Consequently, your Company

became an AkzoNobel company effective that date.

The Board had, at its meeting held on 28 March 2008,

recommended a proposal to divest the Adhesives business of the

Company; this has since been approved by the shareholders

through postal ballot on 17 May 2008. The initial consideration

of Rs 260 cr, including Rs 30 cr towards the Company's

shareholding in its subsidiary Polyinks Limited, has been received

subject to certain agreed adjustments for cash, debt and working

capital. The financial effect of this divestment will be reflected

in the Company's results on completion of the transaction.

MANAGEMENT DISCUSSION & ANALYSIS

Paints

Market conditions were, on the whole, good for the Paints

business and there was robust demand in most parts of the

country. Backed by the strong demand for its products, the

Paints business continued to grow aggressively and delivered

a much higher performance over the previous year.

DIRECTORS' REPORT

The Paints business initiatives in building the premium Dulux

portfolio, placement of in-store tinting machines, innovative

and new colour offers and a demand-generation initiative

with painters/contractors helped improve the Company's

channel relationships whilst achieving higher consumer

satisfaction.

In the Decorative segment, exteriors continued to be the

fastest growing range and the business further strengthened

its portfolio in this category. WeatherShield Max, a premium

exterior paints, was renovated to improve its water resistant

properties and the new formulation has gained wide

acceptance with trade and consumers. The Company now

has the full range of products and services in this category

and is poised to improve its position.

The Company has also maintained its focus on the interior

finishes. New products - low cost Acrylic Distemper, Primer

and Putty - were launched in this category. The Enamel

segment has been witnessing a slowdown for some years since

other materials on signboards, hoarding and the like are

replacing the enamel paint. Woodcare is emerging as an

attractive opportunity and the business renovated its products

to participate in this segment. The Company continues to

use its research and development base to bring to the

consumer new products with improved features and for

special applications.

The refinish business continued to do well. The market

continues to witness the trend of customer upgrading from

conventional refinish paints to PU based paints. Company's

PU based products viz. Eterna, Vektor and Duco PU have

found good acceptance with the dealers and users.

Overall, the outlook for 2008-09 appears positive. The

government's thrust on infrastructure and continuance of tax

incentives on home loans and reduced excise duties will have

a favourable impact on the paints industry. However, high

crude oil prices and inflation will impact input costs leading

to pressure on margins. The increase in interest rates could

adversely affect the housing sector. The automobile sector

too is expected to grow. While the reduction in excise duties

should promote growth, inflation and higher prices could

create negative pressures.

Chemicals / Others

The Adhesives, Polymer and Starch businesses performed

well with sales growing by 20%. The Adhesives business

grew by 19% with good growth in Tobacco and Wood

working segments. The Speciality Polymer group also grew

by 28% with excellent growth in the Elotex segment. The

food and pharmaceutical starch business growth was flat

during the year.

With customs duty nearing ASEAN levels, competition will

further intensify from imports as well as from low cost players.

To effectively counter these factors, the business intensified

its focus on value selling and leveraging its first mover

advantage to enhance its market position.

Your Company has entered into a contract with Henkel CAC

Private Limited, an affiliate of the Henkel Group, to divest

its Adhesives business. In line with the contract, the risk and

reward from the Business has been assumed by the purchaser

with effect from 3 April 2008.

RESPONSIBLE CARE - SECURITY, SAFETY, HEALTH,

ENVIRONMENT ('SSHE') AND CORPORATE SOCIAL

RESPONSIBILITY

Your Company continued to sustain its high standards of SSHE

performance, returning yet another year with no major injury or

incident. Extensive efforts were carried out to drive awareness

amongst all employees across the organisation on the basic

requirements of SSHE and engaging them personally in the SSHE

process through reporting of at least one learning incident per

person per month. Recognising that the use of two wheeler is a

major risk to the individuals, a new guideline for two wheeler

usage was put in place aiming to reduce risks on two wheeler

usage in the course of work.

Mohali Plant was awarded the 'Punjab State Safety Award' for

its outstanding SSHE performance.

No occupational illness was reported during the year.

CONSERVATION OF ENERGY,

DEVELOPMENT & INNOVATION

RESEARCH,

The Company's performance on energy and waste reduction

continued to improve ahead of targets. Particulars in respect of

Conservation of Energy, Technology Absorption and Foreign

Exchange Earnings and Outgo, pursuant to section 217(1)(e) of

the Companies Act, 1956, are given in Annexure I to this report.

INFORMATION TECHNOLOGY

The SAP system in Paints business was extended to cover more

areas of front-end operations like management of Colour Solution

Stores equipment, distribution of Point of Sale ('POS')

merchandise etc. The SAP system with the added facility to make

relevant information available on 'Anytime Anywhere' basis

through SMS on the mobile phones and the on-line business

tracker, has now been well ingrained in the blood stream of the

business. The business also introduced e-payment system for all

its vendors to enable direct credit of the amounts to the vendors'

bank accounts through electronic banking, thereby dispensing

with paper cheques altogether for vendor payment.

Similar initiatives were also pursued by the National Starch

business to improve operating efficiencies and internal controls

and deliver value to the customers.

HUMAN RESOURCES

Cordial relations with the employees prevailed at all the Company

locations during the year. The total number of employees on the

rolls of the Company, including its subsidiary, as at 31 March

Annual Report 2007-08 – ICI India Limited

5

DIRECTORS' REPORT

2008 was 952. A statement containing the particulars of

employees as required under section 217(2A) of the Companies

Act, 1956 is given in page 42.

INTERNAL CONTROL SYSTEMS

The Company has an effective Risk Management framework,

which helps the Board to monitor the exposure and state of

controls in the key business processes. Your Company has wellestablished procedures for internal control across its various

locations, commensurate with its size and operations. The

organization is adequately staffed with qualified and experienced

personnel for implementing and monitoring the internal control

environment. The internal audit function is adequately resourced

and reports to the Audit Committee of the Board.

During the year there was one instance of defalcation, resulting

in a loss of approx Rs 1 lac. Necessary actions have been taken

to strengthen the control system to prevent recurrence.

CORPORATE GOVERNANCE

The Company is in due compliance with the norms of Corporate

Governance as outlined in clause 49 of the Listing Agreements

with National Stock Exchange and Bombay Stock Exchange;

Annexure II to this report summarizes the details of such

compliance.

DIRECTORS

Mr Rajiv Jain was re-appointed as the Managing Director of the

Company for a period of five years with effect from 1 April 2008,

subject to approval of the shareholders in the forthcoming Annual

General Meeting. The Company has received a notice under

Section 257 of the Companies Act, 1956 proposing Mr Jain's

reappointment.

Mr A M Ransom resigned from the Board vide his letter dated

28 April, 2008. The Board placed on record its deep appreciation

of the valuable services rendered by Mr Ransom during his tenure

as Director of the Company. The Board also placed on record its

appreciation of the valuable contribution of Mr D R Carter during

his tenure as Alternate Director to Mr Ransom.

Mr A J Britt was appointed as a Director with effect from

12 May 2008 in the casual vacancy caused by the resignation of

Mr A M Ransom.

b) they have selected such accounting policies and applied them

consistently and made judgments and estimates that are

reasonable and prudent so as to give a true and fair view of

–

the state of affairs of the Company as on 31 March 2008

and

–

the profit for the year ended on that date;

c) they have taken proper and sufficient care for the maintenance

of adequate accounting records in accordance with the

provisions of the Companies Act, 1956, for safeguarding the

assets of the Company and for preventing and detecting fraud

and other irregularities; and

d) they have prepared the annual accounts on a going concern

basis.

Cautionary Statement

Some of the statements in this report, describing the Company's

objectives and expectations expressed in good faith, may

constitute 'forward looking statements' within the meaning of

applicable laws and regulations. Actual results might differ

materially from those, in the event of changes in the assumptions/

market conditions.

SUBSIDIARY COMPANY

The statement of particulars relating to the Company's subsidiary

Polyinks Limited ('Polyinks'), pursuant to Sec 212 of the

Companies Act, 1956, is given in page 44.

The Company has obtained the approval of the Central

Government for not attaching the full accounts of Polyinks to its

annual accounts. A summary of the Balance Sheet of Polyinks

as on 31 March 2008 and its performance for the year ended on

that date is given in page 44.

CONSOLIDATED RESULTS

As required under the Listing Agreement, audited consolidated

financial results provided in the Annual Report include the

performance of Polyinks. A summary of the consolidated financial

performance is given below:

2007-08

(Rs cr)

2006-07

Total income

973

1057

Profit before tax from operations

109

117

90

603

60

463

Total Assets Employed

765

871

Total Shareholder Funds

763

870

Mr A Narayan and Mr R Gopalakrishnan, Directors, will retire

by rotation at the forthcoming Annual General Meeting and are

eligible for reappointment.

AUDITORS

Profit before tax

Profit after tax

M/s BSR & Associates retire as the Auditors of the Company at

the conclusion of the forthcoming Annual General Meeting and

being eligible have offered themselves for reappointment.

DIRECTORS' RESPONSIBILITY STATEMENT

Your Directors confirm that:

a) in the preparation of the Annual Accounts, the applicable

accounting standards have been followed;

6

Annual Report 2007-08 – ICI India Limited

The current year's figures are not comparable with those of the

previous year on account of acquisition and divestment of

businesses in the previous year.

DIRECTORS' REPORT

ACKNOWLEDGMENT

The Directors wish to convey their gratitude and appreciation to all the employees of the Company for their valuable contribution

during the year. They also wish to place on record their appreciation to the Company's customers, shareholders, investors, bankers,

agents, suppliers, distributors and other business associates for their cooperation and support.

On behalf of the Board

Gurgaon

20 May 2008

A NARAYAN

Chairman

ANNEXURE I

– Cost savings through process improvements and

substitution of raw materials.

DISCLOSURE OF PARTICULARS WITH RESPECT TO

CONSERVATION

OF ENERGY,

TECHNOLOGY

ABSORPTION, FOREIGN EXCHANGE EARNINGS AND

OUTGO PURSUANT TO SECTION 217(1)(e) OF THE

COMPANIES ACT, 1956

(c)

R&D efforts of your Company will continue to focus on

development of new products and applications, efficiency

improvements, waste reduction, saving in energy consumption

and introduction of environment friendly products.

A) CONSERVATION OF ENERGY

1. Power & fuel consumption

2007-08

(a) Electricity

(i) Purchased

Unit

Total cost

Rate

(ii) Own Generation

Units

Units / KL of diesel oil

Cost / unit

(b) Fuel Oil

Quantity

Total cost

Average rate

(d) Expenditure on R&D

2006-07

mwh

Rs lacs

Rs / kwh

11426

510

4.46

11249

482

4.28

mwh

kwh

Rs / kwh

1076

7271

11.42

447

4109

8.83

kl

Rs lacs

Rs / kl

1405

391

27829

1659

446

26683

Electricity (kwh per te/kl)

Paints

Uniqema

National Starch

Catalysts

99

–

140

1584

103

138

143

1529

Fuel Oil (kl per te/kl)

Paints

Uniqema

National Starch

Catalysts

–

–

0.01

0.53

0.01

0.04

0.01

0.60

(Rs lacs)

1.

Research & Development (R&D)

2007-08

2006-07

30

382

412

25

277

302

0.4%

0.3%

(i) Capital

(ii) Recurring

(iii) Total

(iv) Total R & D expenditure

as a percentage of turnover

2.

Technology Absorption, Adaptation and Innovation

(a) Efforts & Benefits

– New and innovative products in response to changing

customer needs, like Polyputty, Hi-endurace exterior

emulsions and Weathershield Clear for alternate surfaces

were launched.

– Based on customer feedback, some products in the

woodcare range were renovated and re-launched.

– Usage of raw materials in some product lines were

optimized.

2. Consumption per unit of production

B) ABSORPTION OF TECHNOLOGY

Future plan of action

(b) Particulars of technology imported in the last 5 years from

the beginning of the financial year

Technology

imported

Polymerization

Technology

C)

Year of

import

Has the

technology

been fully

absorbed?

If not fully

absorbed,

reasons and

future plan of

action

2005

No

Technology

absorption is

in progress

FOREIGN EXCHANGE EARNINGS AND OUTGO

(a)

Total Foreign Exchange earned and used

(Rs lacs)

(a) Specific areas in which R&D is carried out by the Company

2007-08

The Company's R&D activities concentrated on development

of new products and applications, efficient use of resources

and improving environment friendliness of the products.

(b) Benefits derived as a result of the above R&D

The businesses achieved sales growth ahead of market and

improved their profitability through:

– Launch of new and innovative products; and

Earned

Used

(b)

2006-07

6,86

11,02

148,10

184,12

Future Plans

Use innovation and R&D strengths to achieve further

process improvements and development of new products

and applications.

Annual Report 2007-08 – ICI India Limited

7

ANNEXURE II

REPORT ON CORPORATE GOVERNANCE

1. Company's Philosophy on Code of Corporate Governance

Your Company remains strongly committed to sound Corporate

Governance practices in order to achieve the highest standards

of management and business integrity and to give sustainable

long term returns to all its stakeholders.

2. Board of Directors

Composition

The Board composition is in conformity with the provisions of

the Companies Act, 1956 and the Listing Agreement. The

composition of the Board and details of directorship in

companies including ICI India Limited are as follows:

Name of

Directors

Category of

Directorship

in ICI India

Directorships in Membership

other companies1 in specified

Public Private / Committees2

Foreign /

limited by

guarantee

Mr A Narayan

Non Executive

Chairman

1

1

2

Mr Rajiv Jain3

Managing

Director

–

1

1

Mr Sandeep Batra

Wholtime

Director

1

1

–

Mr A J Britt4

Non Executive

–

3

2

Mr R Gopalakrishnan Non Executive

Independent

9

3

4

Non Executive

Independent

13

5

5

Mr M R Rajaram

Non Executive

2

2

2

Mr A M Ransom5

Non Executive

–

–

2

Mr M V Subbiah

Non Executive

Independent

4

2

2

Ms R S Karnad

1

2

3

4

5

Excludes Alternate Directorships

Specified Committees - Audit, Shareholder/Investor Grievance

Re-appointed w.e.f. 1 April 2008

Appointed w.e.f. 12 May 2008

Resigned w.e.f. 28 April 2008

Meetings & Attendance

Given below is the consolidated list of meetings of the Board

and specified Committees held during 2007-08 and attendance

details of Directors:

Meeting details during April 2007 to March 2008

Name of the meeting

Annual General

Meeting (AGM)

Board

Audit Committee

Shareholders/Investors

Grievance Committee

(SHIGC)

Remuneration &

Nominations

(R&N) Committee

8

Dates on which meetings were held

19 July 2007

16 May, 26 May, 19 July, 26 October,

2007, 24 January and 28 March 2008

16 May, 19 July, 26 October 2007 and

24 January 2008

26 October 2007 and 24 January 2008

16 May 2007

Annual Report 2007-08 – ICI India Limited

Attendance details at meetings during April 2007 to March 2008

No. of meetings held

AGM Board Audit SHIGC R&N

1

6

4

2

1

Mr A Narayan

1

6

NA

NA

NA

Mr Rajiv Jain

1

5

NA

2

NA

Mr Sandeep Batra

1

5

NA

NA

NA

NA

Mr M R Rajaram

1

6

NA

2

Mr A M Ransom

1

4

4

2

1

Mr R Gopalakrishnan

1

3

3

NA

1

Ms R S Karnad

–

5

3

NA

1

Mr M V Subbiah

1

3

3

NA

–

NA-signifies not a member of the relevant committee.

All information in terms of Listing Agreement are shared with the

Board through periodic reports and statements and discussions in

Board/Committee meetings.

Directors to be appointed/re-appointed

In terms of the Articles of the Association of the Company,

Mr Aditya Narayan and Mr R Gopalakrishnan will retire by rotation

in the forthcoming Annual General Meeting and, being eligible,

have offered themselves for re-appointment.

Mr Rajiv Jain was re-appointed as the Managing Director with effect

from 1 April 2008 for a further period of five years. Mr Jain's reappointment as the Managing Director and his remuneration are to be

approved by the members in the forthcoming Annual General Meeting.

Mr A J Britt, who was appointed as a Director of the Company with

effect from 12 May 2008 in the casual vacancy caused by the resignation

of Mr A M Ransom, will continue in office till the date on which Mr

Ransom would have retired in the normal course.

A brief resume of each of the above directors, as required under

clause 49(VI) of the Listing Agreement, is given below. Though Mr

Britt is not liable to retire and seek re-election at the forthcoming

Annual General Meeting, his resume is also being included hereunder

for information of the members.

i. Mr Rajiv Jain

Mr Rajiv Jain joined the ICI Group in 1974 and was

appointed to the Board of the Company in 1997. He had

held a number of senior positions in Corporate Finance,

Information Technology and headed the Specialty Chemicals,

Rubber Chemicals, Catalysts and Explosives businesses.

He was appointed Chief Financial Officer in December

1997 and Chief Operating Officer of the Company in

February 2000. He was appointed Managing Director and

CEO Paints in April 2003 for a term of 5 years and has

since been re-appointed w.e.f. 1 April 2008. Mr Jain, born

in January 1951, has done his B Tech (Hons) in Chemical

Engineering from IIT Kharagpur and MBA from USA.

Apart from ICI India Limited, Mr Jain is the Chairman of

ICI India Research & Technology Centre and a Director of

CIC Paints Pvt Ltd, Colombo.

ii. Mr Aditya Narayan

Mr Aditya Narayan was appointed Chairman of the Board

in April 2003. Starting as a management trainee in 1973, he

worked in diverse functions and has held several senior

positions including those of the Chief Executive of Fertilizer

and Explosives businesses. He served as the Managing

Director of the Company from August 1996 to April 2003,

CORPORATE GOVERNANCE

during which period he played a key role in reshaping the

Company's business portfolio. Just before becoming the

Managing Director, he served as the Corporate Planning

Manager at the ICI Group headquarters in London.

Mr Narayan, born in January 1952, is a B Tech from IIT,

Kanpur. He also holds formal qualifications in Law,

Multidisciplinary Sciences and Strategic Management.

Apart from ICI India Limited, Mr Narayan is a Director of

the following companies:

1. Hindustan Unilever Limited

2. BHP Billiton Marketing Services India Pvt Ltd

iii. Mr R Gopalakrishnan

Mr R Gopalakrishnan is a Non-Executive Director of the

Company since May 1999.

Mr Gopalakrishnan, born in December 1945, is a graduate in

Physics from Calcutta University and in Engineering from

IIT, Kharagpur. In 1967 he joined Hindustan Lever as a

Management Trainee and went on to become a member of

Hindustan Lever's Management Committee as Executive

Director (Exports) in mid 1980s. In 1991, he was appointed

Chairman, Unilever Arabia, based in Jeddah to establish and

manage Unilever's consumer products business in the GCC

countries. Upon return to India in 1995, he became the

Managing Director of Brooke Bond Lipton India Limited,

Unilever's foods and beverages company in India. After the

merger of that company with Hindustan Lever Ltd, he was

appointed Vice-Chairman of the merged entity. After 31 years

with Levers, he joined Tata Sons in August 1998 as an

Executive Director.

Apart from ICI India Limited, Mr Gopalakrishnan is a

Director in the following companies:

1. Rallis India Ltd

2. Tata Chemicals Ltd

3. Tata Sons Ltd

4. Tata Motors Ltd

5. Tata Power Co. Ltd

6. Tata Teleservices Ltd

7. Tata AutoComp Systems Ltd

8. Tata Technologies Ltd

9. Castrol India Ltd

10. ABP Pvt Ltd

11. IMACID S.A.

12. Advinus Therapeutics Pvt Ltd

iv. Mr Anthony J Britt

Mr Anthony J Britt joined the Board of the Company as a

Non Executive Director w.e.f. 12 May 2008, in the casual

vacancy caused by the resignation of Mr A M Ransom.

Born in Sydney in 1960, Mr Britt is currently the Chief

Executive Officer, Decorative Paints Asia for AkzoNobel,

prior to which he held various general management positions

in both the Decorative Paints and Marine and Protective

Coatings businesses with AkzoNobel.

Currently based in Singapore, Mr Britt has extensive

international experience. He spent six years from 1998 in

New Jersey as the Global Director, Yacht Coatings with

AkzoNobel. Whilst based in Brisbane, he was the General

Manager, Marine Coatings and later became the General

Manager, Decorative Paints, Central Europe. During this

period he held various directorship roles in Korea, Japan,

Australia and Germany.

Mr Britt holds a Bachelor of Engineering (Chemical),

Honors degree from Sydney University and MBA from

Macquarie University.

Apart from ICI India Limited, Mr Britt is a Director in the

following companies:

1. ICI Swire Paints (Shanghai) Ltd

2. ICI Swire Paints (China) Ltd

3. ICI Swire Paints Ltd

3. Audit Committee

The Audit Committee comprises only NEDs and is chaired by

Ms R S Karnad. The Managing Director, Director in charge of

Finance, the Internal Auditors and Statutory Auditors are

permanent invitees to the meetings of the Committee, with the

Company Secretary acting as its Secretary. The members of the

Committee are eminent professionals with necessary knowledge

in financial, accounting and business matters. Any other person/

executive, when required, also attend the meetings of the

Committee. Minutes of the Audit Committee meetings are

circulated to the Board members.

The terms of reference of this Committee are in line with the

norms specified in Clause 49 of the Listing Agreement and

Section 292A of the Companies Act, 1956.

For details of meetings of the Committee held during the year

and attendance therein, please refer para (2) above.

4. R&N Committee

The purpose of the Committee is to assist

nomination of members to the Board and

performance of the Executive Directors and

recommendations as to their remuneration,

approved by the shareholders.

the Board in the

in evaluating the

make appropriate

within the limits

The R&N Committee comprises only NEDs and is chaired by

Mr M V Subbiah. The Chairman of the Board is a permanent

invitee to the meetings of the Committee.

For details of meetings of the Committee held during the year

and attendance therein, please refer para (2) above.

Remuneration of Directors

While remuneration of Executive Directors is recommended by

the R&N Committee, the remuneration to the NEDs is approved

by the Board. The NEDs, other than Mr A M Ransom or his

Alternate Director, are paid sitting fees @ Rs 10,000 per meeting

for attending Board/Committee meetings, where they have been

nominated as members, and Commission as approved by the

Board/Shareholders from time to time.

The details of remuneration paid to the Directors during the

year 2007-08 are given below:

Figures in Rs lacs

Managing /

Wholetime

Directors

Mr Rajiv Jain

Mr Sandeep Batra

Total

Non-Executive

Directors

Mr A Narayan

Mr R Gopalakrishnan

Ms R S Karnad

Mr M R Rajaram

Mr M V Subbiah

Total

Total

Remuneration

a

(a = b + c)

239.06

82.18

321.24

5.60

5.70

5.90

5.80

5.60

28.60

Fixed

Performance

component linked payments

b

c

Salary,

Performance

Allowances &

Pay

Perquisites

159.30

79.76

62.49

19.69

221.79

99.45

Sitting Fees

0.60

0.70

0.90

0.80

0.60

3.60

Commission

5.00

5.00

5.00

5.00

5.00

25.00

Annual Report 2007-08 – ICI India Limited

9

CORPORATE GOVERNANCE

Notes:

a) The service contracts with the Managing/Wholetime Directors are for a period of five years terminable at six months notice on

either side. Extracts of such contracts are communicated to the shareholders as required under law.

b) Performance linked payments are made to the Managing/Wholetime Directors based on pre-agreed parameters and taking into

account the recommendations of the R&N Committee.

c) In case of NEDs, fixed component of remuneration represents sitting fees paid to them for attending Board/Committee meetings.

The criteria for payment of Commission to the NEDs are outlined in para 10(vi) below.

d) Presently, the Company does not have any stock option scheme.

5. Shareholders/Investors Grievance Committee

The SHIGC of the Company was headed by Mr A M Ransom, NED, who has since been replaced by Mr A J Britt. The other members

are Mr Rajiv Jain and Mr M R Rajaram. The Company Secretary functions as the Secretary to this Committee and has been nominated

as the Compliance Officer.

There were no complaints received from the shareholders during 2007-08. Routine queries/service requests received from the shareholders

were addressed/resolved within 7 days of receipt of such communication. No share transfers arising out of the financial year in question

were pending beyond the normal service time.

For details of meetings of the Committee held during the year and attendance therein, please refer para (2) above.

6. General Body Meetings

i.

Details of the last three Annual General Meetings of the Company are given below:

Date of AGM

Time

Place

19 July 2007

2.00 pm

Bharatiyam Complex

IB 201, Salt Lake

Kolkata - 700106

26 July 2006

2.00 pm

- do 5 August 2005

2.00 pm

- do ii.

One special resolution was passed in AGM during the past three years, for de-listing the Company's shares from Calcutta Stock

Exchange, which was approved by requisite majority in the AGM held on 19 July 2007.

iii.

One special resolution was passed during 2007-08 through postal ballot for buyback of its own shares by the Company, which

was approved by 99.9% of the votes polled. The postal ballot was conducted in accordance with the procedure prescribed under

the Companies Act 1956, with Mr A R Das, Chartered Accountant, Kolkata, acting as the scrutinizer.

There is no proposal pending as on date for approval as a special resolution through postal ballot.

7. Disclosures

i.

There was no materially significant related party transactions entered into by the Company with its Promoters, Directors or the

Management, their subsidiaries or relatives etc, that may have potential conflict with the interests of the Company at large. The

Directors periodically disclose their interest in different companies, which are noted by the Board. The Register of Contracts

containing the transactions with companies in which Directors are interested is placed before the Board regularly for its approval.

ii.

None of the NEDs had any materially significant pecuniary relationship or transaction vis-à-vis the Company, which may have

a potential conflict with the interest of the Company at large. Mr A Narayan and Mr M R Rajaram receive pension and other

benefits from the Company for the past services rendered as the Company's employees. Mr A M Ransom was entitled to

remuneration and other benefits for his role and responsibilities in Imperial Chemical Industries Ltd, the holding company.

Mr A J Britt is entitled to remuneration and other benefits for his role and responsibilities in AkzoNobel NV, the ultimate holding

company.

iii.

All NEDs have confirmed that they do not hold any shares in the Company.

iv.

Disclosures, as required under the relevant Accounting Standards, have been incorporated in the Accounts.

v.

A declaration by the Managing Director on the adoption, dissemination and compliance of the Company's code of Business

Conduct is attached to this report.

vi.

There were no strictures or penalties imposed on the Company by Stock Exchanges or Securities Exchange Board of India or any

statutory authority for non-compliance of any matter related to capital markets, during the last three years.

vii.

The Company has adopted a Whistle Blower Policy as part of its Code of Business Conduct. It is affirmed that no personnel has

been denied access to the Audit Committee.

8. Means of Communication

Description

Status/remarks

i.

Quarterly Results

The quarterly results of the Company are published and advised to the Stock

Exchanges where the Company's shares are listed.

ii.

Newspapers wherein results

are normally published

Business Standard (English), Aajkal (Bengali)

10 Annual Report 2007-08 – ICI India Limited

CORPORATE GOVERNANCE

iii.

iv.

Any website, where displayed.

Yes, the results, press releases and other relevant information are

Whether it also displays official news

displayed on the Company's website www.iciindia.com. The financial results

releases.

and shareholding pattern are also posted on SEBI's EDIFAR website.

Presentations made to institutional

investors or to the analysts

Normally no such presentations are made.

9. General Shareholder Information

Subject

i.

AGM: date, time and venue

ii.

iii.

iv.

v.

Financial year

Date of Book Closure

Dividend payment date(s)

Listing on Stock Exchange

vi.

Stock Code

Details

17 July 2008 at 1400 hours at Bharatiyam Complex, IB 201, Salt Lake,

Kolkata - 700106

April to March

1 July 2008 to 17 July 2008 (both days inclusive)

On or around 21 July 2008 (after approval at the AGM)

The Company's shares are listed in BSE and NSE and can be traded under the

'Permitted Category' in CSE. The Company's shares have been delisted from

Calcutta Stock Exchange with effect from 15 April 2008. Listing fees for the

period 1 April 2008 to 31 March 2009 have been paid to BSE and NSE.

Bombay Stock Exchange (BSE)

: 500710

National Stock Exchange (NSE)

: ICI EQ

Calcutta Stock Exchange (CSE)

: 10000015

ISIN

: INE133A01011

vii. Market Price data and stock performance during 2007-08

Month

ix. Registrar and Share :

Transfer Agent

M/s C B Management

Services (P) Ltd., Kolkata

High

(Rs/share)

Low

(Rs/share)

Volume

(000 nos.)

BSE + NSE

April-07

476

415

247

May-07

564

425

286

June-07

559

500

195

July-07

600

487

539

August-07

558

492

759

September-07

590

491

1351

October-07

541

495

625

November-07

599

493

319

December-07

640

501

424

January-08

584

475

533

February-08

590

482

158

5,001-50,000

38

590

1.5

March-08

689

500

299

50,001-10,00,000

15

5,217

13.6

10,00,001 and above

6

28,959

75.5

40,131

38,379

100.0

viii.

x.

Share Transfer System :

All requests for share transfers

are processed and approved by

the Seal and Share Transfer

Committee, which normally

meets twice a month for this

purpose. Share transfers are

registered and returned within 30

days from the date of lodgment

of complete documents.

xi. Distribution of Shareholding as on 31 March 2008

Range

(No. of shares)

Performance in comparison to BSE Sensex from March

2005 to March 2008

No. of

share

(000's)

% to

total

issued

capital

1-50

25,305

491

1.3

51-500

13,652

1,969

5.1

501-5,000

1,115

1,153

3.0

TOTAL

xii.

No. of

shareholders

Dematerialization of

shares and liquidity

: The Company’s equity shares have

been notified for trading only in

demat form w.e.f. 17 January 2000.

As of 31 March 2008, 91% of the

Company's equity shares (other

than shares held by ICI UK) have

been dematerialized (No. of Demat

accounts : 15187).

The Company has entered into

agreements with NSDL & CDSL

for smooth operation of demat

mode of shareholding.

Annual Report 2007-08 – ICI India Limited 11

CORPORATE GOVERNANCE

xiii Outstanding GDRs / : None issued / outstanding

ADRs / Warrants or

any convertible

instruments, conversion

date and likely impact

on equity

xiv

Plant locations

xv

Address for

correspondence

Shareholders correspondence are

to be addressed to:

1. C B Management Services

(P) Ltd, P-22, Bondel Road,

Kolkata 700 019

OR

: The Company's plants are

located at Hyderabad (Andhra

Pradesh), Thane (Maharashtra)

and Mohali (Punjab)

2. The Company Secretary

ICI India Ltd, DLF Plaza

Tower, 10th floor, DLF Qutab

Enclave, Phase-1,

Gurgaon 122 002, Haryana.

10. All the mandatory requirements of the clause 49 of the Listing Agreement have been complied with by the Company. The status visà-vis the non mandatory requirements is as follows:

i

Description

Status as on 31 March 2008

a) Non Executive Chairman's

office and expenses

The non Executive Chairman has been provided an office at the

Company's corporate office in Gurgaon. All expenses incurred by

him in the performance of his official duties are borne by the

Company.

b) Tenure of Independent Directors

None of the Independent Directors on the Company's Board have

served more than 9 years each, from the date when the new clause 49

has become effective (1 January 2006). However, Mr R Gopalakrishnan

and Mr M V Subbiah have completed 9 years as Directors of the

Company and continue to serve on the Board as Independent Directors.

ii

Remuneration Committee

Refer para 4 above.

iii

Sending of half yearly declaration of financial

performance including summary of the

significant events during the past six months

to each household of shareholders

As the Company's quarterly results are published in leading

newspapers and major developments are covered in the press

releases, which are posted on the Company's website, sending the

half yearly financial results to the shareholders is not considered

necessary.

iv

Audit qualifications

There is no audit qualification in the current year.

v

Training of Board members in the

business model of the Company etc.

The Executive Directors are covered by the Company's training

programmes for its employees.

The NEDs are briefed about business operations from time to time and

during discussions at Board meetings.

vi

Mechanism for evaluating NEDs

The NEDs' contribution to the Company is mainly in the areas of

general management and good corporate governance. They also serve

as a 'bouncing board' for the operating strategies of the Company,

besides bringing in an external perspective to the Company's growth

plans. The NEDs are therefore remunerated in the form of sitting fees

for participating in the Board and Committee meetings and a

Commission (subject to a maximum of Rs 10 lacs per Director per

annum) as a token of recognition of their contribution, with the

approval of the Board.

vii

Whistle Blower Policy

Refer para 7(vii) above.

Certification by the Auditors

As required under Clause 49 of the Listing Agreement, the auditors of the Company have examined the compliance of the Corporate

Governance norms by the Company. Their report is appended.

On behalf of the Board

Gurgaon

20 May 2008

12 Annual Report 2007-08 – ICI India Limited

A NARAYAN

Chairman

CORPORATE GOVERNANCE

Declaration by the CEO

Sub: Code of Conduct - Declaration under Clause 49(I)(D)

This is to certify that:

1.

In pursuance of the provisions of Clause 49(I)(D) of the Listing Agreement, a Code of Business Conduct for the Company has been

approved by the Board in its meeting held on 21st January 2002, which was subsequently amended at the Board meeting of 23 January

2004 to incorporate the Whistle Blower policy.

2.

The said Code of Business Conduct has been posted on the website of the Company and has also been circulated to the Board members

and all the employees of the Company.

3.

All Board members and senior management personnel have affirmed compliance with the said Code of Business Conduct, for the year

ended 31st March 2008.

20 May 2008

Rajiv Jain

Gurgaon

Managing Director

AUDITORS' CERTIFICATE ON COMPLIANCE WITH CLAUSE 49 OF THE LISTING AGREEMENT

To the Members of ICI India Limited

We have examined the compliance of conditions of corporate

governance by ICI India Limited ('the Company') for the year

ended 31 March 2008, as stipulated in clause 49 of the Listing

Agreement of the Company with the stock exchanges.

The compliance of conditions of corporate governance is the

responsibility of the management. Our examination was limited

to procedures and implementation thereof, adopted by the

Company for ensuring the compliance of the conditions of

corporate governance. It is neither an audit nor an expression of

opinion on the financial statements of the Company.

We have been explained that no investors' grievances are pending

for a period exceeding one month, as on 31 March 2008, against

the Company as per the records maintained by the Company.

We further state that such compliance is neither an assurance as

to the future viability of the Company nor efficiency or

effectiveness with which the management has conducted the

affairs of the Company.

For BSR & Associates

Chartered Accountants

In our opinion and to the best of our information and according

to the explanations given to us, we certify that the Company has

complied with the conditions of corporate governance as

stipulated in the abovementioned Listing Agreement.

KAUSHAL KISHORE

Gurgaon

20 May 2008

Partner

Membership No. 090075

Annual Report 2007-08 – ICI India Limited 13

Auditors’ Report

Statement, dealt with by this report, are in agreement with the books

of account;

(d) in our opinion, the Balance Sheet, Profit and Loss Account and the

Cash Flow Statement dealt with by this report, comply with the

accounting standards referred to in sub-section (3C) of section 211

of the Companies Act, 1956, to the extent applicable;

(e) on the basis of written representations received from the directors of

the Company as on 31 March 2008 and taken on record by the Board

of directors, we report that none of the directors is disqualified as on

31 March 2008 from being appointed as a director in terms of clause

(g) of sub-section (1) of section 274 of the Companies Act, 1956;

and

(f) in our opinion and to the best of our information and according to

the explanations given to us, the said accounts give the information

required by the Companies Act, 1956, in the manner so required and

give a true and fair view in conformity with the accounting principles

generally accepted in India:

(i) in the case of the Balance Sheet, of the state of affairs of the

Company as at 31 March 2008;

(ii) in the case of the Profit and Loss Account, of the profit for the

year ended on that date; and

(iii) in the case of Cash Flow Statement, of the cash flows for the

year ended on that date.

TO THE MEMBERS OF ICI INDIA LIMITED

1.

2.

3.

4.

We have audited the attached Balance Sheet of ICI India Limited ('the

Company') as at 31 March 2008 and also the Profit and Loss Account

and the Cash Flow Statement of the Company for the year ended on

that date, annexed thereto. These financial statements are the

responsibility of the Company's management. Our responsibility is to

express an opinion on these financial statements based on our audit.

We conducted our audit in accordance with auditing standards generally

accepted in India. Those Standards require that we plan and perform

the audit to obtain reasonable assurance about whether the financial

statements are free of material misstatement. An audit includes

examining, on a test basis, evidence supporting the amounts and

disclosures in the financial statements. An audit also includes assessing

the accounting principles used and significant estimates made by

management, as well as evaluating the overall financial statement

presentation. We believe that our audit provides a reasonable basis for

our opinion.

As required by the Companies (Auditor's Report) Order, 2003 ('the

Order'), issued by the Central Government of India in terms of subsection (4A) of section 227 of the Companies Act, 1956 ('the Act'), we

enclose in the Annexure, a statement on the matters specified in

paragraphs 4 and 5 of the said Order.

Further to our comments in the Annexure referred to above, we report

that:

(a) we have obtained all the information and explanations, which to the

best of our knowledge and belief were necessary for the purposes of

our audit;

(b) in our opinion, proper books of account, as required by law, have

been kept by the Company so far as appears from our examination

of those books;

(c) the Balance Sheet, Profit and Loss Account and the Cash Flow

For BSR & Associates

Chartered Accountants

Gurgaon

20 May 2008

Annexure referred to in paragraph 3 of the Auditors' Report

to the Members of ICI India Limited on the accounts for the

year ended 31 March 2008

(i)

(a)

(b)

(c)

(ii)

(a)

(b)

(c)

(iii)

(a)

The Company has maintained proper records showing full

particulars, including quantitative details and situation of fixed

assets.

As explained to us, the fixed assets are physically verified by the

management in accordance with a phased programme designed to

cover all items of fixed assets over a period of three years, which, in

our opinion, is reasonable having regard to the size of the Company

and nature of its fixed assets. In accordance with the programme,

fixed assets at certain locations have been physically verified by

the management during the year and no material discrepancies were

noticed on such verification.

During the year, the Company has not disposed off a substantial

part of its fixed assets.

According to the information and explanations given to us,

physical verification has been conducted by management at

reasonable intervals during the year in respect of inventory of

raw materials, stores and spare parts, work-in-process and finished

goods in the Company's possession. The existence of stocks lying

with third parties as at 31 March 2008 has been confirmed based

on confirmations or statements of account received from such

third parties. In our opinion, the frequency of physical verification

is reasonable.

In our opinion and according to the information and explanations

given to us, the procedures for physical verification of inventories

followed by the management are reasonable and adequate in

relation to the size of the Company and the nature of its business.

On the basis of our examination of the records of inventories, we

are of the opinion that the Company is maintaining proper records

of inventories. The discrepancies noticed on physical verification

of inventories as compared to book records were not material

and have been properly dealt with in the books of account.

The Company has granted a loan to its subsidiary company which

is covered in the register maintained under Section 301 of the

Companies Act, 1956. The maximum amount outstanding during

the year was Rs 647 lacs and the year-end balance of such loan

was Rs 641 lacs.

14 Annual Report 2007-08 – ICI India Limited

(b)

(iv)

(v)

(vi)

KAUSHAL KISHORE

Partner

Membership No.: 090075

In our opinion, the rate of interest and other terms and conditions

on which the loan has been granted to the subsidiary listed in the

register maintained under Section 301 of the Companies Act,

1956 are not, prima facie, prejudicial to the interest of the

Company.

(c)

In the case of the loan granted to the subsidiary listed in the

register maintained under Section 301 of the Companies Act,

1956, the borrower has been regular in repaying the principal

amounts as stipulated and in the payment of interest.

(d) There are no overdue amounts of more than Rs 1 lac in respect of

the loan granted to the subsidiary listed in the register maintained

under Section 301 of the Companies Act, 1956.

(e)

The Company has not taken any loans, secured or unsecured from

companies, firms or other parties covered in the register

maintained under Section 301 of the Companies Act, 1956.

Accordingly, paragraphs 4 (iii) (e) to 4 (iii) (g) of the Order are

not applicable.

In our opinion and according to the information and explanations given

to us, there is an adequate internal control system commensurate with

the size of the Company and the nature of its business with regard to

purchase of inventories and fixed assets and with regard to the sale of

goods and services. Further, on the basis of our examination and

according to the information and explanations given to us, we have

neither come across nor have been informed of any incidence of major

weaknesses in the aforesaid internal control system.

(a)

In our opinion and according to the information and explanations

given to us, the particulars of contracts or arrangements referred

to in section 301 of the Companies Act, 1956 have been entered

in the register required to be maintained under that section.

(b) In our opinion and according to the information and explanations

given to us, the transactions made in pursuance of contracts or

arrangements entered in the register maintained under section

301 of the Companies Act, 1956, and exceeding Rs 5 lacs in

respect of any party during the year have been made at prices

which are reasonable having regard to prevailing market prices

at the relevant time.

In our opinion, and according to the information and explanations given

to us, the Company has complied with the provisions of Section 58A,

Section 58AA or other relevant provisions of the Companies Act, 1956

and the rules framed there-under/ the directives issued by the Reserve

AUDITORS' REPORT (Contd.)

Bank of India (as applicable) with regard to deposits accepted from the

public. Accordingly, there have been no proceedings before the Company

Law Board or National Company Law Tribunal (as applicable) or

Reserve Bank of India or any Court or any other Tribunal in this matter

and no order has been passed by any of the aforesaid authorities.

(vii) In our opinion and according to the information and explanations given

to us, the Company has an internal audit system commensurate with its

size and the nature of its business.

(viii) We have broadly reviewed the books of account maintained by the

Company in respect of products where pursuant to the rules made by

the Central Government, the maintenance of cost records has been

prescribed under section 209(1)(d) of the Companies Act, 1956 and are

of the opinion that, prima facie, the prescribed accounts and records

have been made and maintained. However, we have not made a detailed

examination of such records with a view to determine whether they are

accurate or complete.

(ix) (a)

According to the information and explanations given to us and

on the basis of our examination of the records of the Company,

amounts deducted/ accrued in the books of account in respect of

(b)

undisputed statutory dues including Provident Fund, Investor

Education and Protection Fund, Employees' State Insurance,

Income tax, Sales tax, Wealth tax, Service tax, Customs duty,

Excise duty, Cess and other material statutory dues have generally

been regularly deposited during the year by the Company with

the appropriate authorities.

According to the information and explanations given to us, no

undisputed amounts payable in respect of Provident Fund,

Investor Education and Protection Fund, Employees' State

Insurance, Income tax, Sales tax, Wealth tax, Service tax, Customs

duty, Excise duty, Cess and other material statutory dues were in

arrears as at 31 March 2008 for a period of more than six months

from the date they became payable.

According to the information and explanations given to us and

the records of the Company examined by us, there are no dues of

Income tax, Sales tax, Wealth tax, Service tax, Customs duty,

Excise duty and Cess which have not been deposited with the

appropriate authorities on account of any dispute, except as

mentioned below:

(Amount in Rs lacs)

Name of the Statute

Income Tax Act, 1961

Nature of the

dues

Income tax

Central Excise Act, 1944

Excise duty

Central Sales Tax Act, 1956

Amount of

dispute *#

32,83

Amount paid

under protest

–

Period to which

the amount relates

1995-96 to 2004-05

(Assessment year)

1991-92 to 2005-06

2004-05 and 2005-06

4,99

7

–

–

Sales tax

11,90

1,38

West Bengal Sales

Tax Act, 1994

Sales tax

5,17

–

Uttar Pradesh Trade

Tax Act, 1948

Sales tax

5,47

–

Delhi Sales Tax Act, 1975

Sales tax

79

–

The Kerala General

Sales Tax Act, 1963

Rajasthan Sales Tax Act, 1994

Bihar Sales Tax Act, 1959

The Madhya Pradesh General

Sales Tax Act, 1958

Orissa Sales Tax Act, 1947

Various other State

Sales Tax Acts

Sales tax

67

–

Sales tax

Sales tax

Sales tax

71

2,17

2,15

–

47

70

1998-99, 2003-04

1992-93 to 1999-00

1982-83 to 1999-00

Sales tax

Sales tax

1,71

4

1,65

–

1995-96 to 1999-00

2000-01 to 2004-05

Forum where dispute is pending

Commissioner of Income Tax

Customs, Excise and Service Tax Appellate Tribunal

Commissioner Appeals of Central Excise and

Service Tax

1982-83 to 2004-05

Sales Tax Officer / Sales Tax Revision Board /

Deputy Commissioner / Deputy Commissioner

Appeal / Appellate Tribunal

1995-96,1997-98,1998-99, Sales Tax Officer/ Sales Tax Revision Board /

1999-00,2002-03,2003-04 Deputy Commissioner/ Deputy Commissioner

Appeal / Additional Commissioner / Appellate

Tribunal / High Court

1976-77,1979-80,1980-81,

1986-87,1987-88,1988-89,

1989-90,1992-93,2000-01,

2003-04, 2004-05

1985-86,1986-87,1987-88,

2003-04,2004-05

2000-01,2001-02,2002-03

* Including disputed dues of Rs 931 lacs which have been stayed.

# Excluding the demands the proceedings of which have been set aside or remanded for reassessment by the appropriate authorities.

(x)

(xi)

(xii)

(xiii)

(xiv)

(xv)

(xvi)

(xvii)

The Company does not have any accumulated losses at the end of the

financial year and has not incurred cash losses in the financial year and

in the immediately preceding financial year.

According to the information and explanations given to us, the Company

has not defaulted in repayment of dues to its bankers. The Company

did not have any outstanding dues to any financial institutions or

debenture-holders during the year.

According to the information and explanations given to us, the Company

has not granted any loans and advances on the basis of security by way

of pledge of shares, debentures and other securities.

According to the information and explanations given to us, the Company

is not a chit fund or a nidhi/ mutual benefit fund/ society.

According to the information and explanations given to us, the Company

is not dealing or trading in shares, securities, debentures and other

investments.

According to the information and explanations given to us, the Company

has not given any guarantees for loans taken by others from banks or

financial institutions during the year.

According to the information and explanations given to us, the Company

did not have any term loans outstanding during the year.

According to the information and explanations given to us and on an

overall examination of the balance sheet of the Company, we are of the

opinion that the funds raised on short-term basis have not been used for

long-term investments.

(xviii) The Company has not made any preferential allotment of shares to

companies/firms/parties covered in the register maintained under

Section 301 of the Companies Act, 1956 during the year.

(xix) The Company did not have any outstanding debentures during the year.

(xx) The Company has not raised any money by way of public issue during

the year.

(xxi) We have been informed that a salesman of the Company had

misappropriated funds amounting to around Rs 1 lac collected from

dealers and though the same is not significant, it has been appropriately

dealt with. Based on the audit procedures performed and according to

the information and explanations given to us, no other fraud on or by

the Company has been noticed or reported during the year.

For BSR & Associates

Chartered Accountants

Gurgaon

20 May 2008

KAUSHAL KISHORE

Partner

Membership No.: 090075

Annual Report 2007-08 – ICI India Limited 15

BALANCE SHEET

As at 31 March 2008

As at 31 March 2007

(Rs lacs)

(Rs lacs)

Schedule

I)

SOURCES OF FUNDS

1.

2.

Shareholders’ funds

a) Share capital

b) Reserves and surplus

1

2

Deferred tax liability (net)

17 (21,25)

38,38

724,59

Total

II)

762,97

40,87

828,78

869,65

9,48

8,10

772,45

877,75

APPLICATION OF FUNDS

1.

Fixed assets

a) Gross block

b) Less : Accumulated depreciation

c)

d)

3

311,57

178,32

Net block

Capital work-in-progress

133,25

10,47

2.

Investments

4

3.

Current assets, loans and advances

a) Inventories

b) Sundry debtors

c) Cash and bank balances

d) Loans and advances

5

6

7

8

Less: Current liabilities and provisions

a) Current liabilities

b) Provisions

9

10

285,69

155,93

143,72

129,76

3,53

692,60

825,72

123,95

104,00

16,99

54,43

132,15

164,65

13,90

44,46

299,37

355,16

265,97

97,27

234,04

202,38

363,24

133,29

436,42

Net current assets / (liabilities)

(63,87)

(81,26)

Total

772,45

877,75

Significant accounting policies

Notes to the accounts

16

17

The accompanying schedules form an integral part of the financial statements.

As per our report attached.

For BSR & Associates

Chartered Accountants

For ICI India Limited

KAUSHAL KISHORE

Partner

Membership No: 090075

A NARAYAN

Chairman

RAJIV JAIN

Managing Director

Gurgaon

20 May 2008

16 Annual Report 2007-08 – ICI India Limited

S BATRA

Wholetime Director

R GUHA

Company Secretary

PROFIT AND LOSS ACCOUNT

Schedule

Income

Gross sales

Less : Excise duty

Net sales

Other income

Total income

Expenditure

Materials consumed, etc.

Other expenditure

Depreciation (net)

Interest (net)

11

12

13

14

Profit before taxation from operations *

Exceptional items [gain / (loss)] *

Profit before taxation *

Provision for taxation : *

– Current tax

– Deferred tax

– Fringe benefit tax

Profit after taxation

Balance brought forward

Balance available for appropriation

Appropriations

General reserve

Proposed dividend

Corporate dividend tax

15

Balance carried to the Balance Sheet

Basic and diluted earnings per equity share (in Rs.) 17 (19)

* Information on discontinuing business

17 (3,26)

Adhesives business

Profit before taxation from operations

Income tax expense related to the above

* Information on discontinued business

Uniqema business

Profit before taxation from operations

Income tax expense related to the above

Profit on disposal of discontinued business (pre tax)

Income tax expense related to the above disposal

For the year ended

31 March 2008

(Rs lacs)

For the year ended

31 March 2007

(Rs lacs)

1062,36

132,22

930,14

34,19

964,33

1007,05

118,83

888,22

66,10

954,32

551,68

281,50

22,51

(50)

855,19

109,14

(18,73)

90,41

533,09

256,36

22,47

2,29

814,21

140,11

446,12

586,23

26,60

7

3,53

60,21

472,69

532,90

140,00

(4,94)

2,75

448,42

220,37

668,79

54,00

30,70

5,22

89,92

442,98

15.16

67,00

110,35

18,75

196,10

472,69

109.72

15,28

5,78

11,41

4,76

–

–

–

–

11,63

3,82

250,85

51,86

Significant accounting policies

16

Notes to the accounts

17

The accompanying schedules form an integral part of the financial statements.

As per our report attached to the Balance Sheet.

For BSR & Associates

Chartered Accountants

For ICI India Limited

KAUSHAL KISHORE

Partner

Membership No: 090075

A NARAYAN

Chairman

RAJIV JAIN

Managing Director

S BATRA

Wholetime Director

R GUHA

Company Secretary

Gurgaon

20 May 2008

Annual Report 2007-08 – ICI India Limited 17

CASH FLOW STATEMENT

A.

109,14

140,11

22,51

16

(37)

–

12

1,12

(10,80)

(10,30)

(50)

Operating profit before working capital changes

Changes in :

Trade and other receivables

Inventories

Trade payables and other creditors

Cash generated from operations

Income tax paid

Exceptional items (relating to outflow on account of

voluntary retirement scheme payments, additional

contribution to employee retiral funds and other provisions)

Net cash flow from operating activities (A)

C.

For the

year ended

31 March 2007

(Rs lacs)

Cash flow from operating activities

Profit before taxation and exceptional items

Adjusted for :

Depreciation

Loss on write-off of fixed assets

Provisions/liabilities no longer required written back

Other provisions made during the year

Bad debts and advances written off

Provision for doubtful debts and advances (net)

Investment income (including dividend from subsidiary)

Profit on sale/maturity of current investments

Interest (net)

B.

For the

year ended

31 March 2008

(Rs lacs)

1,94

22,47

–

(3)

1,25

15

1,68

(46,06)

(6,61)

2,29

111,08

(4,90)

8,20

8,88

12,18

123,26

(37,27)

(5,17)

(24,86)

115,25

(24,04)

(34,79)

54,49

(4,34)

110,91

(155,97)

(6,91)

80,82

(51,97)

(33,11)

–

(3,20)

63,23

–

2,10

(2,30)

–

50,00

10,30

3,45

–

13,32

103,79

(26,91)

(66,07)

(3,21)

332,06

320,00

4,78

(74)

5

50,00

6,61

45

31,10

15,97

664,09

Cash flow from financing activities

Borrowings during the year

Borrowings repaid during the year

Buyback of shares

Dividend paid

Corporate dividend tax

Interest paid

50,00

(50,00)

(133,49)

(109,45)

(18,75)

(2,95)

–

–

–

(24,54)

(3,44)

(2,95)

Net cash flow from financing activities (C)

(264,64)

(30,93)

Net changes in cash and cash equivalents (A+B+C)

(80,03)

581,19

Cash and cash equivalents - opening balance

Cash and cash equivalents - closing balance

779,02

698,99

197,83

779,02

Cash flow from investing activities

Purchase of fixed assets

Investment in subsidiary

Inter corporate deposit to subsidiary company

Sale of businesses *

Sale of investment in subsidiary company

Sale of properties (including advance received)

Payments relating to divested businesses

Sale of other fixed assets

Redemption of capital gains bonds

Profit on maturity / redemption of Fixed Maturity Plans

Interest received

Dividend income from subsidiary

Income from investments

Net cash flow from investing activities (B)

18 Annual Report 2007-08 – ICI India Limited

SCHEDULES TO THE ACCOUNTS

Cash and cash equivalents comprise :

Cash in hand

Cheques in hand

Bank balance in current accounts

Fixed deposits held as margin money **

Bank balance in unclaimed dividend account **

Investments in fixed maturity debt Mutual Funds

As at 31 March 2008

(Rs lacs)

As at 31 March 2007

(Rs lacs)

31

2

13,46

29

2,91

682,00

698,99

30

46

10,86

27

2,01

765,12

779,02

Notes :